Click image to open full size in new tab

Article Text

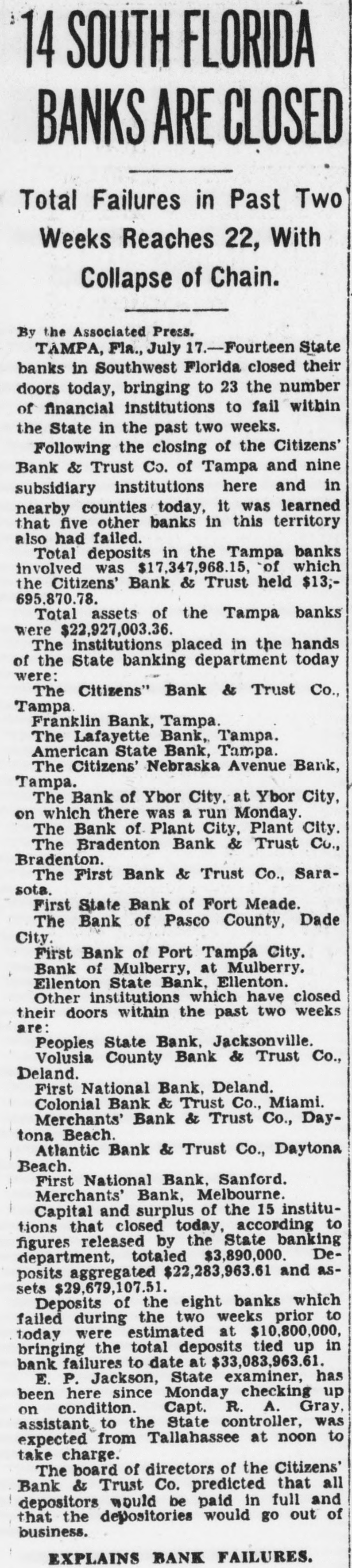

14 SOUTH FLORIDA BANKS ARE CLOSED Total Failures in Past Two Weeks Reaches 22, With Collapse of Chain. By the Associated Press. TAMPA, Fla., July 17.-Fourteen State banks in Southwest Florida closed their doors today, bringing to 23 the number of financial institutions to fail within the State in the past two weeks. Following the closing of the Citizens' Bank & Trust Co. of Tampa and nine subsidiary institutions here and in nearby counties today, it was learned that five other banks in this territory also had failed. Total deposits in the Tampa banks involved was $17,347,968.15, of which the Citizens' Bank & Trust held $13;695.870.78. Total assets of the Tampa banks were $22,927,003.36. The institutions placed in the hands of the State banking department today were: The Citizens" Bank & Trust Co., Tampa Franklin Bank, Tampa. The Lafayette Bank, Tampa. American State Bank, Tampa. The Citizens' Nebraska Avenue Bank, Tampa. The Bank of Ybor City, at Ybor City, on which there was a run Monday. The Bank of Plant City, Plant City. The Bradenton Bank & Trust Co., Bradenton. The First Bank & Trust Co., Sarasota. First State Bank of Fort Meade. The Bank of Pasco County, Dade City. First Bank of Port Tampa City. Bank of Mulberry, at Mulberry. Ellenton State Bank, Ellenton. Other institutions which have closed their doors within the past two weeks are: Peoples State Bank, Jacksonville. Volusia County Bank & Trust Co., Deland. First National Bank, Deland. Colonial Bank & Trust Co., Miami. Merchants' Bank & Trust Co., Daytona Beach. Atlantic Bank & Trust Co., Daytona Beach. First National Bank, Sanford. Merchants' Bank, Melbourne. Capital and surplus of the 15 institutions that closed today, according to figures released by the State banking department, totaled $3,890,000. Deposits aggregated $22,283,963.61 and assets $29,679,107.51. Deposits of the eight banks which failed during the two weeks prior to today were estimated at $10,800,000, bringing the total deposits tied up in bank failures to date at $33,083,963.61. E. P. Jackson, State examiner, has been here since Monday checking up on condition. Capt. R. A. Gray, assistant to the State controller, was expected from Tallahassee at noon to take charge. The board of directors of the Citizens' Bank & Trust Co. predicted that all depositors would be paid in full and that the depositories would go out of business. EXPLAINS BANK FAILURES.