1.

July 1, 1921

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

BANK'S DOORS CLOSED Scandinavian Not Able to Meet Its Obligations and Suspends While scores of tragedy-strick en men and stood thetically apa the Scandinavian officials of the bank can outside bank, in the warm Ameri drizzle state examiner's board investigation of the defence tion the their - Friday institu began into How much can be salvaged the wreck will not be known from eral weeks, altho well-informed ers believe that the losses to positors will be comparatively small de. CLOSER AFTER BANKERS TRY VAINLY TO SAVE IT The Scandinavian American when a conference to all parts of the ers its find doors from state of closed failed bank. a means to save the 8. Stacy, who took of the bank a management when Ralph year over bank. ago. the it was on the financial over the records and the Institution to the papers of visor turned state shoals, super. of banks Friday desperate fight to on its feet had left the and bank Stacy's morning. him keep white drawn. He had been three nights. means sleep for trying without to find to prevent a crash. According to bankers . circles here, It in least financial three will high be weeks before It will at possible for any depositor to with. be money from the STATE draw bank. GUARANTEE FUND WILL BE DRAINED clation The Seattle Clearing House on has agreed to advance Asso claims. and money $500,000 depositori in the State the entire Guaranty to Fund will be called Depositors' pay the debts of the upon Scandinavian cording The help American. bank. pervisor to John P. Duke, state ac. amount of banking. owns a su. will of valuable property. large into cash. this take considerable time to but turn Possibility that all member. the State to Fund may be banks Guaranty of Depositors' assessed pay the Joses of the American bank. dollar "I were Indicated dollar, navian have by Scandi. Duke. for not been able to yet the whether the banks are determine to the full amount of the loss liable for extent of the or just the fund-$500,000. Duke money in has never point, been according to officials. navian total deposits of the 251. American bank were $11,828. Scandi. This The Stacy raised. declared new and his associates in exonerated management were the from blame completely great deal of made them." "A Duke asserted. credit by "They Duke. is due interests a tireless fight to protect have the the bank of the depositors and to tide over its difficulties." TACOMA BANK'S FAILURE Duke HASTENED whinkage attributed the failure CRASH and of values after to the ian to the failure of the the war bank of one time the two vorced closely connected. were At American at the Tacoma. institutions Scandinav Tho di. Tacoma time, in extent attle $3,000,000 institution. bank reflected to collapse the upon the of the Se. was Hart arrived in Duke for Banking and Supervisor Governor closeted withdrawals. with Seattle of in Friday. the interests It is thought of the nearly that State he an here hour ors' Guaranty number of persons feeted A larger Fund. Deposit navian by the failure of the af. any ScandiScandinavian other than Seattle by has the bank. collapse of ings over The dollars accounts. to the ranging from a sav. few Dreary, thousands hopeless faces in evidence were bank much outside 21,000 the Friday. Laborers, women, fishermen and scrub. farmers cazed at small doors ed of the institution the and closed standers. worried questions of the ask. by. "Would (Turn the bank pay any. to Page 9, Column 2)

2.

July 1, 1921

Capital Journal

Salem, OR

Click image to open full size in new tab

Article Text

Big Seattle Bank Closes Door Today AmerScandinavian ican Turns Affairs Over to State Supervisor of Banking Seattle, Wash., July 1.-The Scandinavian American bank, of Seattle, with a capital and surplus of one million two hundred fifty six thousand eight hundred thirty eight dollars, and deposits totalling over eleven million eight hundred thousand dollars, was closed today following the action of the board of directors shortly after midnight this morning in turning over the bank's affairs to the state supervisor of banking. The bank was a member of the federal reserve system, the Seattle Clearing House association, and the Washington State Bank Depositors' Guaranty fund. Shrink age of values during the last year and a half and recent abnormal deposit decreases were given by John P. Duke, state supervisor of banking, as reasons for the suspension. Failure of the ScandinavianAmerican bank of Tacoma, Wn., some months ago, was believed to have been responsible to a large extent for the withdrawal of deposits. The institutions were not connected when the Tacoma bank failed, but at one time had been closely allied. Following the action of the directors in suspending, Supervisor Duke issued a statement in which he absolved the present management and said "credit is due for its earnest and untiring efforts to protect the interests of the depositors and carry the bank over its troubles."

3.

