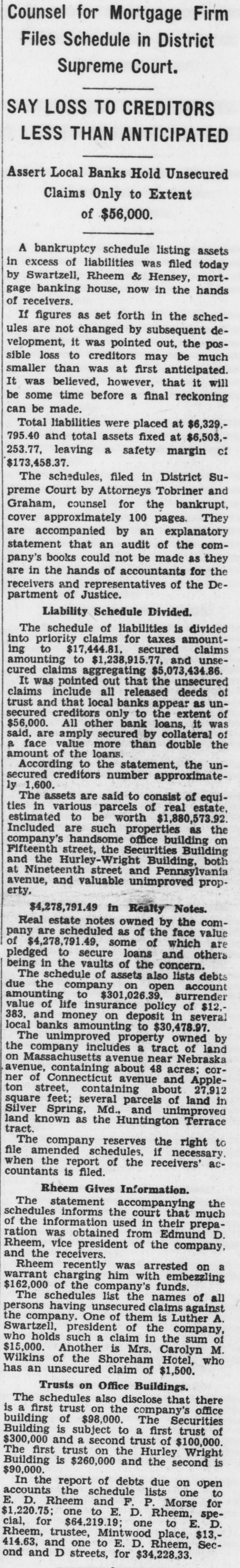

Article Text

AUDIT OF BANKRUPT FIRM UNDERTAKEN Department of Justice Men Scan Books of Swartzell, Rheem & Hensey. The Department of Justice today began its audit of the books of Swartzell, Rheem & Hensey, mortgage banking house, for which receivers were appointed yesterday. The investigation is being made under instructions from United States Attorney Leo A. Rover, who announced yesterday he had received "reliable information of the possibility of a violation of law growing out of the conduct of the affairs of the company." It was also learned today that special agents of the Bureau of Investigation, Department of Justice, will be assigned to the case as soon as the audit is completed. It is expected this will require several days. The receivers, Julius I. Peyser and Henry P. Blair, went to the company's office on Fifteenth street yesterday and took possession of its books and records The receivers were appointed by Justice William Hitz after the firm had filed a petition in voluntary bankruptcy. In the petition filed with the court by the company, the volume of its business was fixed at $18,000,000. The details of the investigation are in the hands of Neil Burkinshaw, assistant United States attorney, who assisted in the prosecution of F. H. Smith Co. officials recently. Aside from legal developments in the case of the firm of Swartzell, Rheem & Hensey, one of the first effects of its voluntary petition in bankruptcy was the halting of construction work on the new buildings of the Westchester Apartment development and the New Shoreham Hotel. Builders Await Settlement. The bankrupt mortgage banking firm acted in the original financing on both of these projects, and due to the bankruptcy proceedings the builders of these two projects, both decided to stop construction work pending settlement of the resulting legal tangles, or until some satisfactory arrangements had been made. Gustave Ring, president of the Westchester Development Corporation, announced today that work had been halted on the new building of the huge apartment development along Cathedral avenue between Thirty-ninth street and Glover Parkway. Plans for the resumption of work there, he said, now are under way and construction may be renewed shortly, after certain arrangements have been completed. In this case, it is said, Swartzell, Rheem & Hensey handled the original financing, running to $1,350,000. After this project was under way, it is reported, the property was refinanced by means of a loan from a large national insurance company, by which the first loan was paid off. Harry M. Bralove, builder of the New Shoreham Hotel, large residential hotel project on Calvert street, between Connecticut avenue and Twenty-eighth street, announced that work had been stopped on the new unit of this building. This project was financed through Swartzell, Rheem & Hensey.