1.

August 30, 1913

Alexandria Gazette

Alexandria, VA

Click image to open full size in new tab

Article Text

RIGHMOND DANA CLOSES ITS DOORS e e e Commonwealth Bank Comn pelled to Apply For t Receivers . : b TO PAY DEPOSITORS. State Bank Examiners is Confident Creditors Will Not Lose By Closy ing of Institution. Richmond, Va., Aug. 30.-By order of Charles C. Barksdale, examiner of the Bureau of the poration Banking Commission, the State Common- Corwealth Bank and its branches at 25th and Broad streets and 3914 Williamsburg Avenue, Fulton, were closed yesafternoon. terday Application Moncure, of will be made before Judge the Court, early today by Mr. for the reChancery Barksdale appointment of ceivers. The doors will not be opened notice last night that were posted this morning, they having been closed by direction of the Banking Bureau. "So far as I am able to ascertain, Mr. last will receive money said positors Barksdale, their night, "de- in and I might add further, that, general confull, in my opinion, banking ditions in Richmond are satisfactory and that I see no cause for and sound, citizens of uneasiness among the Richmond. The immediate cause of the Commonwealth's embarrassment, accorda statement issued W. L. ing by President to Waters, last is night the to meet of creditor bank's the demand temporary inability banks for to repayment of money borrowed of its customers. gives assurance the statement take care that The the bank's investments are sound and that every depositor will be paid 100 cents on the dollar. Mr. Barksdale stated in explanation of the banking bureau's action that of the Common finances ,wealth's an examination disclosed that it did not have enough quick assets to raise the necessary cash to meet the usual demands necessary for the protection of its depositors. A large proportion of its loans and invest_ ments are on real estate collateral of which, because of the stringency the money market and the inactivity of real estate are not immediate ly collectable. Complications due to these causes, said Mr. Barksdale, made it necessary to ask for the ap. pointment of a receiver. In the transactions of its business, Commonwealth Bank was inde_ pendent the of the local clearing-house. "The Commonwealth Bank is in no connected with Clearing-House offiway Association of Richmond," said cers of that institution last ngiht. The Commonwealth Bank was founded about seven years ago, and maintained its principal banking It house at 12 North Ninth street. apparently enjoyed a solid growth, establishing branches at 25th and Broad Ave. and 3914 Williamsburg streets home bank and two branches The have about 6,500 depositors. Accord- bank's to the statement of the ing finances at the close of business Aug9 individual and saving deposits certotaled ust $615,396.14. and demand tificates of deposit $31,239..70. Most of the depositors belong to bank the industrial classes, the the having city's been founded, according to s.atement of its officers, to cater par- and ticularly to the small depositor savborrower. The individual small accounts are uniformly modest, savand ings in many cases represent the ings The of news years. of the bank's embarrass- sur last night caused general ment Its stock par, value $100, was prise. yesterday on the Richmond quoted stock market at 112. The bank is to have valuable real estate known holdings, both improved and unimproved. and the hope was expressed generally that it will be able to adjust all demands without loss to deposi. tors. The officers were of the opinion that unless liquidating expenses proved to be unusually heavy. there would be even no loss to the holders of the banks $300,000 of capital stock.

2.

August 31, 1913

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

CLOSING OF BANK CAUSES NO ALARM Commonwealth Depositors Relieved Over Appointment of Receivers by the Court. NO CLAMOR FOR MONEY Few Persons Around Closed Doors-Receivers Will Begin at Once to Wind Up Affairs. With the appointment of receivers to wind up its affairs, and the assurance that the depositors would not lose, the alarm occasioned by the closing of the Commonwealth Bank and its two branches by order of the State Corporation Commission, quickly abated yesterday, and no appreciable effect was felt by the other local banking institutions. James W. Gordon and John B. Lightfoot, Jr., who were named by Judge William A. Moncure, of the Chancery Court, as receivers for the defunct concern, have been bonded In the sum of $750,000. and are under orders to begin an immediate inventory. They will put forth every effort to liquidate the assets as quickly as possible in order to relieve the financial embarrassment some of the bank's patrons night suffer by its suspension. As the next step after closing the doors of the Commonwealth Bank Friday afternoon, the banking division of the State Corporation Commission, through J. R. Tucker, Jr., early yesterday morning filed a bill in equity in the Chancery Court of Richmond, asking for the appointment of receivers on the grounds that the State banking laws had not been fully observed; that irregularities were being practiced and that the capital of the bank had been, or was, in danger of being impaired. Denies Alleged Irregularities, On behalf of the board of directors, an answer to the complaint was entered by President W. L. Walters, who denied the allegations of irregularities, but united in the prayer for the supervision of the court in winding up the affairs of the institution. Judge Moncure was requested by the complainant to enjoin all officers, dlrectors, agents or employes of the bank, and all persons, whomsoever, from interfering in any manner with the possession or management of the property or assets in the hands of the receivers. This injunction was granted, and the receivers were empowered to take over all property, real, personal or mixed, and all officials and employes of the bank were ordered to turn over all books or property whatsoever to them. Under the court's instructions the (Continued On Second Page.)

3.

