1.

February 1, 1930

Imperial Valley Press

El Centro, CA

Click image to open full size in new tab

Article Text

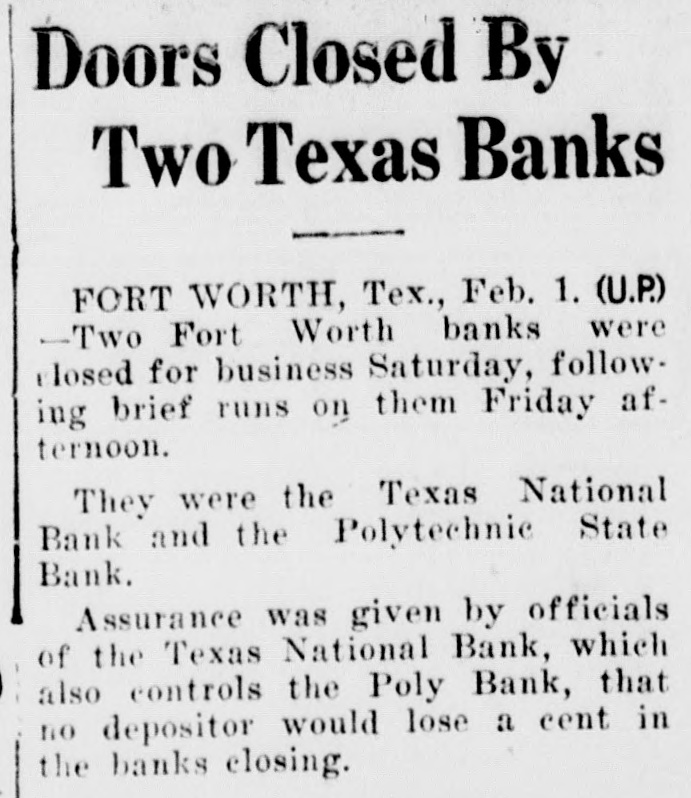

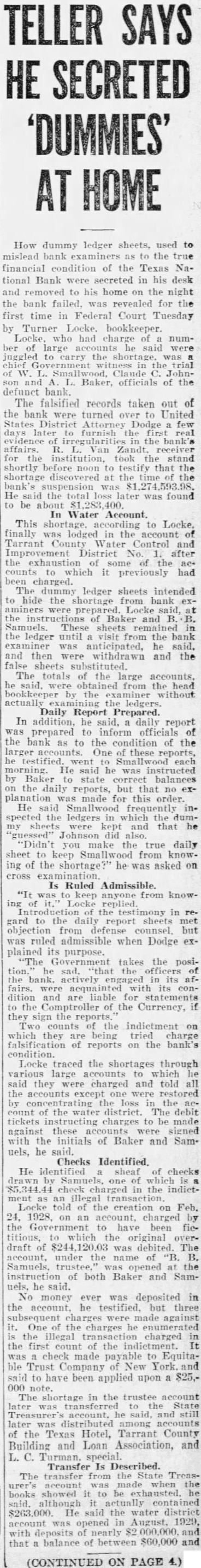

Doors Closed By Two Texas Banks FORT WORTH, Tex., Feb. 1. (U.P.) -Two Fort Worth banks were closed for business Saturday, following brief runs on them Friday afternoon. They were the Texas National Bank and the Polytechnic State Bank. Assurance was given by officials of the Texas National Bank, which also controls the Poly Bank, that no depositor would lose a cent in the banks closing.

2.

