Click image to open full size in new tab

Article Text

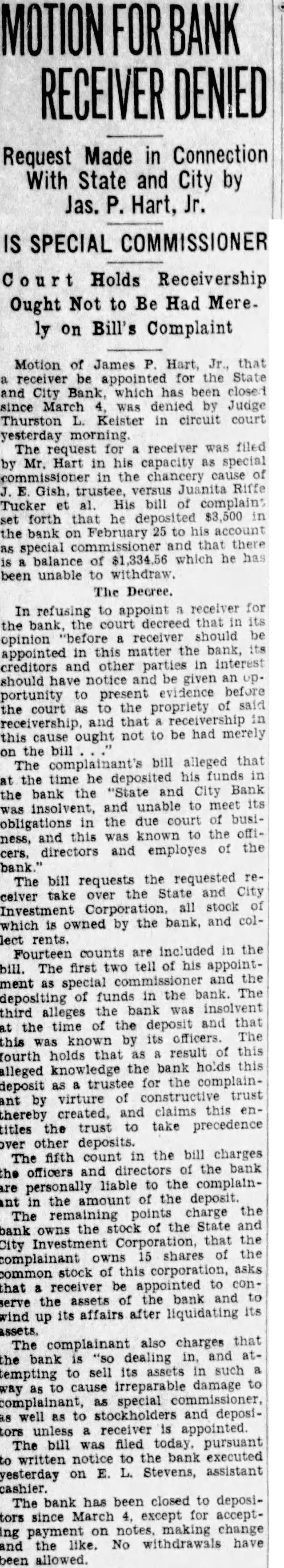

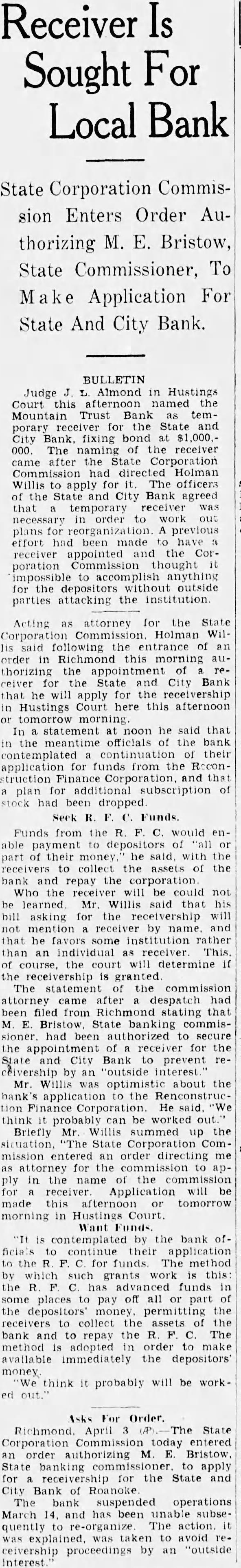

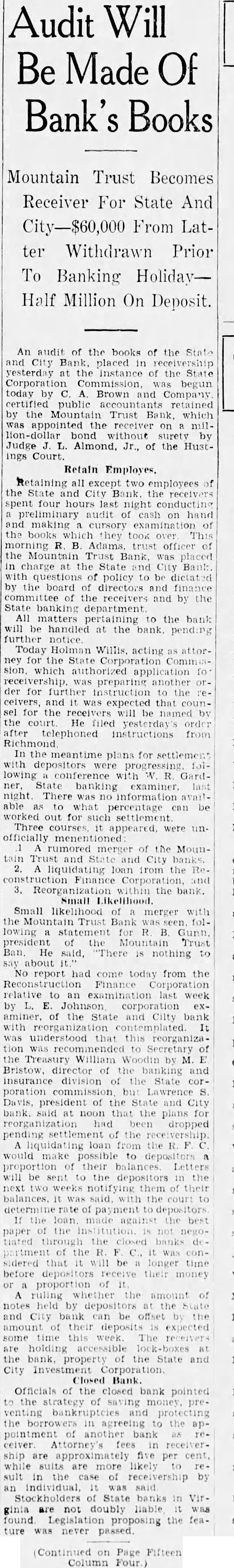

AUDIT INDICATES PAYMENT CLOSED BANK

(Continued From Page One) including interest, totaling besides capital surplus books Total All said yesterday. transferred to the Mountain Trust except the Department. negotiations for the sale of which are now the liquidation will end the history of the and City the Day Night Bank for business the following March 313 South ferson Its charter provided for minimum and capital of $100,000 and respectively.