July 1, 1921

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

WITH CROWDS BEFORE THE SCANDINAVIAN "Oh, this bank'll be open next Two policemen and half a dozweek. We'll all get our money, all en plain clothes men found it dif. right," an optimist grinned. ficult to keep the sidewalk clear and the crowd moving at the At 11:30 a sign was pasted on the Scandinavian American bank door. saying the Swedish vice conjust before the noon hour. sulate had moved to room 618, Al aska building A crew of bank ex"I have $325 in the bank and a aminers and assistants could be seen Liberty bond." said one depositor. inside. That's a pretty heavy loss for a workingman." When the bank closed many police "Yes," said another, "It seems officers were caught. With the anearned funny with all these signs on nouncement of the closing. Captain the windows, 'deposits guaranteed, E. C. Collier of headquarters, treasthat the bank had to close." urer of the Ballard Aerie No. 172. Fraternal Order' of Eagles, reported A soberly dressed woman, well the entire funds of the Ballard past middle age, approached the Eagles, amounting to over $3,100. door of the bank and bent close had been deposited in the Ballard to read the sign. "Bank closed." branch of the bank. A policeman told her to move Captain of Detectives Charles Tenon. "Well, I don't what else I nant had a small checking account could do," she said. "All my with the bank. One official. who remoney is in there." fused to be quoted, stated that he had a $6,000 account in the bank, Men were lined up on the curb which he drew out early Thursday three-deep: some were optimistic. morning, after he had received a "We'll get our money back in time "tip" that the bank would suspend all right," said one. "It says on the Thursday night. window that the bank is a member Lieut. J. c. Wickman is said to of the federal reserve." have nearly $1,300 on deposit there. Many police officers and patrolmen, "Well, I haven't got much who were hard hit. offered to sell money in the bank," said antheir holdings for 50 centa on the other. "I guess I'm lucky. I dollar. spend most of my money."

4.

July 1, 1921

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

HERE'S MORE ABOUT BANK CLOSES STARTS ON PAGE ONE thing? Was it 'busted for good and all? How much would a woman with $3,000 savings account get out of the ruin? Couldn't the government do something about It?" One little old woman, who had lost all of her slender savings, dropped disconsolately against the big brass doors. When the policeman gently told her to move on, she looked at him dully. "I had everything in there," she said, and she dragged herself away. "I saved It for my old age. Now its gone-gone." Most of the depositors could not realize that the bank had closed. "It'll be all right in a little while -you'll see," they muttered. ATTEMPT T OTAKE OVER BANK IS FAILURE An attempt to have the Scandinavian American taken over in a merger of four. large Seattle banks failed Thursday, when the banks declared themselves unwilling to as sume the debts of the Scandinavian. The banks which it was proposed to amalgamate were the First Na tional, the National Bank of Commerce, the Metropolitan Bank and the Scandinavian American. If such a merger had been effect. ed. the collapse of the Scandinavian American bank would have been prevented, as the sussets of the sus. pended bank would have been taken over by the consolidated companies and the depositors paid in full. The Scandinavian bank has a cap ital stock of $1,000,000, which can be assessed 100 per cent to help pay the claims of the depositors. In other words, the owners of the bank. the stockholders, must pay into the bank the value of their stock. Many of the large stockholders, however, are insolvent. Some of the assets will take considerable time to liquidate. One instance is that of a large bearing apple orchard, valued at close to $500.000, which the Scandinavian American bank is said to own in Eastern Washington.

5.

July 2, 1921

The McCarthy Weekly News

McCarthy, AK

Click image to open full size in new tab

Article Text

TELEGRAPHIC SEATTLE BANK CLOSES ITS DOORS Seattle July 1st. The Scandinavian American Bank suspended payment this morning owing depositors about eleven million dollars. The action was decided upon at a meeting of directors. A run on this bank had been in progress ever since the failure of the Tacoma Scandinavian American Bank, which it had originally founded as a branch. John H. Duke, supervisor of state banking, took charge of the institution this morning. It IS the opinion 01 conservative Dankers that the closed concern will 111 time pay nearly 111 full.

6.

July 2, 1921

The Kusko Times

Takotna, Tokotna, McGrath, AK

Click image to open full size in new tab

Article Text

Seattle, July 1.-The Scandinavian American Bank of this city suspended this morning, owing depositors about eleven million dollars. The closing of the bank followed a meeting of the directors this morning, at which the decisive action was taken. A run has been in progress on the Seattle bank since the fail ure of the Tacoma ScandmavianAmerican Bank, which it originally founded as a branch. John H. Duke, supervisor of State banking, took charge of the institution this morning.. It is the opinion of conservative bankers that the closed con-

7.

July 2, 1921

The Nenana News

Nenana, AK

Click image to open full size in new tab

Article Text

POWERFUL SEATTLE BANK FORCED TO CLOSE DOORS SEATTLE, July 2-The Scandinavian American Bank, of this city, closed its doors yesterday, and the directors have turned the institution over to John P. Duke, state supervisor of banks, who issued a statement in which he attributes the "failure largely to a shrinkage in values during the last year and to recent abnormal decreases in deposits. The present management is in no way to blame." The directors explained that they made an unsuccessful effort to merge with three other banks in an attempt to save the institution. The last statement of the bank shows a capital and surplus of two and a quarter million dollars, and deposits of thirteen millions. There is no statement available of assets and liabilities. It was claimed at the time of the failure of the Scandinavian American Bank, of Tacoma, that there was no connection between that institution and the Seattle bank of the same name, but heavy withdrawals of deposits from the local bank would seem to indicate that the public believed otherwise.

8.