February 1, 1930

The Atlanta Journal

Atlanta, GA

Click image to open full size in new tab

Article Text

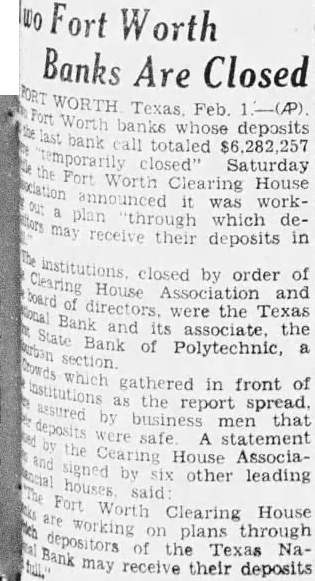

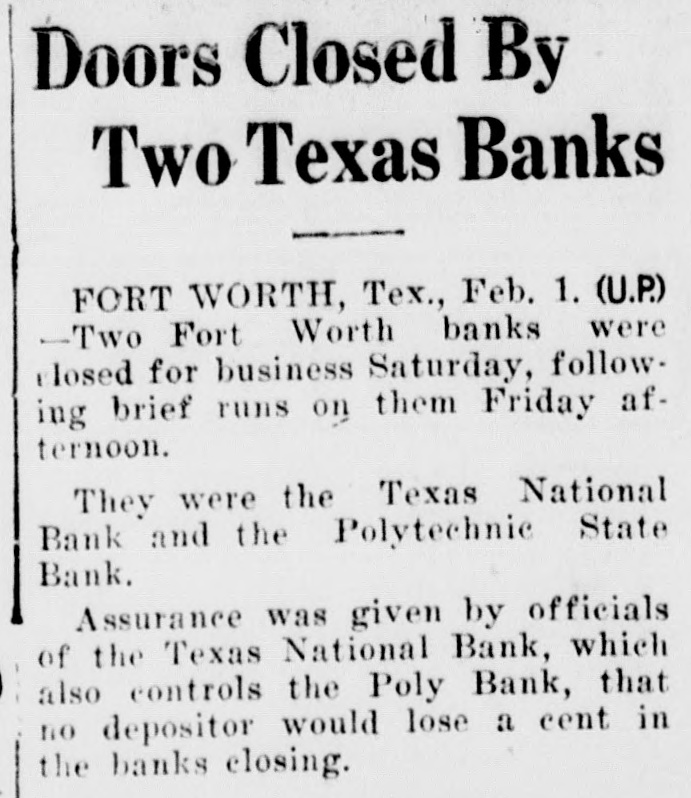

Fort Worth Banks Are Closed deposits call totaled Saturday Fort House was through which demay receive their deposits in institutions closed by order of House Association and the Texas Bank its the section. Bank of Polytechnic, which gathered in front of institutions as the report spread men that safe statement House Associasigned houses other leading Fort Clearing House working through depositors the Texas NaBank may receive their deposits

3.

February 2, 1930

The Pittsburgh Press

Pittsburgh, PA

Click image to open full size in new tab

Article Text

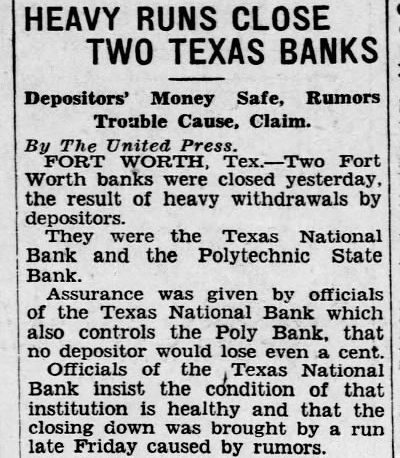

HEAVY RUNS CLOSE TWO TEXAS BANKS

Depositors' Money Safe, Rumors Trouble Cause, Claim.

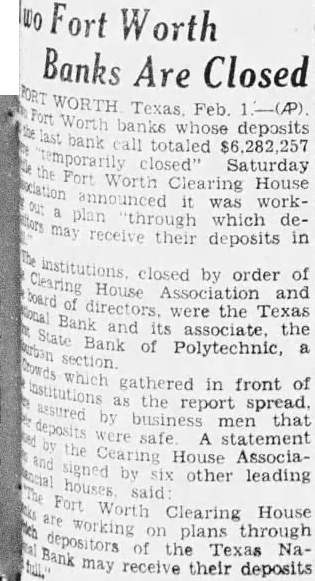

By The United Press. FORT WORTH, Tex.-Two Fort Worth banks were closed yesterday, the result of heavy withdrawals by depositors. They were the Texas National Bank and the Polytechnic State Bank. Assurance was given by officials of the Texas National Bank which also controls the Poly Bank. that no depositor would lose even cent. Officials of the Texas National Bank insist the condition of that institution is healthy and that the closing down was brought by a run late Friday caused by rumors.

4.

