Article Text

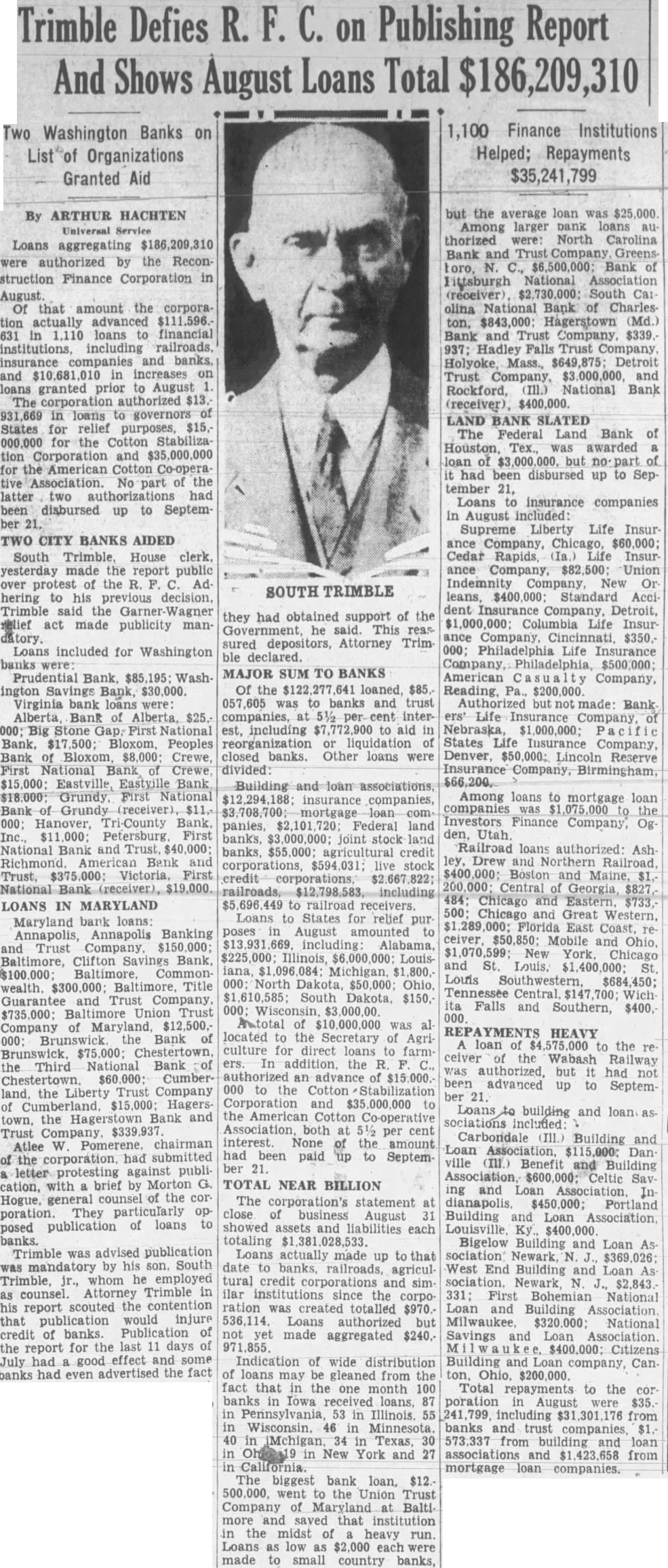

Trimble Defies on Publishing Report And Shows August Loans Total $186,209,310

Two Washington Banks on Organizations Granted Aid

By ARTHUR HACHTEN Universal Service Loans aggregating were authorized by the Reconstruction Finance Corporation in August. Of that amount the corpora tion actually advanced 631 in 1,110 loans to financial institutions, including railroads, insurance companies and banks. and in increases on loans granted prior to August The corporation authorized $13,in loans to governors of States for relief purposes, $15,for the Cotton Stabilization Corporation and for the American Cotton Co-operative No part of the latter two had been disbursed up to Septem ber TWO CITY BANKS AIDED South Trimble, House clerk, yesterday made the report public over protest of the Adhering to his previous decision, Trimble said the act made publicity mandatory. Loans included for Washington banks were: Prudential Bank, Washington Savings Bank, Virginia bank loans were: Alberta, Bank of Alberta, $25. 000; Big Stone Gap; First National Bank, Bloxom, Peoples Bank of Bloxom, $8,000; Crewe, First National Bank of Crewe Eastyille Bank Grundy, First National Bank of Grundy (receiver), 000; Hanover, Tri-County Bank. Inc., First National Bank and Trust. Richmond. American Bank and Victoria, First National LOANS IN MARYLAND Maryland bank loans: Annapolis, Annapolis Banking and Trust Baltimore, Clifton Savings Bank, Commonwealth. Baltimore, Title Guarantee and Trust Company, Baltimore Union Trust Company of Maryland, Brunswick. the Bank of the Third National Bank Chestertown. Cumberland, the Liberty Trust Company of Cumberland. Hagerstown, Hagerstown Bank and Trust Company. $339,937 Atlee W Pomerene. chairman the corporation, had submitted letter protesting against publiwith brief by Morton Hogue, general counsel of the corporation. They particularly oppublication of loans to posed banks. Trimble was advised publication was mandatory by his son. South Trimble, jr., whom he employed as counsel. Attorney Trimble in his report scouted the contention that publication would injure credit of banks. Publication of the report for the last days of July had good effect and some banks had even advertised the fact they had obtained support of the he said. This reassured depositors, Attorney Trimble declared. MAJOR SUM TO BANKS Of the loaned, $85. was to banks and trust companies, at 5½ cent interest, including to aid in reorganization or liquidation of closed banks. Other loans were divided: Building and associations, insurance companies, mortgage loan panies, Federal land banks, joint stock land banks, agricultural credit corporations, live stock credit to railroad receivers. Loans to States for relief pur poses in August amounted to including: Alabama, Illinois, Louisiana, Michigan, 000; North Dakota, Ohio, South Dakota, $150,Antotal of was located the Secretary of Agriculture for direct loans to farmIn addition, the R. authorized an advance of 000 to the Cotton Stabilization Corporation and the American Cotton Co-operative Association. both at 5½ per cent interest. None of the amount had been paid up to September 21. TOTAL NEAR BILLION