July 2, 1921

Great Falls Tribune

Great Falls, MT

Click image to open full size in new tab

Article Text

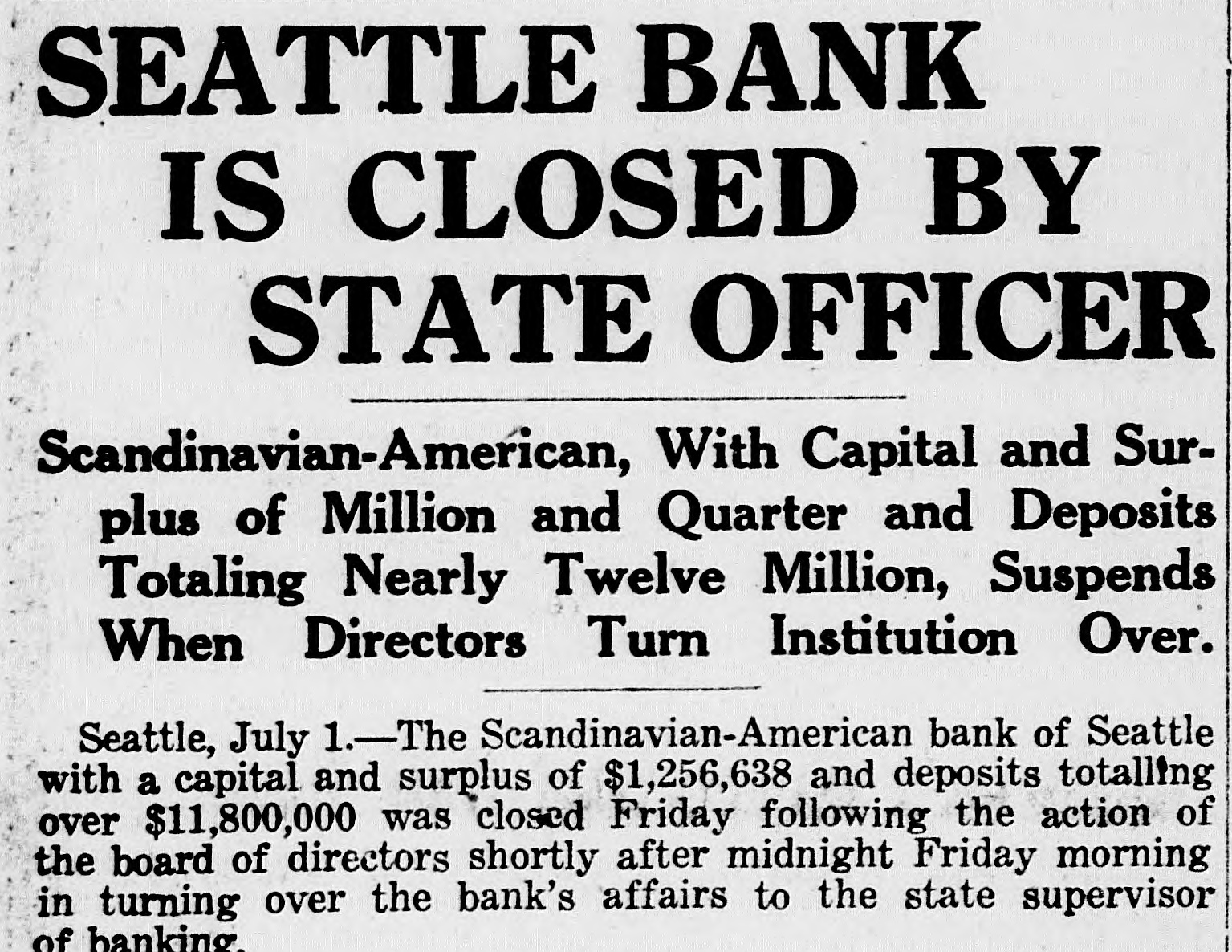

SEATTLE BANK IS CLOSED BY STATE OFFICER Scandinavian-American, With Capital and Surplus of Million and Quarter and Deposits Totaling Nearly Twelve Million, Suspends When Directors Turn Institution Over. Seattle, July 1.-The Scandinavian-American bank of Seattle with a capital and surplus of $1,256,638 and deposits totalling over $11,800,000 was closed Friday following the action of the board of directors shortly after midnight Friday morning in turning over the bank's affairs to the state supervisor of banking.

9.