August 31, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

RECEIVERS NAMED FOR COMMONWEALTH J. W. GORDON AND J. B. LIGHTFOOT TO WIND UP AFFAIRS OF CLOSED BANK. LITTLE EXCITEMENT OPTIMISTIC STATEMENTS OF BANK EXAMINER HAS REASSURING EFFECT ON THE DEPOSITORS. John B. Lightfoot and James W. Gordon were yesterday named as receivers for the Commonwealth bank by Judge Moncure in Chancery court. on the application of J. Randolph Tucker, appearing for the State corporation commission, and bond was fixed at $750,000. The receivers will qualify early Monday morning. and the receivers will take immediate charge of its affairs. State Bank Examiner Charles C. Barksdale took charge of the banks, and its two branches late Friday afternoon for the protection of the depositors, and patrons were greeted yesterday morning with notices on the doors to that effect. Mostly Small Depositors. The failure of the bank created little excitement despite the fact that two-thirds of Tts patrons are small depositors. The optimistic statement of the examiner and the president of the institution-that the depositors will be paid dollar for dollar has had a reassuring effect. It will require several months to wind up the affairs of the bank. The receivers are instructed to collect all the assets and place them in trust with the Chancery court, which will distribute them to the depositors when the work is complete. Most of the bank's assets are tied up in real estate which is not quickly collectible, and the winding-up process will necessarily be slow. which will work a hardship to the small depositor. but eventually it is believed none of them will lose anything. The name of F. F. McConnell was erroneously given yesterday morning in the directorate of the bank. Mr. McConnell is not connected with the bank either as stockholder or director, and has no interest in the bank.

4.

August 31, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

NO CAUSE FOR EXCITEMENT. There is no reason for fear on the part of depositors and stockholders in the Commonwealth Bank that their savings and investments will be wiped out by the closing of the doors of the bank by State Examiner Barksdale. There is even reason to believe that every cent of outstanding obligations will be met and that depositors will receive dollar for dollar. Until & more complete examination is made the examiner cannot state definitely the financial condition of the bank, but the investigation which influenced him to close the bank temporarily was not of such nature as to cause him to believe that a crash would result if prompt action were taken. The closing of the bank was in the nature of a precaution against such & crash and the application for receivership 18 chiefly for the purpose of enabling the bank to realize on its securities. President Walters of the bank 18 optimistic and State Bank Examiner Barksdale expresses the belief that all obligations will be met The Virgintan hopes that these beliefs will be realized and that no one will be the loser through the closing of the bank. In the meantime depositors should not be unduly frightened. The Virginian believes it can speak more positively regarding the situation in the city at large. The other banks are not affected in any way, none of them having any connection with the Commonwealth and all of them being in a sound condition. The fact that the State examiner has investigated the affairs of but one bank and has found that one not to be on the verge of ruin, is evidence of this. His action shows him to have been vigilant and yet cautious and conservative. These things are evidence that were there any reason whatever for fearing a failure of any other bank that bank would have been investigated before this. Financially, The Virgintan 1s assured by men in a position to know, Richmond is as strong today as at any time. The difficulties of the Commonwealth furnish an exception to the rule.

5.

September 2, 1913

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

RECEIVERS GIVE BOND Lightfoot and Gordon Execute $750,000 Surety for Their Trust. John B. Lightfoot, Jr., and James W. Gordon, receivers for the Commonwealth Bank, executed bond for $750.000 in the Chancery Court yesterday as security for their trust. The sureties are the United States Fidelity and Guarantee Company and the Fidelity and Deposit Company, of Maryland. The receivers announced yesterday that beginning this morning the Commonwealth Bank, as well as the branches at Twenty-fifth and Broad Streets and 3914 Williamsburg Avenue, Fulton, will be open daily to receive money due either the central bank or the branches. The banks will be kept open for this purpose each business day for an indefinite period.

6.

September 2, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

KNOWS NOTHING OF REORGANIZATION PRESIDENT WALTERS COULD NOT CONFIRM COMMONWEALTH REPORT. Though report was heard yesterday afternoon that there is a movement under way for the reorganization of the Commonwealth bank, which closed its doors Friday night, President W. L. Walters, of the institution, last night said he knew nothing of such movement. The report was that the bank will be reorganized. new capital being invested, and that the business of the bank will be continued. The receivers named by Judge Moncure in the Chancery court Saturday, J. B. Lightfoot, Jr., and James W. Gordon, yesterday executed the required bond, $750,000. The sureties are the United States Fidelity and Guarantee company and the Fidelity and Deposit company of Maryland.

7.

September 3, 1913

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

OPENS TO COLLECT NOTES By direction of John B. Lightfoot. Jr., and James W. Gordon, receivers appointed by Judge Moncure, of the Chancery Court, the doors of the Commonwealth Bank, 12 North Ninth Street, and its two branches were opened yesterday morning so that people having notes with the bank might take them up or curtail them by partial payments, and so that other business of this nature might be transacted. It was not permitted, though. that checks should be cashed or that any moneys whatever should be paid out. It will be several days probably before the receivers, who are under $750,000 bond for the faithful performance of their duties, will be able to determine the exact condition of the bank's ffairs.

8.

