Click image to open full size in new tab

Article Text

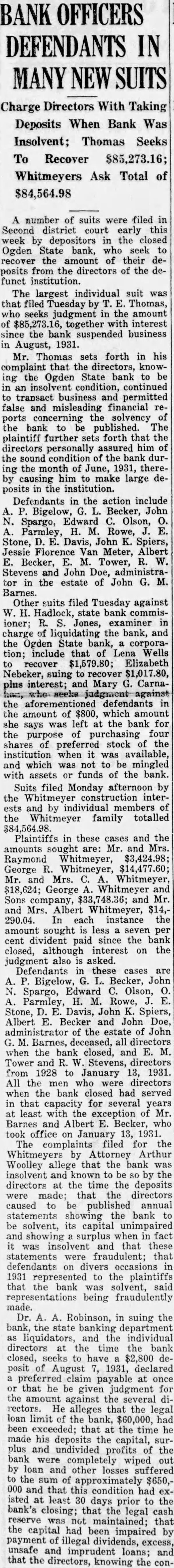

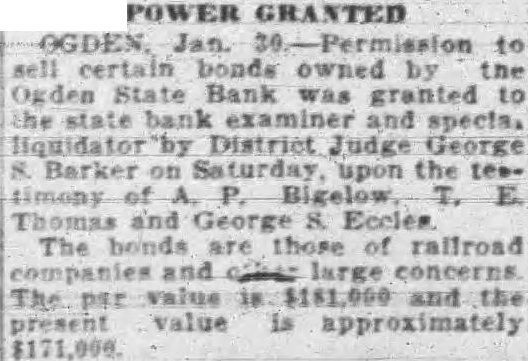

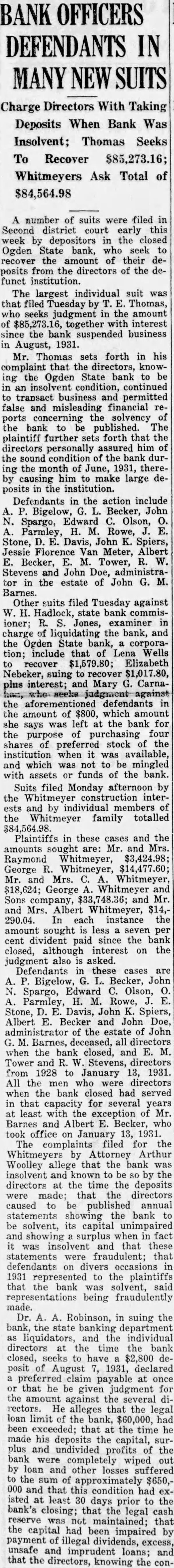

DEFENDANTS IN

Charge Directors With Taking Deposits When Bank Was Insolvent; Thomas Seeks To Recover $85,273.16; Whitmeyers Ask Total of

