Article Text

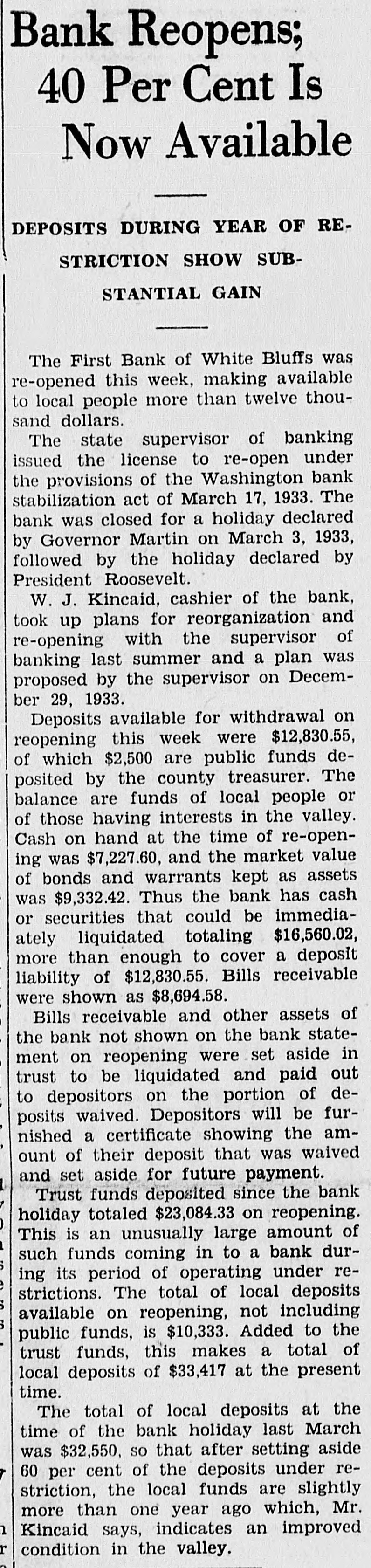

# Bank Holiday # Slows Business The proclamation issued by President Roosevelt last Sunday brought to a halt one of the greatest financial panics in the history of the United States. The long continued decline of all commodity, stock and bond values was throwing a greater and greater strain on the credit machinery of the country and at the time of the holiday called in Michigan, to protect the closing of banks there, the country was ripe for the final panic that this and succeeding events started. People in both this and foreign countries began a rush to convert their bank balances into gold and currency and to hoard it or to ship it abroad. One state after another called holidays and enacted hasty legislation to try to cope with the situation, until on the day of the inauguration of President Roosevelt, every state in the union was involved in holidays declared by the governors of the states. As soon as the inaugural ceremonies were completed, President Roosevelt began the conferences which resulted in his calling a national bank holiday and placing an embargo on the paying out or export of gold, silver or gold certificates, and which closed all banking institutions in the United States. This action was taken to protect the finances of the country and preserve its gold reserves; and the closing of the banks was for the purpose of preventing further withdrawals and protecting the assets of the banks for the benefit of all depositors. Previous to the calling of the national holiday, Governor Martin of this state had called a bank holiday effective from midnight, March 3rd, to midnight, March 6th. A few days previous to the calling of the state holiday the legislature had enacted new legislation which enabled the state supervisor of banking to authorize a bank, on application, to cease paying checks drawn on it but to remain open and render a limited banking service in accepting new deposits in trust, which the depositor could withdraw or check on at will. These new deposits could not be loaned and could be deposited in only such depository as the state supervisor of banking would permit. The supervisor could also permit a limited withdrawal of the old deposits if he deemed best. Prior to the calling of the national holiday, unusual withdrawals by depositors had forced a number of banks within the state to avail themselves of the provisions of this new law. W. J. Kincaid, cashier of the First Bank of White Bluffs, says that through the fine coperation of the people of this valley it had not been necessary for this bank to avail itself of the provisions of the new law. The bank, however, complied with the holiday declared by Governor Martin, and Cashier Kincaid says that the bank will comply with the directions issued from time to time by the federal Treasury Department in working out the involved banking situation in the country. On Tuesday the banks began opening, to render the banking functions authorized by the Secretary of the Treasury on Monday and Tuesday. These functions permitted the banks to make change for customers, permit free access to safety deposit boxes, pay checks for relief of distress, medical supplies, food and wages and provide for shipments of food products, but in all such transactions were prohibited from paying out any gold or gold certificates. Besides this very limited authority to pay checks drawn against deposits held by the banks at the time the President's proclamation was made, all banks are authorized to accept new deposits of cash, checks drawn on the U. S. Treasurer or other checks which may be paid. These new deposits are kept entirely separate from all other funds of the bank and considered as trust funds. A new set of books must be opened to account for such deposits and they cannot be loaned and no interest can be paid on them. The bank is required to keep the full amount of these new deposits available for checking or withdrawal in the form of cash on hand, deposit in the Federal Reserve bank and United States government bonds. These new deposits may be withdrawn without any restriction whatever, are absolutely safe and will not be involved in any restrictions which affect the old deposits. At the time of going to press no announcement had been received from Washington, D. C., as to the manner in which old deposits would be released, what new form of bank legislation would be proposed to Congress which convenes today or what form emergency currency or scrip would