Article Text

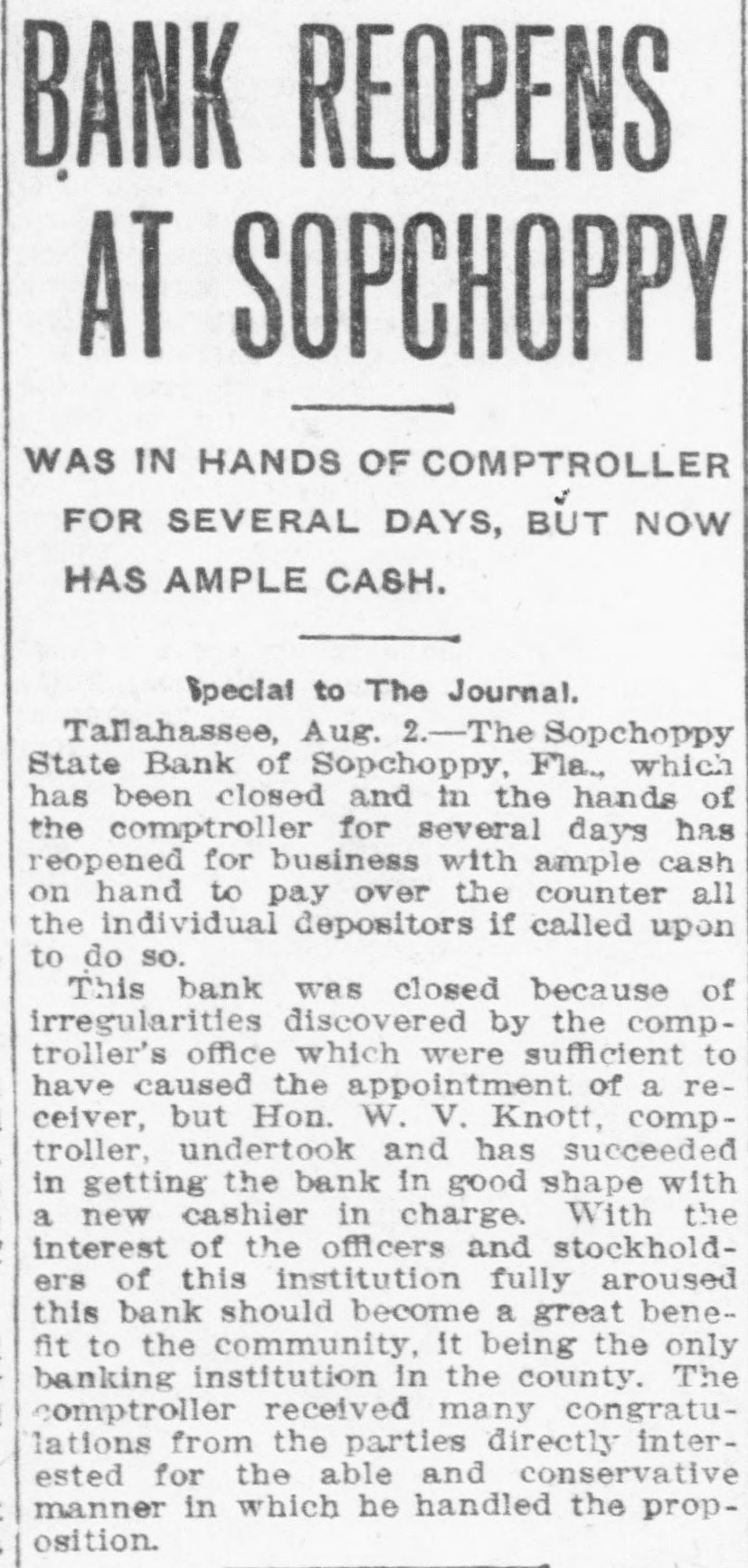

BANK REOPENS AT SOPCHOPPY WAS IN HANDS OF COMPTROLLER FOR SEVERAL DAYS, BUT NOW HAS AMPLE CASH. Special to The Journal. Tallahassee, Aug. 2.-The Sopchoppy State Bank of Sopchoppy, Fla., which has been closed and in the hands of the comptroller for several days has reopened for business with ample cash on hand to pay over the counter all the individual depositors if called upon to do so. This bank was closed because of irregularities discovered by the comptroller's office which were sufficient to have caused the appointment of a receiver, but Hon. W. V. Knott, comptroller, undertook and has succeeded in getting the bank in good shape with a new cashier in charge. With the interest of the officers and stockholders of this institution fully aroused this bank should become a great benefit to the community, it being the only banking institution in the county. The comptroller received many congratulations from the parties directly interested for the able and conservative manner in which he handled the proposition.