Click image to open full size in new tab

Article Text

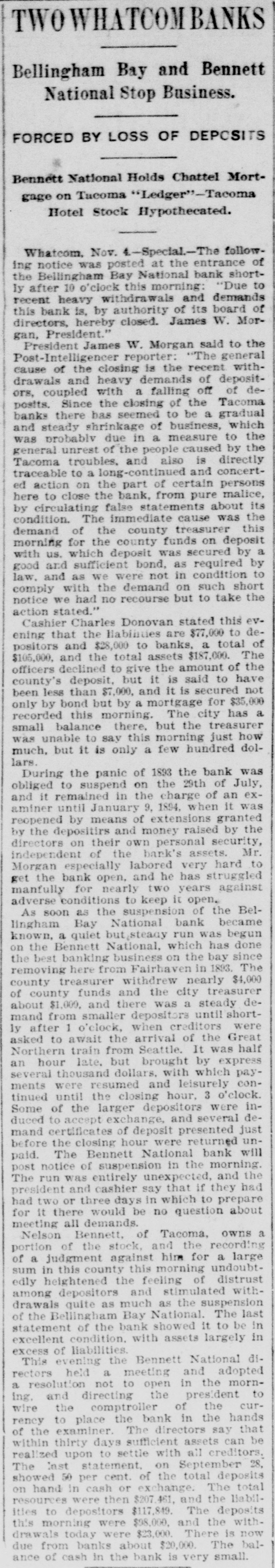

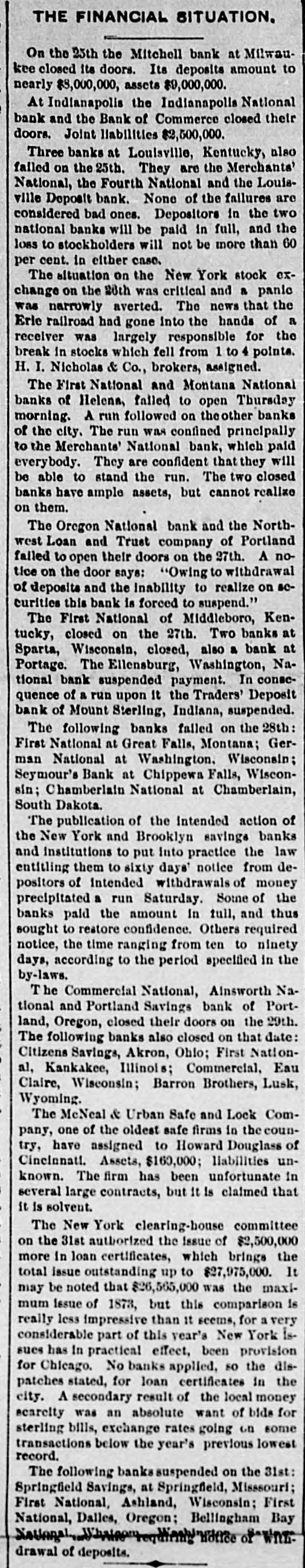

THE FINANCIAL SITUATION. On the 25th the Mitchell bank at Milwaukee closed its doors. Its deposits amount to nearly $8,000,000, assets $9,000,000. At Indianapolis the Indianapolis National bank and the Bank of Commerce closed their doors. Joint liabilities $2,500,000. Three banks at Louisville, Kentucky, also failed on the 25th. They are the Merchants' National, the Fourth National and the Louisville Deposit bank. None of the failures are considered bad ones. Depositors in the two national banks will be paid in full, and the loss to stockholders will not be more than 60 per cent. in either case. The situation on the New York stock exchange on the 28th was critical and a panic was narrowly averted. The news that the Erle railroad had gone into the hands of a receiver was largely responsible for the break in stocks which fell from 1 to 4 points. H. I. Nicholas & Co., brokers, assigned. The First National and Montana National banks of Helena, failed to open Thursday morning. A run followed on theother banks of the city. The run was confined principally to the Merchants' National bank, which paid everybody. They are confident that they will be able to stand the run. The two closed banks have ample assets, but cannot realize on them. The Oregon National bank and the Northwest Loan and Trust company of Portland failed to open their doors on the 27th. A notice on the door says: "Owing to withdrawal of deposits and the Inability to realize on securities this bank is forced to suspend." The First National of Middleboro, Kentucky, closed on the 27th. Two banks at Sparta, Wisconsin, closed, also a bank at Portage. The Ellensburg, Washington, National bank suspended payment. In consequence of a run upon It the Traders' Deposit bank of Mount Sterling, Indiana, suspended. The following banks failed on the 28th: First National at Great Falls, Montana; German National at Washington, Wisconsin; Seymour's Bank at Chippewa Falls, Wisconsin; Chamberlain National at Chamberlain, South Dakota. The publication of the intended action of the New York and Brooklyn savings banks and institutions to put into practice the law entitling them to sixty days' notice from depositors of intended withdrawals of money precipitated a run Saturday. Some of the banks paid the amount In full, and thus sought to restore confidence. Others required notice, the time ranging from ten to ninety days, according to the period specified in the by-laws. The Commercial National, Ainsworth National and Portland Savings bank of Portland, Oregon, closed their doors on the 29th. The following banks also closed on that date: Citizens Savings, Akron, Ohio; First National, Kankakee, Illinois; Commercial, Eau Claire, Wisconsin; Barron Brothers, Lusk, Wyoming. The McNeal & Urban Safe and Lock Company, one of the oldest safe firms in the country, have assigned to Howard Douglass of Cincinnati. Assets, $160,000; liabilities unknown. The firm has been unfortunate in several large contracts, but it Is claimed that it is solvent. The New York clearing-house committee on the 31st authorized the Issue of $2,500,000 more in loan certificates, which brings the total issue outstanding up to $27,975,000. It may be noted that $26,565,000 was the maximum Issue of 1873, but this comparison is really less impressive than it seems, for a very considerable part of this year's New York issues has In practical effect, been provision for Chicago. No banks applied, so the dispatches stated, for loan certificates in the city. A secondary result of the local money scarcity was an absolute want of bids for sterling bills, exchange rates going on some transactions below the year's previous lowest record. The following banks suspended on the 31st: Springfield Savings, at Springfield, Misssouri; First National, Ashland, Wisconsin: First National, Dalles, Oregon: Bellingham Bay National Whatcom lequiring Notice of When drawal of deposits.