Article Text

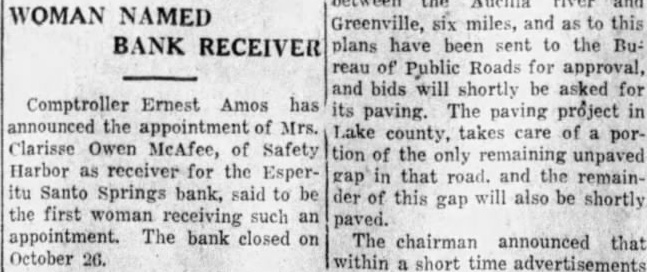

Aucilla river and WOMAN NAMED Greenville, six miles, and to this BANK RECEIVER plans have been sent to the Bu- Comptroller Ernest Amos has paving. The paving project in announced the appointment of Lake county, takes care porClarisse Owen McAfee, of Safety tion of the only remaining unpaved Harbor as receiver for the Esper- the gap that road. and remainitu Santo Springs bank, said to der of this will also be shortly gap the first woman receiving such an paved. appointment. The bank closed on The chairman announced that October within short time