Click image to open full size in new tab

Article Text

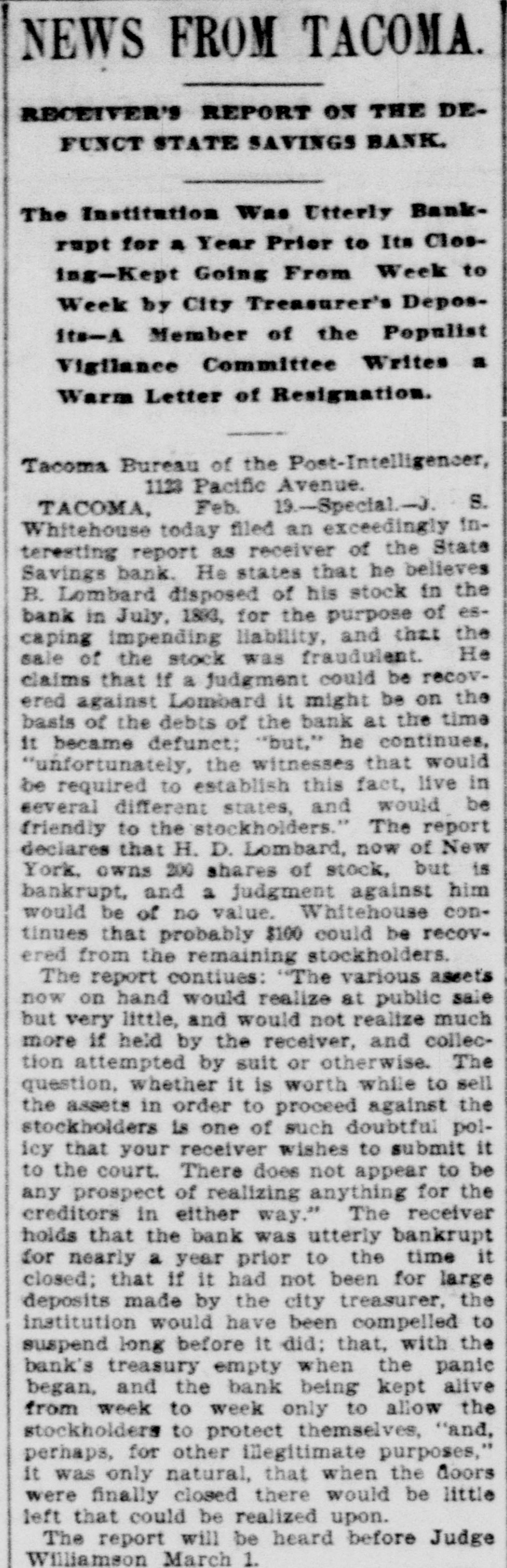

NEWS FROM TACOMA. RECEIVER'S REPORT ON THE DEFUNCT STATE SAVINGS BANK. The Institution Was Utterly Bankrupt for a Year Prior to Its Closing-Kept Going From Week to Week by City Treasurer's Deposits-A Member of the Populist Vigilance Committee Writes a Warm Letter of Resignation. Tacoma Bureau of the Post-Intelligencer, 1123 Pacific Avenue. TACOMA, Feb. 19.-Special.-J. S. Whitehouse today filed an exceedingly interesting report as receiver of the State Savings bank. He states that he believes B. Lombard disposed of his stock in the bank in July, 1893, for the purpose of escaping impending liability, and that the sale of the stock was fraudulent. He claims that If a judgment could be recovered against Lombard it might be on the basis of the debts of the bank at the time it became defunct; "but," he continues, "unfortunately, the witnesses that would be required to establish this fact, live in several different states, and would be friendly to the stockholders." The report declares that H. D. Lombard, now of New York, owns 200 shares of stock, but is bankrupt, and a judgment against him would be of no value. Whitehouse continues that probably $100 could be recovered from the remaining stockholders. The report contiues: "The various assets now on hand would realize at public sale but very little, and would not realize much more if held by the receiver, and collection attempted by suit or otherwise. The question, whether it is worth while to sell the assets in order to proceed against the stockholders is one of such doubtful policy that your receiver wishes to submit it to the court. There does not appear to be any prospect of realizing anything for the creditors in either way." The receiver holds that the bank was utterly bankrupt for nearly a year prior to the time it closed; that if it had not been for large deposits made by the city treasurer, the institution would have been compelled to suspend long before it did; that, with the bank's treasury empty when the panie began, and the bank being kept alive from week to week only to allow the stockholders to protect themselves, "and, perhaps, for other illegitimate purposes," it was only natural, that when the doors were finally closed there would be little left that could be realized upon. The report will be heard before Judge Williamson March 1.