Article Text

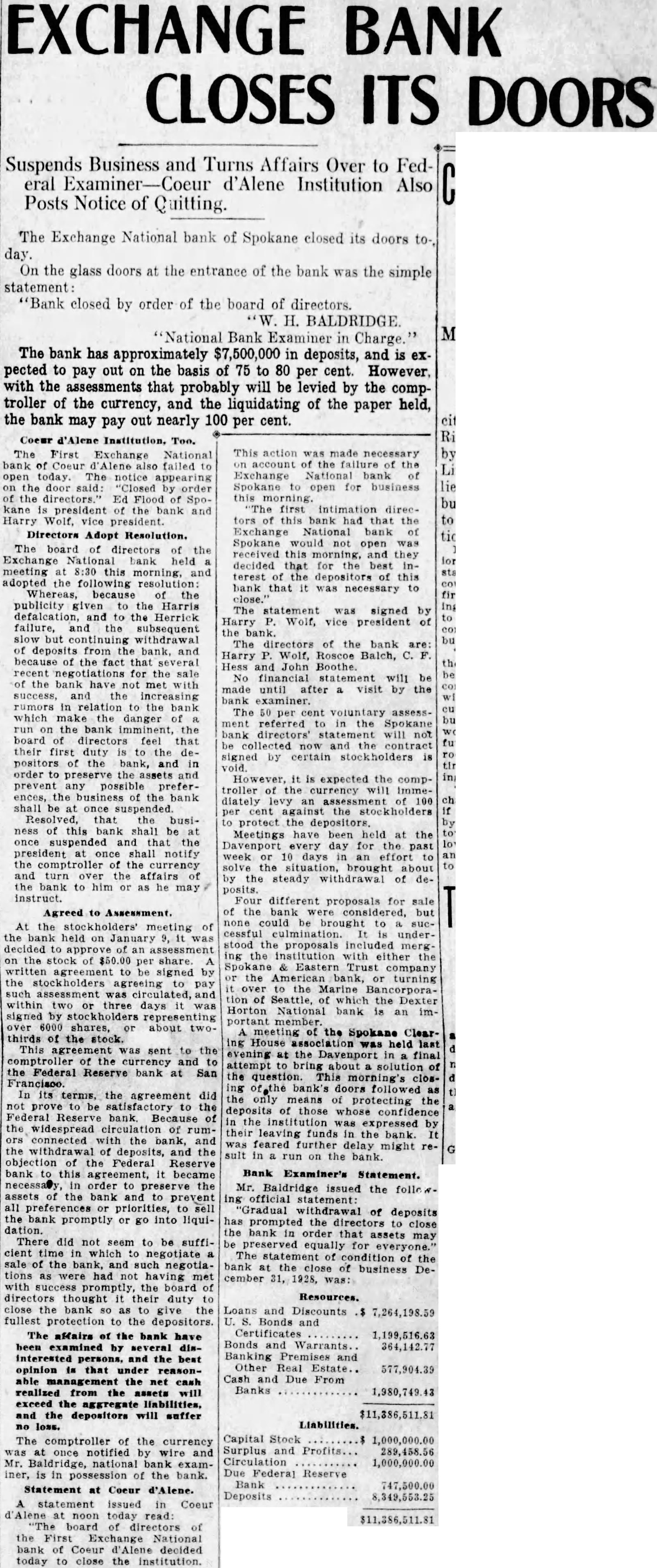

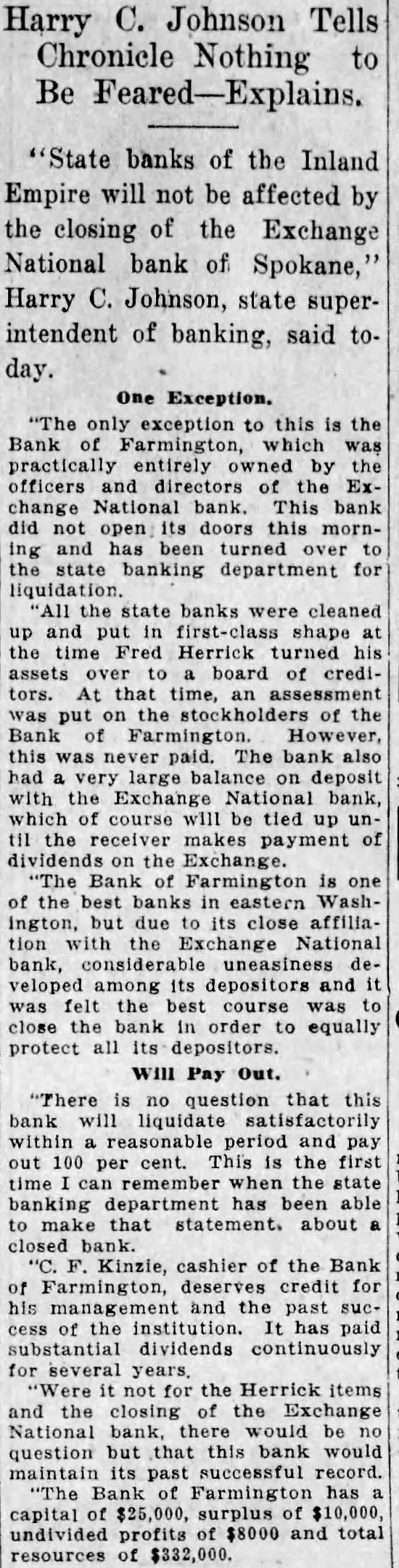

EXCHANGE NATIONAL BANK CLOSES DOORS ASK JAIL TERMS ALL RUM CASES Drastic Orders Issued by County Prosecutor Due to Rogers' Trial. Drastic orders concerning the conviction of liquor violators were issued today to all deputy prosecutors by Prosecutor Charles Greenough as a result of Deputy Prosecutor Frank Funkhouser yesterday being successful in his plea to Justice Charles Gram for a suspended jail sentence and suspended fine of $250 in the case of Frank Rogers, 25. have instructed all my deputies to demand jail sentences for violators of the liquor law,' said Prosecutor Greenough. Pleaded Guilty. Rogers entered plea of guilty manufacturing liquor and admitted owning and operating still in a house at E2 Eighth. Although censured Rogers and he severely declared that he believed that Rogshould be deported, Funkhouser ers recommended to Justice Gram that the jall sentence be suspended. Funkhouser explained his recommendations by saying that he and Deputy Sheriff W. A. Harker had stipulated with Rogers' attorney, and had agreed to recommend suspended sentence if Rogers would plead guilty. When Funkhouser halted the trial for Brower denied having Deputy Sheriff Hark sentence this Brower Talked After the this onference. ledge in Sheriff orders Sheriff his action persons in reduce hat more imporwill barter liquor tant Greenoug the lay facts There may exceptions, but these will where evidence is sufficient to secure conviction case is carried higher court." Judge Gram said he favor suspended liquor law