Click image to open full size in new tab

Article Text

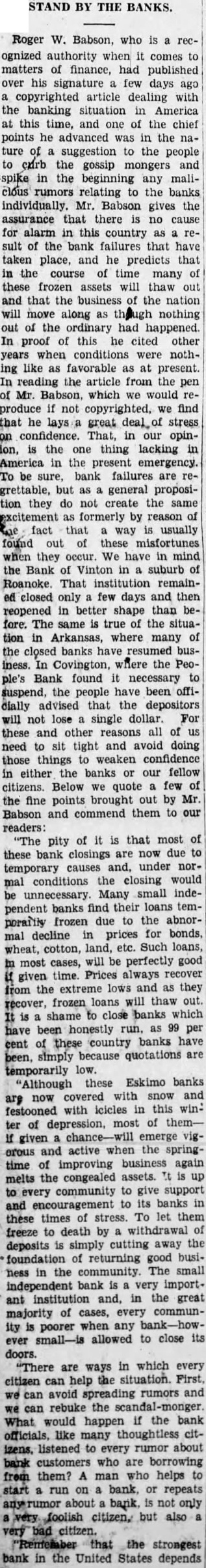

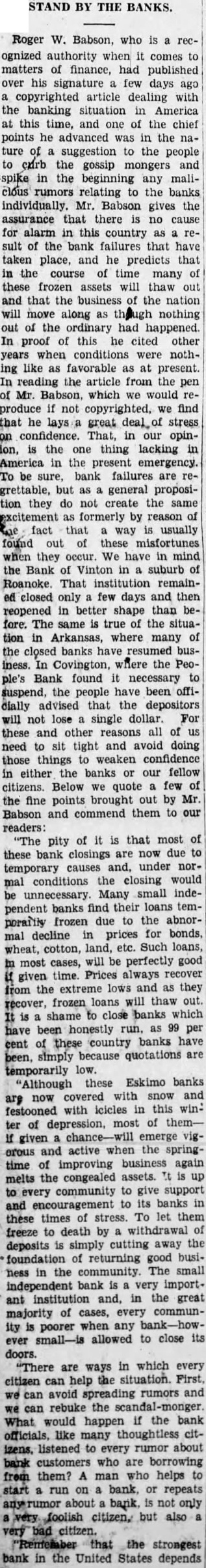

STAND BY THE BANKS.

