Article Text

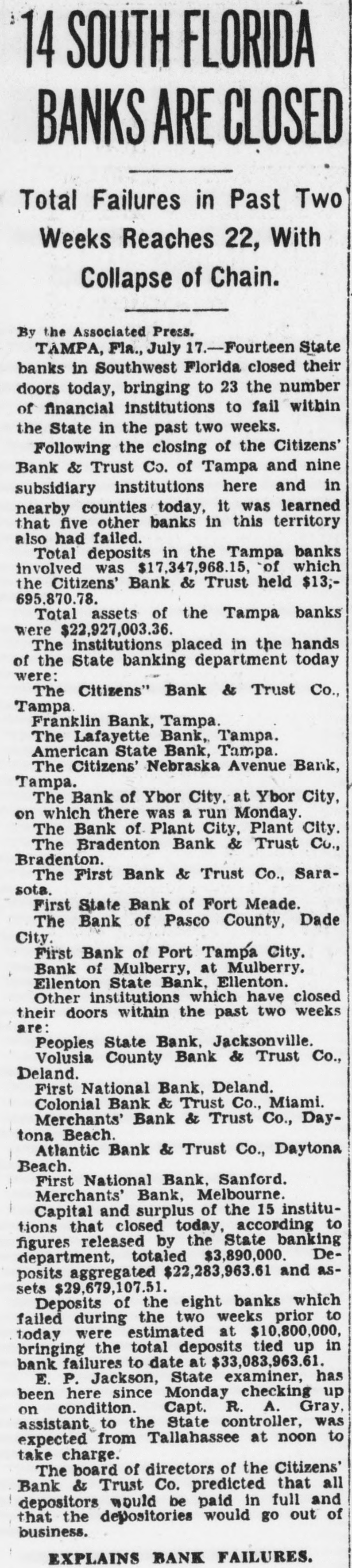

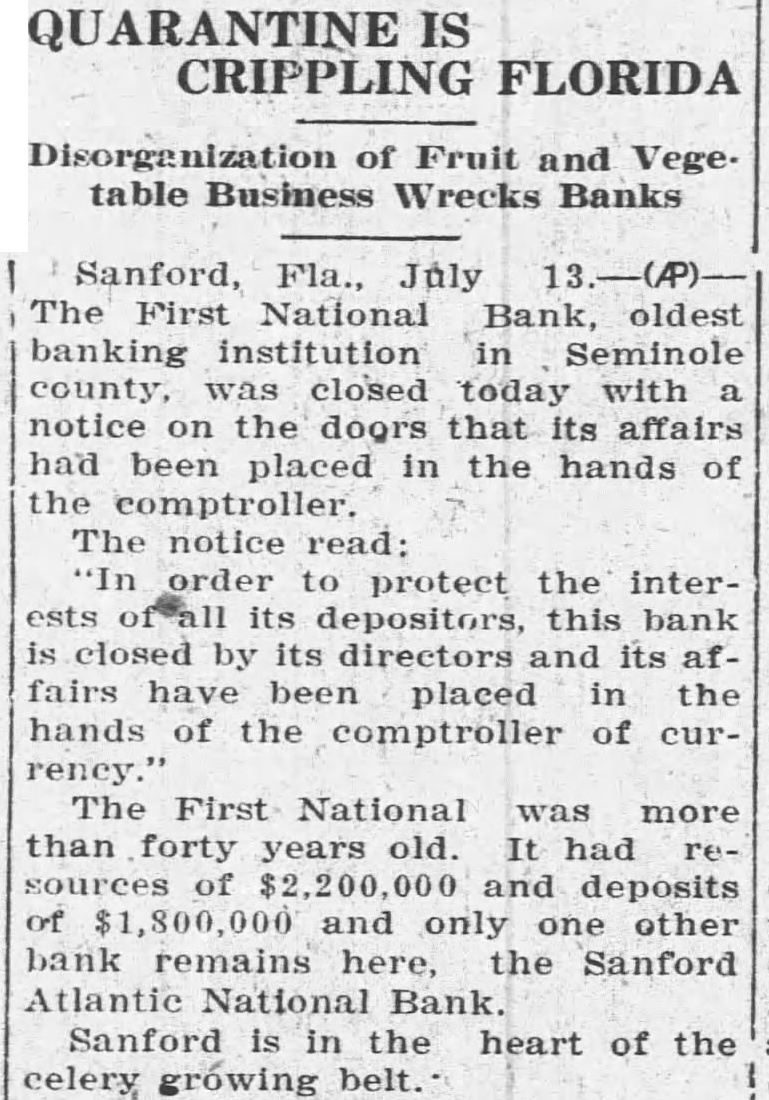

Authorities at Work on Reorganization or Liquidation of Institutions. ONE OF TWO IN SANFORD CLOSED DOORS TODAY Seven Now Have Suspended, Two at Daytona Beach Going Out of Business Yesterday. By the Associated Press. JACKSONVILLE, Fla., July 13.-App.oximately $9,000,000 in depositors' money was tied up today as State and Federal banking authorities worked toward the reorganization or liquidation of six Florida banks which have closed within the last eight days, five of them since Thursday. The latest to fail were two in Daytona Beach, the Merchants' Bank & Trust Co., and the Atlantic Bank & Trust Co., which suspended business yesterday. Both were closed, according to notices on their doors, by State bank examiners pending reorganization for the protection of their customers. The failure of the Daytona Beach banks brought a run on the two remaining institutions in the city, which continued business despite heavy withdrawals. De Land, in the same county, suffered closing of the only two banks in the city, the Volusia County Bank & Trust Co. and the First National Bank, Thursday, while the Colonial Bank & Trust Co. of Miami failed to open on that day. The People's Bank of Jacksonville closed last Friday morning. While banking department officials from the State and Federal Governments audited the books of the six banks, John L. Fouts, president of four other closed Central Florida banks, prepared for preliminary hearing on three charges involving violation of State banking laws. Fouts was president and director of the State Bank of Bartow, the First National Bank of Lakeland, the First National Bank of Auburndale and the State Bank of Winter Haven. Fouts is alleged to have loaned himself $5,000 from one of the banks without the consent of the directors, at a time when the bank was not in a position to make the loan, and to have altered minutes of a directors' meeting to show that the loan was approved. Sanford Bank Closes. SANFORD, Fla., July 13 (AP).-The First National Bank, oldest banking : institution in Seminole County, was closed today with a notice on the doors that its affairs had been placed in the hands of the controller. The notice read: "In order to protect the interests of all its depositors, this bank is closed by its directors and its affairs have been placed in the hands of the controller of currency." The First National was more than 40 years old. It had resourcesof $2,200,000 and deposits of $1,800,000. Only one other bank remains here, the Sanford Atlantic National Bank.