Moved In

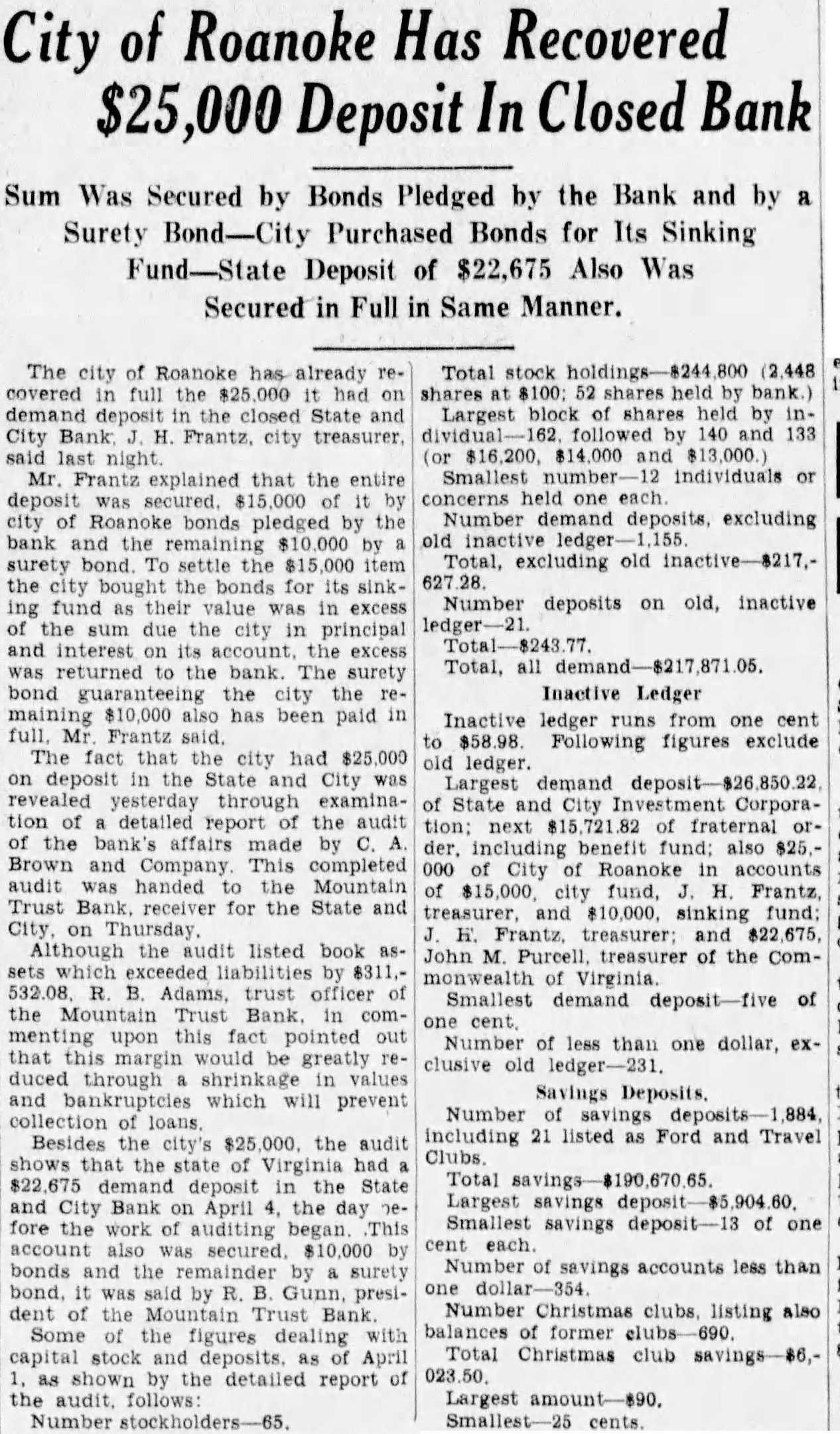

The bank was moved May. 116 West Haley Later was presiwhich Mr. Haley the year by had become The changed to the State City November 27. 1925 large expansion place. meeting which the 2,000 shares the capital and $200,000. respectively. The present purchased from the Colonial National Bank April The purchase actually by the and City vestment Corporation the valued an of owned either by bank its In the annual statement as the capital stock shown and the stock holders had capital stock from $300,000 $275,000. understood that approximately $60,000 was withdrawn from deposit during months preceding national when holidays being declared the and and diswere decreased Official Statement Mr Adams' statement follows: assume that the two things in which the public is most interested are what amount the depositors receive and when disbursements It difficult for the receiver these with any degree certainty. "According the auditors' report there margin book assets over liabilities, which indicate that the From will be greatly duced due to bankruptcies and shrinkage in values. The auditors were directed to list the assets the values carried by the and not supposed go the the collectibility of the and undertake collect in short notes and would acute credit situation Roanoke. The amount be realized on the assets and the within which can collected large extent be contingent upon pick up and an but not too will to the mean the ference between their per 40 per cent or perhaps twice that amount. WIII Be Developed. to the depositors will delayed longer than normally would the fact the City Bank had borrowed prior the For these loans the had pledged collateral portion notes. In protect equity this collateral be the best interest the for the ceiver to pay these before any disbursement is to the deposiOur first interest being to see that the the to hold the expense of liquidation mum. of receiver effected saving premium of addition, succeeded having due the State remitted are skeleIn order further assets moved the Trust Bank with exception of the Mortgage Loan Be Vacated. pending now for the sale this and, the sale completed and proved the banking ters the State and City Bank will that the audit has been comthe will ask to the Reconstruction Corporation liquidating loan accordance this granted. used to the bank and pay dend to depositors Reconstruction Finance Corporation may approve."

