Click image to open full size in new tab

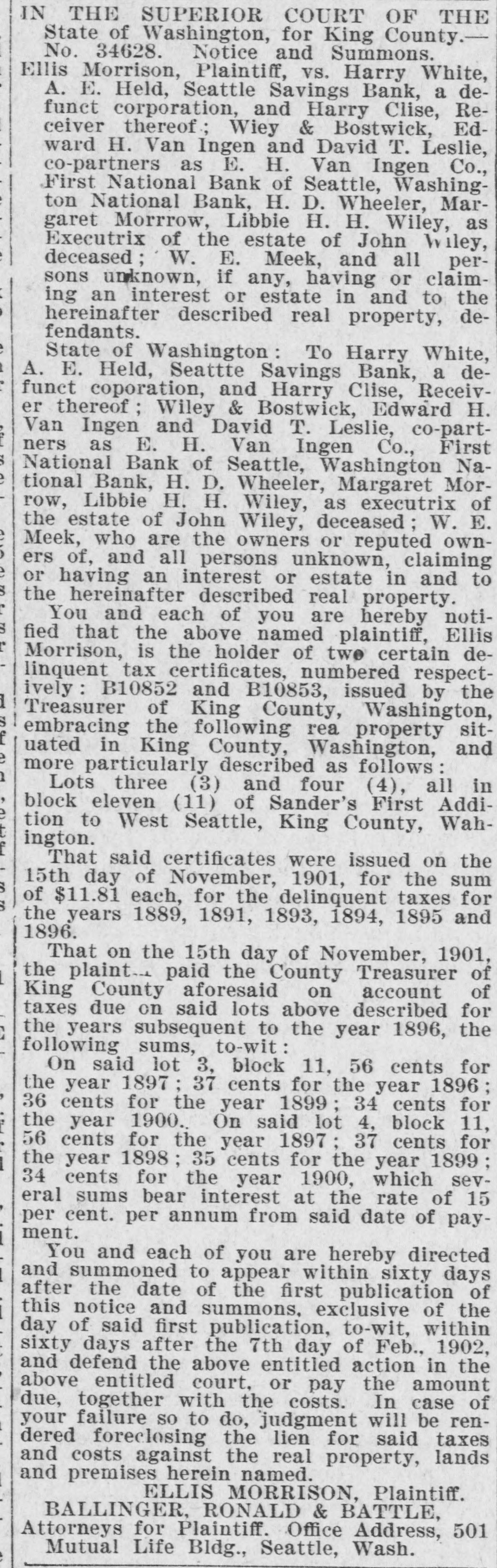

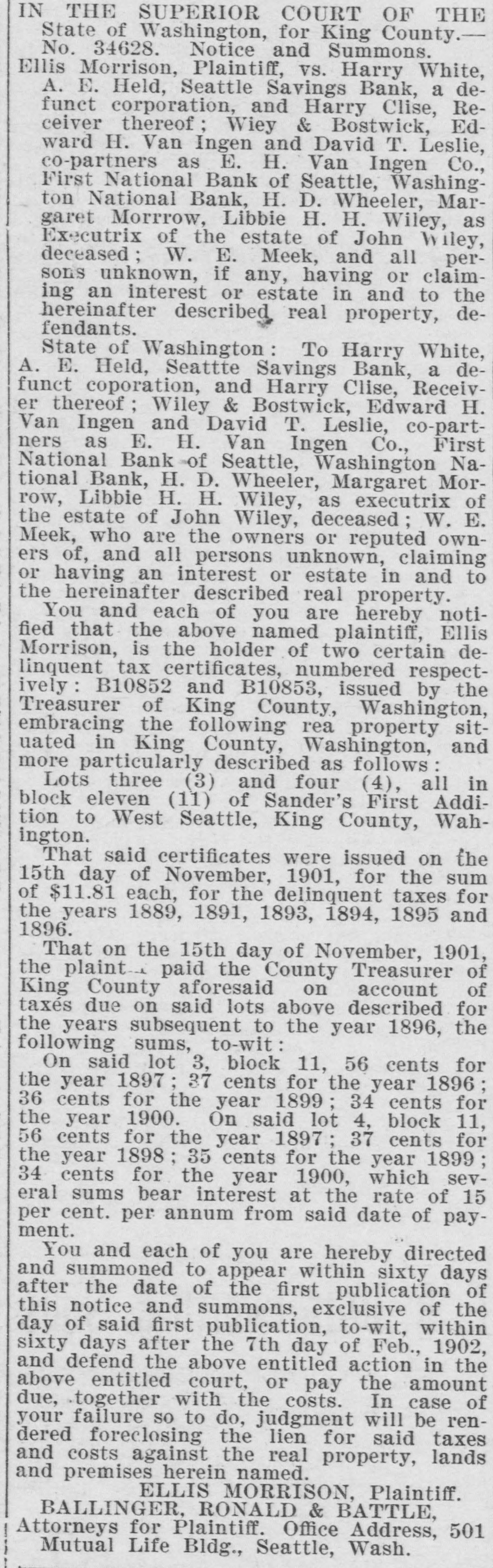

Article Text

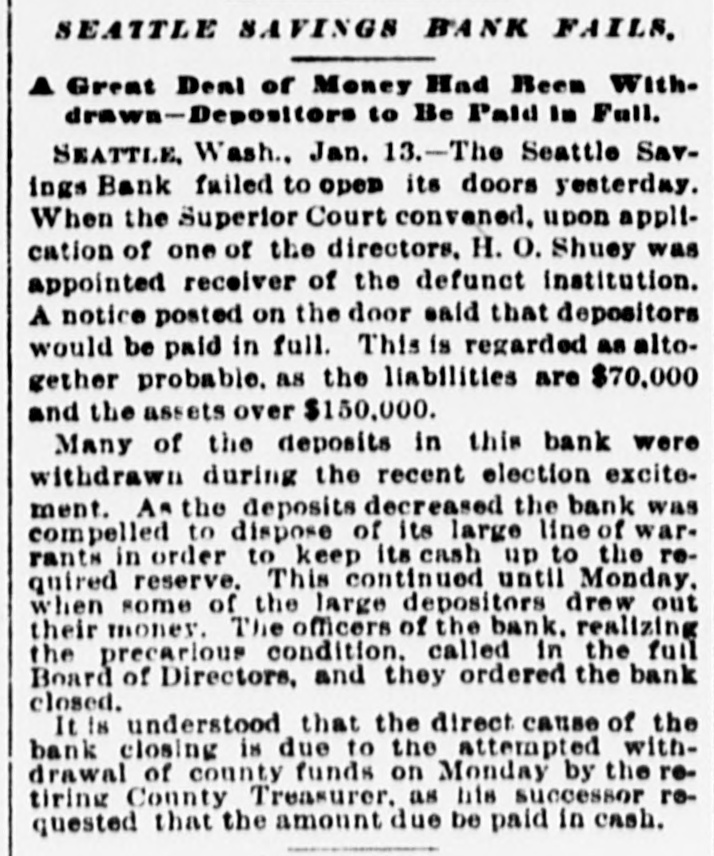

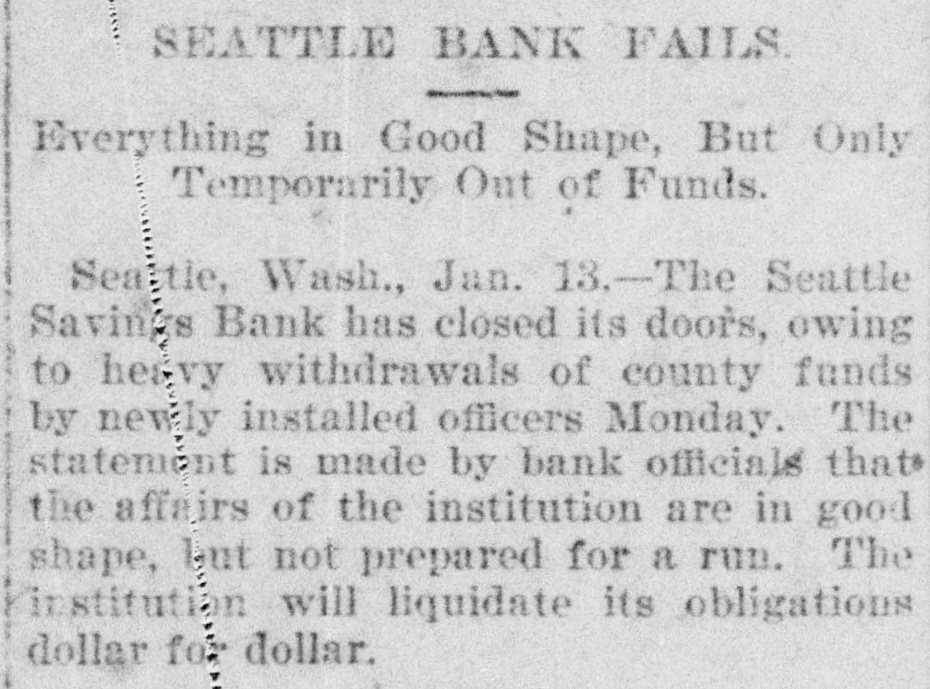

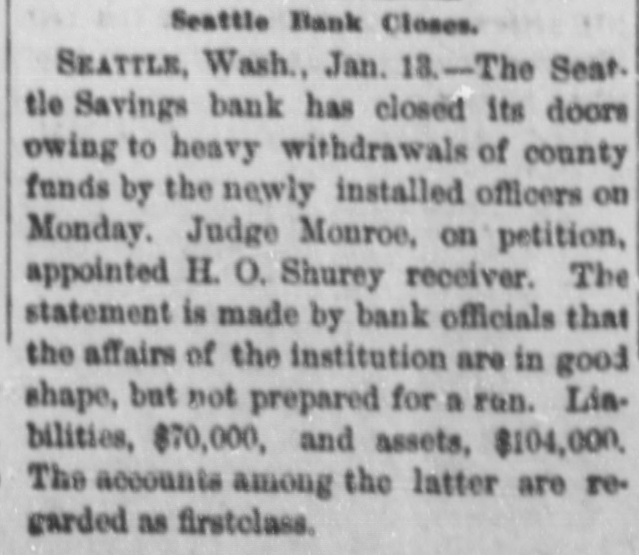

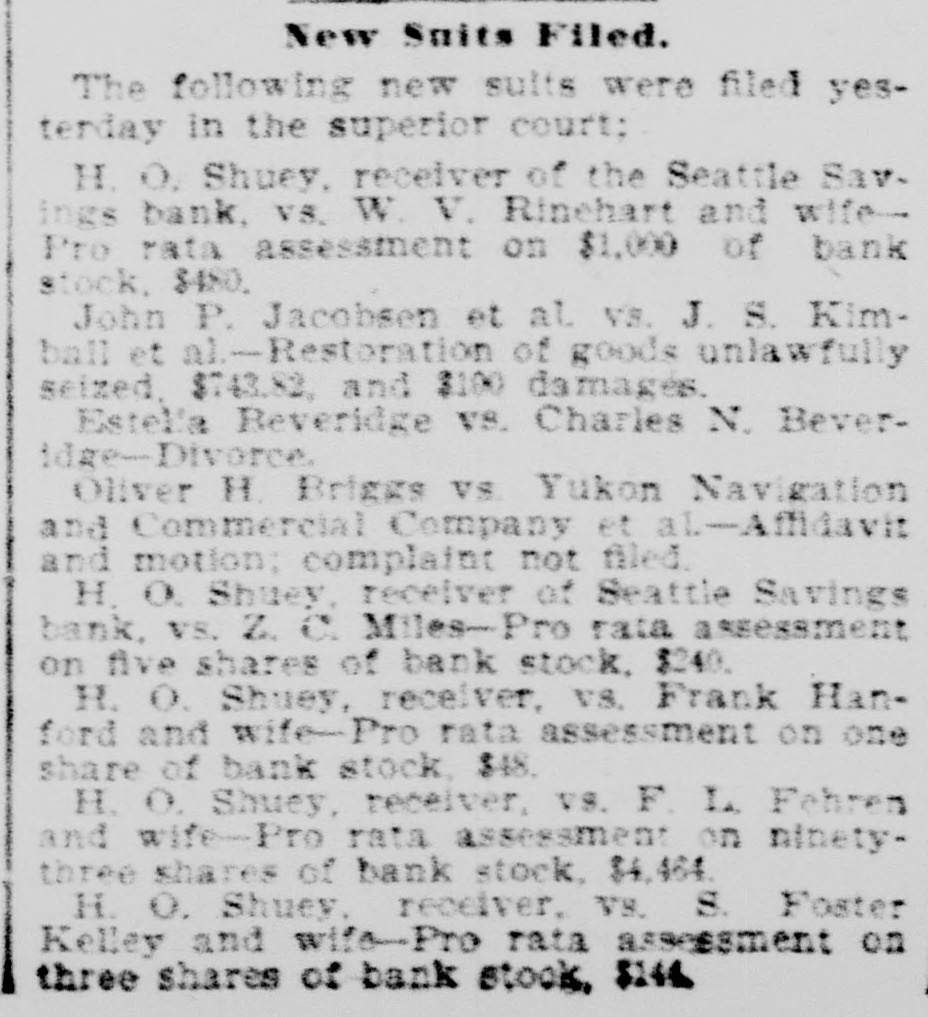

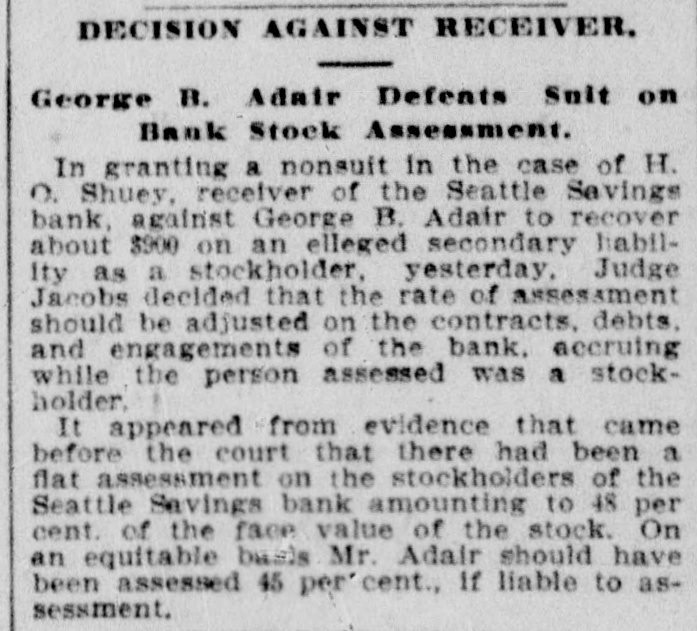

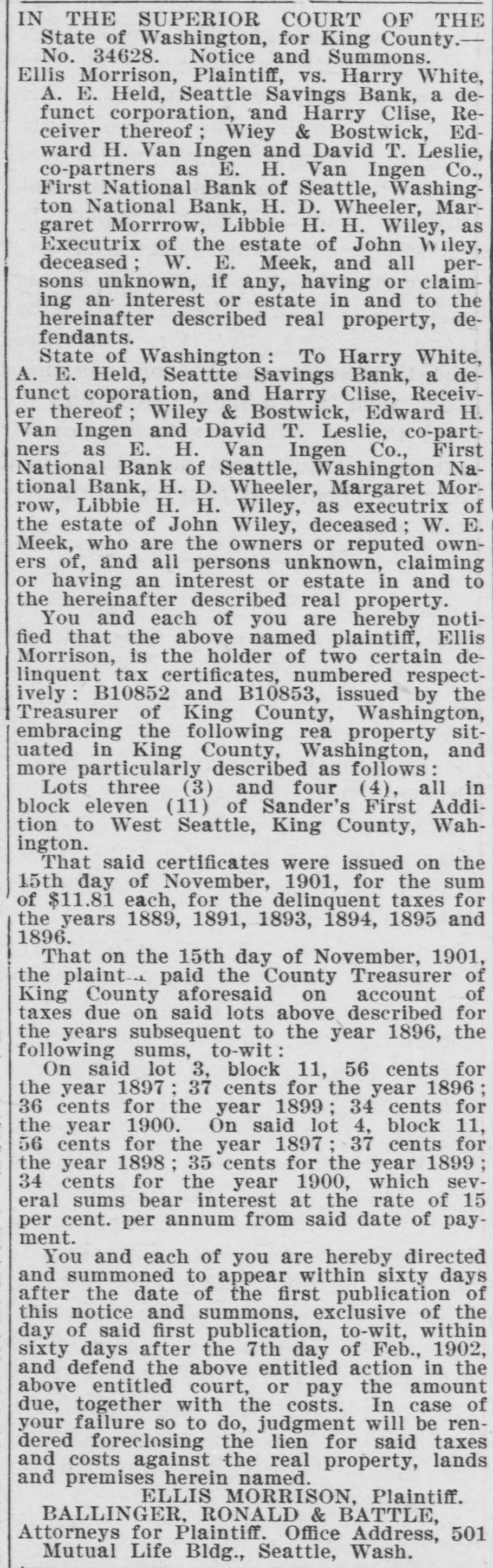

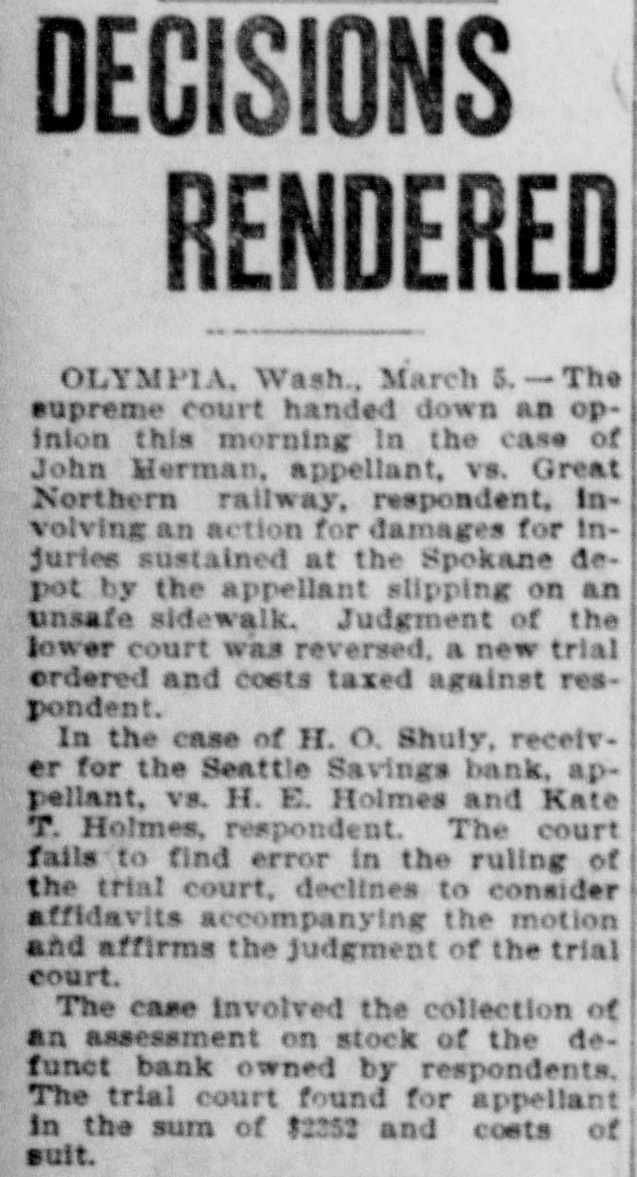

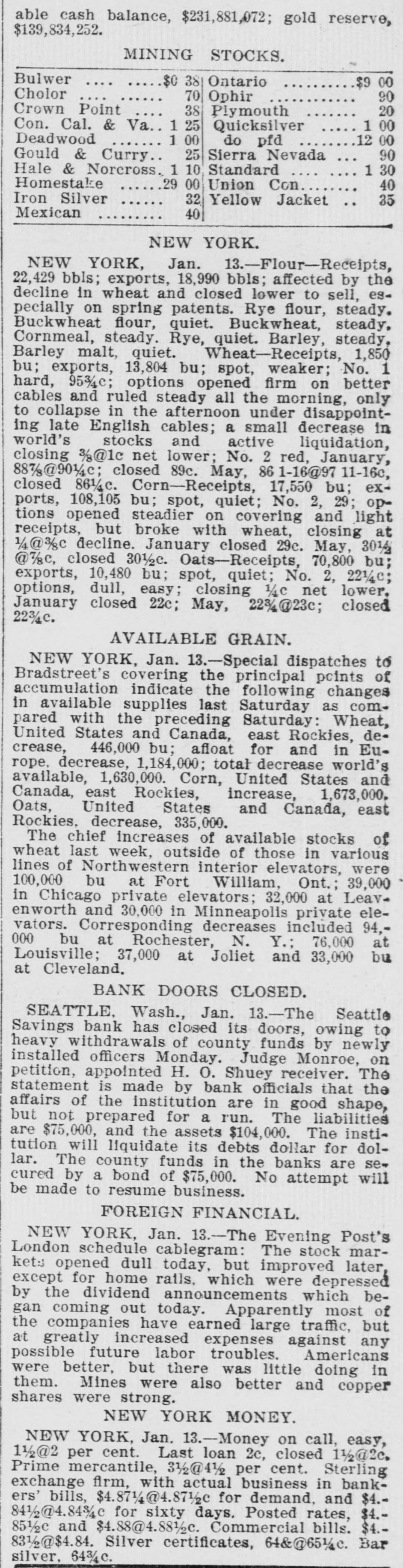

able cash balance, $231,881,072; gold reserve, $139,834,252. MINING STOCKS. Bulwer $0 38 Ontario $9 00 Cholor 90 70 Ophir Crown Point 38 20 Plymouth Con. Cal. & Va. 1 25 1 00 Quicksilver Deadwood 1 00 12 00 do pfd 25 Sierra Nevada 90 Gould & Curry Standard 1 30 Hale & Norcross. 