September 3, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

DRUG STORE FIRST TO FEEL FAILURE CLOSING OF COMMONWEALTH BANK REFLECTED IN DRUG BUSINESS OF J. T. LEWIS ASSIGNMENT IS MADE NOTES DISCOUNTED IN COMMONWEALTH BANK AGGREGATE $5,250-POWERS-TAYLOR DRUG CO. LARGEST CREDITOR The first business house of Richmond to show that it has felt the effects of the closing of the doors of the Commonwealth bank last Friday night is the drug business of J. T. Lewis at 4 East Broad street. The company made an assignment In favor of Robert L. Powers and H. S. Morris yesterday. the deed of trust being filed in the office of the clerk of the Chancery court. Among the creditors whose accounts are secured pro rata by the assignment are named the receivers of the Commonwealth bank, holding notes aggregating $5,250. discounted by that bank. The deed assigns all the stock and fixtures and business and accounts of the drug store to Messrs. Powers and Morris, who will make an inventory, collect accounts due and straighten out the business. Creditors Secured. First secured by the assignment are the fees for the deed and Its recording. commission of five per cent to three trustees, rent due Mrs. Henry G. Cannon, the landlord, and one month's wages, $85, to P. S. Lewis, clerk at the store. Second, secured pro rata, are the accounts of Powers-Taylor Drug company, holding notes amounting to $2.255, and open account of $1,020.43; Richard Gwathmey & Co., notes of $321.08 and open account, $151.60; Vaughan-Robertson Drug company, notes $700, open account, $650: Cliff Weil Cigar company, open account, $94.16; Strauss Cigar company, open account, $50.

9.

September 5, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

RECEIVERS' NOTICE. In reply to many inquiries, and in view of the great mass of work involved in settling up the affairs of The Commonwealth Bank, Incorporated, we respectfully ask that all persons in interest will promptly comply with and take notice of the following requests and information. and thus assist us in realizing the best results for all concerned-viz: 1. Bring all pass-hooks to No. 12 North Ninth street at once and leave them to be written up, and we will return them after The American Audit Company has completed its examination and statement of the affairs of the bank. 2. We cannot pay anything to the depositors at this time, but dividends will be declared under orders of the court as soon as the amount in our hands justifies a distribution. It is impossible for us to say when this will be, but we shall use every effort to realize on the assets as soon as the nature of the case will permit. We cannot express any opinion as to what will ultimately be paid to the depositors. 3. Arrangements are being perfected to deliver all collection notes and other property. upon which the bank has no claim, as soon as the audit company finishes its work. 4. The court has authorized the setoff of deposits against discounted notes due by depositors, where the demands are mutual, but this cannot be done until the dudit is completed. 5. All persons indebted to the bank or its branches are requested to make prompt payment to us at the main office of the bank at No. 12 North Ninth street. 6. All depositors are urgently requested to file with the receivers their present correct address and to notify them of subsequent changes. JAMES W. GORDON, JNO. B. LIGHTFOOT, JR., Receivers. September 5th.

10.

September 6, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

RECEIVERS' NOTICE. In reply to many inquiries, and/ in view of the great mass of work involved in settling up the affairs of The Commonwealth Bank, Incorporated, we respectfully ask that all persons in interest will promptly comply with and take notice of the following requests and information, and thus assist us in realizing the best- results for all con cerned-viz: 1. Bring all pass-books to No. 13 North Ninth street at once and leave them to be written up, and we will return them after The American Audit Company has completed its examination and statement of the affairs of the bank. 2. We cannot pay anything to the depositors at this time, but dividends will be declared under orders of the court as soon as the amount in our hands justifies a distribution. It is impossible for us to say when this will be, but we shall use every effort to realize on the assets as soon as the nature, of the case will permit. We cannot express any opinion as to*what will ultimately be paid to the depositors. 3. Arrangements are being perfected to deliver all collection notes and other property, upon which the bank has no claim, as soon as the audit company finishes its work. 4. The court has authorized the setoff of deposits against discounted notes due by depositors, where the demands are mutual, but this cannot be done until the audit is completed. 5. AU persons indebted to the bank or its branches are requested to make prompt payment to us at the main office of the bank at No. 12 North Ninth street. 6. All depositors are urgently requested to file with the receivers their present correct address and to notify them of subsequent changes. JAMES W. GORDON, JNO. B. LIGHTFOOT, JR, Receivers. September 5th.

11.

October 26, 1913

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

BANK DEPOSITS ARE BIGGER THAN EVER Thirteen Banks Report Increase of $2,100,800.56 Since Last Statement. HAVE ENORMOUS RESERVES Sworn Statements Disprove Reports of Withdrawals and Hoarding of Currency. Deposits in Richmond banks since the last government call for a statement on August 3 have increased more than $2,000,000. Five banks have not yet published their statements in accordance with the call Issued on Friday, but the thirteen banking houses, including all of the national banks In the city, which have up to this time published their statements, show that on August 9 their total of individual deposits subject to check was $28,007,067.71. On October 21, these same thirteen banks reported a total of $30,107,868.27 in Individual deposits subject to checks, an increase of $2.100,800.56. Bumper crops with high prices, especially in the tobacco section, and the high standing of the larger Richmond banks with out-oftown depositors are given as the chief reasons for the increase. No Evidence of Withdrawals. An analysis of the sworn figures in the statements already published will afford a complete answer to those who feared that suspension of payment on the part of the Commonwealth Bank on August 29 would result in withdrawals from other banks and the hoarding of money. The figures show that on the contrary individual depositors have placed in the banks since that date more than $2,000,000. One of the notable features of the statements, which in the main are regarded as very satisfactory, is the enormous amount the Richmond banks have on deposit with approved reserve agents. One bank has, besides the cash in its vaults, $1,690,000 subject to its immediate call on deposit with approved reserve agents. Slight curtailments of the total amounts of loans and discounts are indicated in a number of the statements, as compared with those of August 9. nearly all of the banks taking the precaution of accumulating quick assets which could be converted into cash at any time in the event of sudden demand. Large Sums Available. As a result, most of the banks now have on hand or subject to their Immediate call very large sums over and above their legal reserve, and which are available for commercial loans. The period of comparative inactivity has greatly strengthened the position of the clearing-house banks in the matter of immediately available assets. and those who have critically studied the sworn statements made as of October 21 are of the belief that the time has about come when the banks will

12.

