Article Text

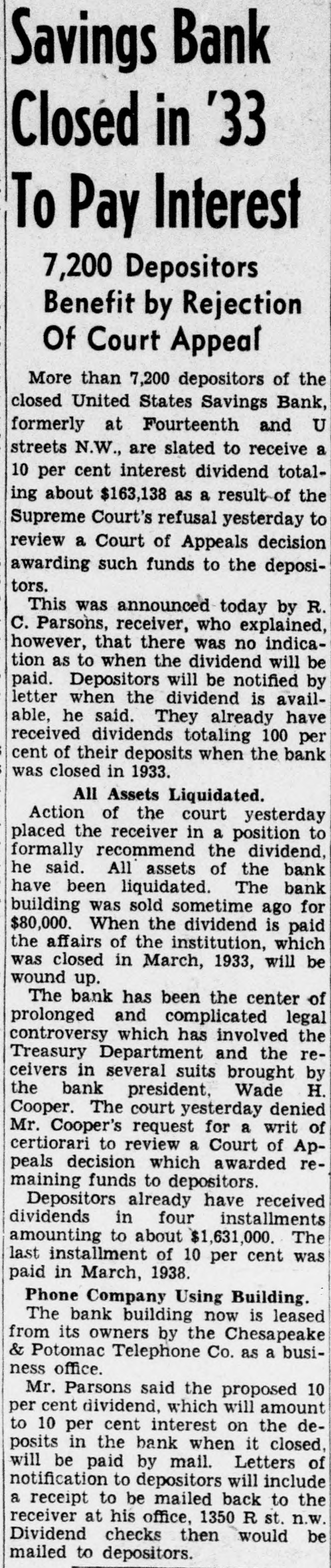

Savings Bank Closed in '33 To Pay Interest 7,200 Depositors Benefit by Rejection Of Court Appeal More than 7,200 depositors of the closed United States Savings Bank, formerly at Fourteenth and U streets N.W., are slated to receive a 10 per cent interest dividend totaling about $163,138 as a result of the Supreme Court's refusal yesterday to review a Court of Appeals decision awarding such funds to the depositors. This was announced today by R. C. Parsons, receiver, who explained, however, that there was no indication as to when the dividend will be paid. Depositors will be notified by letter when the dividend is available, he said. They already have received dividends totaling 100 per cent of their deposits when the bank was closed in 1933. All Assets Liquidated. Action of the court yesterday placed the receiver in a position to formally recommend the dividend, he said. All assets of the bank have been liquidated. The bank building was sold sometime ago for $80,000. When the dividend is paid the affairs of the institution, which was closed in March, 1933, will be wound up. The bank has been the center of prolonged and complicated legal controversy which has involved the Treasury Department and the receivers in several suits brought by the bank president, Wade H. Cooper. The court yesterday denied Mr. Cooper's request for a writ of certiorari to review a Court of Appeals decision which awarded remaining funds to depositors. Depositors already have received dividends in four installments amounting to about $1,631,000. The last installment of 10 per cent was paid in March, 1938. Phone Company Using Building. The bank building now is leased from its owners by the Chesapeake & Potomac Telephone Co. as a business office. Mr. Parsons said the proposed 10 per cent dividend, which will amount to 10 per cent interest on the deposits in the bank when it closed, will be paid by mail. Letters of notification to depositors will include a receipt to be mailed back to the receiver at his office, 1350 R st. n.w. Dividend checks then would be mailed to depositors.