Click image to open full size in new tab

Article Text

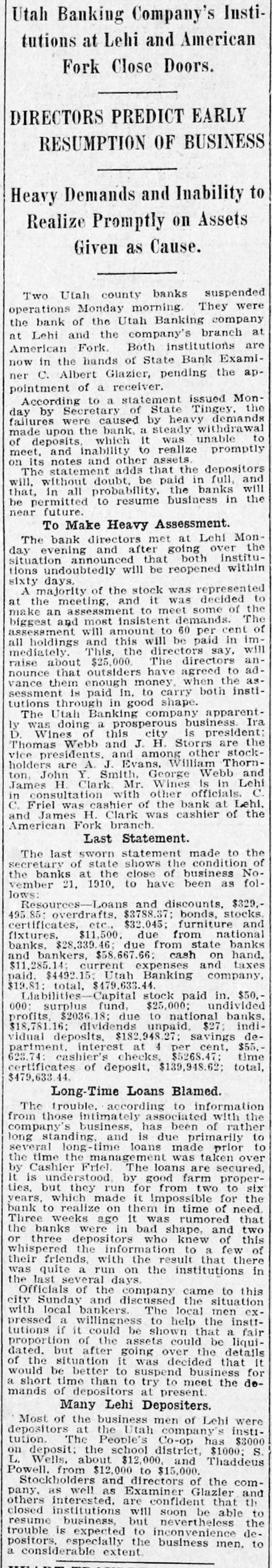

Utah Banking Company's Institutions at Lehi and American Fork Close Doors. DIRECTORS PREDICT EARLY RESUMPTION OF BUSINESS Heavy Demands and Inability to Realize Promptly on Assets Given as Cause. Two Utah county banks suspended operations Monday morning. They were the bank of the Utah Banking company at Lehi and the company's branch at American Fork. Both institutions are now in the hands of State Bank Examiner C. Albert Glazier, pending the appointment of a receiver. According to a statement issued Monday by Secretary of State Tingey. the failures were caused by heavy demands made upon the bank, a steady withdrawal to of deposits, which It was unable meet, and inability to realize promptly on its notes and other assets. The statement adds that the depositors will, without doubt, be paid in full, and that, in all probability, the banks will be permitted to resume business in the near future. To Make Heavy Assessment. The bank directors met at Lehi Monday evening and after going over the situation announced that both institutions undoubtedly will be reopened within sixty days. A majority of the stock was represented at the meeting. and it was decided to make an assessment to meet some of the biggest and most insistent demands. The assessment will amount to 60 per cent of all holdings and this will be paid in immediately. This. the directors say. will raise about $25,000. The directors announce that outsiders have agreed to advance them enough money. when the assessment is paid in. to carry both institutions through in good shape. The Utah Banking company apparently was doing a prosperous business Ira D. Wines of this city is president: Thomas Webb and J. H. Storrs are the vice presidents. and among other stockholders are A. J. Evans, William Thornton, John Y. Smith, George Webb and James H. Clark Mr. Wines Is in Lehi in consultation with other officials. C. C. Friel was cashier of the bank at Lehi. and James H. Clark was cashier of the American Fork branch. Last Statement. The last sworn statement made to the secretary of state shows the condition of the banks at the close of business November 21, 1910, to have been as follows: Resources-Loans and discounts, $329.495.85: overdrafts. $3788.37; bonds, stocks. certificates, etc., $32.045; furniture and fixtures. $11,500. due from national banks. $28,339.46; due from state banks and bankers, $58,667.66: cash on hand, $11,285.14; current expenses and taxes paid, $4492.15: Utah Banking company. $19.81: total, $479,633.44. Liabilities-Capital stock paid in. $50,000: surplus fund, $25,000; undivided profits, $2036.18; due to national banks. $18,781.16; dividends unpaid, $27: individual deposits, $182,948.27; savings department. interest at 4 per cent, $55.623.74: cashier's checks, $5268.47; time certificates of deposit, $139,948.62; total, $479,633.44. Long-Time Loans Blamed. The trouble. according to information from those intimately associated with the company's business, has been of rather long standing, and is due primarily to several long-time loans made prior to the time the management was taken over by Cashier Friel. The loans are secured, It is understood, by good farm properties, but they run for from two to six years, which made it Impossible for the bank to realize on them in time of need. Three weeks ago it was rumored that the banks were in bad shape, and two or three depositors who knew of this whispered the information to a few of their friends, with the result that there was quite a run on the institutions in the last several days. Officials of the company came to this city Sunday and discussed the situation with local bankers. The local men expressed a willingness to help the instttutions if it could be shown that a fair