December 23, 1913

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

WHAT DEPOSITORS WILL GET UNKNOWN RECEIVERS REPORT Impossible to State at This Time How Much of Assets of Commonwealth Bank Will be Realized. Voluminous Report Filed With Chancery Court by Gordon and Lightfoot, Receivers. Court Enters Order Conffirming the Report. The most voluminous document to be filed in the Chancery court in several terms was that presented yesterday by James W. Gordon and John B. Lightfoot, Jr., receivers for the Commonwealth Bank, incorporated, in the case of the State corporation commission against the bank, whose doors were closed August 29th last. The report of the receivers merely transmits the report of the American Audit company as to the condition of the Commonwealth bank on the day the institution was closed. The American Audit company's report covers nearly 200 closely typewritten pages bound into one volume. At this time. the receivers declare, 't cannot be stated how much of the bank's assets will be realized or how much of its liabilities It will be able to meet. What portion of their money depositors will receive cannot be stated until a later report is made. Report Approved. The court entered an order, filing and confirming the report of the receivers, aproving their action in segregating the old books and papers of the bank and storing them in a basement vault of the bank building: approving their action in disposing of the unexpired lease on 3914 Williamsburg avenue, the Fulton branch of the bank. and in disposing of the railings and standing desks at the Twenty-fifth street branch. The report showed the receivers realized $75 from the sale of the railings and desks, and $75 from a contract with Davis Brothers for taking out the vault in making the Fulton branch suitable for the new tenants. The order of the court also accepted the report of the American Audit company, and the schedules of the books, papers and furniture and fixtures returned as exhibits. with the report, as an Inventory by the receivers of the assets of the bank. Work is Complicated. "An Inspection of this report of the American Audit company." say the receivers in their report to the court, 'will disclose the complicated nature of the administration in which your receivers are engaged. They (Continued on Second Page.)

13.

January 8, 1914

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

before he had acknowledged Jr., and James father W. After B. Lightfoot. before was his himself John Gordon, receivers: others that he of $13.and before for the shortage Common responsible in the assets of he the had been a 461.72 in which Harding. twentywealth John yesterday old. to bookkeeper. five Bank. succeeded H. assigned serve him, in years detectives warrants on J. eluding grand larceny His father, three is still at large. last night, how- that and Harding. promised by the police. himthe young E. ever, upon man demand would surrender self this morning. Harding's self-confessed wide period Though range over a hundred of peculations time, amounts. and involve only several three warrants by Chief He varying sworn out against may him be held on or any one for of Police of them. separate mentary were all Werner. warrants issued against each and him. supplemay be Delay. theft Given Ten Days' of certain book- funds With the tracing the young was the work of after they unaccounted keeper. for to and, the receivers had ten practically ended: in their report and delayed handing order to allow Harding to make days. in to fulfil a promise filed yesterday his good family the shortage, their they investigations of result of the findings Their report Company, the the American showed contained Audit Harding funds. to be whose The responsible accounting for the missing been granted on respite had A. Lamb. ten of receivers informed father who the days' plea had Attorney and the John would that to Harding's mother their joint bond by give and secure obligation incurred that make good The the receivers reported to setheir the Hardings son. refused and that at Attorney the last memo- Lamb, cure the bond, and whom and personal certain property to papers been turned over, randa of real Harding had to belonging to refused young to return them the receivers. Two Automobiles. Partial Owns recovery was bonded may be in had the Fidelity though, sum of as the United he is $5,000 by Company, and his Harding Guaranty States lia- enand offset against cashier's he is titled bility $2,000 to have represented learned by a also that check. the The owner receivers of two automobiles, now in Norfolk. amounts varying Some from Harding to a sum took more to than the books $1,000. checked day $5 times. according him, he stole nearly took a every short rebehind the week, and then During the first months, the in cess in peculation. records show. he day did take money the not few the Toward on thirteenth latter pethe peculations, careless He of riod of month. his and the thirteen however, disregard- day he held no terrors is shown ed it up to bank became entirely. continued for It him. within that a and few the take tors thefts days appointment of the failure of receivers of of the small to deposi- acthe care of who the had hundreds here their meagre his counts. confronted with proof thought of the When Harding said that exceed he more than guilt. would not in checkamount $5,000. up his When own later false had he entries, fallen aided far he found short ing his estimate involved. The small at of that the whole sum became.h hundreds when the thefts of the end day and thousands him. the week closed against $13,461.72 books were Total Shortage report filed by the receivers. According John Gordon. to the B. Harding Lightfoot, is in Jr., directly the and asJames responsible of W. the for Commonwealth a shrinkage report was Bank filed of sets $13,461.72. When the of the Chancery conwith Judge Moncure, called into Court. ference he Commonwealth's immediately and Chief of Attorney Police conMinetree Werner. Folkes and, for was a short suggested Louis with them. It Harding's arsultation that warrants out. for young Major Werner, the facts then in rest be gworn informed of the warrants being fully made oath to Purdie, and In was before the case, Magistrate whole J. A. dectective force dea. short engaged time the in searching for the his faulter. theft.4. according the receivers, to his Harding's before Alian Talown father, confession and 'Thomas H. G. Proctor. P Howard. made were out Jaid checks upon bott simple plan. on He the Commonwer wealth and a in his own which name he had no deposit. brought by Bank. destroyed in them when to the bank in. house covering the was additions the which then clearing. he forcing employed. the charge the on shortage by ledger. He did not general (Continued on Ninth Page.)

