Article Text

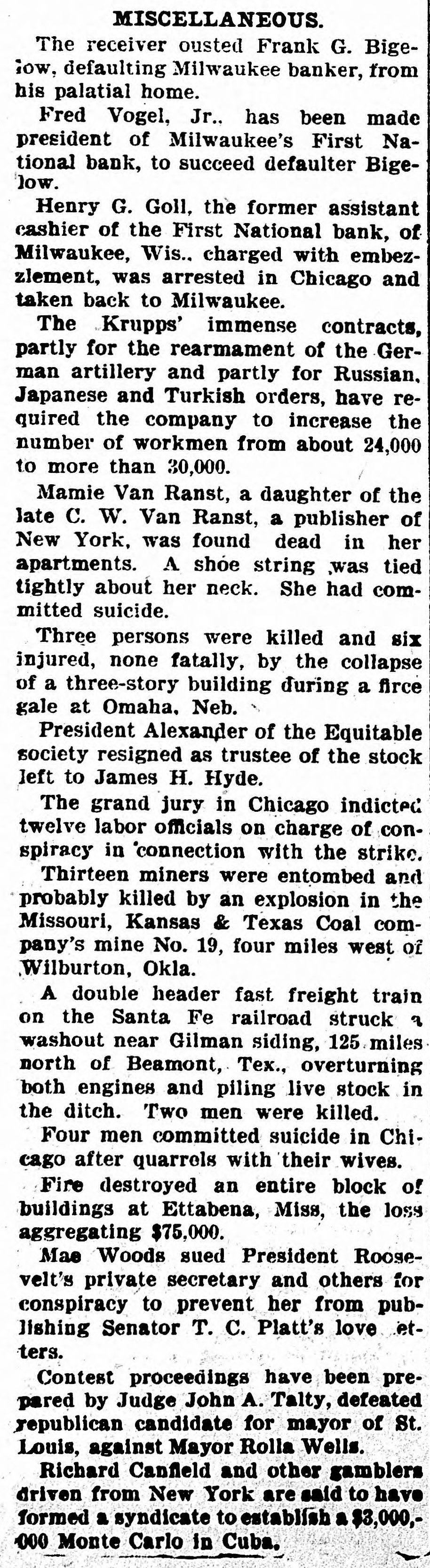

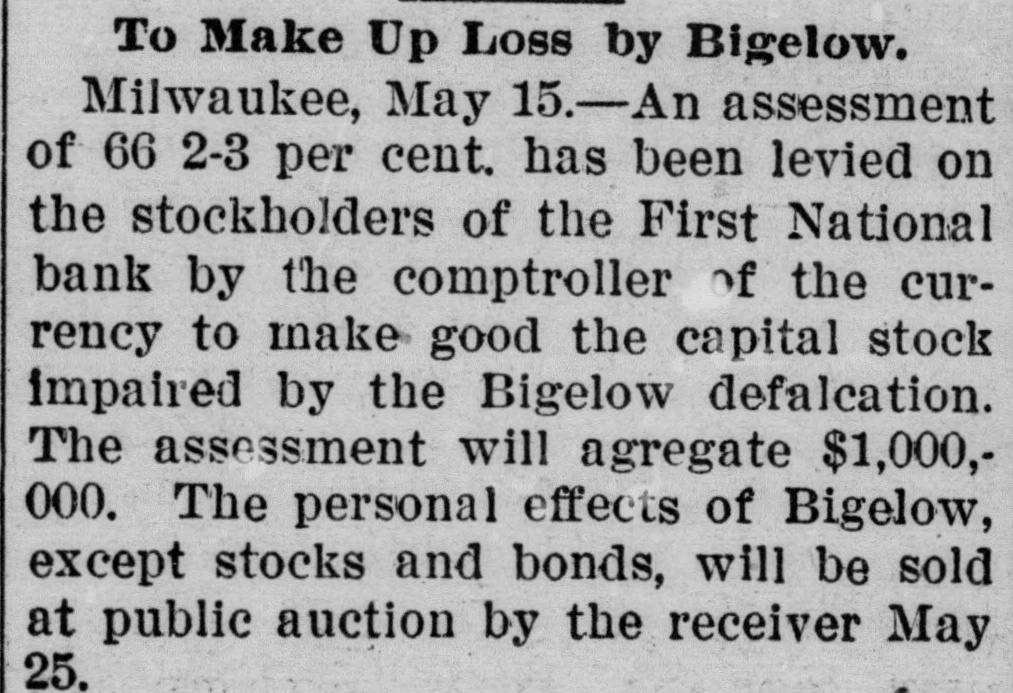

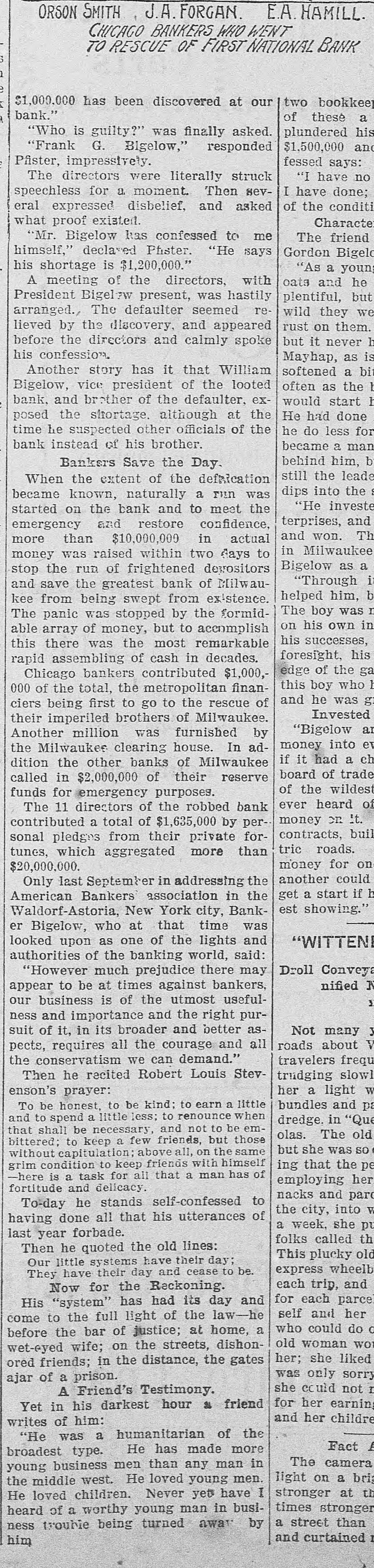

BIGELOW President of the First National Bank of Milwaukee, confesses embezzlement of $1,450,000. The arrest of Mr. Bigelow followed his confession to the board of directors of the bank that he was a defaulter to the extent of $1,450,000. Following Mr. Bigelow's confession he was removed from the presidency of the bank. and the facts in the case were laid before the federal authorities. The complaint was sworn to by United States District Attorney H. K. Butterfield. It charges that Bigelow, as president of the First National Bank, embezzled a sum exceeding $100,000. A complaint and a warrant, identical with those in Bigelow's case, were made out to Henry G. Goll, assistant cashier of the bank, but Goll could not be found. Mr. Bigelow was taken before United States Commissioner Bloodgood. Bail was fixed at $25,000. and he was released to appear before the next Federal Grand Jury. Mr. Bigelow's confession was made a special meeting of the board of directors Saturday evening. He met with the directors yesterday and all last night. In addressing his fellowdirectors President Bigelow said he had a painful statement to make, a confession that he had misdirected the funds of the bank, and that an examination of his books and a comparison of figures would show that he was indebted to the bank for more than $1,450,000. This money, he said, had been lost in speculation in wheat and stocks. Not a dollar of it could be recovered, and the only sum he could offer toward compensating the bank was personal securities valued at $300,000. MR. BIGELOW WIDELY KNOWN. Mr. Bigelow had been recognized as among the foremost financiers of the Northwest. He has been associated with the First National Bank in various capacities for more than fifteen years, and his business connections with trust companies, manufacturing concerns, real estate deals and other similar ventures numbered scores. He was honored a year ago by election to the presidency of the American Bankers' Association. In making his statement to the directors of the bank Mr. Bigelow said he had become involved in speculation in Wall Street several months