Click image to open full size in new tab

Article Text

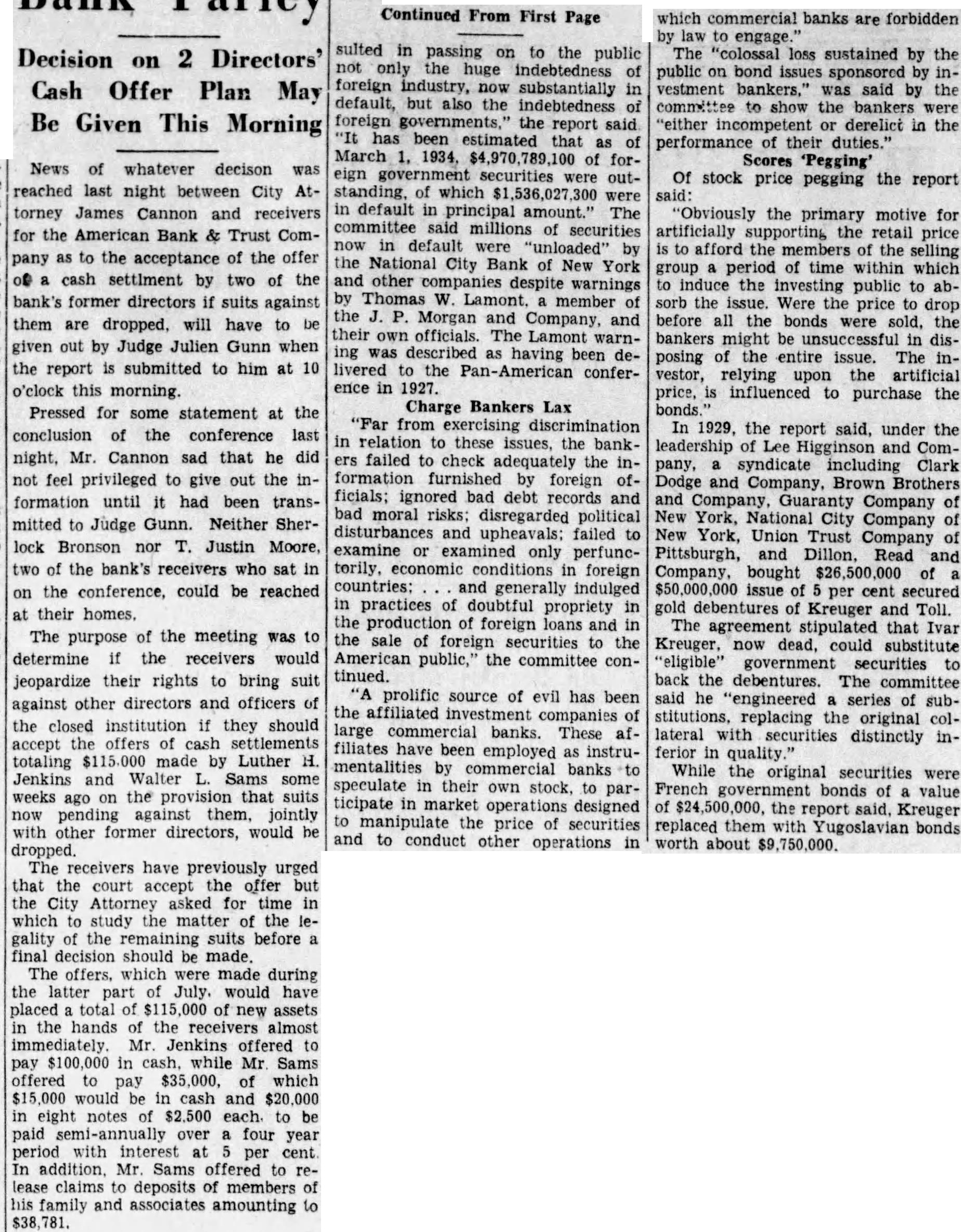

Decision on 2 Directors' Cash Offer Plan May Be Given This Morning

News of whatever decison was reached last night between City Attorney James Cannon and receivers for the American Bank Trust Company the of the offer cash settlment by two of the bank's former directors suits against them are dropped, have to given out by Judge Julien Gunn the report submitted to him 10 o'clock this morning. Pressed for statement at of the conference last night, Mr. Cannon sad that he did not privileged to give out the formation had been transmitted Judge Gunn. Neither Sherlock Bronson nor Justin Moore, two the bank's who sat in on the conference, could be reached at their The purpose the meeting was determine receivers jeopardize their rights bring suit against other directors and officers the closed institution they should accept settlements totaling by Luther Jenkins and Walter Sams some weeks the provision that suits pending against them. jointly former directors, would The have previously that court the City asked for time which to study the matter the gality remaining suits before final decision should made. The offers, which were made during the latter July. would have placed total new assets the hands of the receivers almost pay while offered pay which be and eight notes $2,500 each. paid over four year period interest cent In Mr. Sams offered to claims deposits members and associates amounting

Continued From First Page sulted in passing on to the public not the huge indebtedness foreign industry, now substantially default, but the indebtedness foreign the report said that March 1934, forsecurities outstanding. which default principal committee millions securities now in default were "unloaded" the National Bank of New York and despite warnings Thomas member the and their officials. The the conference in Charge Bankers Lax "Far in relation these issues, the bankfailed check adequately the by foreign ficials; records and bad moral disregarded political upheavals: failed examine only perfuneforeign countries: and generally indulged practices propriety production foreign and the foreign the American public," the committee continued. prolific source of evil has been the large banks. These mentalities commercial banks speculate own stock ticipate designed manipulate price securities and to conduct other operations which commercial banks are forbidden engage." "colossal loss sustained by the public on bond issues sponsored by vestment bankers." was said by the committee the bankers were "either incompetent derelict in the performance 'Pegging' Of stock price pegging the report

"Obviously the primary motive for artificially supporting the retail price afford the members selling group period time within which induce the investing public to absorb the Were price to before all bonds sold, the posing the entire issue. The investor, relying artificial influenced purchase the 1929. the report said, under the leadership Higginson Comsyndicate including Clark Dodge and Company, Brown Brothers Company, Company York, National Company New York, Trust Company Pittsburgh, and Company, $26,500,000 debentures Kreuger Toll. The stipulated that Ivar Kreuger. now dead, could substitute "eligible" securities back the debentures. The said he 'engineered series subreplacing the original collateral securities distinctly inWhile the securities were of value of $24,500,000, the said. Kreuger replaced them with Yugoslavian bonds worth about