Article Text

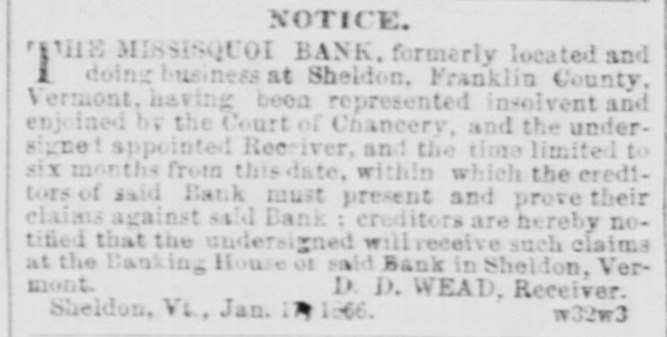

The coal trade in the coal regions has very much slackened off, and the demand at the yards in this city is quite active. The indications now favor the conclusion that the opening of trade next spring will find the stock on hand pretty well exhausted. Under these prospects the stocks of the several coal producing companies are largely dealt in and at improving prices. At anything like present quotations for coal no effort will be spared to make all the new companies as productive next season as possible, and as there is a probability that the carrying compantes will be able to furnish a better supply of cars than heretofore, the production of coal will be largely increased, thus favoring more reasonable prices. The new Lehigh and Mahonoy Railroad, connecting up to Locust Mountain, and opening to market the coal of several largely producing colleries in the Mahonoy region, will throw a largely increased supply of the best kind of fuel in the market. With the promised extension of the trade, and increased number of producers, there will be difficulty in forming combination to put up prices, as was charged during the last season. In several other directions we hear of new outlets for coal, and as present prices will bear considerable reduction, with large profits to producers, we welcome the prospect to consumers of fuel at more reasonable rates next year. We stated yesterday that the bills of the Missisquoi Bank of Sheldon, Vermont, had been refused in Boston. The following, from the Burlington Free Press of the 6th instant, explains the reason:A report that the disappearance of Mr. Hubbell had been explained by the discovery of a heavy deficiency in the funds of the bank of which he was cashier reached us on Wednesday last; but in view of all the circumstances we chose to withhold it for fuller and more authentic information. This, we are pained to say, fully confirms the report. Mr. Hubbell is a defaulter to a very large amount. An examination of the accounts of the bank by competent accountants has resulted in the discovery of mbezzlements, reaching back for years, and stated as high as $75,000. A comparison of the books with the accounts of the bank note company which printed the notes of the bank, as we hear, indicates considerable over-issues of circ lation not appearing on the books, and alterations of the entries of mutilated bills destroyed, and false footings cover additional abstractions of the funds. The bank suspended payment on Thursday. The directors, of whom Mr. Hubbell's father is one, assure the billholders that the assets will be sufficient to cover the redemption of the bills, and that they will be redeemed as soon as the indebtedness of the bank can be collected in. As the directors are also men of property, and are liable on their bonds, the public is not likely to suff r a loss. The loss to the stockholders will of course be heavy. The bank had a capital of $100,000. It had taken no steps towards changing into a national bank, and was consequently preparing to wind up after next July. It has always stood well. Mr. Cashier Hubbell had the reputation of living rather extravagantly; but it is not known that he has gambled in stocks or made bad investments on his private account. He left behind property to the amount of about $15,000 in real estate in Sheldon and in stocks, and was also a partner in the firm of S. B. Green & Co., of Sheldon. He had many friends and a wide acquaintance, and these sad developments naturally create much excitement in Franklin county and elsewhere, among those who were interested in him or the bank.