Article Text

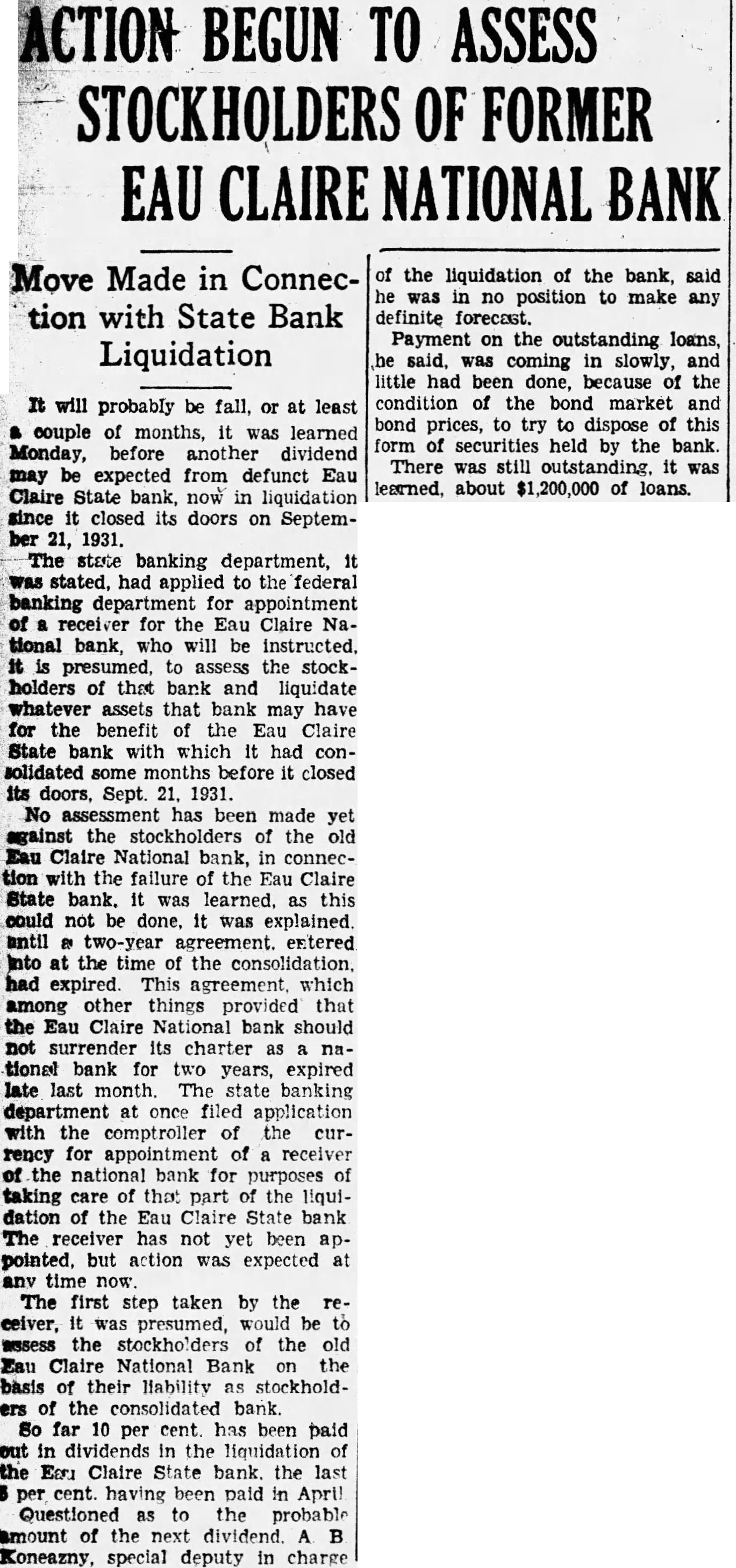

ACTION BEGUN TO ASSESS STOCKHOLDERS OF FORMER EAU CLAIRE NATIONAL BANK Move Made in Connection with State Bank Liquidation It will probably be fall, or at least a couple of months, it was learned Monday, before another dividend may be expected from defunct Eau Claire State bank, now in liquidation since it closed its doors on September 21, 1931. The state banking department, it was stated, had applied to the federal banking department for appointment of a receiver for the Eau Claire National bank, who will be instructed. it is presumed. to assess the stockholders of that bank and liquidate whatever assets that bank may have for the benefit of the Eau Claire State bank with which it had consolidated some months before it closed its doors, Sept. 21, 1931. No assessment has been made yet against the stockholders of the old Eau Claire National bank, in connection with the failure of the Eau Claire State bank. it was learned. as this could not be done, it was explained into at the time of the consolidation. had expired. This agreement. which among other things provided that the Eau Claire National bank should not surrender its charter as a national bank for two years, expired late last month. The state banking department at once filed application with the comptroller of the currency for appointment of a receiver of the national bank for purposes of taking care of that part of the liquidation of the Eau Claire State bank The receiver has not yet been appointed. but action was expected at any time now The first step taken by the receiver, It was presumed, would be to missess the stockholders of the old Eau Claire National Bank on the basis of their liability as stockhold. ers of the consolidated bank. So far 10 per cent. has been paid out in dividends in the liquidation of the Earl Claire State bank. the last 5 per cent. having been paid in April Questioned as to the probable amount of the next dividend. A B Koneazny, special deputy in charge of the liquidation of the bank, said he was in no position to make any definite forecast. Payment on the outstanding loans, he said, was coming in slowly, and little had been done, because of the condition of the bond market and bond prices, to try to dispose of this form of securities held by the bank. There was still outstanding. it was learned, about $1,200,000 of loans.