Click image to open full size in new tab

Article Text

debts, dues, and demands due the state.

Under this act many bonds were put out with

coupons, which expressed on their face that

they were receivable for taxes.

On the seventh of March, 1872, however,

the general assembly passed another act pro-

hibiting the officers charged by law with the

collection of taxes from receiving in payment

thereof anything else than coin, or treasury,

or national bank notes. The supreme court

of appeals of Virginia decided at its Novem-

ber term, 1872, in the case of Antoni against

Wright, that in issuing these bonds the state

entered into a valid contract with all persons

taking the coupons to receive them in pay-

ment of taxes and state dues; that the act of

1872, so far as it conflicted with this contract,

was void; and that the writ of mandamus

was the proper remedy to compel a collector

to accept the coupons in question when offered

in payment of taxes.

On the fourteenth of January, 1882, the

general assembly passed another act, entitled

"An act to prevent frauds upon the common-

wealth and the holders of her securities in

the collection and disbursement of revenues,"

which provided, among other things, that

coupons should not be received for taxes until

their genuineness had been established by an

appropriate judical proceeding, the nature of

which the act duly set forth.

On the twentieth of March Andrew Antoni

tendered to the treasurer of the city of Rich-

mond a coupon for $415 in payment of taxes.

It was refused and Antoni potitioned the su-

preme court of appeals for a mandamus to re-

quire its acceptance. That court being equally

divided in opinion on the questions involved,

denied the writ and the case was brought to

this court for review Chief Justice Waite in

delivering the opinion of the court says the

question we are now to consider is

not whether if the coupon tendered is

in fact genuine, and such as ought un-

der the contract to be received and

the tender is kept good, the treasurer can

proceed to collect the tax by distraint or such

other process as the law allows, without mak-

ing himself personally responsible for any

trespass he may commit, but whether the act

of 1882 violates any implied obligation of the

state in respect to the remedies that may be

employed for the enforcement of its contract

if the collector refuses to take them.

The right of the coupon holder is to have his

coupon received for taxes when offered. The

question here is not as 'to that right, but as to

the remedy the holder has for its enforcement

when denied. At the time the coupon was

issued there was a remedy by mandamus from

the supreme court of appeals to compel the tax

collector to take the coupon and cancel the

tax. By the act of 1882 the following changes

are made in the old remedy: First, the

taxes actually due must be paid in money

before the court can proceed after the

collector has signified in the proper way

his willingness to receive the coupons if they

are genuine and in law receivable; second,

the coupons must be filed in the court of ap-

peals; and third, they must be sent to the local

court to have the fact of their genineness and

receivability determined, subject to an ap-

peal to the circuit court and the supreme

court of appeals. As the suit is for a

mandamus all the provisions of the

general law regulating the practice not

inconsistent with the new law remain, and

if the petitioner succeeds in getting his

peremptory writ he will recover his costs. No

issues are required that it would not have

been in the power of the collector to raise be-

fore the change was made, and there is no ad-

ditional burden of proof imposed to meet the

issues, so that the simple question is whether

the requirements of the advance of the taxes

and the change of the place and manner of

trial impair the obligation of the contract on

the part of the state to furnish an adequate

and efficacious remedy to compel a tax col-

lector to receive the coupons in payment of

taxes in case he will not do it without com-

pulsion. In the opinion of this court they do

not.

Inasmuch as we are satisfied that a remedy

is given by the act of 1882, substantially

equivalent to that in force when the coupons

were issued, we have not deemed it necessary

to consider what would be the effect of a

statute taking away all remedies. The judg-

ment of the Virginia supreme court of appeals

is affirmed. Justices Field and Harlau dis-

sented.

### MR. JUSTICE FIELD DISSENTS.

Justice Field in his dissent says: "I am

not able to agree with the majority of the

court in the judgment in this case, nor in

the reasoning on which it is founded.

The legislation of Virginia which is

sustained appears to me to be in flagrant vio-

lation of the contract with her creditors under

the act of Mar. 30, 1871, commonly known as

the funding act; and the doctrines advanced

by the court, though not so intended, do, in

fact, license any disregard of her obligations

which the ill-advised policy of the legislature

may suggest. I find myself bewildered by

the opinion of the majority of the court. I

confess that I cannot comprehend it, so for-

eign does it appear to be to what I have here-

tofore supposed to be established and settled

law, and I fear that it will be appealed

to as an excuse, if not justification,

for legislation amounting practically to the

repudiation of the obligations of states and

of their subordinate minicipalities-their

cities and counties. It will only be necessary

to insert in their statutes a false recital of the

existence of forged and spurious bonds and

coupons as a plausible protext for such legis-

lation-and their schemes of plunder will be

accomplished. No greater calamity could, in

my judgment, befall the country than the

general adoption of the doctrine that it is not

a constitutional impairment of the obligation

of contracts to embarrass their enforcement

with onerous and destructive conditions and

thus to evade the performance of them. I am

of opinion that the judgment of the court of

appeals of Virginia should be reversed and

the cause remanded with instructions to

award the mandamus.

