Article Text

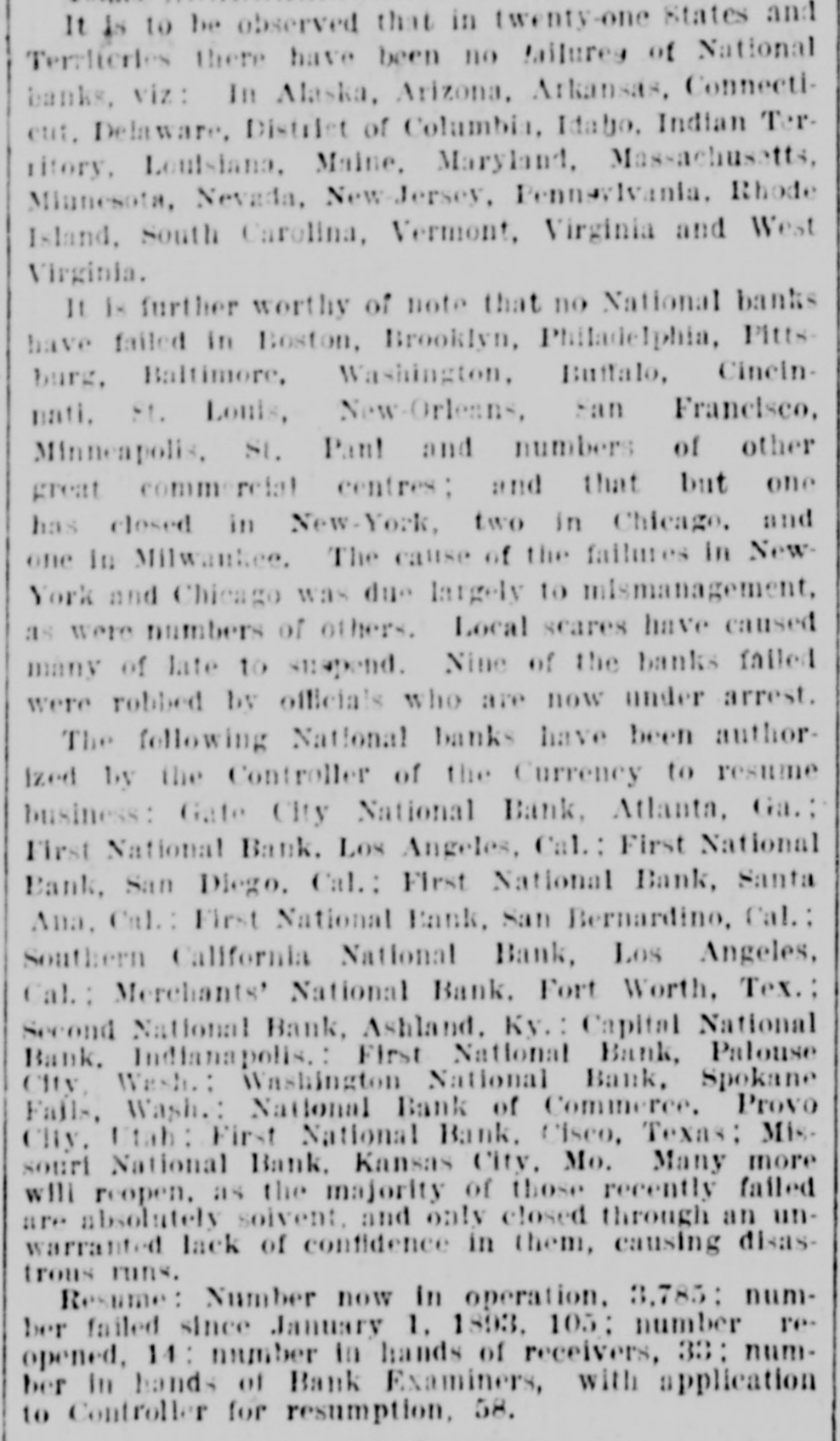

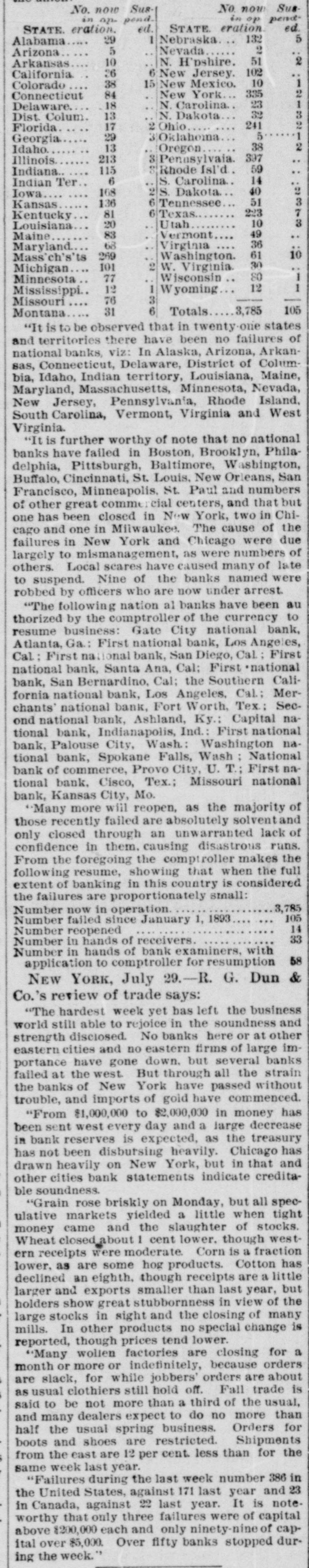

Receiver for a Hotel Company. CHATTANOOGA, TENN., June 7.-The attorneys representing the Columbia Finance and Trust Company of Louisville, who are trustees under the bondholders and acting in sympathy with the latter, asked Judge Key this morning to name a receiver for the Cumberland Gap Hotel Company, the most important part of the property being Four Seasons Hotel at Harrogate, which has been a resort of New York fashionable people. The applicants for a receivership claim that the appointment was asked merely for the purpose of reorganization. The management remains the same and no change is to be made in the conduet of the hotel. Mr. Lionel Graham, president of the hotel company, is named as receiver. The liabilities are, with the exception of an insignificant amount, the bonded indebtedness of the company$350,000. The assets, conservatively estimated, are $750,000. Small Business Failures. KALAMAZOO, MICH., June 7.-The Winans-Pratt Carriage Company made an assignment yesterday. Liabilities and assets unknown. BEATRICE, NEB June 7.-The State Bank at Cortland closed yesterday. It is a small institution. CHICAGO, ILL., June 7.