Article Text

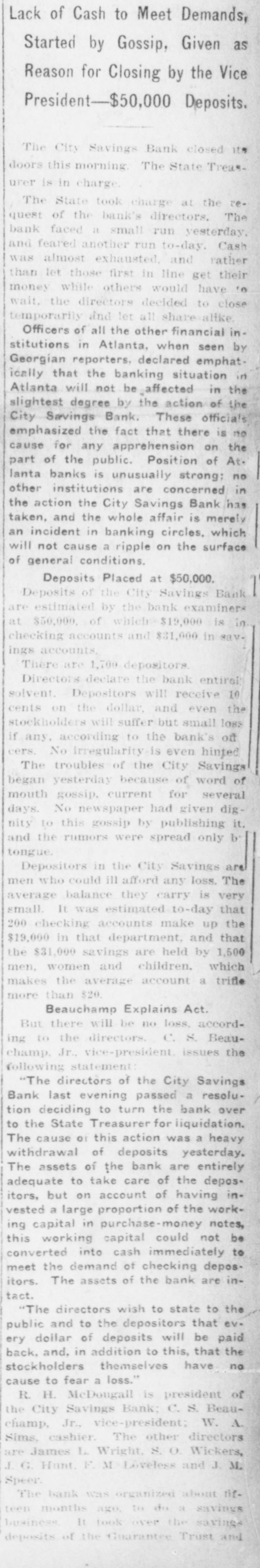

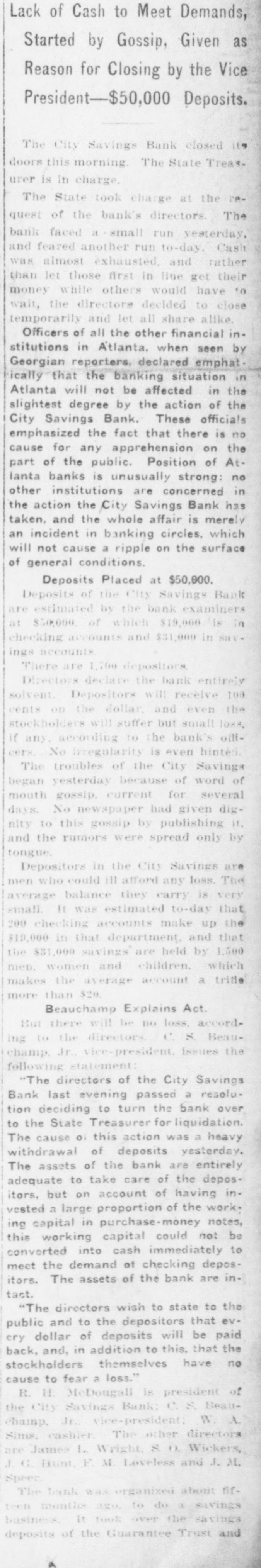

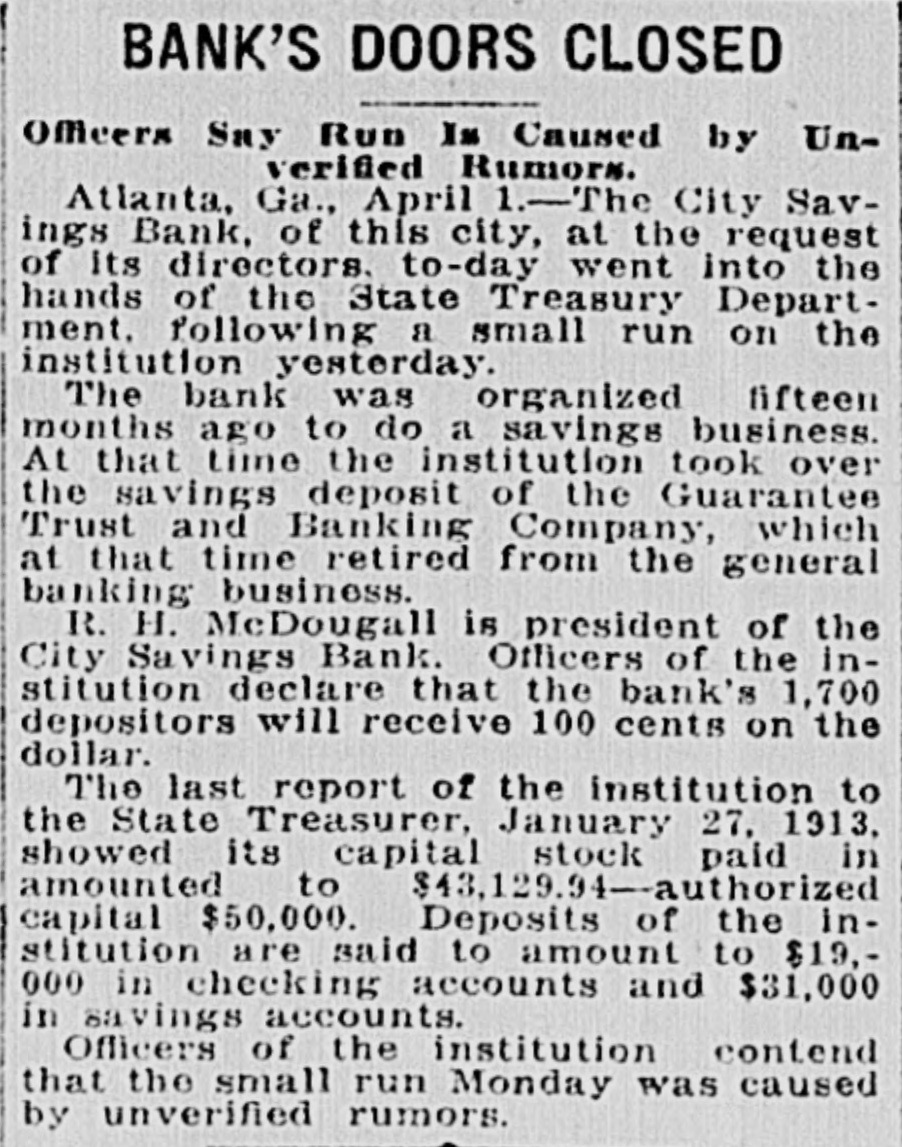

Started by Gossip, Given as Reason for Closing by the Vice President-$50,000 Deposits. The City Savings Bank closed its doors this morning The State Treasurer is in charge The State took charge at the request of the bank's directors. The bank faced a small run yesterday. and feared another run to-day. Cash was almost exhausted. and rather than let those first in line get their money while others would have to wait. the directors decided to close temporarily and let all share alike Officers of all the other financial institutions in Atlanta, when seen by Georgian reporters, declared emphatically that the banking situation in Atlanta will not be affected in the slightest degree by the action of the City Savings Bank. These officials emphasized the fact that there is no cause for any apprehension on the part of the public. Position of At. lanta banks is unusually strong: no other institutions are concerned in the action the City Savings Bank has taken, and the whole affair is merely an incident in banking circles. which will not cause a ripple on the surface of general conditions. Deposits Placed at $50,000. Deposits of the City Savings Bank are estimated by the bank examiners at $50,000. of which $19,000 is in checking accounts and $31,000 in savings accounts, There are 1,700 depositors. Directors declare the bank entirel solvent. Depositors will receive 10 cents on the dollar, and even the stockholders will suffer but small loss if any, according to the bank's off cers. No