$84,564.98

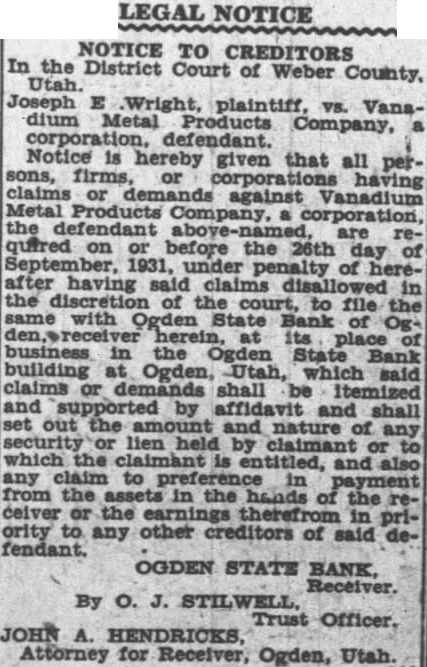

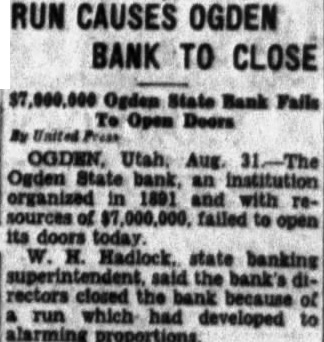

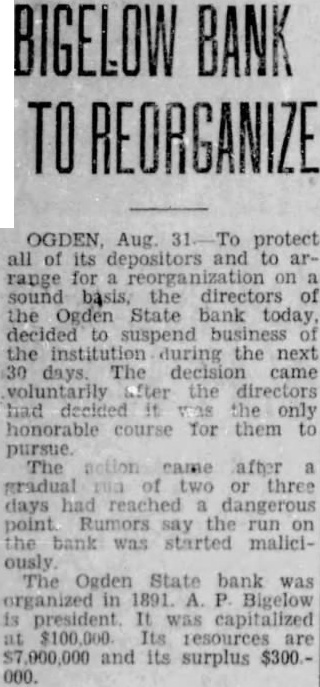

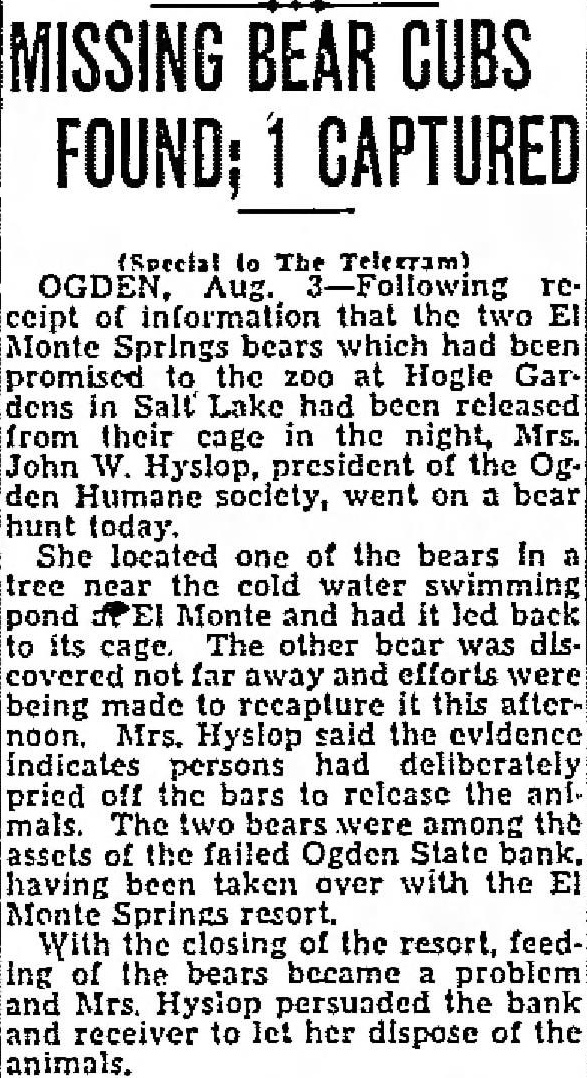

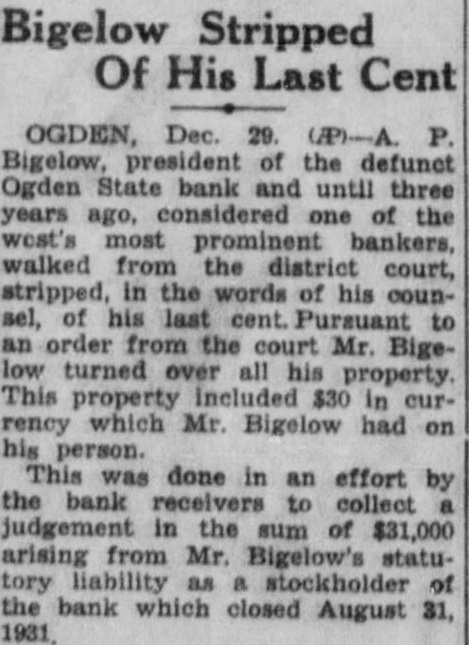

A number of suits were filed Second district court early this week depositors the closed Ogden State bank, who seek recover the amount of their posits from the directors of the funct institution. The largest individual suit was that filed Tuesday Thomas, who seeks judgment in the amount of together interest since the bank suspended business August, 1931. Mr. Thomas sets forth in his complaint that the directors, knowing the Ogden State bank to be in insolvent condition, continued transact business permitted false misleading financial ports concerning solvency the bank published. plaintiff further sets forth that the directors personally assured him of condition the bank durthe month of June, 1931, therecausing him make large posits in the institution. in the action include Bigelow, Becker, John Spargo, Edward Olson, Parmley, H. Rowe, Stone, John Spiers, Jessie Florence Van Meter, Albert Becker, Tower, Stevens and John Doe, administrain the estate of John Barnes. Other suits filed Tuesday against W. Hadlock, state bank commisioner; Jones, examiner in charge of liquidating the bank, and the Ogden State bank, corporainclude that of Lena Wells tion; recover $1,579.80; Elizabeth Nebeker, suing to recover plus interest; and Mary Carnathe aforementioned defendants the amount of $800, which amount she says was left at the bank for purpose purchasing shares of stock of the institution when was available, and which to mingled with assets funds of the bank. Suits filed Monday afternoon by the construction interand by the Whitmeyer family totalled Plaintiffs in these cases and the amounts sought are: Mr. and Mrs. Raymond Whitmeyer, $3,424.98; George Whitmeyer, Mr. and Mrs. Whitmeyer, George Whitmeyer Sons Mr. company, and Mrs. Albert Whitmeyer, 290.04. In each instance the amount sought less cent divident paid since the bank closed, although interest on the judgment also asked. Defendants in these cases are Bigelow, Becker, John Spargo, Edward Olson, Parmley, Rowe, Stone, Davis, John Spiers, Albert Becker and John Doe, of the estate of John Barnes, deceased, when the bank closed, and E. M. Tower and Stevens, directors from 1928 January 13, 1931. the who were directors when bank closed had served that capacity for several least with the exception Mr. Barnes and Albert Becker, who took office on January 13, 1931. filed for the Whitmeyers by Attorney Arthur Woolley allege that the insolvent and known be so by the directors at the time the deposits made; that directors caused published annual statements showing the bank solvent, its capital and showing surplus when was and that these were fraudulent; that defendants divers 1931 to the plaintiffs that the bank solvent, said representations being fraudulently made. Dr. Robinson, in suing the bank, the banking department liquidators, and the individual directors the time the bank closed, seeks to have $2,800 deposit of August 1931, declared preferred claim payable at that he be given judgment the amount against the several rectors. He alleges that the legal loan limit the bank, been that at the time made his deposits the capital, plus and undivided profits of the were completely wiped loan other losses the sum $650,and that this condition had isted least 30 the days prior to bank's closing; that the legal the capital had been impaired payment of illegal excess, unsafe and that the directors, knowing