February 4, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

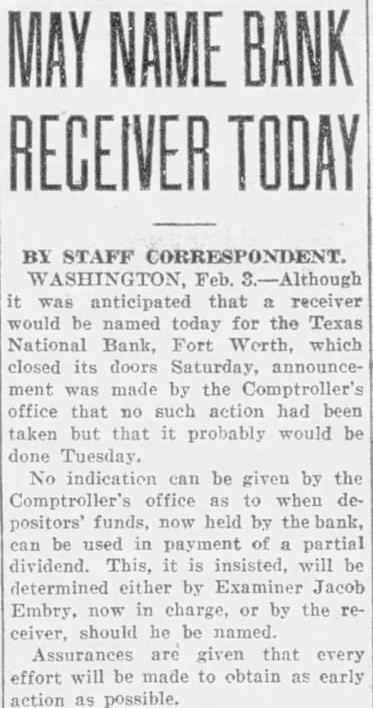

BANK

BY STAFF Feb. anticipated that receiver would be named today for the Texas National Bank, Fort Worth, which closed its doors Saturday, ment was made by the Comptroller's office that no such action had been taken but that probably would be done Tuesday. No indication can be given by the Comptroller's office when positors' funds, now held by the bank, be used in payment of partial dividend. This, insisted, will be determined either by Examiner Jacob Embry. now in charge, or by the ceiver, should he be named. Assurances are given that every effort will be made to obtain early action possible.

5.

February 4, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

CONTRACT MEETING TODAY

The board of directors of Tarrant County Control and Improvement District No. will meet at 3 o'clock this afternoon in the Capps Building to consider execution of a contract with the contractors for the construction of the two new voirs on West Fork of the Trinity of the Trinity Farms struction the McKenzie Company will appear before the today Walter R. Bennett. president of the board. yesterday announced that he did not believe the closing of the Tex as National Bank, depository for the water district. would affect the progress of the lake construction. He the deposit approximately $1,500.000 is fully covered by a depository bond.

6.

February 4, 1930

Fort Worth Star-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

R. L. Van Zandt Due Soont

R. Vau Zandr. whose appointment Texas National Bank was anopunced in Vashington Tuesday morning by Comptroller of the Currency Poole, has been instructed to proceed to Fort Worth as soon possible according to disfrom Van Zandt St Augustine, has acting as ceiver national bank. Actual liquidation of Texas National Bank require some time, officials the Treasury indicated Tuesday in Washington. They stated had no information as yet which would to indicate when funds held by the bank be available 12 depositors

Son of Maj. K. M. Van Zandt. former governor of the FedBank at Dallas for the Eleventh District Van Zandt is familiar to banking circles in this secHe native of Fort Worth being of Ma. M. Zandt president the Worth ational Bank. He started his eareer in the Fort Worth National Bank where he worked bookkeeper after his graduation from Texas & M. ColHis first appointment of importance the Treasury Department This was at

(CONTINUED ON PAGE 4)

7.

February 4, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

BANK

BY STAFF anticipated that receiver would named today for the Texas National Bank. Fort Worth, which closed doors Saturday, announcement made by the Comptroller's that such action had been taken but that probably would done Tuesday. No indication can be given by the Comptroller's office when positors' held by be used payment partial dividend. This, will determined either by Examiner Jacob now by the ceiver. should named. Assurances given that every effort will be made to obtain early possible.

8.

February 4, 1930

Abilene Daily Reporter

Abilene, TX

Click image to open full size in new tab

Article Text

Van Zandt Named Bank's Receiver

FORT WORTH. Feb. 4. (UP)Richard L. Van Zandt, former governor of the federal reserve bank at Dallas, son of Major K. M. Van Zandt, veteran Fort Worth National Bank head. will be receiver for the Texas National Bank, closed following run. Appointment of Van Zandt was announced in Washington Tuesday by the comptroller of the treasury.

9.

