Click image to open full size in new tab

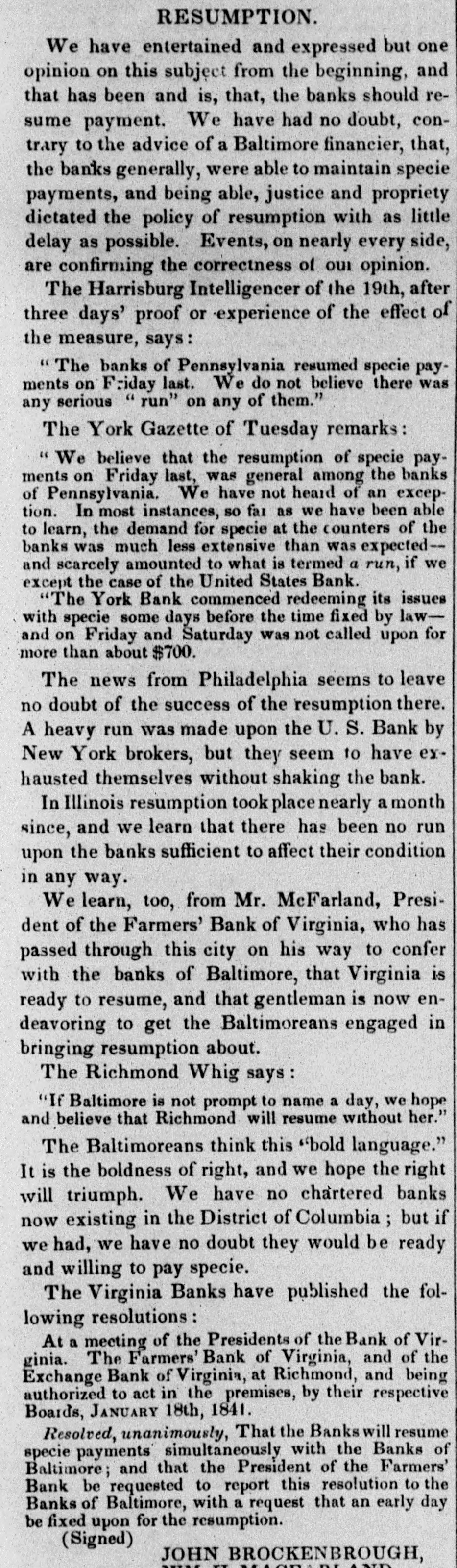

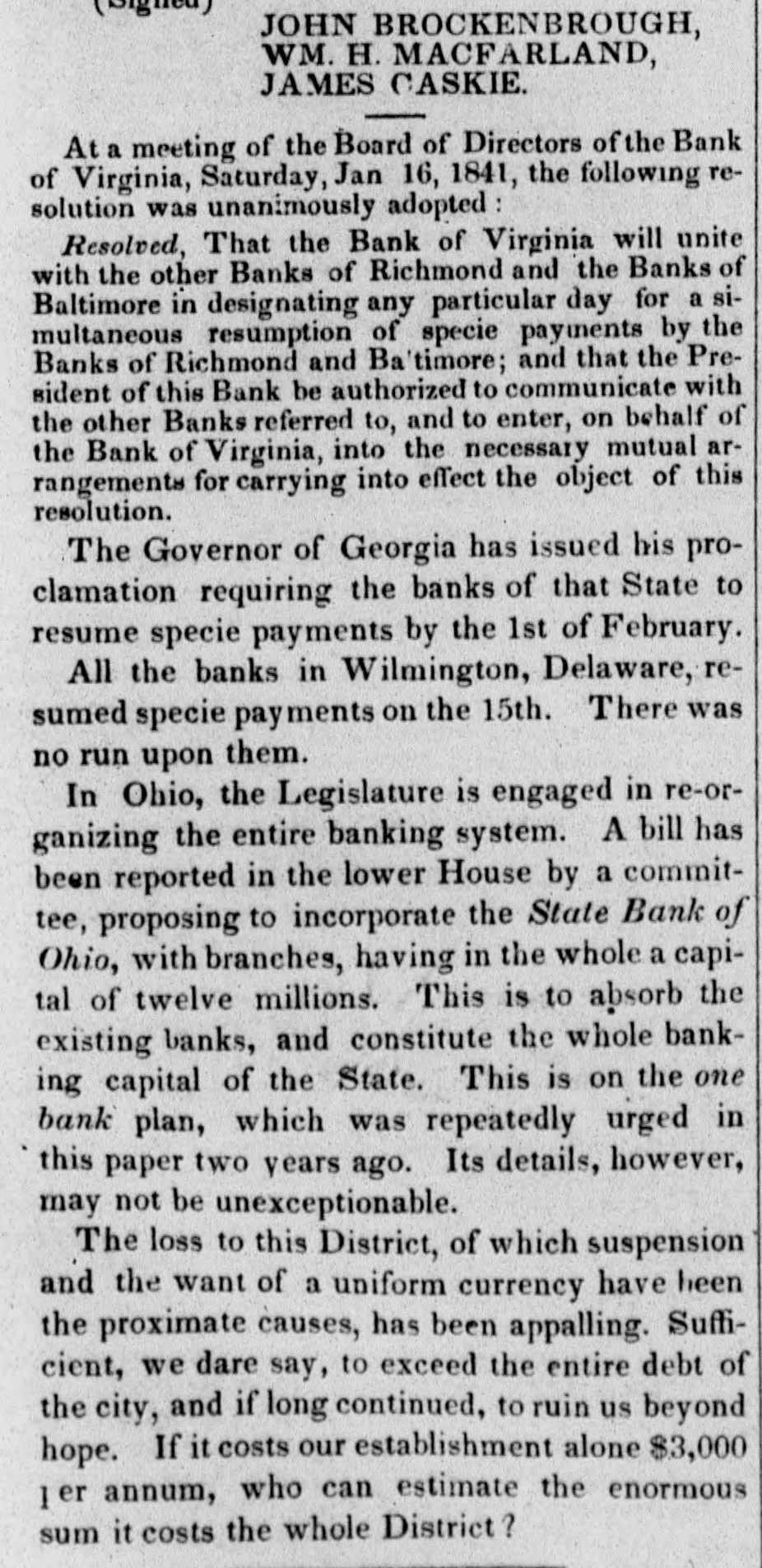

Article Text

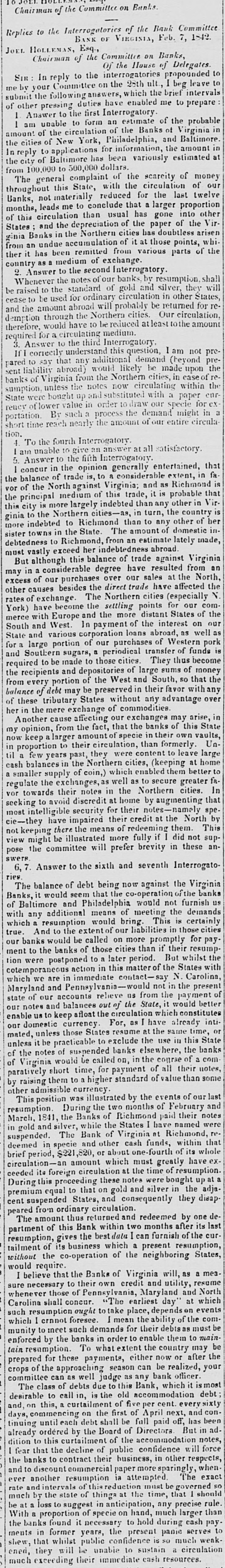

TO JOEL HOLLEMAN, ESQ.,

Chairman of the Committee on Banks.

Replies to the Interrogatories of the Bank Committee

BANK OF VIRGINIA, Feb. 7, 1842.

JOEL HOLLEMAN, Esq.,

Chairman of the Committee on Banks,

Of the House of Delegates.

SIR: In reply to the interrogatories propounded to me by your Committee on the 28th ult., I beg leave to submit the following answers, which the brief intervals of other pressing duties have enabled me to prepare:

1. Answer to the first Interrogatory.

I am unable to form an estimate of the probable amount of the circulation of the Banks of Virginia in the cities of New York, Philadelphia, and Baltimore. In reply to applications for information, the amount in the city of Baltimore has been variously estimated at from 100,000 to 500,000 dollars.

The general complaint of the scarcity of money throughout this State, with the circulation of our Banks, not materially reduced for the last twelve months, leads me to conclude that a larger proportion of this circulation than usual has gone into other States; and the depreciation of the paper of the Virginia Banks in the Northern cities has doubtless arisen from an undue accumulation of it at those points, whither it has been remitted from various parts of the country as a medium of exchange.