July 5, 1921

The Daily Alaskan

Skagway, AK

Click image to open full size in new tab

Article Text

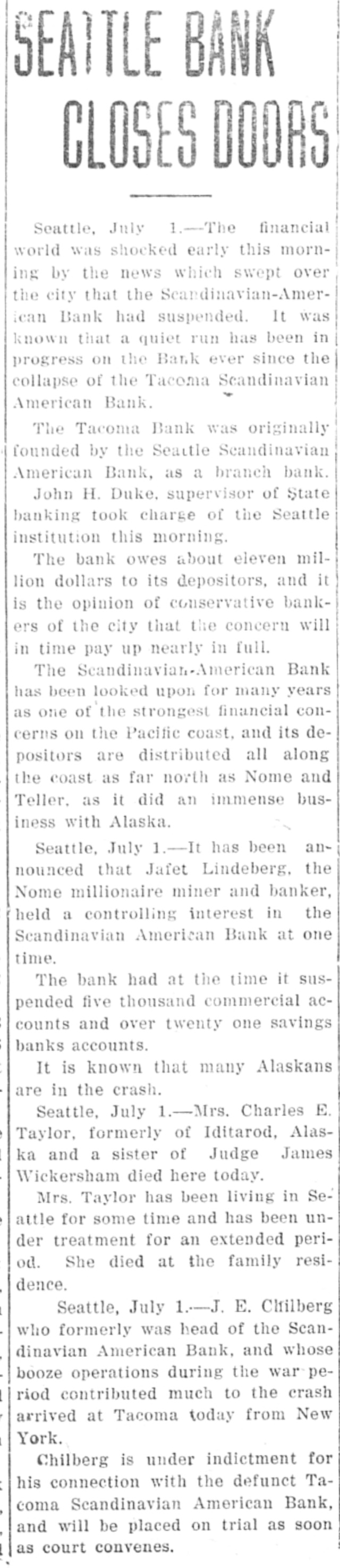

SEATTLE BANK CLOSES DOORS Seattle, July .-The financial world was shocked early this morning by the news which swept over the city that the Seandinavian-American Bank had suspended It was known that a quiet run has been in progress on the Bank ever since the collapse of the Tacoma Scandinavian American Bank. The Tacoma Bank was originally founded by the Seattle Scandinavian American Bank, as a branch bank. John H. Duke, supervisor of State banking took charge of the Seattle institution this morning. The bank owes about eleven million dollars to its depositors, and it is the opinion of conservative bankers of the city that the concern will in time pay up nearly in full. The ScandinavianeAmerican Bank has been looked upon for many years as one of the strongest financial concerns on the Pacific coast, and its depositors are distributed all along the coast as far north as Nome and Teller. as it did an immense business with Alaska. Seattle, July 1.-It has been announced that Jafet Lindeberg, the Nome millionaire miner and banker, held a controlling interest in the Scandinavian American Bank at one time. The bank had at the time it suspended five thousand commercial accounts and over twenty one savings banks accounts. It is known that many Alaskans are in the crash. Seattle, July 1.-Mrs. Charles E. Taylor, formerly of Iditarod, Alaska and a sister of Judge James Wickersham died here today. Mrs. Taylor has been living in Seattle for some time and has been under treatment for an extended period. She died at the family residence. Seattle, July 1.-J. E. Chilberg who formerly was head of the Scandinavian American Bank, and whose booze operations during the war period contributed much to the crash arrived at Tacoma today from New York. Chilberg is under indictment for his connection with the defunct Tacoma Scandinavian American Bank, and will be placed on trial as soon as court convenes.

10.

July 9, 1921

The Nome Nugget

Nome, AK

Click image to open full size in new tab

Article Text

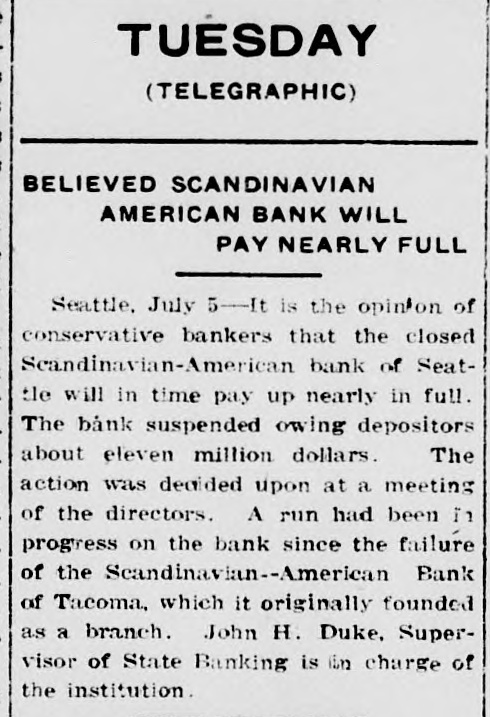

TUESDAY (TELEGRAPHIC) BELIEVED SCANDINAVIAN AMERICAN BANK WILL PAY NEARLY FULL Seattle, July 5--It is the opinion of conservative bankers that the closed Scandinavian-American bank of Seattle will in time pay up nearly in full. The bank suspended owing depositors about eleven million dollars. The action was decided upon at a meeting of the directors. A run had been in progress on the bank since the failure of the Scandinavian--American Bank of Tacoma, which it originally founded as a branch. John H. Duke. Supervisor of State Banking is in charge of the institution.

11.

