Click image to open full size in new tab

Article Text

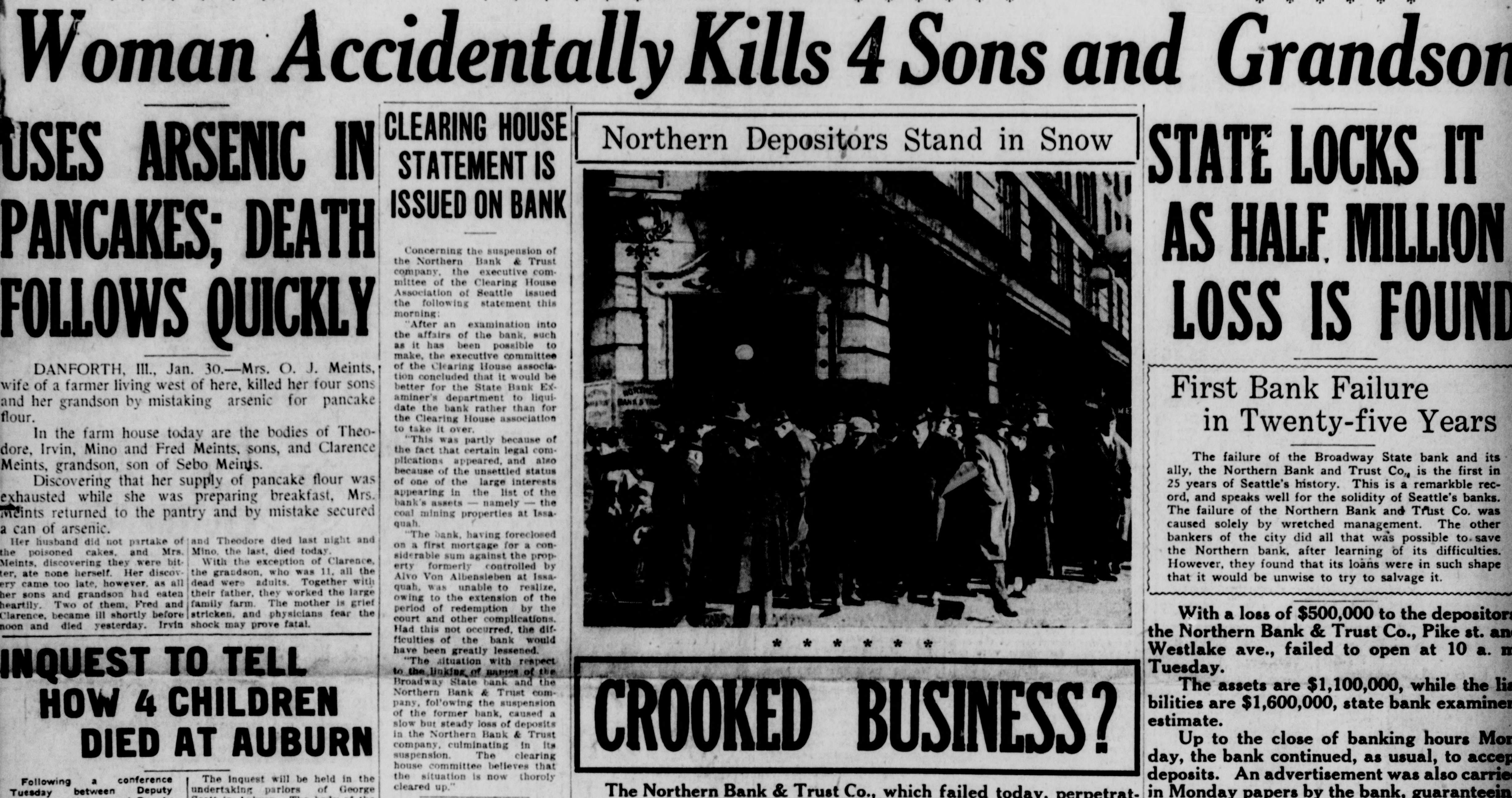

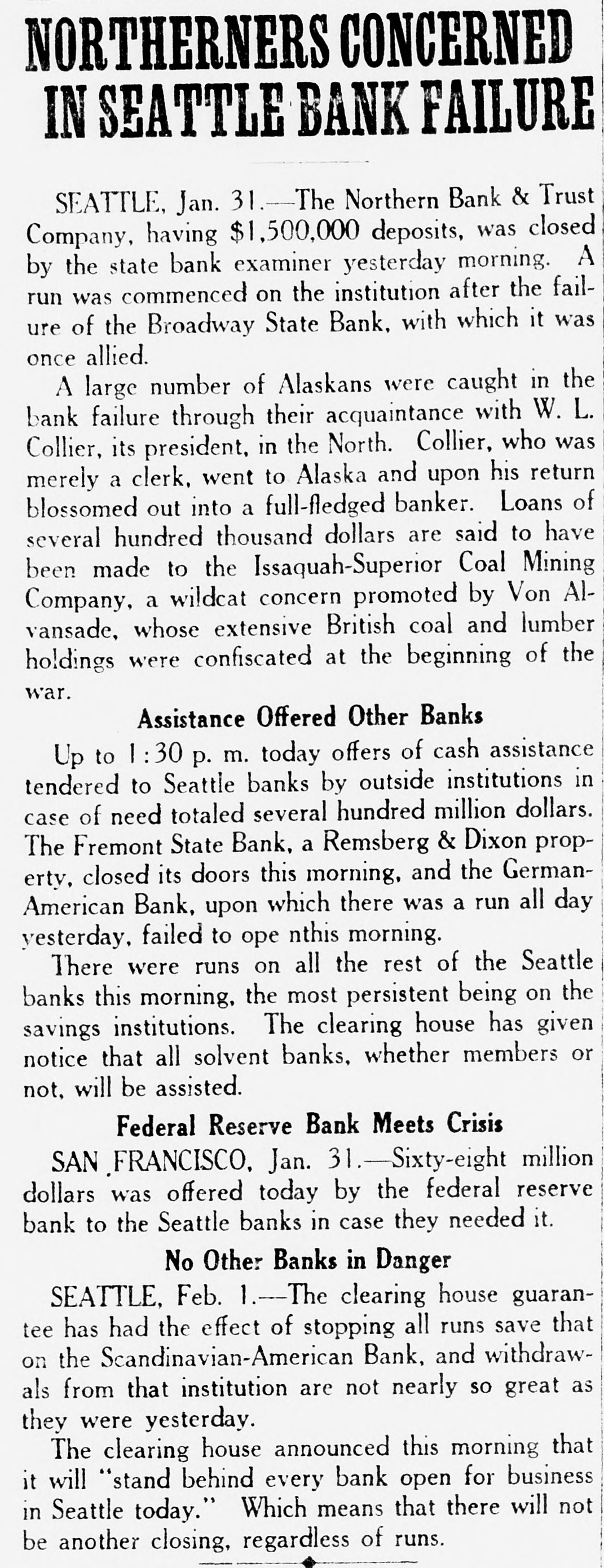

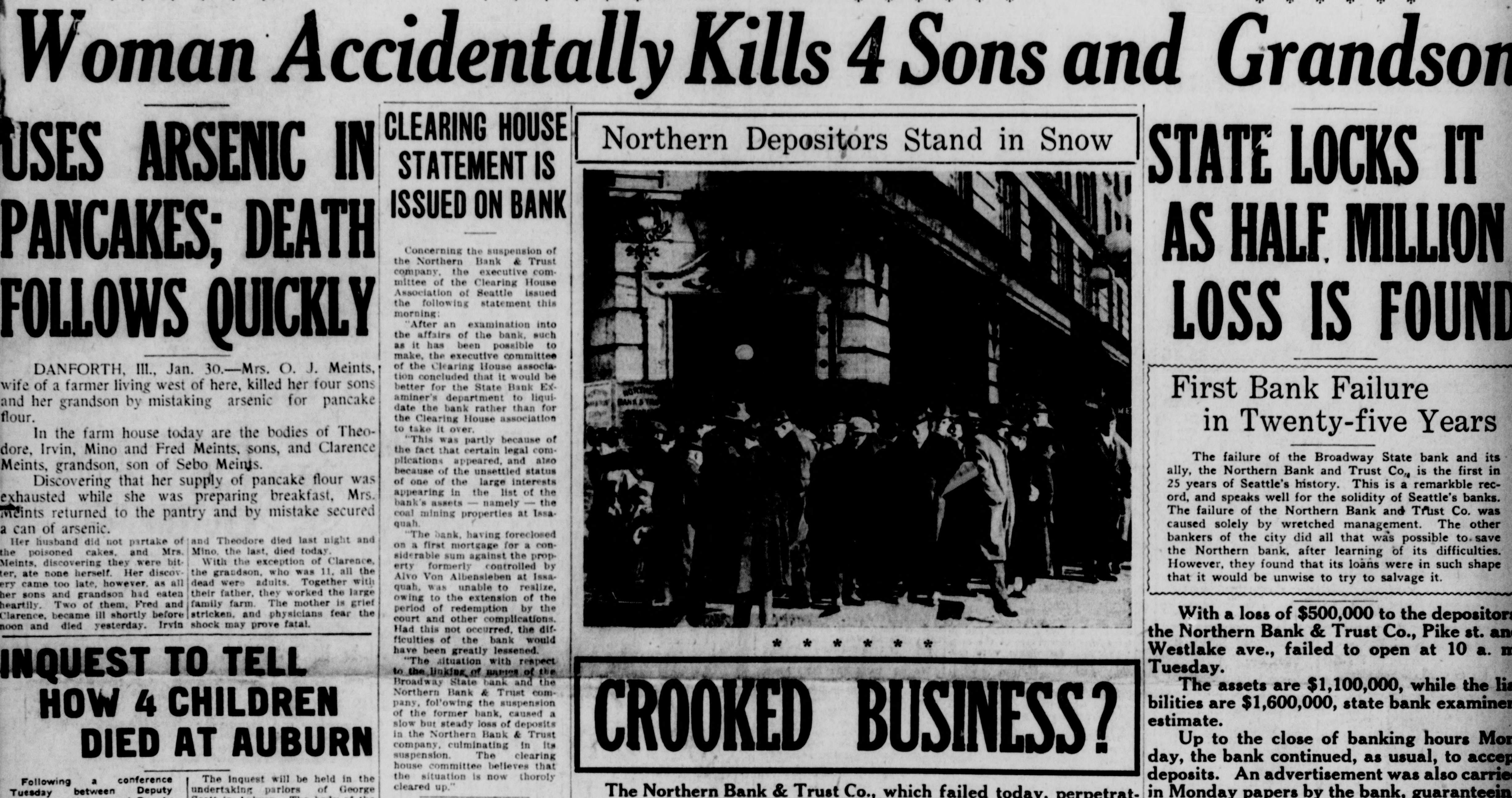

Woman Accidentally Kills 4 Sons and Grandson CLEARING HOUSE Northern Depositors Stand in Snow STATEMENT IS USES ARSENIC IN STATE LOCKS IT ISSUED ON BANK Concerning the suspension of AS HALF MILLION the Northern Bank & Trust PANCAKES; DEATH company, the executive committee of the Clearing House Association of Seattle issued the following statement this morning After an examination into the affairs of the bank, such LOSS IS FOUND FOLLOWS QUICKLY it has been possible to make, the executive committee of the Clearing House associaDANFORTH, III., Jan. 30.-Mrs. O. J. Meints, tion concluded that it would be better for the State Bank Exwife of a farmer living west of here, killed her four sons First Bank Failure aminer's department to liquiand her grandson by mistaking arsenic for pancake date the bank rather than for flour. the Clearing House association to take it over. in Twenty-five Years In the farm house today are the bodies of Theo"This was partly because of the fact that certain legal comdore, Irvin, Mino and Fred Meints, sons, and Clarence The failure of the Broadway State bank and its plications appeared, and also Meints, grandson, son