2. Answer to the second Interrogatory.

Whenever the notes of our banks, by resumption, shall be raised to the standard of gold and silver, they will cease to be used for ordinary circulation in other States, and the amount abroad will probably be returned for redemption through the Northern cities. Our circulation, therefore, would have to be reduced at least to the amount required for a circulating medium.

3. Answer to the third Interrogatory.

If I correctly understand this question, I am not prepared to say that any additional demand (beyond present liability abroad) would likely be made upon the banks of Virginia from the Northern cities, in case of resumption, unless the notes now circulating within the State were bought up and substituted with a paper currency of lower value in order to draw our specie for exportation. By such a process the demand might in a short time reach nearly the amount of our entire circulation.

4. To the fourth Interrogatory.

I am unable to give an answer at all satisfactory.

5. Answer to the fifth Interrogatory.

I concur in the opinion generally entertained, that the balance of trade is, to a considerable extent, in favor of the North against Virginia; and as Richmond is the principal medium of this trade, it is probable that this city is more largely indebted than any other in Virginia to the Northern cities-as, in turn, the country is more indebted to Richmond than to any other of her sister towns in the State. The amount of domestic indebtedness to Richmond, from an estimate lately made, must vastly exceed her indebtedness abroad.

But although this balance of trade against Virginia may in a considerable degree have resulted from an excess of our purchases over our sales at the North, other causes besides the direct trade have affected the rates of exchange. The Northern cities (especially N. York) have become the settling points for our commerce with Europe and the more distant States of the South and West. In payment of the interest on our State and various corporation loans abroad, as well as for a large portion of our purchases of Western pork and Southern sugars, a periodical transfer of funds is required to be made to those cities. They thus become the recipients and depositories of large sums of money from every portion of the West and South, so that the balance of debt may be preserved in their favor with any of these tributary States without any advantage over her in the mere exchange of commodities.

Another cause affecting our exchanges may arise, in my opinion, from the fact, that the banks of this State now keep a larger amount of specie in their own vaults, in proportion to their circulation, than formerly. Until a few years past, they were content to leave large cash balances in the Northern cities, (keeping at home a smaller supply of coin,) which enabled them better to regulate the exchanges, as well as to secure greater favor towards their notes in the Northern cities. In seeking to avoid discredit at home by augmenting that most intelligible security for their notes-namely specie-they have impaired their credit at the North by not keeping there the means of redeeming them. This view might be illustrated more fully if I did not suppose the committee will prefer brevity in these answers.

6, 7. Answer to the sixth and seventh Interrogatories.

The balance of debt being now against the Virginia Banks, it would seem that the co-operation of the banks of Baltimore and Philadelphia would not furnish us with any additional means of meeting the demands which a resumption would bring. This is certainly true. And to the extent of our liabilities in those cities our banks would be called on more promptly for payment to the banks of those cities than if their resumption were postponed to a later period. But whilst the cotemporaneous action in this matter of the States with which we are in immediate contact-say N. Carolina, Maryland and Pennsylvania-would not in the present state of our accounts relieve us from the payment of our notes and balances out of the State, it would better enable us to keep afloat the circulation which constitutes our domestic currency. For, as I have already intimated, unless those States resume at the same time, or unless it be practicable to exclude the use in this State of the notes of suspended banks elsewhere, the banks of Virginia would be called on, in the course of a comparatively short time, for payment of all their notes, by raising them to a higher standard of value than some other admissible currency.

