Article Text

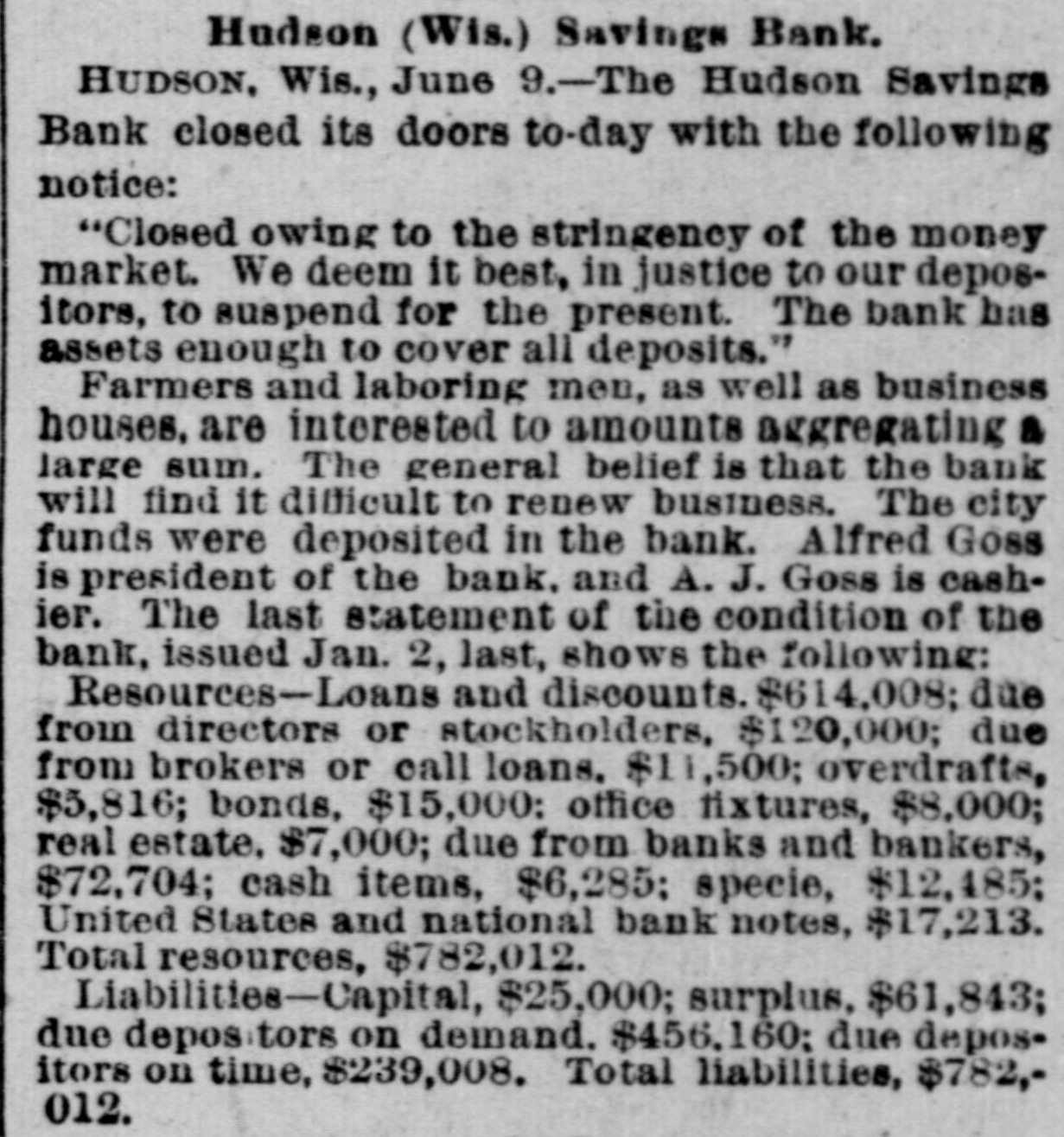

EMBARRASSED BANKS. MANY PRIVATE INSTITUTIONS SUSPEND PAYMENT. A Big Montana Banking House in Dimculties-A Failure at Ellensburg, Wash.-Several Chicago Concorns Close Doors. MISSOULA, Mont., June 9.-C.P.Higgins' Western bank closed its doors at noor today, displaying a formal notice of suspension. This is a private concern and no statement has been obtained at present. Stringency in the money market and threatened litigation precipitated the collapse. It was the depository for county and city funds to the extent of about $80,000, the bank owns large land intereste. Its Encorporators From these lands and improvements they expect to realize more than double the amount required for liquidation when business will be resumed. Several emali business firms are affected by the failure. ELLENSBURG, Wash., June 9.-A notice was posted on the doors of the banking house of Ben E. Snipes & Co. this morning that the bank had temporarily suepended, owing to heavy withdrawals of deposite and inability to realize on securities amply sufficient to pay five dollars for one of indebtedness. A run on the branch bank at Roslyn yesterday precipitated the closing of the parent bank in this city. There is no excitement over the suspension. ALTON, Ill., June 9.-The bank of J. E. Hyattat Gillespie failed today. From information received here it seem a run has been in progress for several days, and this caused the failare. Details have not been learned. CHICAGO, June 9.-Jernberg, Griffin & Co., private bankers, have failed. Liabilities, $20,000; assets, $24,000. Jernberg, as real estate dealer, has also failed, with assets of $200,000; liabilities, $150,000. HUDSON, Wis., June 9.-The Hudson Savings bank closed its doors today. A note on the door saye the closing is temporary, owing to the monetary stringency, and that the bank has enough assets to cover all deposits. The bank had nearly $700,000 on deposit, and the failure created great commotion among business men. Farmers and laboring men will suffer severely. The city: funds are deposited in the bank. The general belief is the bank will find it difficult to resume. CHICAGO, June 9.-Joseph Higgins, a private banker, with branch banks in Illinois, failed this morning; assets, $50,000; liabilities not given. He has branches at Mascoutah, Serento, Gillespie and St. Ann. The assignment covers all. FLORENCE, Ala., June 9.-The Triscumbia Banking company closed its doors this morning. No statement was made. NEW ORLEANS, June9.-The Louisiana Cypress Lumber company is in the hands of a receiver, the result of the depression in the money market. A euit was filed by William S. Hopetra of Muskegon, Mich., to recover $311,431 due on notes. The assets of the company are nominally $300,000; indebtedness probably $200,000. GALVESTON, Tex., June 9.-The Texas Trading company, a wholesale and retail establishment, has made an assignment to W. H. Dorland; assets $163,000, liabilities $180,800. NEW YORK, June 9.-E.1 F. Sanford & Co., jewelers, assigned; liabilities $150,000, assets $100,000. New YORK, June 9.-Judge McAdam has appointed Fabiua M. Clark and Dr. Henry T. Cutter receivers of the Casino.