Click image to open full size in new tab

Article Text

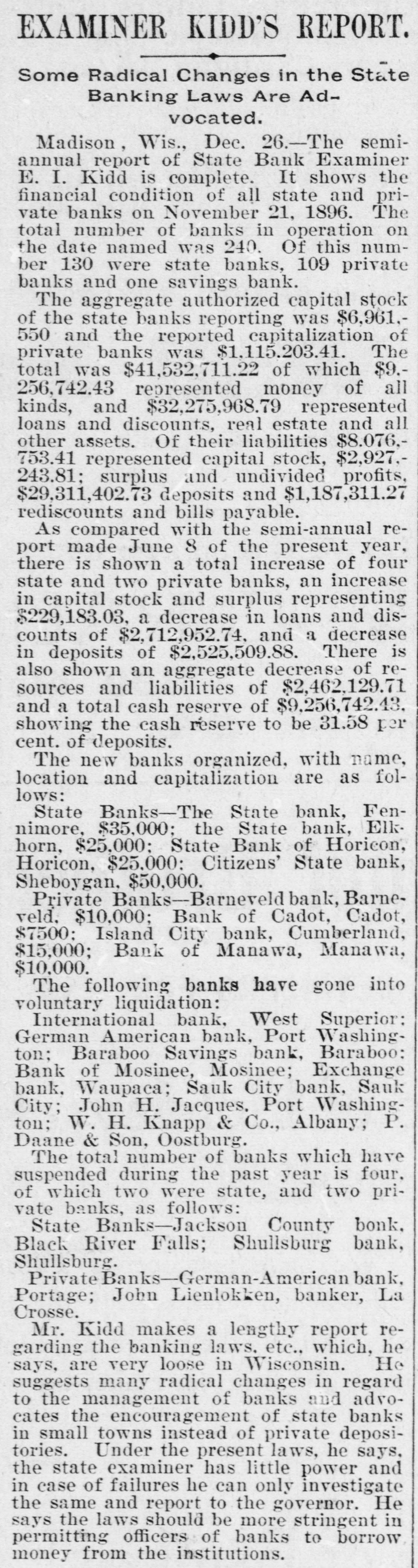

EXAMINER KIDD'S REPORT. Some Radical Changes in the State Banking Laws Are Advocated. Madison, Wis., Dec. 26.-The semiannual report of State Bank Examiner E. I. Kidd is complete. It shows the financial condition of all state and private banks on November 21, 1896. The total number of banks in operation on the date named was 240. Of this number 130 were state banks, 109 private banks and one savings bank. The aggregate authorized capital stock of the state banks reporting was $6,961.550 and the reported capitalization of private banks was $1,115,203.41. The total was $41,532,711.22 of which $9.256,742.43 represented money of all kinds, and $32,275,968.79 represented loans and discounts, real estate and all other assets. Of their liabilities $8.076,753.41 represented capital stock, $2,927,243.81; surplus and undivided profits, $29,311,402.73 deposits and $1,187,311.27 rediscounts and bills payable. As compared with the semi-annual report made June 8 of the present year, there is shown a total increase of four state and two private banks, an increase in capital stock and surplus representing $229,183.03, a decrease in loans and discounts of $2,712,952.74. and a decrease in deposits of $2,525,509.88. There is also shown an aggregate decrease of resources and liabilities of $2,462,129.71 and a total cash reserve of $9,256,742.43. showing the cash réserve to be 31.58 per cent. of deposits. The new banks organized. with name, location and capitalization are as follows: State Banks-The State bank, Fennimore, $35,000; the State bank, Elkhorn, $25,000; State Bank of Horicon, Horicon, $25,000: Citizens' State bank, Sheboygan, $50,000. Private Banks-Barneveld bank, Barneveld. $10,000; Bank of Cadot, Cadot, $7500: Island City bank, Cumberland, $15,000; Bank of Manawa, Manawa, $10,000. The following banks have gone into voluntary liquidation: International bank. West Superior: German American bank, Port Washington; Baraboo Savings bank, Baraboo: Bank of Mosinee, Mosinee; Exchange bank. Waupaca; Sauk City bank. Sauk City; John H. Jacques. Port Washington; W. H. Knapp & Co., Albany; P. Daane & Son, Oostburg. The total number of banks which have suspended during the past year is four, of which two were state, and two private banks, as follows: State Banks-Jackson County bonk. Black River Falls; Shullsburg bank, Shullsburg. PrivateBanks-German-American bank, Portage; John Lienlokken, banker, La Crosse. Mr. Kidd makes a lengthy report regarding the banking laws. etc., which, he says, are very loose in Wisconsin. He suggests many radical changes in regard to the management of banks and advocates the encouragement of state banks in small towns instead of private depositories. Under the present laws, he says, the state examiner has little power and in case of failures he can only investigate the same and report to the governor. He says the laws should be more stringent in permitting officers of banks to borrow money from the institutions.