Article Text

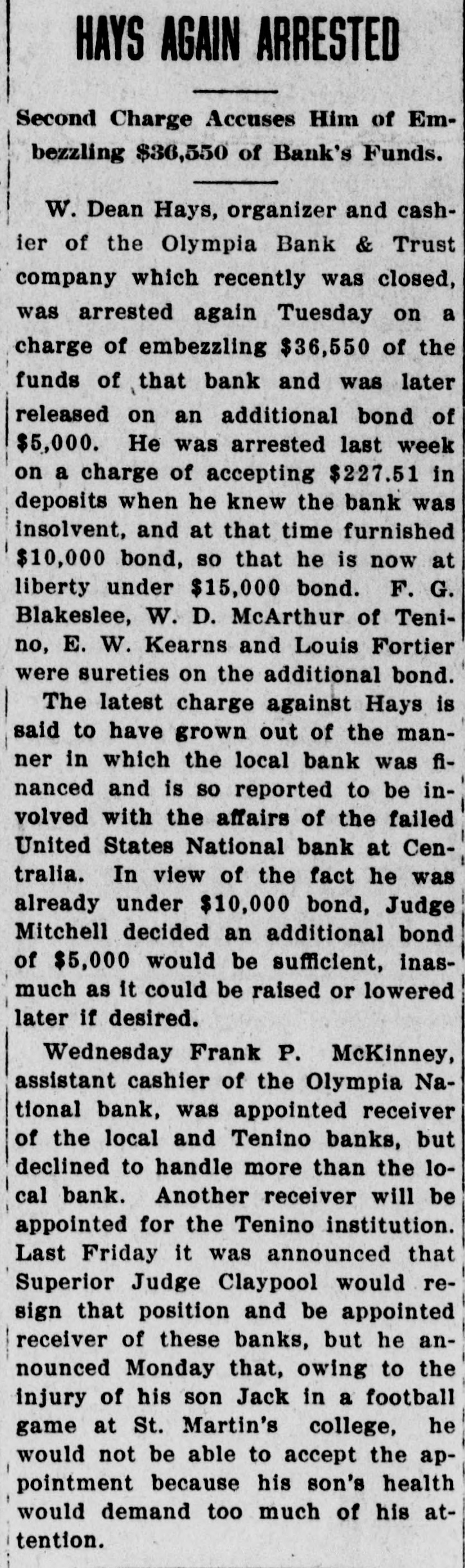

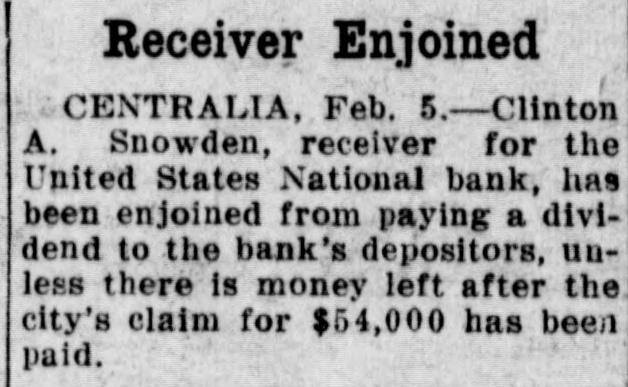

CENTRALIA BANKS FAIL FOR $1,250,000 Had Loaned Too Much Money to Themselves --- Tenino Bank, Also Fails Centralia, Wash., Sept. 21.-The United States National Bank with deposits of over $1,000,000 and the Union Loan & Thust Company, with deposits of over $250,000, failed to open their doors today following an inspection of the institutions' books by Bank Examiner Lloyd L. Mulit. The heaviest depositor in the banks was the city of Centralia, which had $90,000 on deposit. The closing of the institutions leaves the municipality with but $10,000 cash on hand from its spring tax receipts. The greatest factor in the closing of the doors of the two banks, according to George Dysart. one of the stockholdtrs, was over-confidence on the part of the bank officials in the handling of commercial paper, on which it was found impossible to realize when a financial stress came. It is said that the trouble is directly due to financing mill and logging properties in which the bank people were interested. United States Attorney Clay Allen and Marshal J. M. Boyles are in the city in connection with the closing of the banks, but their mission has not been announced. The closing caused no little excitement but the directors of both institutions assert they will turn over all of their private property and that depositors will be paid in full. The other two Centralia banks were prepared to withstand runs but none developed. The State Bank at Tenino, owned by the same interests as the two institutions which closed here, also failed to open its doors this morning. The failure of the Tenino bank, which is under the jurisdiction of the state bank examiner and not the federal authorities, was largely due, bank officials stated, to the fact that the bank had invested heavily in commercial paper similar to that held by the two local concerns.