November 21, 1921

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

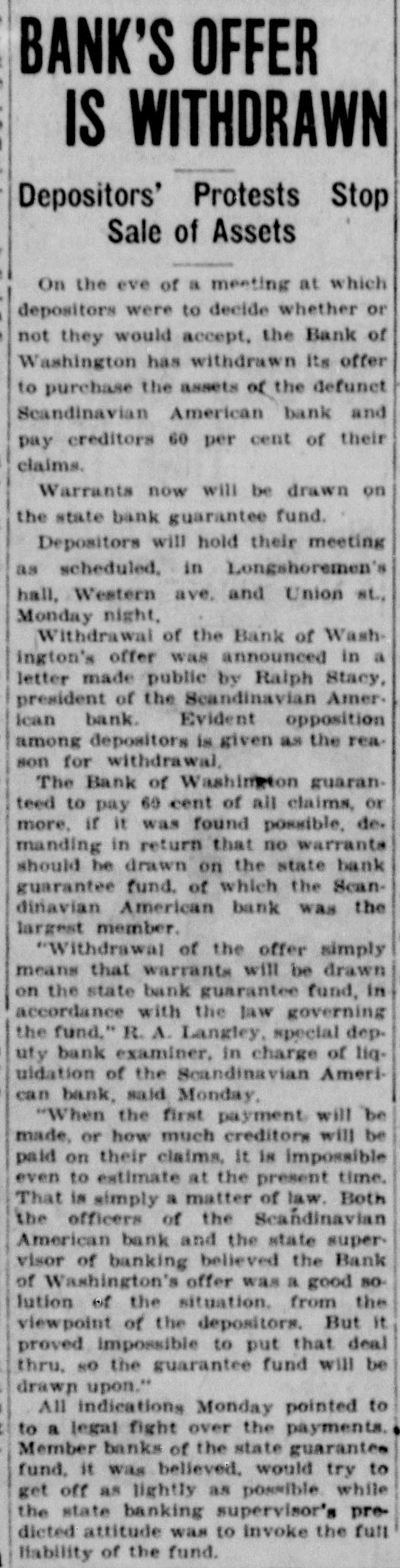

BANK'S OFFER IS WITHDRAWN Depositors' Protests Stop Sale of Assets On the eve of a meeting at which depositors were to decide whether or not they would accept, the Bank of Washington has withdrawn its offer to purchase the assets of the defunct Scandinavian American bank and pay creditors 60 per cent of their claims. Warrants now will be drawn on the state bank guarantee fund. Depositors will hold their meeting as scheduled, in Longshoremen's hall, Western ave. and Union st. Monday night, Withdrawal of the Bank of Washington's offer was announced in a letter made public by Ralph Stacy, president of the Scandinavian Amer. Ican bank. Evident opposition among depositors is given as the reason for withdrawal, The Bank of Washington guaranteed to pay 60 cent of all claims, or more, if it was found possible. demanding in return that no warrants should be drawn on the state bank guarantee fund. of which the Scandiriavian American bank was the largest member. "Withdrawal of the offer simply means that warrants will be drawn on the state bank guarantee fund, in accordance with the law governing the fund," R. A. Langley, special dep. uty bank examiner, in charge of liq. uldation of the Scandinavian American bank, said Monday, "When the first payment will be made, or how much creditors will be paid on their claims, It is impossible even to estimate at the present time. That is simply a matter of law. Both the officers of the Scandinavian American bank and the state supervisor of banking believed the Bank of Washington's offer was a good solution of the situation. from the viewpoint of the depositors. But it proved impossible to put that deal thru, so the guarantee fund will be drawn upon." All indications Monday pointed to to a legal fight over the payments. Member banks of the state guarantee fund, it Was believed, would try to get off as lightly as possible while the state banking supervisor's predicted attitude was to invoke the full liability of the fund.

12.

April 6, 1922

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

HUGE SUIT IN WAKE OF BANK CRASH Court Action for $104,000 Grows Out of Failure of Scandinavian American Suit for $104,000 and Interest was filed in superior court Wednesday against the Wicks Tire & Rubber Products Co., the Olympic Tire & Rubber Co., the Scandinavian American bank of Seattle, James Fletcher and George B. Baker, by D. H. C. Bampson. Of the amount sued for, $100,000 Is asked as principal of a bond Issue originally put out by the Wicks company, while $1,000 is Hampson's fee as trustee of the assets of the concern and $3,000 is counsel's fees. On October 1. 1919, the complaint states, the Wicks company issued 840 negotiable coupon serial bonds in the sum of $100,000. and later executed a mortgage by the terms of which all assets and property of the company were assigned in trust to the Scandinavian American bank of Beattle On January 25. 1931, It is claimed, the Olympic Tire & Rubber Co. became successor to the Wicks company. and took over all assets and liabilities. On June 30, 1921, the Scandinavian American bank closed Its doors and has since been in the hands of the state bank examiner. Sampson was elected trustee by the bondholders of the Wicks Tire & Rubber Products Ca. and took possession of the propeety and assets of the successor, the Olympia Tire & Rubber Co. He has declared the whole amount of the bond Issue due. and is suing to collect. Fletcher and Baker are brought in because they have claims against the assets of the rubber concern, and Sampson seeks to have his lien as trustee declared prior to theirs.

13.

April 12, 1922

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

Stockholders Sue Banking Supervisor R. Miner and Anna M. Miner throught suit for $1.000 in superior court Wednesday against John P. Duke, state supervisor of banking, who is liquidating the assets of the Scandinavian-American bank of so. attic. The plaintiffs allege that they were sold an over-issue run of bank stock, and that therefore in reality never received value for their money.

14.

