Article Text

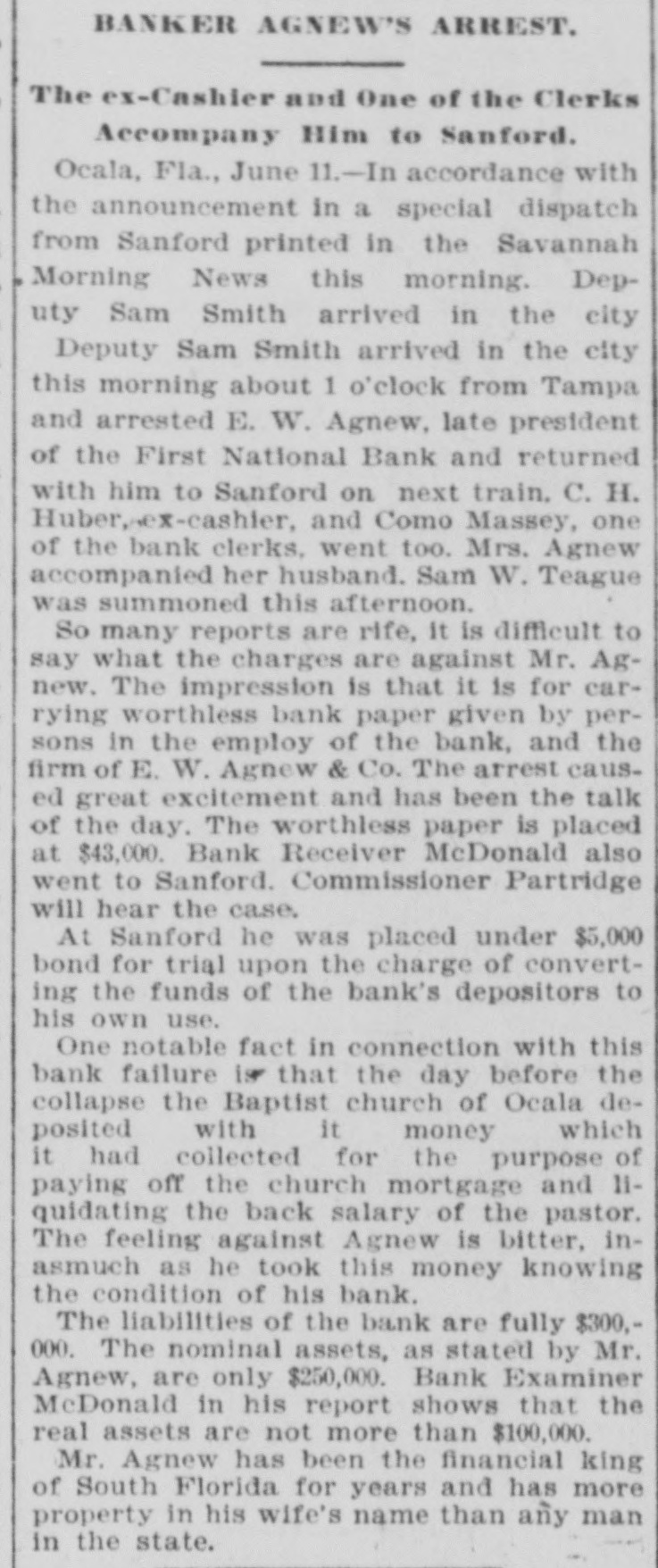

BANKER AGNEW'S ARREST. The ex-Cashier and One of the Clerks Accompany Him to Sanford. Ocala, Fla., June 11.-In accordance with the announcement in a special dispatch from Sanford printed in the Savannah Morning News this morning. Deputy Sam Smith arrived in the city Deputy Sam Smith arrived in the city this morning about 1 o'clock from Tampa and arrested E. W. Agnew, late president of the First National Bank and returned with him to Sanford on next train. C.H. Huber,-ex-cashier, and Como Massey, one of the bank clerks. went too. Mrs. Agnew accompanied her husband. Sam W. Teague was summoned this afternoon. So many reports are rife, it is difficult to say what the charges are against Mr. Agnew. The impression is that it is for carrying worthless bank paper given by persons in the employ of the bank, and the firm of E. W. Agnew & Co. The arrest caused great excitement and has been the talk of the day. The worthless paper is placed at $43,000. Bank Receiver McDonald also went to Sanford. Commissioner Partridge will hear the case. At Sanford he was placed under $5,000 bond for trial upon the charge of converting the funds of the bank's depositors to his own use. One notable fact in connection with this bank failure is that the day before the collapse the Baptist church of Ocala deposited with it money which it had collected for the purpose of paying off the church mortgage and 11guidating the back salary of the pastor. The feeling against Agnew is bitter, inasmuch as he took this money knowing the condition of his bank. The liabilities of the bank are fully $300,000. The nominal assets, as stated by Mr. Agnew, are only $250,000. Bank Examiner McDonald in his report shows that the real assets are not more than $100,000. Mr. Agnew has been the financial king of South Florida for years and has more property in his wife's name than any man in the state.