14.

January 8, 1914

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

WILL SURRENDER, SAYS HIS FATHER Tells Police John H. Harding Will Not Attempt to Leave City. POLICE MAKE VAIN SEARCH Three Warrants Against Bank Clerk Are Sworn Out by Chief of Police. John H. Harding, about twenty-five years old, former bookkeeper of the Commonwealth Bank, was the object of a vain search yesterday afternoon and last night by detectives, who held three warrants charging him with stealing $2,160 of the bank's funds while his entire shortage is said to exceed $13,000. At 11 o'clock DetecKellam and Detective went to the home tive-Sergeant Bertuccl of John He E. Harding, father of the young man. said his son was not there, but assured the officers that he would surrender this morning. He refused to tell where the young man had hidden himself. Chief Swears Out Warrants. The warrants for Harding's arrest were shown out by Chief of Police Werner, after he had been summoned before Judge William A. Moncure, in the Chancery Court, which is now in charge of the bank's affairs. A conference was held between Judge Moncure, Major Werner, Commonwealth's Attorney Folkes and John B. Lightfoot, Jr., and James W. Gordon, receivers for the bank Major Werner was told that Harding was short more than $13,000. By means of forcing balances in his ledgers, destroying checks and other means, he had COVered his alleged peculations from day to day, until the books were examined by accountants of the American Audit Company. Major Werner was shown a long list of items, ranging from small sums to hundreds of dollars, which Harding is accused of having turned to his own use. The result of the consultation was that Major Werner selected three of the items and swore out warrants in each case. The Three Changes. Though Harding's total peculations aggregate more than $18,000, the three charges which stand against him total only $2,160. One warrant charges that on June 7. 1913, he stole $1,400. A second that on June 10. 1913, he stole $410. The third accuses him of stealing $350 on January 6. 1913. The witnesses named In the warrants, and who will be called upon to testify against Harding. are as follows: Louis Werner, Chief of Police: Thomas P. Howard, resident manager for Virginia. West Virginia and Kentucky of the American Audit Company: Allan Talbott. accountant of the American Audit Company; H. G. Proctor. cashier of the bank, and John B. Lightfoot, Jr., and James W. Gordon, receivers. As soon as the warrants were issued by Magistrate J. A. Purdie, who had been summoned to police headquarters by Major Werner, they were placed in the hands of Kellam. With Bertucci he went to Harding's home, 309 Minor Street, Barton Heights. where Harding occupies a flat with his wife, whom he married last August. From 4 o'clock until long after 7 they waited in vain for him to appear. They had learned that he only left fifteen minutes before they arrived. Outgoing Trains Watched, When they were certain that their watch was useless the detectives roturned to Richmond and hurried to the Byrd Street Station, believing that the former bookkeeper might board the northbound Atlantic Coast Line train at S o'clock. They searched each coach while the train was traveling from Byrd Street to Elba, but found no trace of Harding. Returning to headquarters. Kellam and Bertuccl were instructed to visit the home of Harding's father. In the meantime Captain of Detectives called in most plain had Ninth of Page.) his (Continued On

15.

January 10, 1914

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

Through Attorney, I. R. Lee Files Petition Praying Court That Receivers of Commonwealth Bank Repay Him. Others Who Made Deposits Few Days Before Bank Closed its Doors Contemplate Similar Action. No Criminal Charges Yet. A new turn in the Commonwealth bank case, whose doors were closed August 29th last, and one that promises other interesting developments came to light yesterday afternoon when it became known that on Tuesday, Judge William A. Moncure, of the Chancery court, gave leave to I. R. Lee, of Bermuda Hundred, to file by his attorney, Robert H. Talley. a petition praying the court that the receivers of the defunct 1 tank pay him $1,099.25, balance due him on account of a deposit of $1,350, received by John E. Harding. assistant cashier, at the Fulton branch of the bank on August 18, 1913, when, petitioner alleges, the officers and agents of the bank, knew It was insolvent and unable to meet its obligations. Other Depositors. Others who made deposits, while not knowing of the bank's insolvency -some of them as late as the day before the closing of the bank became known-are seriously inclined to file petitions like that of I. R. Lee, in an effort to recover in full deposits made after August 18th. Several of these feel that if such petitions are not filed they will receive only a pro rata of the money they had deposited on or after that date. Mr. Lee in his petition alleges the taking of the deposit constituted a fraud against him, and that by operation of the law it made the bank. then, and the receivers, now, trustees of the money deposited after the bank was known, according to the allegation, by its officers and agents, to be utterly unable to meet its obligations. While the petition is entirely a chancery matter. being a petition of a creditor. such as might be filed in any similar chancery cause, there may develop criminal proceedings against the agent of the bank who received the deposit. At the present time there is no criminal proceeding against anyone. It was authoritatively stated last night. Since the public learned yesterday of the action of Mr. Lee, in filing the petition for recovery of lvis deposit of August 18. 1913, a number of the patrons of the defunet bank have begun the consideration of filing similar petitions for the recovery of amounts of deposits made after bank officials and employes knew of the bank's insolvency. These individuals, should others take action similar to that of Mr. Lee, would involve the persons who actually received their money on deposit. Deposited $1,350. The petition of Mr. Lee sets forth that Mr. Lee on August 18, 1913, when officers and agents of the bank knew the institution was insolvent, made a deposit of $1,350, which was accepted at the Fulton branch of the bank. The petition further sets forth that Mr. Lee drew a check for $50.75 on August 28th. the day before the bank was closed. and placed in the hands of receivers. and that on August 24th a note of $200 wes charved goinst him