April 24, 1922

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

SEEK TO REGAIN BANK DEPOSITS Last Day" Claims Against Scandinavian in Court Whether last day depositors In the BcandinavianAmerican bank of No. aftle, which closed Its doors June 30, 1921, are entitled to have their deposits refunded, or whether all money taken in on the last day may be considered assets of the institution by the state banking supervisor, was to be decided Monday by Superior Judge C. H. Neal. Evidence in a suit brought against the Beandinavian-American bank of Seattle and J. P. Duke, state bank. ing supervisor, by the Washington Shoe Manufacturing company, was being presented to the court. Four teen other claims have been assigned to the Washington Shoe Manufacturing company for the purpose of the test case. Ralph 8. Stacy, vice president of the Union National bank. and prestdent of the Scandinavian-American bank of Seattle at the time of its failure, admitted on the stand that deposits were accepted on June 30, 1921, in the hope that the bank could be saved: but in case negotia tions fell thru, he testified, such deposits were placed in separate envelopes and were not entered on the books, so that they might be returned. Stacy said that failure of the Scandinavian-American bank of Tacoma started a run on the Seattle institution, which resulted in $3. 500,000 being withdrawn. J. 8. Lane, for 25 years cashier of

15.

July 14, 1922

Vashon Island News-Record

Vashon, WA

Click image to open full size in new tab

Article Text

With harvest almost here, Walla Walla farmers are facing labor shortage that is the most serious in years.

Katie Flora Boidt, 16-year-old daughter of Mr. and Mrs. John A. Boldt of Dahlia, was drowned in the Columbia river.

Aberdeen police receipts for June were $2895.70, according to the monthly report of the department. Arrests numbered 228.

Grays Harbor strawberries were shipped to outside markets last week for the first time in the history of the county berry industry.

Phil Skillman, resident of Olympia for 32 years and long a prominent attorney there, died at the Veterans' home at Retsil, aged 76 years.

A hundred soldiers at Camp Lewis were called out to fight a fire raging over 4000 acres of prairie and timber lands on the government reservation.

Charles Rothwell of Waitsburg is under arrest following an alleged murderous attack on his wife and an attempt to commit suicide. He is thought to be insane.

Plans are being drawn for the construction of a forty-automobile ferry to ply between Anacortes and Victoria, B. C., in place of the two boats now on the run.

The Crown-Willamette company is extending and enlarging its holdings at Camas. Many landmarks are being moved and torn down to make room for new buildings.

With checks totaling $1,353,000 cashed during the annual Fourth of July "splash" celebration, July 1 and 3, banking records were broken in three Aberdeen banks.

The $250,000 mark has been passed in the receipts collected from automobile dricers' licenses, according to an announcement by Director Fred J. Dibble of the department of licenses.

Miss Ruth V. Bollinger, who has the distinction of being called "reverend," since she is pastor of the La Center Methodist Episcopal church, has been appointed probation officer for Clarke county.

Martin Van Berkel, 34, of Seattle, was killed instantly when the automobile which he was driving alone crashed through a bridge at Des Moines, near Tacoma, and dropped 60 feet to the ground below.

Jack Regenvetter, who sued Puget Ball, wealthy Fredonia rancher for $150,000 for alienation of the affections of Mrs. Regenvetter, was awarded $30,000 by a jury in superior court at Mount Vernon.

Revised plans for a general hospital at Everett, as prepared by Boston architects, have been received. The changes were sought to increase the capacity of the proposed building to eighty beds from fifty.

Burning out of the western Washington potato crop by the sixty-day drought is forecasted by dealers, with estimates of reductions to 50 per cent of normal in the Whidby Island and Puget Sound valley district.

The Tillicums of Clarke county, residents who were born in the county 50 or more years ago, have begun preparations for an outing at Battle Ground lake, to which the public is invited, on the afternoon of Sunday, July 16.

The rule of warranty applies to a second-hand motor vehicle as well as to a new one when sold by a dealer on a conditional sale contract, unless the contract specifically provides otherwise, the supreme court has held.

Stockholders of the closed Scandinavian-American Bank of Seattle are liable for superadded liability assessed by John P. Duke, state supervisor of banking, to aid in liquidation of the bank's affairs, the supreme court has held.

New classifications providing some increases and some decreases in rates were filed by the American Railway Express company with the department of public works. The changes are effective both interstate and intrastate, July 15.

Secretary of the Interior Fall has given elaphatic and unqualified approval to the bill recently introduced by Senator Poindexter providing for a federal investigation of the Columbia basin irrigation project in eastern Washington.

16.