1 10 Homestake 29 00 Union Con 40 Iron Silver 32 Yellow Jacket 35 Mexican 40 NEW YORK. NEW YORK, Jan. 13.-Flour-Receipts, 22,429 bbls; exports, 18,990 bbls; affected by the decline in wheat and closed lower to sell, especially on spring patents. Rye flour, steady. Buckwheat flour, quiet. Buckwheat, steady, Cornmeal, steady. Rye, quiet. Barley, steady, Barley malt, quiet. Wheat-Receipts, 1,850 bu; exports, 13,804 bu; spot, weaker; No. 1 hard, 953/4c; options opened firm on better cables and ruled steady all the morning, only to collapse in the afternoon under disappointing late English cables; a small decrease in world's stocks and active liquidation, closing 3/₃@1c net lower; No. 2 red, January, 887/g@901/4c; closed 89c. May, 86 1-16@97 11-16c, closed 861/4c. Corn-Receipts, 17,550 bu; exports, 108,105 bu; spot, quiet; No. 2, 29; options opened steadier on covering and light receipts, but broke with wheat, closing at 1/4@3/sc decline. January closed 29c. May, 301/2 @₃c, closed 301/2c. Oats-Receipts, 70,800 bu; exports, 10,480 bu; spot, quiet; No. 2, 221/4c; options, dull, easy; closing 1/4c net lower. January closed 22c; May, 22%@23c; closed 223/4c. AVAILABLE GRAIN. NEW YORK, Jan. 13.-Special dispatches to Bradstreet's covering the principal points of accumulation indicate the following changes in available supplies last Saturday as compared with the preceding Saturday: Wheat, United