of Sebo Meints. because of the unsettled status ally, the Northern Bank and Trust Co. is the first in of one of the large interests Discovering that her supply of pancake flour was 25 years of Seattle's history. This is a remarkble recappearing in the list of the ord, and speaks well for the solidity of Seattle's banks. exhausted while she was preparing breakfast, Mrs. bank's assets namely the The failure of the Northern Bank and Trust Co. was coal mining properties at Issa. meints returned to the pantry and by mistake secured quah. caused solely by wretched management. The other a can of arsenic. The bank, having foreclosed bankers of the city did all that was possible to save Her husband did not partake of Theodore died last night and on first mortgage for a conMino. the last, died today and cakes, poisoned the Northern bank, after learning of its difficulties. siderable sum against the propthe exception of Clarence, Meints, discovering they were erty formerly controlled by However, they found that its loans were in such shape discovgrandson. who was 11. all the Her ate herself. none Alvo Von Albensleben at Issathat it would be unwise to try to salvage it. with adults. were Together all dead as too however. came late, quah, was unable to realize, sons and grandson had eaten their father, they worked the large owing to the extension of the Fred and Two family farm. The mother is grief of them, heartily. period of redemption by the became ill shortly before stricken. and physicians fear the With a loss of $500,000 to the depositor: court and other complications. noon died yesterday. Irvin shock may prove fatal. Had this not occurred. the dif. the Northern Bank & Trust Co., Pike st. an ficulties of the bank would have been greatly lessened. Westlake ave., failed to open at 10 a. m "The situation with respect Tuesday. to Unking of BAPICS of the INQUEST TO TELL Broadway State bank and the The assets are $1,100,000, while the li Northern Bank & Trust company, fol'owing the suspension bilities are $1,600,000, state bank examiner of the former bank, caused HOW 4 CHILDREN estimate. slow but steady loss of deposits in the Northern Bank & Trust Up to the close of banking hours Mor company. culminating in its CROOKED BUSINESS? DIED AT AUBURN The suspension. clearing day, the bank continued, as usual, to accep house committee believes that deposits. An advertisement was also carrie the situation is now thoroly conference The Inquest will be held in the Following cleared undertaking parlors of George between Deputy Tuesday The Northern Bank & Trust Co., which failed today. pernetratin Monday papers by the bank, guaranteein