16.

January 20, 1914

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

# COMMONWEALTH BANK

# IS AMONG CREDITORS

Among the creditors of the Foster Motor Car company, which has entered bankruptcy proceedings by the filing of a petition in the Federal District court, is the Commonwealth bank, Inc., whose doors were closed August 29th, last. The Motor company owes the bank $13,450, of which probably $5,000 is so secured as to insure its collection, it was said by James W. Gordon, one of the bank's receivers, yesterday.

The receivers of the Foster Motor Car company are E. K. Walker and J. R. Tucker. The liabilities of the company are placed at $42,337.68, and assets at $29,206.67.

17.

July 11, 1914

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

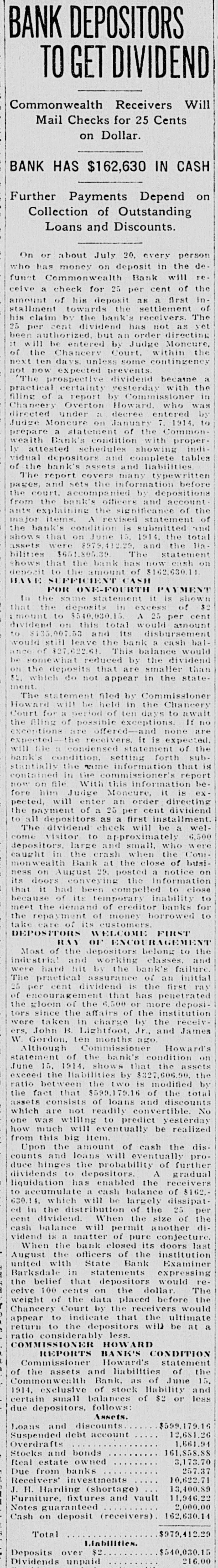

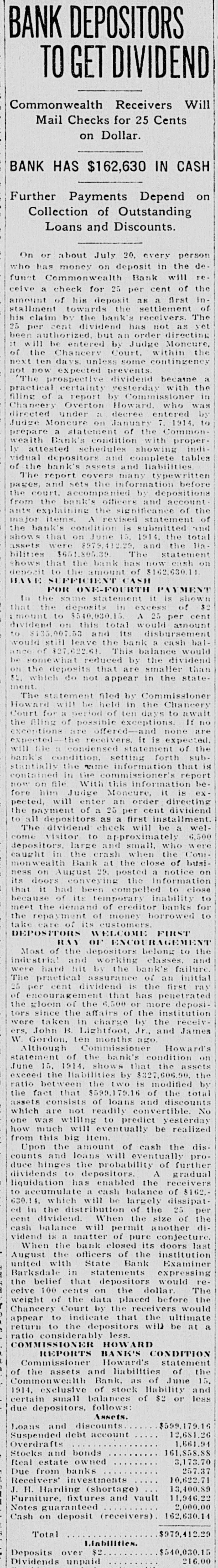

Commonwealth Receivers Will Mail Checks for 25 Cents on Dollar. BANK HAS $162,630 IN CASH Further Payments Depend on Collection of Outstanding Loans and Discounts. On or about July 20, every person who has money on deposit in the de funct Commonwealth Bank will re celve a check for 25 per cent of the amount of his deposit an a first in stallment towards the settlement of his claim by the bank's receivers. The 25 per cent dividend has not as yet been authorized but an order directing :1 will be entered by Judge Moneure, of the Chancery Court. within the next ten days. unless some contingency not now expected prevents The prospective dividend because a practical certainty yesterday with the filing of a report by Commissioner in Chancery Overton Howard who was directed under it decree entered by Judge Moncure on January 7. 1914. to prepare a statement of the Common wealth Bank's condition with proper IV attested schedules showing indi vidual depositors and complete tables of the bank's assets and liabilities The report covers many typewritten pages. and sets the information before the court. accompanied by depositions from the bank's officers and account ants explaining the significance of the major items. A revised statement of the bank's condition is submitted and shows that on June 15. 1914. the total assets were $979,412.25 and the lia bilities $651,805.39 The statement shows that the bank has now cash on depozit to the amount of $162,630.11 HAVE SEFFICIENT FOR ONE-FOURTH PAYMENT In the same statement it is shown that the deposits in excess of 32 :mount to $540,030.15 A 25 per cent dividend on this total would amount to $135,007.53 and its disbursement would still leave the bank a cash bal. once of 327,622.61 This balance would be somewhat reduced by the dividend on the deposits that are smaller than 52. which do not appear in the statement. The statement filed by Commissioner Howard will be held in the Chancery Court for a period of ten days to await the filing of possible exceptions. If no exceptions are offered-and none are expected- the receivers. it is expected. will file : condensed statement of the bank's condition setting forth substantially the name information that is contained in lite ccommissioner's report now on file With this information before him Judge Moneure, it is expected, will enter an order directing the payment of a 25 per cent dividend to all depositors as a first installment. The dividend check will be a welcome visitor to approximately 6,500 depositors large and small, who were caught in the crash when the Commonwealth Bank at the close of business on August 29. posted a notice on its doors conveying the information that it had been compelled to close because of its temporary inability to meet the demand of creditor banks for the repayment of money