Article Text

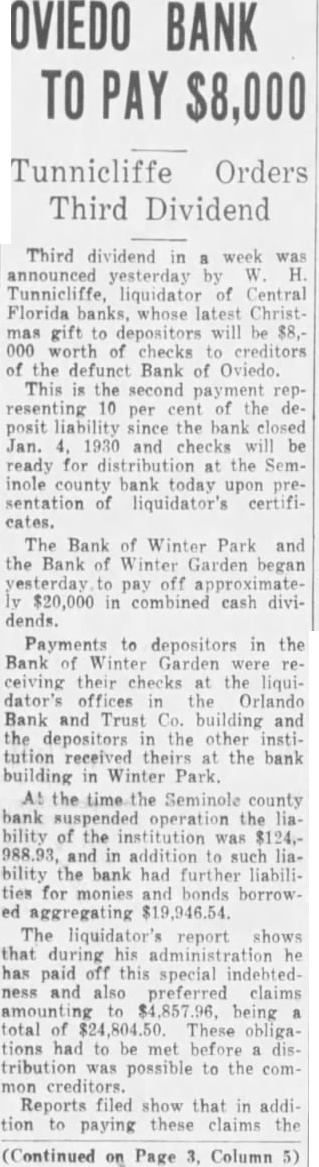

OVIEDO BANK PAY $8,000 Tunnicliffe Orders Third Dividend Third dividend in week announced yesterday Tunnicliffe, liquidator of Central Florida banks, whose latest Christmas gift depositors will 000 worth checks creditors of the defunct Bank of Oviedo. This the second payment resenting 10 cent the per posit liability since the bank closed Jan. 1930 and checks ready for the Seminole county bank today upon sentation of liquidator's certificates. The Bank of Winter Park and the Bank Winter Garden began pay off $20,000 in combined cash dividends. Payments to depositors in the Bank Winter Garden were ceiving their checks the liquidator's offices Orlando Bank and Trust Co. building and the depositors the other institution received theirs the bank building in Winter Park. At the time the Seminole county bank operation liability of the institution was $124.and in addition such bility the bank had further liabilities for and bonds borrowed aggregating $19,946.54. The liquidator's report shows that during his has paid off this special indebted ness and also preferred claims being total of These tions had tribution possible to the Reports filed show that in addition paying these claims the (Continued on Page Column