Click image to open full size in new tab

Article Text

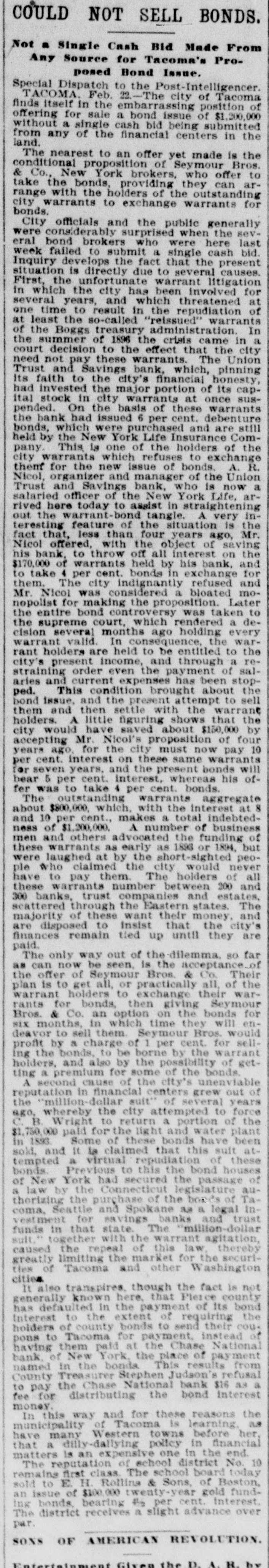

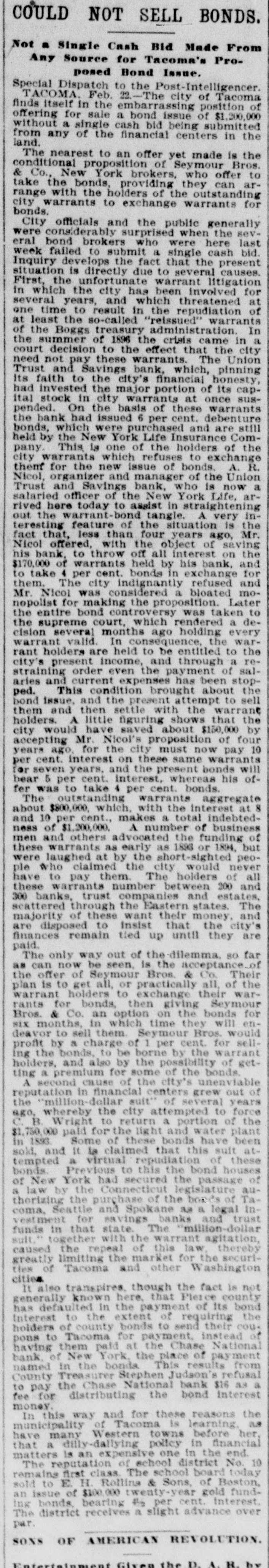

COULD NOT SELL BONDS. Not a Single Cash Bid Made From Any Source for Tacoma's Proposed Bond Issue. Special Dispatch to the Post-Intelligencer. TACOMA. Feb. 22-The city of Tacoma finds itself in the embarrassing position of offering for sale a bond issue of $1,200,000 without a single cash bld being submitted from land. any of the financial centers in the The nearest to an offer yet made is the conditional proposition of Seymour Bros. & Co., New York brokers, who offer to take the bonds, providing they can arrange with the holders of the outstanding city warrants to exchange warrants for bonds. City officials and the public generally were considerably surprised when the several bond brokers who were here last week failed to submit a single cash bid. Inquiry develops the fact that the present situation is directly due to several causes. First, the unfortunate warrant litigation in which the city has been involved for several years, and which threatened at one time to result in the repudiation of at least the so-called "reissued" warrants of the Boggs treasury administration. In the summer of 1896 the crisis came in a court decision to the effect that the city need not pay these warrants. The Union Trust and Savings bank, which, pinning Its faith to the city's financial honesty, had invested the major portion of its capItal stock in city warrants at once suspended. On the basis of these warrants the bank had issued 6 per cent. debenture bonds, which were purchased and are still held by the New York Life Insurance Company This la one of the holders of the city warrants which refuses to exchange themf for the new issue of bonds. A. R. Nicol, organizer and manager of the Union Trust and Savings bank, who is now a salaried officer of the New York Life, arrived here today to assist in straightening out the warrant-bond tangle. A very interesting feature of the situation is the fact that, less than four years ago, Mr. Nicol offered, with the object of saving his bank, to throw off all interest on the $170,000 of warrants held by his bank, and to take 4 per cent. bonds in exchange for them. The city indignantly refused and Mr. Nicol was considered a bloated monopolist for making the proposition. Later the entire bond controversy was taken to the supreme court, which rendered a decision several months ago holding every warrant valid. In consequence, the warrant holders are held to be entitled to the city's present income, and through a restraining order even the payment of salaries and current expenses has been stopped. This condition brought about the bond issue. and the present attempt to sell them and then settle with the warrant holders. A little figuring shows that the city would have saved about $150,000 by accepting Mr. Nicol's proposition of four years ago, for the city must now pay 10 per cent. interest on these same warrants for seven years, and the present bonds will bear 5 per cent. interest, whereas his offer was to take 4 per cent. bonds. The outstanding warrants aggregate 8 about $800,000, which, with the interest at and 10 per cent., makes a total indebtedness of $1,200,000. A number of business men and others advocated the funding of these warrants as early as 1893 or 1894, but were laughed at by the short-sighted people who claimed the city would never have to pay them. The holders of all these warrants number between 200 and 300 banks, trust companies and estates, scattered through the Eastern states. The majority of these want their money, and are disposed to Insist that the city's finances remain tied up until they are paid. The only way out of the dilemma. so far as can now be seen, is the acceptance. of the offer of Seymour Bros. & Co. Their plan is to get all, or practically all, of the warrant holders to exchange their warrants for bonds, then giving Seymour Bros. & Co. an option on the bonds for six months, in which time they will endeavor to sell them. Seymour Bros. would profit by a charge of 1 per cent. for sellIng the bonds, to be borne by the warrant holders, and also by the possibility of getting a premium for some of the bonds A second cause of the city's unenviable reputation in financial centers grew out of the million dollar suit' of several years ago, whereby the city attempted to force B Wright to return a portion of the $1, paid for the light and water plant in 1893 Some of these bonds have been sold, and It la claimed that this suit attempted a virtual repudiation of these bonds. Previous to this the bond houses of New York had secured the passage of a law by the Connecticut legislature authorizing the purchase of the box of Tacoma, Seattle and Spokane as a legal Investment for savings banks and trust funds in that state. The 'million-dollar suit together with the warrant agitation, caused the repeal of this law thereby greatly limiting the market for the securities of Tacoma and other Washington cities It also transpires, though the fact is not generally known here. that Pierce county has defaulted in the payment of Its bond Interest to the extent of requiring the holders of county bonds to send their cou. pons to Tacoma for payment. instead of having them paid at the Chase National bank. of New York, the place of payment named in the bonds This results from County Treasurer Stephen Judson's refusal to pay the Chase National bank $16 as a fee for distributing the bond interest money. In this way and for these reasons the municipality of Tacoma is learning. as have many Western towns before her, that a dilly-dallying policy in financial matters is an expensive one in the end. The reputation of school district No. 10 remains first class The school board today sold to E. H Rollins & Sons, of Boston, an issue of $100 000 twenty year gold fund-