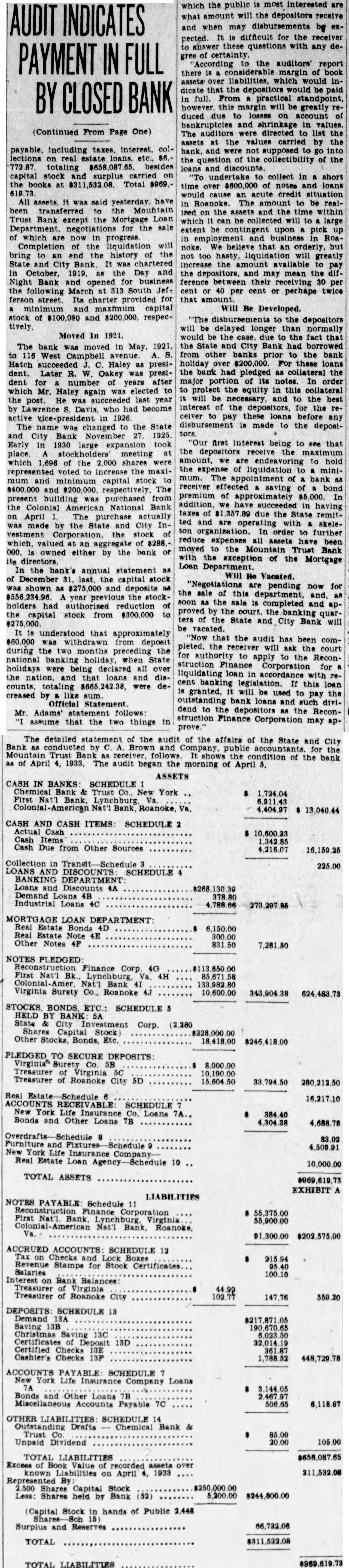

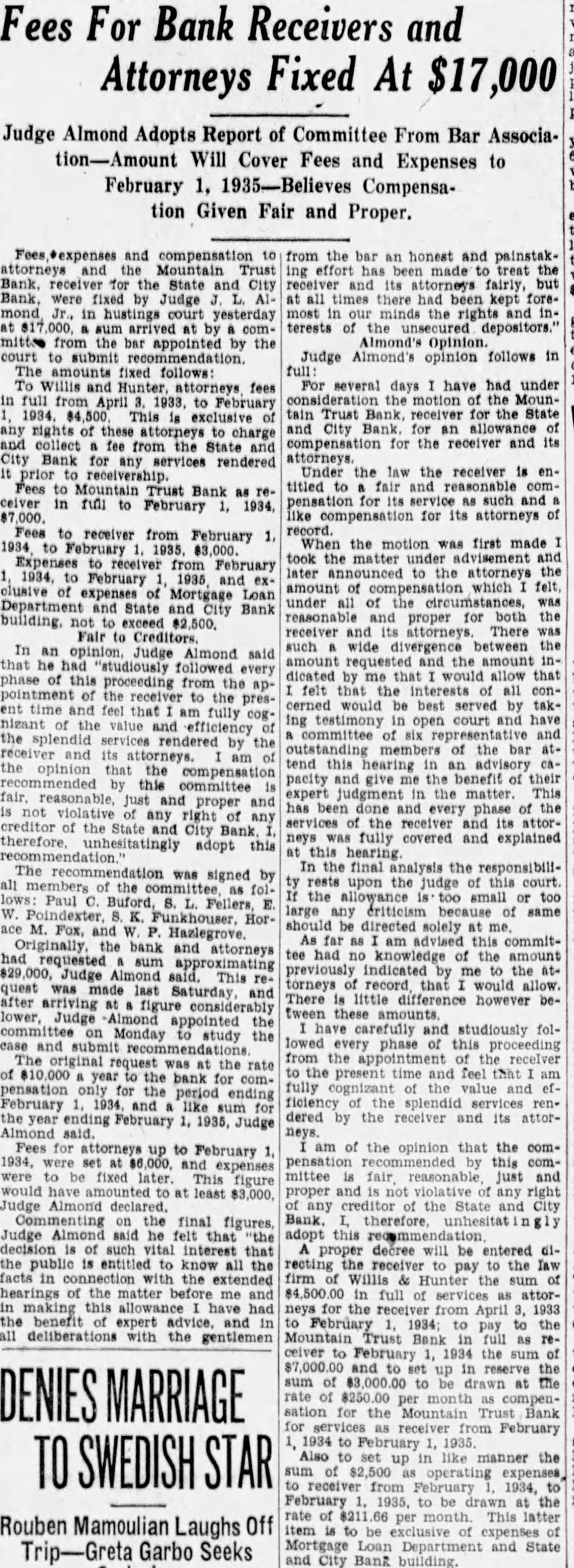

MORTGAGE LOAN Estate Bonds 4D 6,150.00 Estate Note 4E Other Notes 4F NOTES PLEDGED Finance Corp. 4G First Nat'l 4H Bank Virginia Surety Co., Roanoke 4J 10,600.00

TOTAL ASSETS

6,118.67

TOTAL LIABILITIES

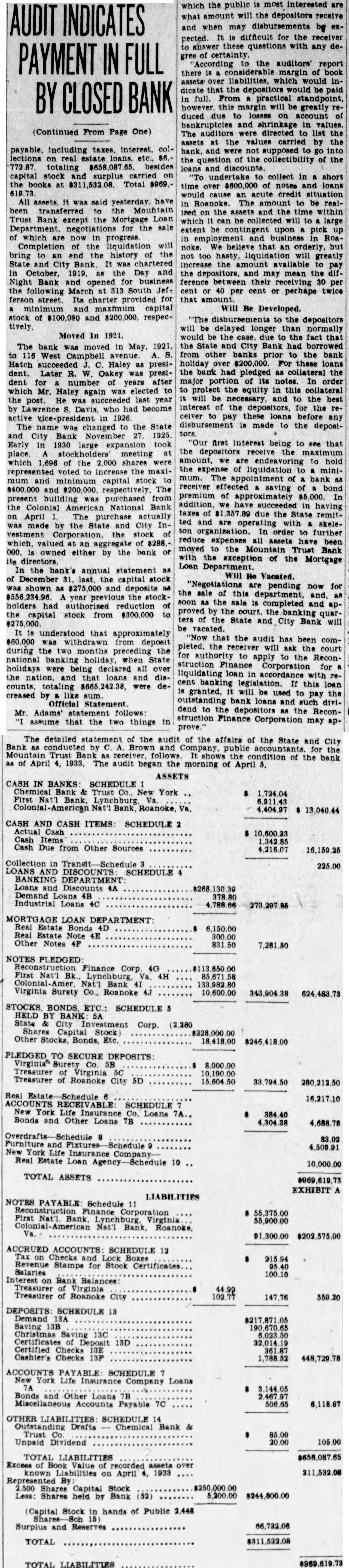

The detailed statement the audit of the affairs of the State and City Bank for the of the bank of April The audit began the morning of April ASSETS CASH IN BANKS SCHEDULE New York 1,724.04 First Bank, Roanoke, Va. 4,404.97 CASH AND CASH ITEMS: SCHEDULE Actual Items Cash Due from Other Sources 4,216.07 16,159.25 225.00 LOANS SCHEDULE BANKING Loans Discounts 4A Demand Loans 4B Industrial Loans 4C 7,281.50 343,904.38 624,483.73 STOCKS ETC.: SCHEDULE HELD BY BANK City Corp. Shares Capital Other Bonds, Etc. 18,418.00 $246,418.00 PLEDGED TO SECURE DEPOSITS 8,000.00 Treasurer Virginia Treasurer of Roanoke City 5D 280,212.50 Real 16,217.10 SCHEDULE New Insurance Loans Bonds and Other Loans 7B 4,304.38 4,688.78 83.02 Furniture Schedule 4,509.91 New York Life CompanyReal Estate Loan 10 10,000.00 NOTES PAYABLE Schedule 11 First Nat'l Virginia 55,900.00 Roanoke $1,300.00 $202,575.00 ACCRUED ACCOUNTS: SCHEDULE 12 215.94 Revenue Stamps for Certificates Salaries 100.10 Bank Treasurer Virginia Treasurer Roanoke City 147.76 559.20 SCHEDULE Demand Saving Christmas 13C Certificates 13D Certified Checks Cashier's Checks 1,788.52 448,729.78 ACCOUNTS SCHEDULE Life Company Loans 3,144.05 Bonds and Other Loans 7B Miscellaneous Payable 7C 506.65 OTHER SCHEDULE Drafts Chemical Bank & Trust Unpaid Dividend TOTAL LIABILITIES $658,087.65 known Liabilities on April 1933 Shares Capital Stock by 5,200.00 (Capital Stock hands of Public Surplus and Reserves 66,732.08 TOTAL $311,532.08