-Joseph Rathbone & Co., lumber dealers, made a voluntary assignment this morning. The assets are scheduled at $500,000, and the possession of the company's property. The firm is composed of Joseph Rathbone and Morton Butler. Inability to realize on commercial paper is given as the cause of the assignment. BEDFORD, IND., June 7.-The Bedford Bank suspended yesterday. Currency for Chicago and the West. NEW YORK, June 7.-Over $1,000,000 in currency was shipped to-day by New York banks to Chicago. Demands from banks in Cincinnati, Cleveland and other parts of the West brought the total shipments up to $1,500,000. Application was made at the sub-Treasury for a telegraphic transfer of $700,000 to San Francisco. An order for $100,000 was filled, for which gold certificates were received. The Chicago Raids Not So Heavy. CHICAGO, June 7.-With one exception -the Hibernian Savings Bank-the runs inaugurated on the various savings deposit institutions are not nearly so heavy to-day, the crowds being less than half as large as yesterday. At the Hibernian the long line of depositors was confronted for the first time this morning by the notice that a thirty-days' notice would be required on deposits of $100 or less and sixty days on amounts above that figure. PALOUSE, WASH. June 7.-The First National Bank, of this city, closed its doors this morning. The suspension is due to the failure of the Bank of Spokane. The bank has a capital and surplus of $100,000, and deposits of about $30,000.