Click image to open full size in new tab

Article Text

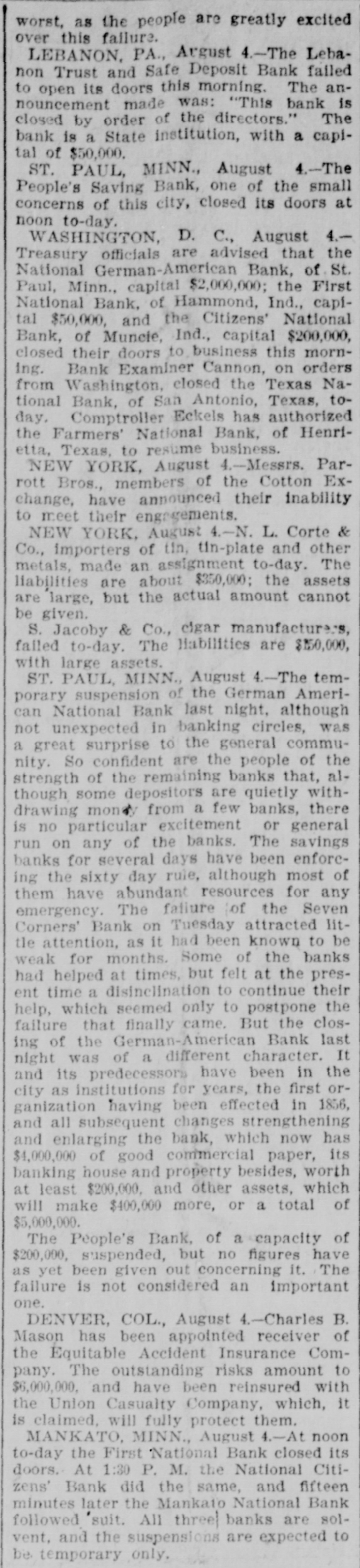

worst, as the people are greatly excited over this failure. LEBANON, PA., Argust 4.-The Lebanon Trust and Safe Deposit Bank falled to open its doors this morning. The announcement made was: "This bank is closed by order of the directors." The bank is a State institution, with a capital of $50,000. ST. PAUL, MINN., August 4.-The People's Saving Bank, one of the small concerns of this city, closed its doors at noon to-day. WASHINGTON, D. C., August 4.Treasury officials are advised that the National German-American Bank, of.St. Paul, Minn., capital $2,000,000; the First National Bank, of Hammond, Ind., capital $50,000, and the Citizens' National Bank, of Muncie, Ind., capital $200,000, closed their doors to business this morning. Bank Examiner Cannon, on orders from Washington, closed the Texas National Bank, of San Antonio, Texas, today. Comptroller Eckels has authorized the Farmers' National Bank, of Henrietta, Texas, to resume business. NEW YORK, August 4.-Messrs. Parrott Bros., members of the Cotton Exchange, have announced their inability to meet their engagements. NEW YORK, August 4.-N. L. Corte & Co., importers of tin, tin-plate and other metals, made an assignment to-day. The liabilities are about $350,000; the assets are large, but the actual amount cannot be given. S. Jacoby & Co., cigar manufacture:s, failed to-day. The liabilities are $150,000, with large assets. ST. PAUL, MINN., August 4.-The temporary suspension of the German American National Bank last night, although not unexpected in banking circles, was a great surprise to the general community. So confident are the people of the strength of the remaining banks that, although some depositors are quietly withdrawing mont from a few banks, there is no particular excitement or general run on any of the banks. The savings banks for several days have been enforcing the sixty day rule, although most of them have abundant resources for any emergency. The failure of the Seven Corners' Bank on Tuesday attracted little attention, as it had been known to be weak for months. Some of the banks had helped at times, but felt at the present time a disinclination to continue their help, which seemed only to postpone the failure that finally came. But the closing of the German-American Bank last night was of a different character. It and its predecessors have been in the city as institutions for years, the first organization having been effected in 1856, and all subsequent changes strengthening and enlarging the bank, which now has $4,000,000 of good commercial paper, its banking house and property besides, worth at least $200,000. and other assets, which will make $400,000 more, or a total of $5,000,000. The People's Bank, of a capacity of $200,000. suspended, but no figures have as yet been given out concerning it. The failure is not considered an important one. DENVER, COL., August 4.-Charles B. Mason has been appointed receiver of the Equitable Accident Insurance Company. The outstanding risks amount to $6,000,000, and have been reinsured with the Union Casualty Company, which, it is claimed, will fully protect them. MANKATO, MINN., August 4.-At noon to-day the First National Bank closed its doors. At 1:30 P. M. the National Citizens' Bank did the same, and fifteen minutes later the Mankato National Bank followed suit. All three banks are solvent. and the suspensions are expected to be temporary only.