ago. More recently he had been a persistent bull in the wheat market, and recent losses in grain had been added to heavy reverses in Wall Street. From small manipulations of the banks funds the defalcations had the million age he had extended passed dollar until mark. and his He short- there- saw no possibility of returning the money, fore confessed his actions. Funds were at once provided by the directors of the bank to protect depositors against loss and to save the bank from a stampede. More than a million dollars was guaranteed to the bank by various stockholders, and no serious run was made on the bank to-day. It is not thought that any complications with creditors of the bank will follow. At the meeting of directors, which was almost continuous for thirty-six hours, several plans suggested for protecting the interests of were the the bank. One, it is said, was to accept resignation of the president and to permit him to go to Europe while the directors make good the amount of his shortage. This would effectually protect the bank. This alleged proposal never came to a conclusion because several directors demanded that the defaulter be punished. A plan to make up the shortage for the protection of depositors was then approved. Bigelow was removed from the presidency of the bank and the case was referred to federal officers. WIFE HEARS WARRANT READ. When the federal marshal called at the Bigelow house to serve the warrant the former bank president was in the library with his wife. Mrs. Bigelow refused to withdraw and the warrant was read in her presence. "I'll be ready to go with you at once," said the banker; then he kissed his wife an affectionate farewell and left the house with the officer, the two walking to the Federal Building, where a United States commissioner was in waiting. None of Mr. Bigelow's friends were in the courtroom. When the resolution was adopted removing Mr. Bigelow from the presidency of the bank, Henry Goll, assistant cashier. was also removed. The removal of the assistant cashier was due to the statement of President Bigelow that he was aided by Goll in concealing the shortage in the bank's accounts. The method adopted was an old one. Collection accounts were manipulated 40 or even 50 Continued on second page.