States and Canada, east Rockies, decrease, 446,000 bu; afloat for and in Europe, decrease, 1,184,000; total decrease world's available, 1,630,000. Corn, United States and Canada, east Rockies, increase, 1,673,000. Oats, United States and Canada, east Rockies. decrease, 335,000. The chief increases of available stocks of wheat last week, outside of those in various lines of Northwestern interior elevators, were 100,000 bu at Fort William, Ont.; 39,000 in Chicago private elevators; 32,000 at Leavenworth and 30,000 in Minneapolis private elevators. Corresponding decreases included 94,000 bu at Rochester, N. Y.; 76,000 at Louisville; 37,000 at Joliet and 33,000 bu at Cleveland. BANK DOORS CLOSED. SEATTLE. Wash., Jan. 13.-The Seattle Savings bank has closed its doors, owing to heavy withdrawals of county funds by newly installed officers Monday. Judge Monroe, on petition, appointed H. 0. Shuey receiver. The statement is made by bank officials that the affairs of the institution are in good shape, but not prepared for a run. The liabilities are $75,000, and the assets $104,000. The institution will liquidate its debts dollar for dollar. The county funds in the banks are secured by a bond of $75,000. No attempt will be made to resume business. FOREIGN FINANCIAL. NEW YORK, Jan. 13.-The Evening Post's London schedule cablegram: The stock markets opened dull today, but improved later, except for home rails, which were depressed by the dividend announcements which began coming out today. Apparently most of the companies have earned large traffic, but at greatly increased expenses against any possible future labor troubles. Americans were better, but there was little doing in them. Mines were also better and copper shares were strong. NEW YORK MONEY. NEW YORK, Jan. 13.-Money on call, easy, 1½@2 per cent. Last loan 2c, closed 11/2@2c. Prime mercantile, 31/2@41/2 per cent. Sterling exchange firm, with actual business in bankers' bills, $4.871/4@4.871/2c for demand, and $4.841/2@4.84%c for sixty days. Posted rates, $4.851/2c and $4.88@4.881/2c. Commercial bills. $4.831/2@$4.84. Silver certificates, 64&@65%c. Bar silver. 643/4c.