The corporation's statement close business August showed assets and liabilities each totaling Loans actually made up to that date to banks, railroads, agricultural credit corporations and similar institutions since the corporation was created totalled $970.536,114. Loans authorized but not yet made aggregated $240,Indication of wide distribution loans may be gleaned from the fact that in the one month 100 banks in Iowa received loans, 87 in Pennsylvania, 53 in Illinois. Wisconsin. in Minnesota. 40 in iMchigan, 34 in Texas, in in New York and 27 The biggest bank loan, $12.went to the Union Trust Company of Maryland Baltimore and saved that institution the midst of heavy run. Loans as low $2,000 each were made to small country banks,

Finance Institutions Helped; Repayments $35,241,799 but the average loan was $25,000 Among larger bank loans authorized were: North Carolina Bank and Company, Greenstoro, $6,500,000; Bank of Fittsburgh National Association olina National Bank of Charleston, $843,000: Hagerstown (Md.) Bank and Trust Company, $339.937; Hadley Falls Trust Company. Holyoke, Mass., $649,875; Detroit Trust Company, and Rockford, (III.) National Bank (receiver), $400,000. LAND BANK SLATED The Federal Land Bank of Houston, Tex., was awarded loan of $3,000,000, but of had been disbursed up to September 21, Loans insurance companies August included: Supreme Liberty Life Insurance Company, Chicago, Cedar Rapids, Life Insurance Company, Union Indemnity Company, New Or leans, Standard Acci dent Insurance Company, Detroit, Columbia Life Insur ance Company, Cincinnati, $350.000; Philadelphia Life Insurance Company, Philadelphia, $500,000; American Company, Pa. not made: Bank Life Insurance Company, Nebraska, States Life Insurance Company, Denver, Lincoln Reserve Insurance Company, Birmingham, Among loans to mortgage loan companies Investors Finance Company, Og den, Utah. Railroad loans authorized: Ash ley, Drew and Northern Railroad, Boston and Maine, $1, Central Georgia, 484: Chicago and Eastern, $733. 500; Chicago and Great Western. Florida East Coast. ceiver. $50,850: Mobile and Ohio. New Chicago and St. Louis, St. Louis Southwestern. Tennessee Central. Wichita Falls and Southern, $400, HEAVY loan of to the ceiver of the Wabash Railway was authorized, but it had not been advanced up to September Loans building and loan sociations included: Carbondale (III.) Building and ville (III.) Benefit and Building Association, Celtic Saving and Loan Association. Indianapolis, Portland Building and Loan Association. Bigelow Building and Loan As sociation Newark, West End Building and Loan As sociation. Newark, N $2,843.331: First Bohemian National Loan and Building Association Milwaukee, National Savings and Loan Association $400,000; Citizens Building and Loan company, Can. $200,000. Total repayments to the cor poration August were $35.including from banks and trust companies, 573,337 from building and loan associations and from mortgage loan companies.