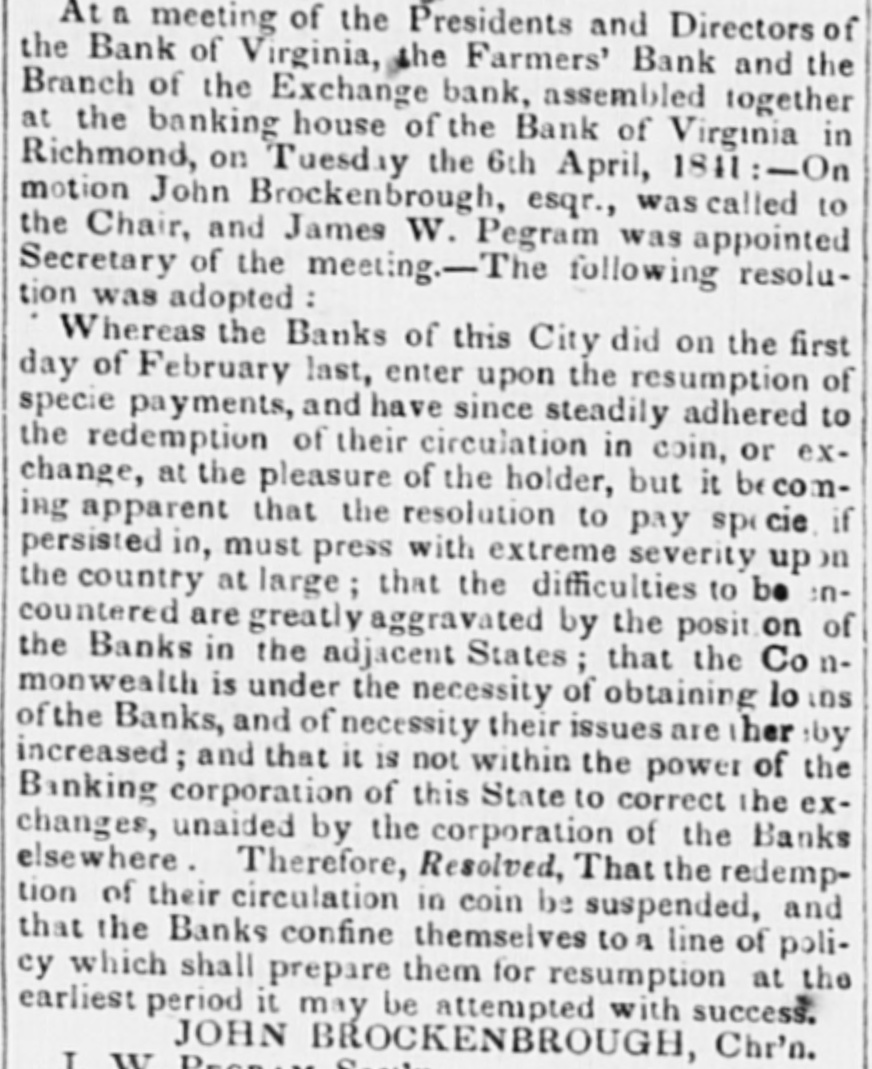

This position was illustrated by the events of our last resumption. During the two months of February and March, 1841, the Banks of Richmond paid their notes in gold and silver, while the States I have named were suspended. The Bank of Virginia at Richmond, redeemed in specie and other cash funds, within that brief period, $221,820, or about one-fourth of its whole circulation-an amount which must greatly have exceeded its foreign circulation at the time of resumption. During this proceeding these notes were bought up at a premium equal to that on gold and silver in the adjacent suspended States, and consequently they disappeared from ordinary circulation.

The amount thus returned and redeemed by one department of this Bank within two months after its last resumption, gives the best data I can furnish of the curtailment of its business which a present resumption, without the co-operation of the neighboring States, would require.

I believe that the Banks of Virginia will, as a measure necessary to their own credit and utility, resume whenever those of Pennsylvania, Maryland and North Carolina shall concur. "The earliest day" at which such resumption ought to take place, depends on events which I cannot foresee. I mean the ability of the community to meet such demands for their debts as must be enforced by the banks in order to enable them to maintain resumption. To what extent the country may be prepared for these payments, either now or after the crops of the approaching season can be realized, your committee can as well judge as any bank officer.

The class of debts due to this Bank, which it is most desirable to call in, is the old accommodation debt; and, on this, a curtailment of five per cent. every sixty days, commencing on the first of April next, and continuing until each debt shall be full paid off, has been already ordered by the Board of Directors. But in addition to this curtailment of the accommodation notes, I fear that the decline of public confidence will force the banks to contract their business, in other respects, and to discount commercial paper more sparingly, whenever another resumption is attempted. The exact rate and intervals of this reduction must be governed so much by the state of things at the time, that I should be at a loss to suggest in anticipation, any precise rule. With a proportion of specie on hand, much larger than the banks found it necessary to hold during cash payments in former years, the present panic serves to shew, that whilst public confidence is so much weakened, they will be unable to sustain a circulation much exceeding their immediate cash resources.