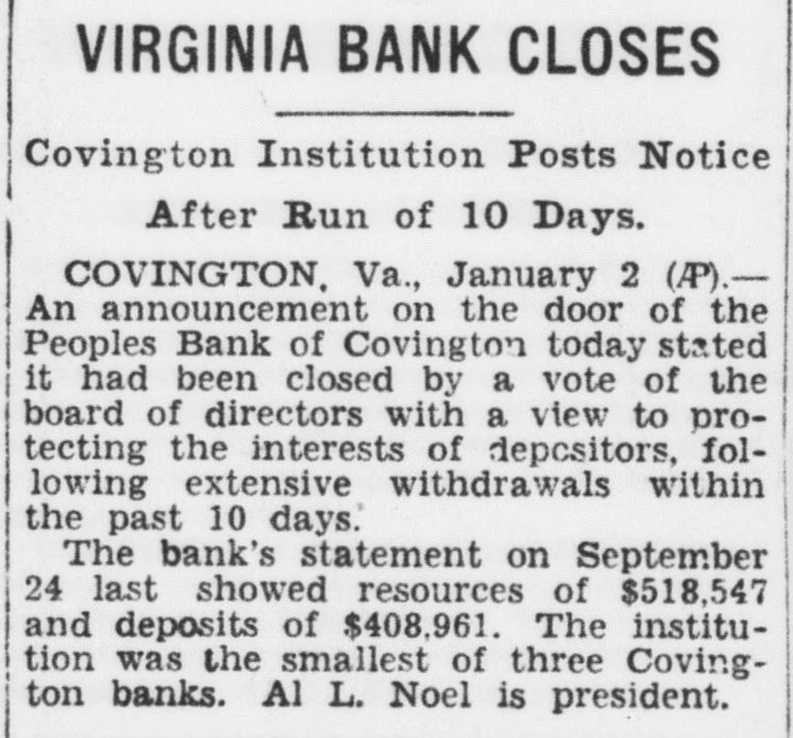

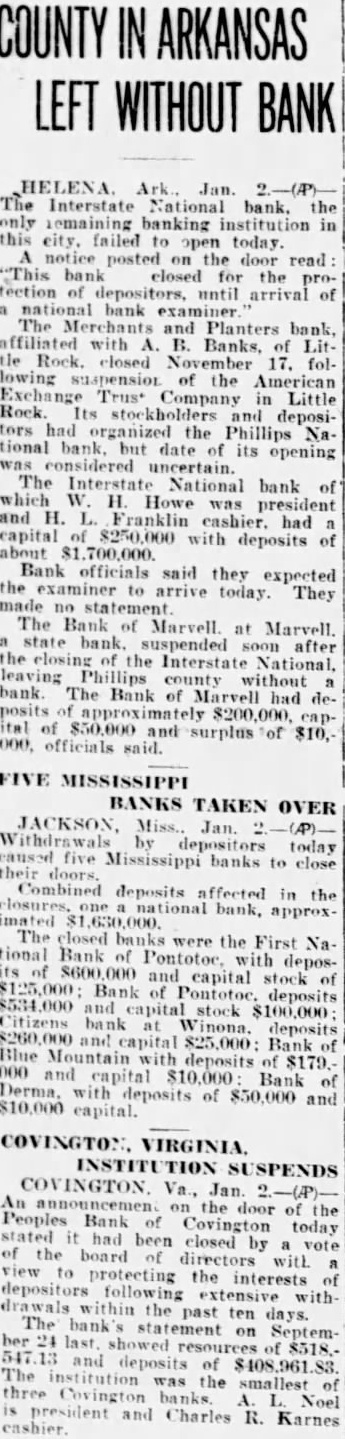

Roger W. Babson, who is a recognized authority when it comes to matters of finance, had published over his signature a few days ago a copyrighted article dealing with the banking situation in America at this time, and one of the chief points he advanced was in the nature of a suggestion to the people to curb the gossip mongers and spike in the beginning any maliclous rumors relating to the banks individually. Mr. Babson gives the assurance that there is no cause for alarm in this country as result of the bank failures that have taken place, and he predicts that in the course of time many of these frozen assets will thaw out and that the business of the nation will move along as though nothing out of the ordinary had happened In proof of this he cited other years when conditions were nothing like as favorable as at present. In reading the article from the pen of Mr. Babson, which we would reproduce if not copyrighted, we find that he lays great deal stress on confidence. That, in our opinion, is the one thing lacking in America in the present emergency. To be sure, bank failures are regrettable, but as general proposition they do not create the same excitement as formerly by reason of fact that way is usually found out of these misfortunes when they occur. We have in mind the Bank of Vinton in a suburb of Roanoke. That institution remained closed only few days and then reopened in better shape than before. The same is true of the situation in Arkansas, where many of the closed banks have resumed business. In Covington, where the People's Bank found it necessary to suspend, the people have been offidially advised that the depositors will not lose single dollar. For these and other reasons all of us need to sit tight and avoid doing those things to weaken confidence in either the banks or our fellow citizens. Below we quote few of the fine points brought out by Mr. Babson and commend them to our readers: "The pity of it is that most of these bank closings are now due to temporary causes and, under normal conditions the closing would be unnecessary. Many small independent banks find their loans temporality frozen due to the abnormal decline in prices for bonds, wheat, cotton, land, etc. Such loans, in most cases, will be perfectly good given time Prices always recover from the extreme lows and as they loans will thaw out. recover, frozen shame to close banks which have been honestly run. as 99 per cent of these country banks have been, simply because quotations are temporarily low. "Although these Eskimo banks are now covered with snow and festooned with icicles in this winter of depression, most of themgiven emerge vigorous and active when the springtime of improving business again melts the congealed assets. It is up to every community to give support and encouragement to its banks in these times of stress. To let them freeze to death by withdrawal of deposits is simply cutting away the foundation of returning good business in the community. The small independent bank is very importinstitution and, in the great majority of cases, every community is poorer when any ever small-is allowed to close its doors. "There are ways in which every citizen can help the situation. First, we can avoid spreading rumors and we can rebuke the What would happen if the bank officials. like many thoughtless citizens. listened to every rumor about bank customers who are borrowing from them? A man who helps to start a run on bank. or repeats any rumor about bank, is not only very foolish citizen, but also very bad citizen. that the strongest bank in the United States depends