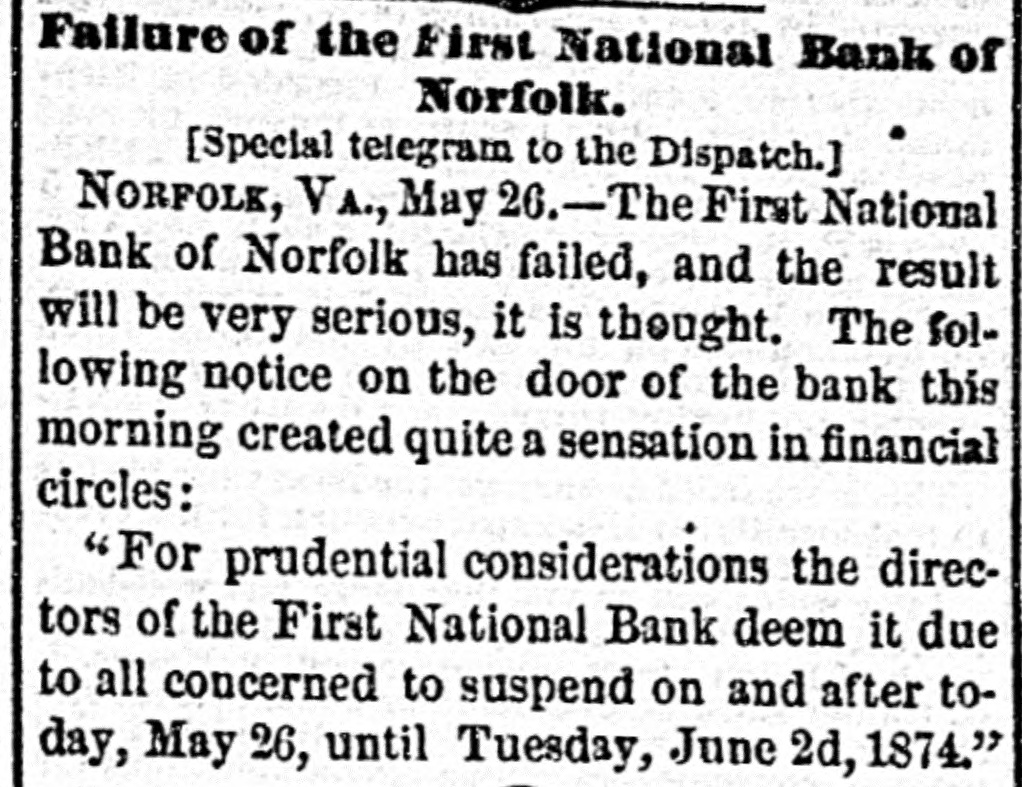

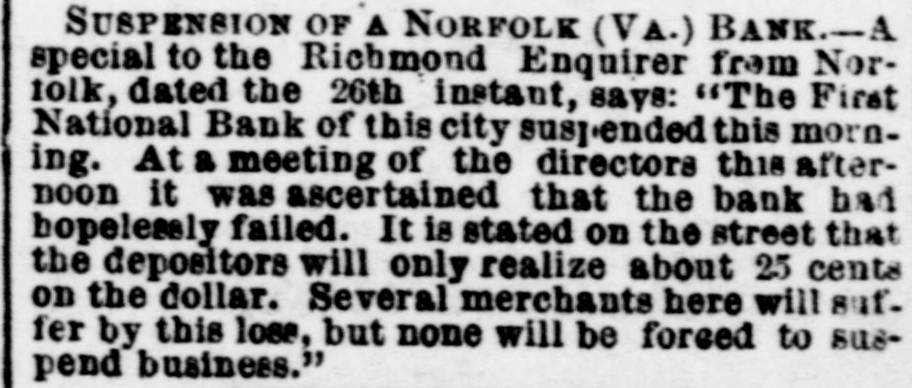

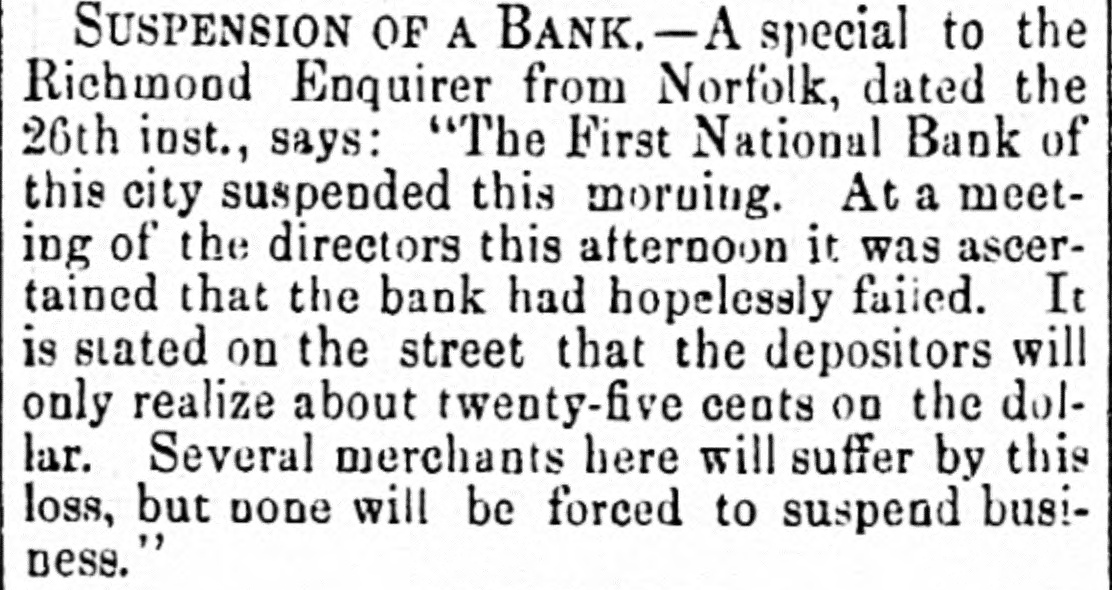

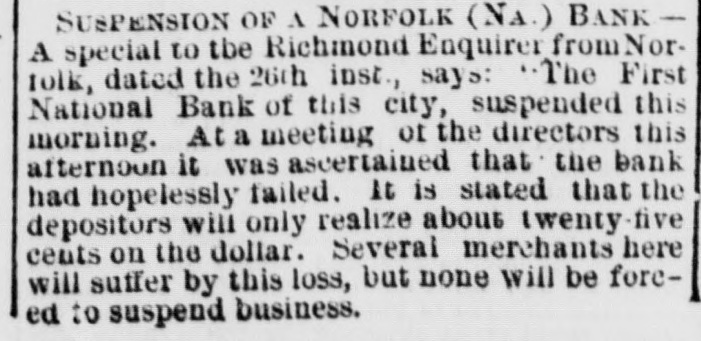

### THE OTHER CASES DECIDED

are as follows: No. 166, Orsor Adams, substi-

tuted for George E. Bowden, as receiver of

the First National bank of Norfolk, Va., ap-

pellant vs. Jacob C. Johnston and Betsy Val-

entine. Appeal from circuit court of the

United States for the district of New Jersey.

Decree reversed with costs and cause re-

manded with directions to enter decree in

conformity with the opinion of this court.

Opinion of Mr. Justice Blatchford. No. 22,

John N. Cushing et al. appellants vs. John

Laird, the younger, et al. Appeal from the cir-

cuit court of the United States for the southern

district of New Yoak. Decree affirmed, with

costs and interest. Opinion by Mr. Justice

Gray.

No. 113. J. P. Giraud Foster and James

Thomson, garnishees, appellants, vs. John N.

Cushing, et al. Appeal from the circuit court

of the United States for the southern district

of New York. Decree affirmed, with costs..

Opinion by Mr. Justice Gray.

No. 51. James D. Russell et al., appellants,

vs. Anne R. Allen et al. Appeal from the

circuit court of the United States for the

eastern district of Missouri. Decree af-

firmed, with costs. Opinion by Mr. Justice

Gray.

No. 82. Wallace S. Jones, executor, &c., et

al., appellants, vs. Wm. N. Habersliam and

Wm. Hunter, executors, &c. Appeal from