February 5, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

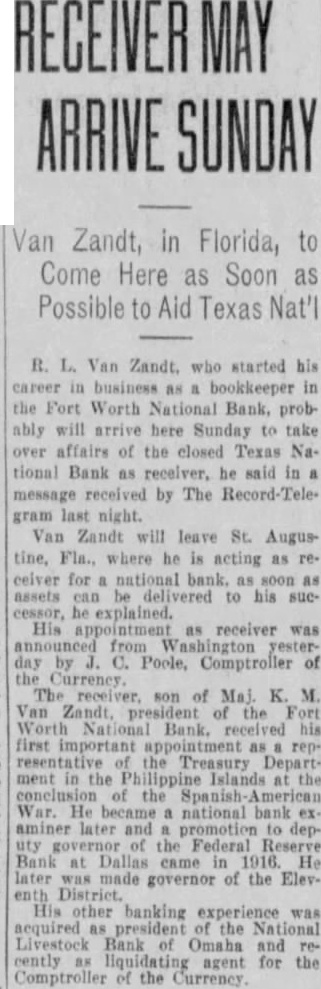

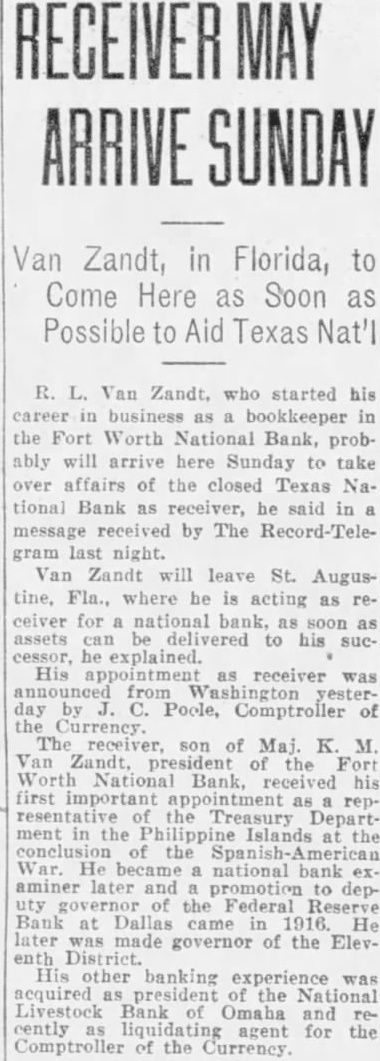

RECEIVER MAY ARRIVE SUNDAY

Van Zandt, in Florida, to Come Here as Soon as Possible to Aid Texas Nat'l

R. L. Van Zandt, who started his career in business as a bookkeeper in the Fort Worth National Bank, probably will arrive here Sunday to take over affairs of the closed Texas National Bank as receiver, he said in a message received by The Record-Telegram last night. Van Zandt will leave St. Augustine, Fla., where he is acting as receiver for a national bank, as soon as assets can be delivered to his successor, he explained. His appointment as receiver was from yesterday by J. C. Poole, Comptroller of the The receiver. son of Maj. K. M. Van Zandt, president of the Fort Worth National Bank, received his first important appointment as rep. resentative of the Treasury Department in the Philippine Islands at the conclusion of the War. He became a national bank examiner later and a promotion to deputy governor of the Federal Reserve Bank at Dallas came in 1916. He later was made governor of the Eleventh District. His other banking experience acquired as president of the National Livestock Bank of Omaha and recently liquidating agent for the Comptroller of the Currency.

10.

February 5, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

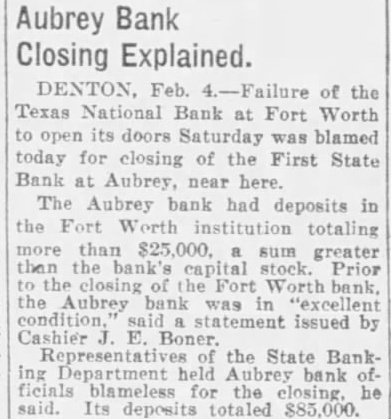

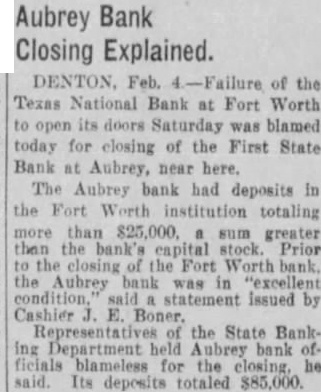

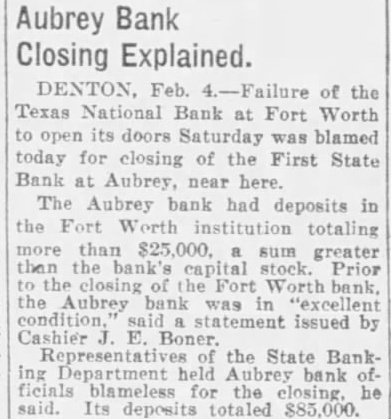

Aubrey Bank Closing Explained.

DENTON, Feb. 4.-Failure of the Texas National Bank at Fort Worth to open its doors Saturday was blamed today for closing of the First State Bank at Aubrey, near here. The Aubrey bank had deposits in the Fort Worth institution totaling more than $25,000. sum greater than the bank's capital stock. Prior the closing Fort Worth bank, the Aubrey bank was in "excellent condition. issued by Cashier J. E. Representative of the State Banking Department held Aubrey bank of ficials blameless for the closing, he said. Its deposits totaled $85,000.

11.

