Click image to open full size in new tab

Article Text

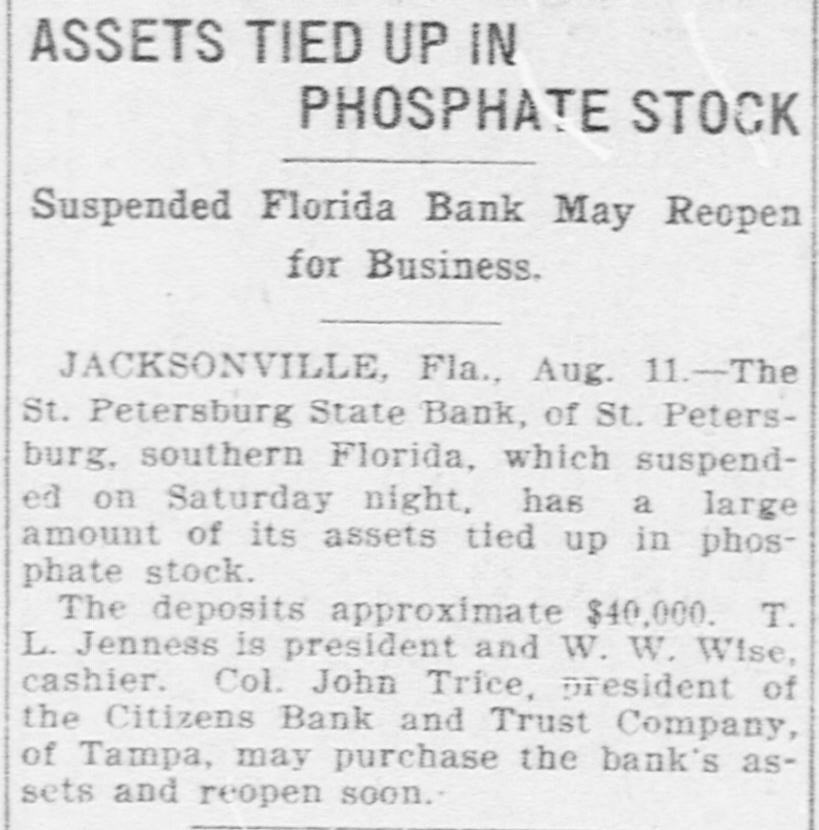

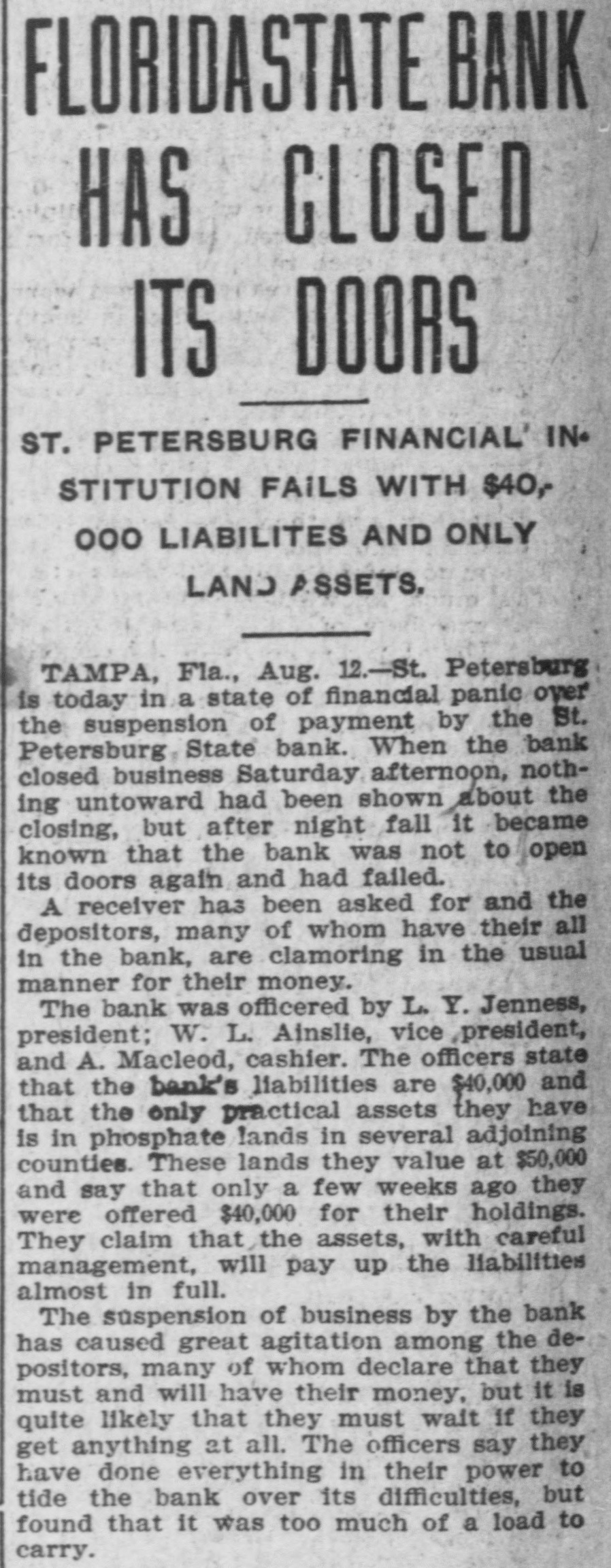

FLORIDASTATE BANK HAS CLOSED ITS DOORS ST. PETERSBURG FINANCIAL IN STITUTION FAILS WITH $40, 000 LIABILITES AND ONLY LAND ASSETS. TAMPA, Fla., Aug. 12.-St. Petersburg is today in a state of financial panic over the suspension of payment by the St. Petersburg State bank. When the bank closed business Saturday afternoon, nothing untoward had been shown about the closing, but after night fall it became known that the bank was not to open its doors again and had failed. A receiver has been asked for and the depositors, many of whom have their all in the bank, are clamoring in the usual manner for their money. The bank was officered by L. Y. Jenness, president; W. L. Ainslie, vice president, and A. Macleod, cashier. The officers state that the bank's liabilities are $40,000 and that the only practical assets they have is in phosphate lands in several adjoining counties. These lands they value at $50,000 and say that only a few weeks ago they were offered $40,000 for their holdings. They claim that the assets, with careful management, will pay up the liabilities almost in full. The suspension of business by the bank has caused great agitation among the depositors, many of whom declare that they must and will have their money, but it is quite likely that they must wait If they get anything at all. The officers say they have done everything in their power to tide the bank over its difficulties, but found that it was too much of a load to carry.