irregularity is even hinted The troubles of the City Savings began yesterday because of word of mouth gossip, current for several days. No newspaper had given dignity to this gossip by publishing it. and the rumors were spread only b' tongue. Depositors in the City Savings are men who could ill afford any loss. The average balance they carry is very small. It was estimated to-day that 200 checking accounts make up the $19,000 in that department, and that the $31,000 savings are held by 1,500 men, women and children. which makes the average account a trifle more than $20. Beauchamp Explains Act. But there will be no loss, according to the directors. C. S. Beauchamp. Jr., vice-president. issues the following statement "The directors of the City Savings Bank last evening passed a resolution deciding to turn the bank over to the State Treasurer for liquidation. The cause 01 this action was a heavy withdrawal of deposits yesterday. The assets of the bank are entirely adequate to take care of the depositors, but on account of having invested a large proportion of the working capital in purchase-money notes, this working capital could not be converted into cash immediately to meet the demand of checking depositors. The assets of the bank are intact. "The directors wish to state to the public and to the depositors that every dollar of deposits will be paid back, and, in addition to this, that the stockholders themselves have no cause to fear a loss." R. H. McDougall is president of the City Savings Bank; C. S. Beauchamp, Jr., vice-president; W. A. Sims, cashier. The other directors are James L. Wright, S. O. Wickers,