borrowed to take care of its customers. FIRST DEPOSITORS WELCOME RAY of ENCOURAGEMENT Most of the depositors belong to the industrial and working classes. and were hard hit by the bank's failure The practical assurance of an initial 25 per cent dividend is the first ray of encouragement that has penetrated the gloom of the 6,500 or more depositors since the affairs of the institution were taken in charge by the receivers. John B. Lightfoot. Jr. and James W. Gordon, ten months ago Although Commissioner Howard's statement of the bank's condition on June 15. 1914. shows that the assets exceed the liabilities by $327,606.90. the ratio between the two is modified by the fact that $599,179.16 of the total assets consists of loans and discounts which are not readily convertible. No one was willing to predict yesterday how much will eventually be realized from this big item. Upon the amount of cash the discounts and loans will eventually produce hinges the probability of further dividends to depositors. A gradual liquidation has enabled the receivers accumulate a cash balance of $162. 630.14. which will be largely dissipated in the distribution of the 25 per cent dividend. When the size of the cash balance will permit another dividend is a matter of pure conjecture. When the bank closed its doors last August the officers of the institution united with State Bank Examiner Barksdale in statements expressing the belief that depositors would reThe celve 100 cents on the dollar weight of the data placed before the Chancery Court by the receivers would appear to indicate that the ultimate return to the depositors will be at a ratio considerably less. COMMISSIONER HOWARD REPORTS BANK'S CONDITION Commissioner Howard's statement of the assets and liabilities of the Commonwealth Bank. as of June 15, 1914. exclusive of stock liability and certain small balances of $2 or less due depositors, follows: Assets. $599,179.16 Loans and discounts 12,681.26 Suspended debt account 1,661.91 Overdrafts 161,858.88 Stocks and bonds 3,173.70 Real estate owned 257.37 Due from banks 10,622.71 Receivers' investments 13,400.89 J. H. Harding (shortage) 11,946.22 Furniture, fixtures and vault 2.000,00 Notes guaranteed Cash on deposit (receivers) 162,630.14 Total $979,412.29 Liabilities. $540,030.15 Deposits over $2 216.00 Dividends unpaid

18.

November 24, 1914

Richmond Times-Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

U. S. CIRCUIT COURT OF APPEALS. The United States Circuit Court of Appeals reconvened yesterday morning at 10 o'clock, with Circuit Judges Pritchard and Woods and District Judge McDowell In attendance. Court announced and handed down its opinion in the following case: No. 1271. Walter H. Taylor and George W. Roper, trustees and Virginia Bank and Trust Company. appellants and cross-appellants vs. Mary Bunn, appellee and cross-appellant; crossappeal from the District. Court of Norfolk. Per curiam opinion. Affirmed. Case argued: No. 1304, C. L. Young. petitioner vs. James W. Gordon and John B. Lightfoot, Jr., receivers of Commonwealth Bank, Inc., respondents; petition to superintend and revise, etc., District Court at Richmond. Va. In bankruptcy. Argued by S. S. P. Patteson, Richmond, Va., for the petitioner, and by John B. Lightfoot, Jr., Richmond. Va., for the respondents, and submitted. Case in call: No. 1298, Bankers' Surety Company of Cleveland, O., and Maryland Casualty Company of Baltimore, Md., appellants vs. E. D. Maxwell, intervenor, appellee: appeal from the District Court at Lynchburg. Va. To be argued by D. Lawrence Groner, Norfolk, Va., for the appellants. and by Harper & Goodman, Lynchburg, Va., for the appellee.

19.