January 17, 1923

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

SOLONS MAY CUT UNIVERSITY FEE Suzzallo Fights Reduction of Tuition OLYMPIA, Jan. 17.-Redue tion of fuition fees at the university would seriously handleap its operation, President Henry Suzzallo declared Tuesday, after he was Informed that Representative Willam P. Totten, of King. Intended to Introduce such a bill before the house today. "The university is being run in ns economical a manner as is possible at the present time." he said. "Since the exposition, our attendance has increased 100 per cent. "Recently It was necessary to limit the attendance, in addition to putting a fee of $15 on each student. If this fee is taken away, It will sert. ously hamper the institution," Dr. Suzzallo said, Representative Charles A. Moran, of King, will introduce a bill in the house today, which will require all county, state and federal officials to resign their positions upon the announcement of their candidacy for other offices. If passed, this bill will eliminate the practice of using department autos for electioneering purpores. and will also eliminate slackness on the art of the campaigners. A resolution was submitted today 1 by Representative William P. Totten to fix responsibility for the great losses of bank depositors during the past two years. The committee in to be instructed to make a written report of findings and submit It not later than February 1. The commit ten is also to report on liquidation of Scandinavian American bank a.m. sets in Seattle. The most important resolution Tuesday was that sponsored by Representative Mahoney of Whitman. It stipulated that all expenses incurred by the state during a given period prior to the inauguration of the Hart administrative code be tabulated and a report given the house by the state auditor and that a report of expenses Incurred dusing a like period after the code had taken effect be made. This report will contain some interesting figures, accord. ing to Representative Mahoney. The final vote placed the resolution in the hands of a committee after much discussion. House bill No. 19 was introduced by Representative Murphine of King and advocates the prohibition of all gambling games within one mile of the campus of the university. House bill No. 20 was also Introduced by Representative Murphine, and provides that the rulings of the Mann white slave not shall apply to inter-county cases in Washington. House bill No. 21 relates to public highway levies and completely repeals the 1-mill public highway levy. This bill was introduced by Representative O. L Olsen, of Spokane county. House bill No. 23, presented. by d Representative Behrens, of King. TOlated to commercial waterways and districts and provided for payment of outstanding bonds. House bill No. 23. introduced by Representative McKinney, of Pierce, related to the colony of the State Soldiers' home. and amended section x-**

17.

