Article Text

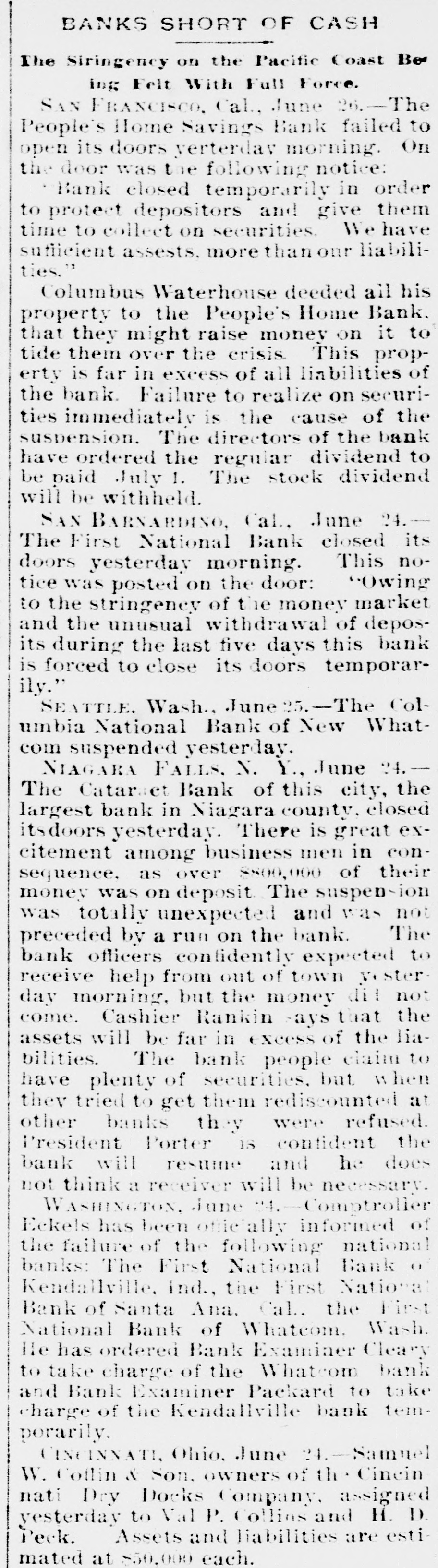

Joseph rarily." officers of the bank Garner, are: viceThe president; H. H. Its diBrown. H. Kohl, cashier. Brinkpresident; O. Brown, H. rectors are: Joseph Hall. O. H. Kohl, W. J. J. meyer, L. J. D. W. Crandall, H. H. Garner, and John M. a Curtis, paid-up James. of $100,000, Flanders capital stock undivided surplus It has a fund of $25,000 and of profits of $7995. individual deposits $261,000; There were demand certificates of deposit, $98,470. last five days between paid $100,000 out over the and In $200,000 the in cash has been counter. the Farmers' Exchange doors The resulting run on in the closing of to its call for Bank the-excited depositors Moncaused the First National. their money at craze had subsided and it day night the that the bank had banks weathered failed was thought but when so many places on the storm, Los Angeles and other a run on the in Wednesday and Bank Thursday started in anew. First National this bank, backed as resources of are fully ample it they The are by men of wealth, for dollar. and be will but to pay depositors a short dollar time before it will reopen This its bank doors. and the Farmers' but careful Exchange policy pursued a liberal industries of deploring this have in supporting community, the misfortune the and principal the that citizens has befallen are them. not a similar craze been National operating would in have Los Had Angeles, found no the difficulty First in obtaining cash to meet all demands. on this A notable feature several of the irresponsible run bank has the last parties have been throughout that on the street five days discirculating stories deposibeen the bank's ability to pay draw his crediting and advising everybody been to openly tors, These fellows have effect. The money. by others, but to no could stop denounced craze was on, and nothing, seemingly. the 11. concedes the ability obligations. of Everybody National to meet all its no excitement First there is little or banks-the San and now streets. The other Bank of San on Bernardino the National and impregnable, Bernardino trouble is considered anticipated. and no Bank of the The further First National morning. One will reopen to-morrow said to-day leading again officers of the bank owing to a depletion "Weclosed,of course, by the steady run made have the cash on hand past. We could on us the money by would have inof raised for the week as this pressing the creditors and emof the bank, but of suffering what barrassment we flurry has bank volved a great the deal present concluded to of close the some- our there doors until a pated. The depositors being considof erably are amply over protected, a doliar of assets to one the liabilities." has been announced hundreds that of Since will it reopen for business congratulations bank have extended their c bank. Brown, the closing of citizens to Joseph them realize president that the ot the placing of Many bank of permanently and would inevitably it in the the bring hands to of many a receiver borrowers financial betrouble. DIEGO, if not disaster. June Confidence matters. is E. S. ing SAN rapidly restored of in the bank Cororado Beach he Babcock, president announced this morning Bank of that ComCompany, accept checks on National the at their will merce and on the First various lines of merchandise full face and value supplies for for carried books in of the tickets comwarehouse and lines. streetear pany's and motor making good of The the Bank Examiner the is Bank of Commerce, progress and in expects examining to conclude this after10 and as good noon. The plan for percentages-10 more in sixty and per adopted, cent ninety on it is and days-is resuming considered expected the as bank will be open Monday. new Merchants' depositors, National Bank, is enThe is crowded with transacted as usual. abling its which business WHATCOM, to be Wash., June 23.-The open NEW Bank did not doors Colambian National A notice OD the on doors this "Owing morning. to inability have to decided realize to securities stated: the directors Cashier Baker says the the close assets temporarily." of the bank are $226,000 and June liabilities $110,000. The Bank morning. of Madera A MADERA, its doors this "Temporarily failed to open doors stated: be paid in suspended. placard on the Depositors will de C. 23.-F. Long, Senator. full." SAN RAFAEL June has made an assignment Francisco. is a ex-State to Henry Pierce of June San 23. -The bank Specu- exoffering Los ANGELES, thing of the past. to buy citement lators who small have discount been store have displays found few notice offering customers. checks at a as every to accept third checks on all the closed banks at par. Examiner Wightman. to-day, National Bank San Francisco is exwho arrived condition from of the national banks banks that the both the Los cellent, says and that resume next week. The fund will probably Bank has a hand. reserve There Angeles National $100,000 on than paymore than to-day most ments was of have been at this more bank, deposits made, upon which and there the is a persistent run redeposits. steady President increase M. Railway H. of Sherman Company of the said Electric Bank toConsolidated suspension of the Pacific the road, was bank day in San that Francisco the would the owner not affect of only a small as the of the stock. special Chamber of session minority The passed Commerce, resolutions at a express- Angeles to-day, in the Los why and sound. ing implicit confidence giving figures to show they banks, are perfectly DEMOCRATS GAIN SOCIAL