February 9, 1915

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

HOUSE. The House of Delegates engaged in a good day's work yesterday with the result that one bill was defeated, one dismissed from the calendar, one passed and eleven ordered to their engrossment. After a long debate in which Montague. White, Oliver, Leedy, Weaver, Williams and Milstead took conspicuous part the House defeated the express companies' tax measure framed by the joint committee on tax revision and offered in the House by the House members of the committee. The measure provided for a change in the method of taxing express companies, placing a tax of one and onequarter cents on the $100 of assessed value of gross earnings, instead of on the mileage at the rate of six dollars a mile, LS under the existing law. Mr. White opposed the bill on the ground that it would cause confusion at this time when the new system of taxation to be adopted is about to become operative. Weaver, Montague and Oliver stated that the change in the system of taxation would not affect the State's revenue in any way, but the House was evidently afraid to try the new system and a majority of all members being necessary for its passage it was defeated. 49 ayes and 38 noes. Oliver Protests. Mr. Oliver, of Fairfax objected to what he thought had been imputations that the subcommittee of the Finance Committee had acted on the bill through ignorance or for some improper motives. declaring that the "imputations are absolutely unfounded." The bill was first defeated by a good majority. then reconsidered and finally defeated, though securing a majority of those voting. because of the lack of a constitutional majority. The Stearnes bill seeking to place the department of agriculture in its expenditures under control of the General Assembly and to provide for an audit of its accounts by the State Auditor rather than by an auditing committee of the department, as un. der the existing law was amended, on motion of Mr. Adams, to make it effective at once instead of in 1918. The bill was then ordered to.its engrossment. Other bills ordered to their engrossment yesterday were a number of local bills and one by Mr. Gregory. of New Kent. allowing district school beards to borrow twice from the literary fund. if approved by those in whose charge the fund is placed. The Morning Session. Debate in the House of Delegates yesterday morning was enlivened by a sharp passage of words between Hill Montague. of Richmond, and Hugh White, of Rockbridge, over the Montague bill exempting from taxation assets of an insolvent bank while it is in the hands of receivers. The bill was finally engrossed as amended by Mr. White. with the approval of the patrons of the measure. The White amendment provided that depositors of insolvent banks must declare their deposits for taxation according to law. The tilt between Mr. Montague and Mr. White was occasioned by the latter's reference to the fact that an insolvent Richmond bank is interested in the passage of the bill. The Richmond delegate seemed to take this reference as an unpleasant insinuation against himself and in his reply took occasion to declare that he is not in any way interested in the Commonwealth Bank. He also referred to previous remarks by Mr. White, which he also had taken as a reflection upon himself. Mr. Montague spoke with some degree of heat, but the gentleman from Rockbridge did not reply to him. Amendment Acceptable. The amendment offered by Mr. White proved acceptable to those Interested in the bill and was saccepted by Mr. Montague willingly. Almost the entire morning session of the House of Delegates was consumed the ent

20.

April 11, 1915

Richmond Times-Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

# HUSTINGS COURT, PART II.

Monday—James W. Gordon and John B. Lightfoot, receivers of the Commonwealth Bank, vs. R. L. Barnes, Lightfoot & Tucker, p. q.: Montague, p. d.

Tuesday—H. C. Ruppert vs. George W. Johnson et al., Pollard, p. q.: Cutchins & Cutchins, p. d.

Wednesday—John W. Smith vs. Theodore W. Jones, Lightfoot & Tucker, p. q.; C. R. Sands and Giles Jackson, p. d.

Thursday—E. A. Stumpf vs. The Fox River Butter Company, Wendenburg & Haddon, p. q.; J. Kent Rawley, p. d.

Friday—W. H. Nelson vs. A. A. Bowman and J. T. Morris, Mathews, p. q.; English, p. d.

Saturday—James H. Chambers vs. Wells Amusement Company, Patterson, p. q.; Collins, p. d.

21.

April 23, 1915

The Richmond Virginian

Richmond, VA

Click image to open full size in new tab

Article Text

BEST BID TOO LOW: PROPERTY WITHDRAWN Because the highest bid reached after the opening of the auction sale yesterday was regarded as too low, the property at Tenth and Main Streets was withdrawn and there was no sale. The bidding opened at $50,000, but the high point was only $56,000. The property was offered for sale at auction by the receivers of the Commonwealth Bank, which institution acquired it some years ago at a cost of $84,000. The offer was made through Sutton & Co., with H. Selden Taylor as auctioneer.

22.

July 30, 1916

Richmond Times-Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

TENTH AND MAIN CORNER IS SOLD TO WOODWARD Pays $70,000 for Twenty Feet to Old Dominion Building Corporation. AMOUNT LESS THAN MORTGAGES Property Was Once Acquired as Home for Now Defunct Commonwealth Bank-Will Be Renovated Under Temporary Lease. Deeds will be placed on record this week in the Chancery Court recording the sale of the valuable property at the southwest corner of Main and Tenth Streets to Stewart M. Woodward for $70,000. The lot fronts twenty feet on Main Street and runs back seventy feet on Tenth. It is one of the few remaining corners in the downtown banking district not improved with a modern office building. The old building now on this site. it is understood, will be renovated and rented for business purposes under a temporary lease pending the permanent improvement of the property with a modern structure. In recent years the property has undergone many vicissitudes, It was acquired several years ago by the Old Dominion Building Corporation, an organization in which most of the stock was held by the defunct Commonwealth Bank and individuals connected with that institution. Tt was understood that It was the ultimate intention to erect a modern banking house on the property, In which the Commonwealth Bank, then located on Ninth Street, was to be established. PRICE PAID IS LESS THAN MORTGAGES Soon afterwards there followed the business depression and other complications which brought about the failure of the Commonwealth Bank. The plans for the improvement of the Main and Tenth Street corner were never realized, and for several years the property has been on the market. The price paid by Mr. Woodward is understood to be considerably less than the amount of the three mortgages with which the property is burdened. It will be applied to the satisfaction of these liens. The sale of the property will not benefit those who hold unsatisfied claims against the defunet Commonwealth Bank, because there will be no balance from the proceeds to apply to any of the notes held by the receivers of the bank as evidence of loans made on this property. The sale was made through the real estate firm of C. L. & H. L. Denoon.