June 30, 1923

Seward Daily Gateway

Seward, AK

Click image to open full size in new tab

Article Text

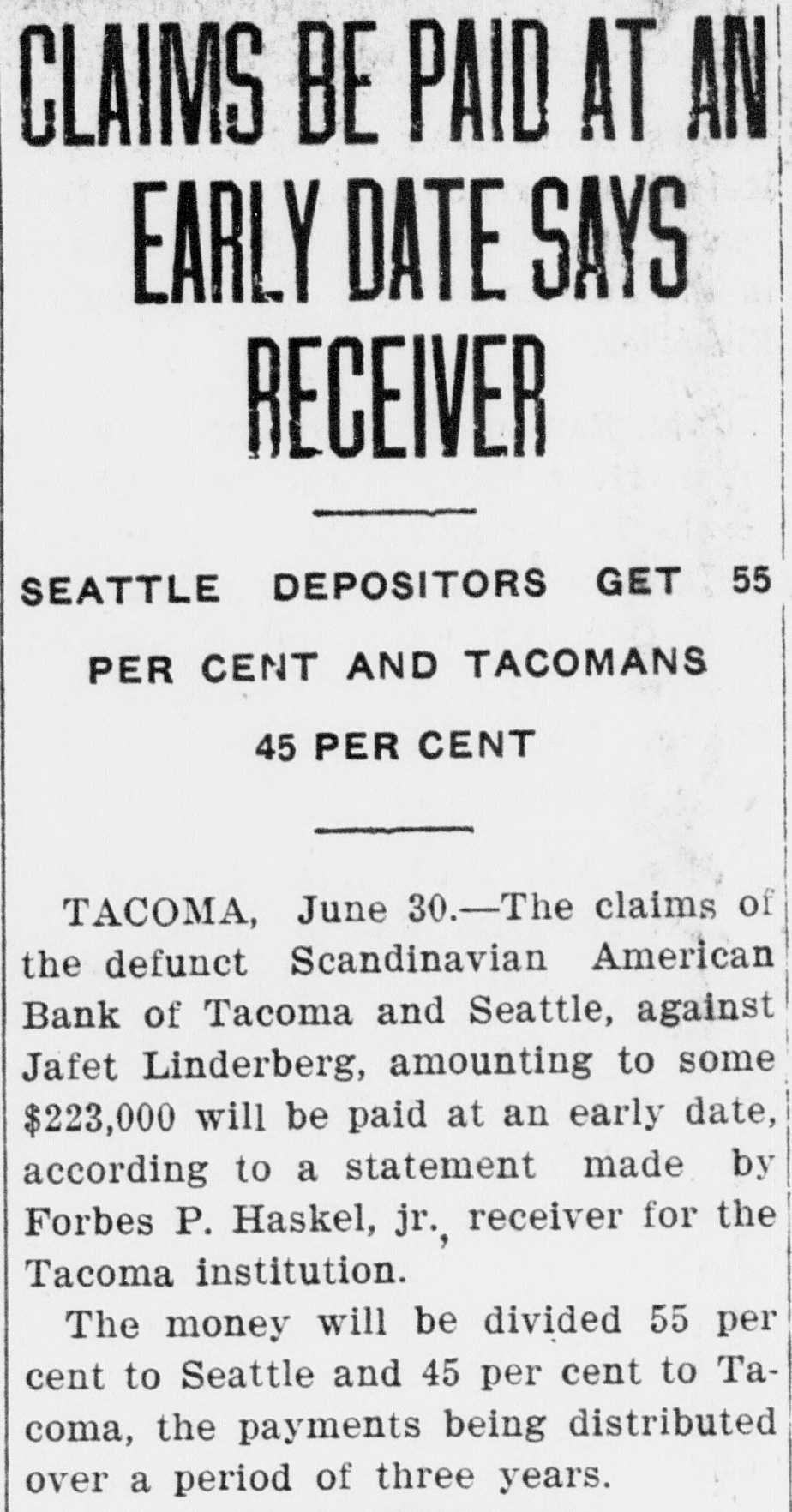

CLAIMS BE PAID AT AN EARLY DATE SAYS UAIJ RECEIVER SEATTLE DEPOSITORS GET 55 PER CENT AND TACOMANS 45 PER CENT TACOMA, June 30.-The claims of the defunct Scandinavian American Bank of Tacoma and Seattle, against Jafet Linderberg, amounting to some $223,000 will be paid at an early date, according to a statement made by Forbes P. Haskel, jr., receiver for the Tacoma institution. The money will be divided 55 per cent to Seattle and 45 per cent to Tacoma, the payments being distributed over a period of three years.

18.

June 30, 1923

The Nome Nugget

Nome, AK

Click image to open full size in new tab

Article Text

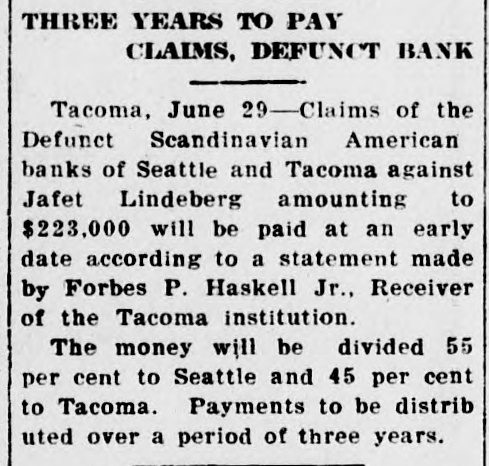

THREE YEARS TO PAY CLAIMS, DEFUNCT BANK Tacoma, June 29-Claims of the Defunct Scandinavian American banks of Seattle and Tacoma against Jafet Lindeberg amounting to $223,000 will be paid at an early date according to a statement made by Forbes P. Haskell Jr., Receiver of the Tacoma institution. The money will be divided 55 per cent to Seattle and 45 per cent to Tacoma. Payments to be distrib uted over a period of three years.

19.

March 11, 1924

Seward Daily Gateway

Seward, AK

Click image to open full size in new tab

Article Text

SCANDINAVIAN BANK PAYING OUT MILLION CASH TO DEPOSITORS SEATTLE, Mar. 11.-The receiver of the defunct Scandinavian American bank of Seattle began paying out a million dollars in cash to depositors today.

20.

March 15, 1924

Seward Daily Gateway

Seward, AK

Click image to open full size in new tab

Article Text

SCANDINAVIAN BANK PAYING OUT MILLION CASH URJI TO DEPOSITORS SEATTLE, Mar. 11.-The receiver of the defunct Scandinavian American bank of Seattle began paying out a million dollars in cash to depositors today.

21.

May 1, 1924

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

# BROKER'S WIDOW MUST EXPLAIN

Mrs. Nellie B. Sander Is Ordered to Court

ESTATE SPENT, CHARGE

Complaint Accuses Relatives of Hiding Assets

Mrs. Nellie B. Sander, wife of the late Fred E. Sander, widely known real estate broker and capitalist, must appear with members of her family before Judge Boyd J. Tallman, of the superior court May 8 and give an accounting of the Sander estate.

A court order to this effect was obtained by James A. Dougan, trustee in bankruptcy for the Fred E. Sander, Inc., a bankrupt firm. In his complaint Dougan charges that the Sanders, the widow and a son, Henry K. Sander, and a daughter, Elizabeth Lilly, have squandered and dissipated the assets of the estate, mainly incorporated in the Seattle Land & Improvement Co.

Other assets of the late banker and capitalist have been hidden, Dougan charges. The house occupied by Mrs. Sander, at 3731 E. Prospect st., was transferred to her name June 14, 1921, when the firm was insolvent. March 8, last, Henry Sander, the son, had several mortgages transferred to himself without consideration.

The Fred E. Sander, Inc., was merely a dummy corporation, Dougan charges, and its assets have mysteriously disappeared and reappeared as part of the Seattle Land & Improvement Co., the solvent concern.

Dougan asks that all the assets of the Seattle Land & Improvement Co. be transferred to the control of the receiver and be impressed with claims totaling $150,000 made against Sander.

Sander was a director of the Scandinavian-American bank, but he died two months before the bank's crash. Included in claims from former clients is one for $100,000 by John P. Duke, supervisor of banking, based on a promissory note given the bank by Sander shortly before his death in return for an unsecured loan.