Click image to open full size in new tab

Article Text

McCauley assumed oince, checked against Boggs' bank accounts, got money out of them when he could and when he couldn't used the current revenues. He followed naturally enough his predecessor's lead. He got $1000 into Harry Lombard's State Savings Bank a day or two before it failed, and Harry went to the Japanese village. The failure of that house put Whitehouse in as receiver and resulted in Boggs' arrest and prosecution, though he was acquitted, and revealed that Boggs had deposited not only warrants, but notes of his own and others as city funds, and that the bank had subscribed by thousands to the campaign fund under the head of "election expenses."

Boggs was acquitted because the evidence against him was wholly that of another's making-i. e., the books of the bank, which, the court held, were conclusive as against the man who made the entries, but as against no one else, and so Boggs escaped without a verdict from the jury, went to Oregon and bought a gold mine, which he was operating when arrested again, a few days ago.

McCauley assumed office in April, 1894, and almost immediately built an elegant residence, furnishing it resplendently with the costliest of goods. Grattan H. Wheeler went to New York as the agent of the Mutual Investment Company. W. B. Allen, president of the Bank of Tacoma, took hundreds of thousands of city warrants and went to Chicago to attempt to dispose of them. A deal was engineered through the City Council whereby bonds and securities were demanded of every bank having city money on deposit, and a contract was made with the Bank of Tacoma permitting it to remain undisturbed for one year.

It was the approach of the close of this year of grace, together with the appointment of a new finance committee that brought suddenly to a close the career of the Bank of Tacoma, with some $228,000 of city money ostensibly on deposit there. An assignment was made to a friend of the president, but the court appointed Tilton receiver. The books were stolen before the receiver could get possession, but enough was left behind to show that Boggs had been borrower to the extent of over $50,000 that he had overdrawn; that he had had $18,000 for "election expenses"; that Wheeler was sent remittances monthly of hundreds of dollars and that Boggs' deposits had consisted of cash, notes, warrants or "any old thing."

Now, then, had come a time for the banks and brokers from whom Boggs had cut loose to get their revenge. The Columbia National was the next largest depository of city funds. At one time over $210,000 had appeared to the city's credit. It was also the depository for large amounts of county funds. A job was set up whereby the Commissioners should demand a count of the county's funds. It was done. Every bank having county funds was required to "dig up" the full amount in coin. The Columbia National was forced to take its best securities to a rival to procure funds to carry on business and at the same time meet the county's demand. It was met, however, the bank's officers apparently expecting to get their gold back next day and go on with business.

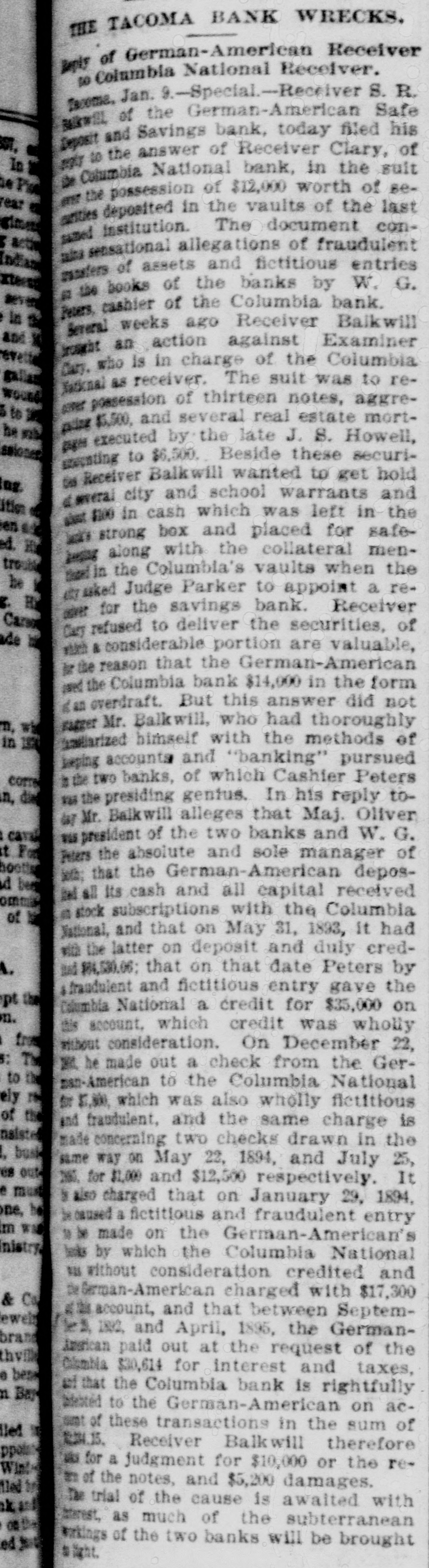

The Commissioners, having once well housed their treasure, put a guard about it and would not allow it to go back. The scheme had worked. The Columbia Bank had then pending in the Controller's office an application for a stock assessment, whereby it claimed it would be able to meet all demands. It owed the city over $100,000, while its side issue, the German-American, owed some $58,000. The city, at the same time, had pending a demand on the Columbia for $16,500, to meet the semi-annual interest on City Hall and funding funds at New York City. Now began in earnest a fight for life on the one hand the Columbia and German-American struggling for a respite, and on the other all the banks of the city to force them out.

In order to gain time a suit by the twin banks was begun to cancel all their obligations to the city on the ground that its deposits with the banks consisted of warrants, the validity of which the city denied, and that therefore the banks owed the city nothing. The city then brought suit for a receiver for the German-American and it was hotly contested. The court granted a receiver. An appeal was taken and denied and the receiver put in possession through force. The books, securities, cash and vouchers were not there, having been taken into the Columbia National's vaults.

