Click image to open full size in new tab

Article Text

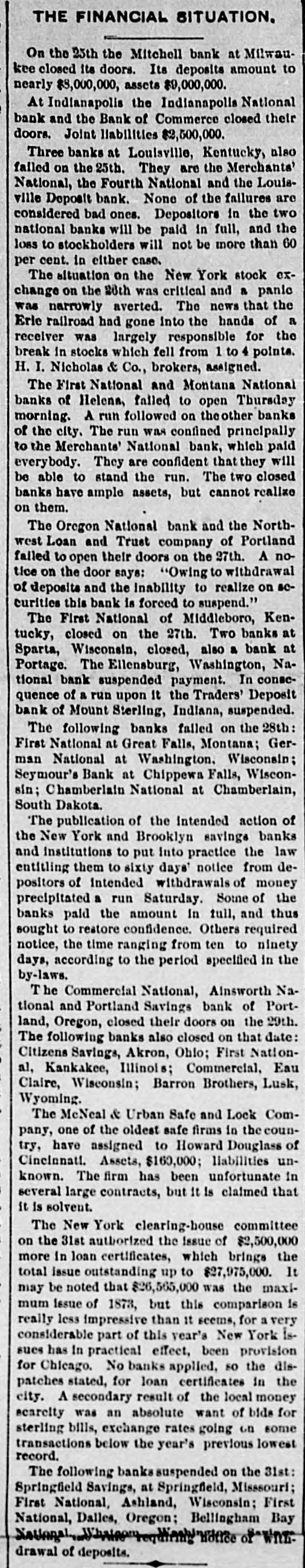

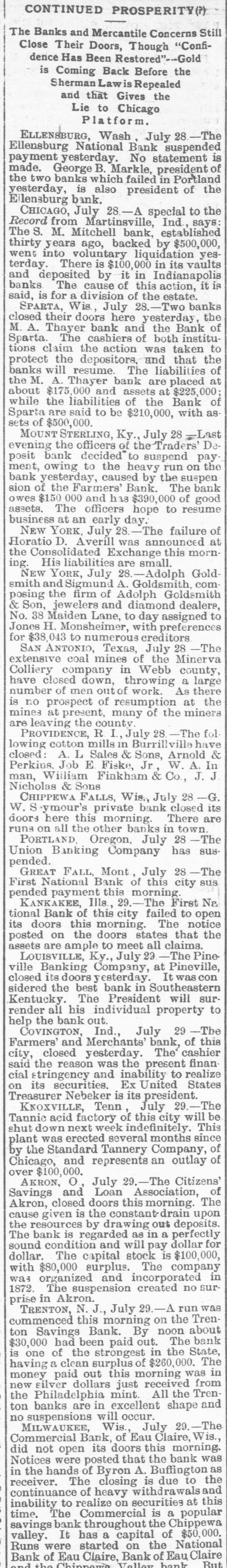

CONTINUED PROSPERITY(P) The Banks and Mercantile Concerns Still Close Their Doors, Though "Confidence Has Been Restored"--Gold is Coming Back Before the Sherman Lawi Repealed and that Gives the Lie to Chicago Platform. ELLENSBURG, Wash July 28-The Ellensburg National Bank suspended payment yesterday. No statement is made. George B. Markle, president of the two banks which failed in Portland yesterday, is also president of the Ellensburg bank. CHICAGO, July 28-A special to the Record from Martinsville, Ind., says: The S. M. Mitchell bank, established thirty years ago, backed by $500,000, went into voluntary liquidation yesterday. There is $100,000 in its vaults and deposited by it in Indianapolis banks The cause of this action, it is said, is for a division of the estate. SPARTA, Wis., July 28.-Two banks closed their doors here yesterday, the M. A. Thayer bank and the Bank of Sparta. The cashiers of both institutions claim the action was taken to protect the depositors, and that the banks will resume. The liabilities of the M. A. Thayer bank are placed at about $175,000 and assets at $225,000; while the liabilities of the Bank of Sparta are said to be $210,000, with as sets of $500,000. MOUNT STERLING, Ky., July 28 -Last evening the officers of the Traders' Deposit bank decided to suspend payment, owing to the heavy run on the bank yesterday, caused by the suspen sion of the Farmers' Bank. The bank owes $150 and has $390,000 of good assets. The officers hope to resume business at an early day. NEW YORK, July 28. The failure of Horatio D. Averill was announced at the Consolidated Exchange this morning. His liabilities are small. NEW YORK, July 28.-Adolph Goldsmith and Sigmund A. Goldsmith, composing the firm of Adolph Goldsmith & Son, jewelers and diamond dealers, No. 38 Maiden Lane, to day assigned to Jones H. Monsheimer, with preferences for $38,043 to numerous creditors SAN ANTONIO, Texas, July 28 -The extensive coal mines of the Minerva Colliery company in Webb county, have closed down, throwing a large number of men outof work. As there is no prospect of resumption at the mines at present, many of the miners are leaving the county PROVIDENCE, R I., July 28 -The following cotton mills in Burrillville have closed: A. L Sales & Sons, Arnold & Perkins. Job E Fiske, Jr, W. A. In man, William Finkham & Co., J. J Nicholas & Sons CHIPPEWA FALLS, Wis., July 28 -G. W. Seymour's private bank closed its doors here this morning. There are runs on all the other banks in town. PORTLAND Oregon, July 28 -The Union Banking Company has suspended. GREAT FALL, Mont, July 28 -The First National Bank of this city sus pended payment this morning. KANKAKEE, Ills., 29.-The First Na tional Bank of this city failed to open its doors this morning. The notice posted on the doors states that the assets are ample to meet all claims. LOUISVILLE, Ky., July 29 The Pineville Banking Company, at Pineville, closed its doors yesterday. It was con sidered the best bank in Southeastern Kentucky. The President will surrender all his individual property to help the bank out. COVINGTON, Ind., July 29 -The Farmers' and Merchants' bank, of this city, closed yesterday. The cashier said the reason was the present finan cial stringency and inability to realize on its securities. Ex United States Treasurer Nebeker is its president. KNOXVILLE, Tenn July 29.-The Tannic acid factory of this city will be shut down next week indefinitely. This plant was erected several months since by the Standard Tannery Company, of Chicago, and represents an outlay of over $100,000. AKRON, 0, July 29.-The Citizens' Savings and Loan Association, of Akron, closed doors this morning. The cause given is the constant-drain upon the resources by drawing out deposits. The bank is regarded as in a perfectly sound condition and will pay dollar for dollar. The capital stock is $100,000, with $80,000 surplus. The company was organized and incorporated in 1872. The suspension created no sur prise in Akron. TRENTON, N. J., July 29.-A run was commenced this morning on the Tren ton Savings Bank. By noon about $30,000 had been paid out. The bank is one of the strongest in the State, having a clean surplus of $260,000. The money paid out this morning was in new silver dollars just received from the Philadelphia mint. All the Tren ton banks are in excellent shape and no suspensions will occur. MILWAUKEE, Wis., July 29 .-The Commercial Bank, of Eau Claire, Wis., did not open its doors this morning.