Political strings began to be pulled on the Controller of the Currency to compel him to appoint a receiver for the Columbia. The bank, however, had strong alliances East and a counter pressure was being exerted. However, Bank Examiner Clary was enlisted and he telegraphed his superior, with the result that he was ordered to take possession. No receiver has yet been appointed.

Thus ended a most remarkable fight for existence, the inside history of which would make a romance of itcelf, the contending interests being shown-a cashier fighting away from prison gates; a set of stockholders at the East strongly desirous of preventing a failure, many of whom had voluntarily come to the rescue with large sums of money; a lot of warrants somewhere, either sold or unsold, liability on which was the same whether void or valid; the best securities tied up to procure a supposedly temporary loan.

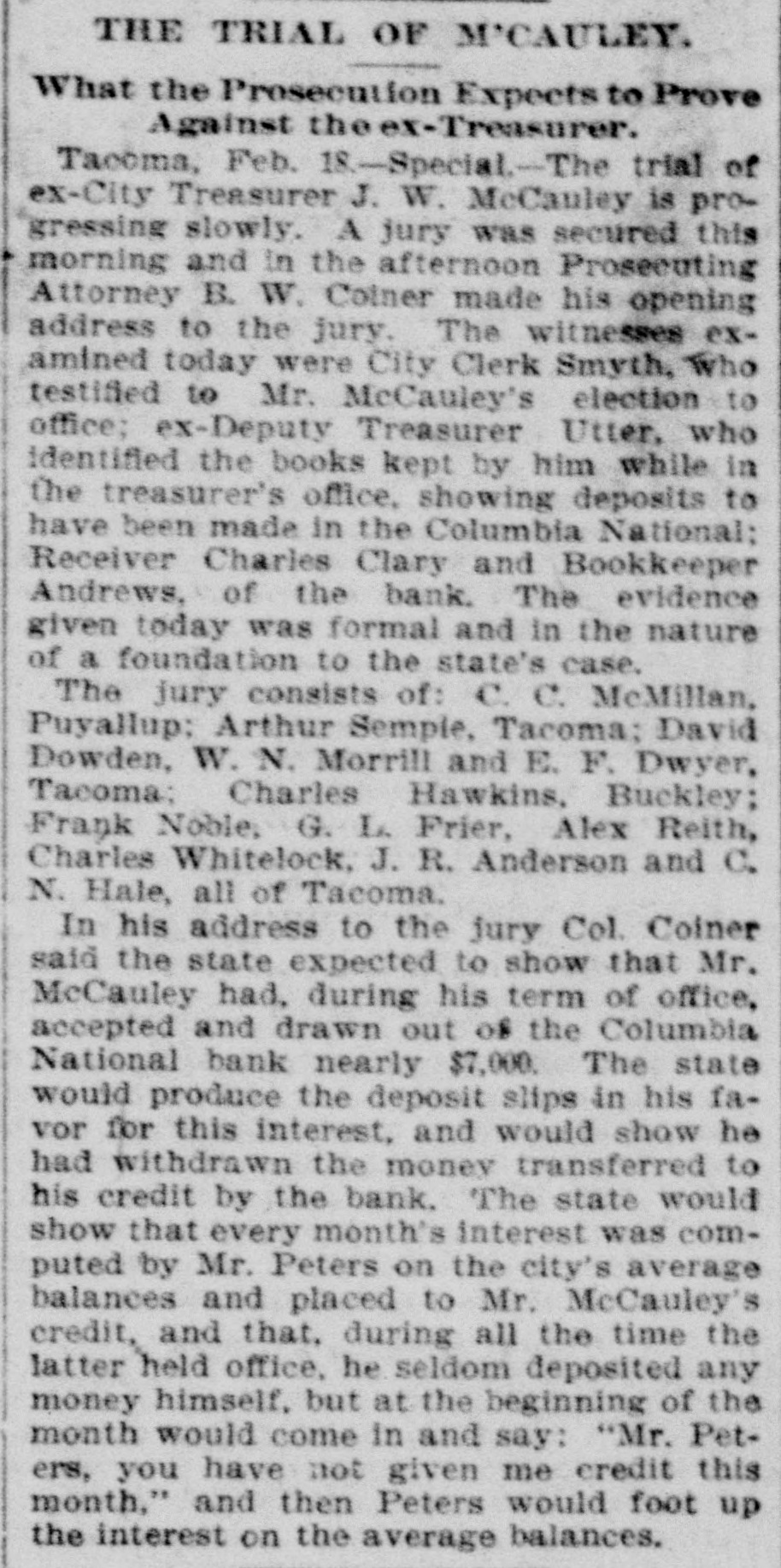

The receiver of the German-American having gained possession, the cashier of that institution gave up hope and made a clean breast of all its operations, telling of how both Boggs and McCauley had been in receipt of regular salaries from the bank and implicating the officers of the Columbia National in extensive frauds upon the city and county. Notes of Boggs for $11,300 were also found among the securities supposed to belong to this bank in the vaults of the Columbia.

The result of these exposures was the arrest of Boggs, the removal of McCauley from office and his subsequent arrest, the arrest of Peters, the cashier, and of the County Treasurer. Public clamor now is for the arrest of all in any wise concerned in the encouragement of Boggs in his evil practices-those who paid him commissions and aided him in covering up his deficit with fictitious bank deposits and all whom the law can in any wise reach.

My judgment of the situation is, however, tha. so many and so prominent are the persons implicated, and so multifarious are the ramifications of the city warrant, bond and bank plot, that all engaged in it will never be brought to punishment. A few scapegoats may be made samples of, but the real culprits-those even worse