February 5, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

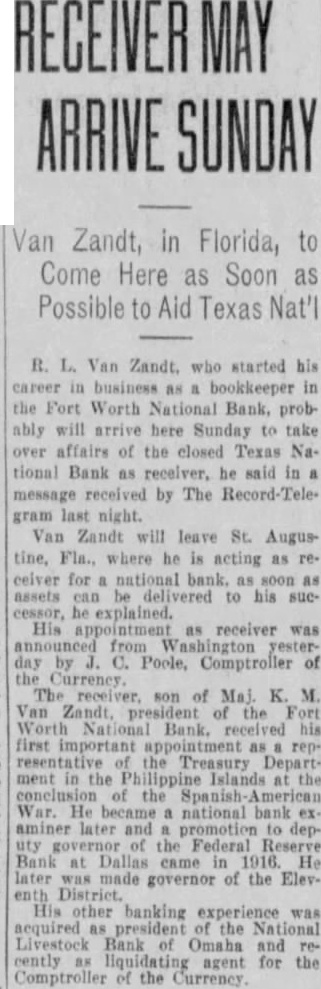

ARRIVE SUNDAY

Van Zandt, in Florida, to Come Here as Soon as Possible to Aid Texas Nat'l

R. L. Van Zandt. who started his career in business as a bookkeeper in the Fort Worth National Bank, probably will arrive here Sunday to take over affairs of the closed Texas National Bank as receiver, he said in message received by The Record-Telegram last night. Van Zandt will leave St. Augustine, Fla., where he is acting as receiver for a national bank. as soon as assets can be delivered to his suehe explained. His appointment as receiver was from Washington yesterday by J. C. Poole, Comptroller of the Currency. The receiver. son of Maj. K. M. Van Zandt, president of the Worth National Bank. received his first important appointment as representative of the Treasury Department in the Philippine Islands at the conclusion of the SpanishWar. He became a national bank examiner later and promotion to deputy of the Federal Reserve Bank at Dallas came in 1916. He later was made governor of the Eleventh District. His other banking experience acquired as president of the National Livestock Bank of Omaha and recently as liquidating agent for the Comptroller of the Currency.

12.

February 5, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

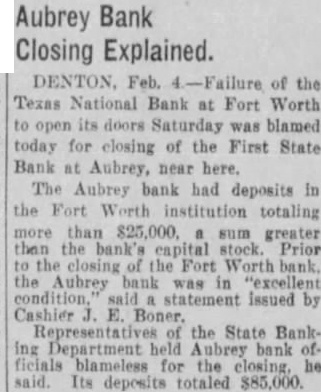

Aubrey Bank Closing Explained.

DENTON, Feb. 4.-Failure of the Texas National Bank at Fort Worth to open its doors Saturday was blamed today for closing of the First State Bank at Aubrey, near here. The Aubrey bank had deposits in the Fort Worth institution totaling more than $25,000. sum greater than the bank's capital stock. Prior to the closing of the Fort Worth bank. the Aubrey bank was in "excellent condition, statement issued by Cashier J. E. Boner. Representatives of the State Banking Department held Aubrey bank officials blameless for the closing, he said. Its deposits totaled $85,000.

13.

February 11, 1930

Fort Worth Star-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

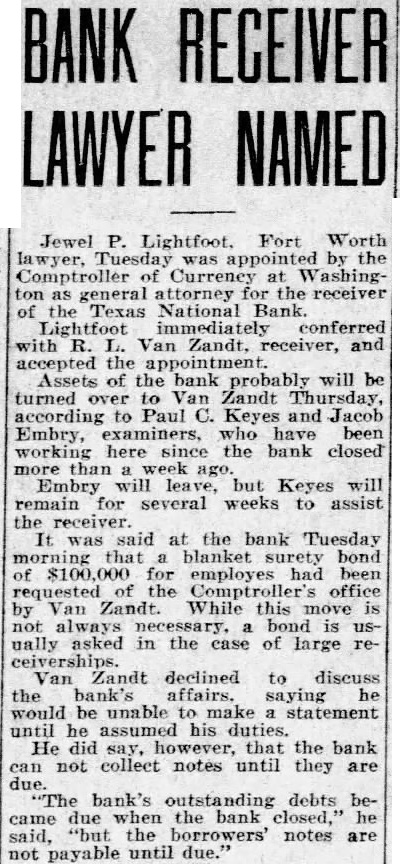

BANK RECEIVER LAWYER

Jewel Lightfoot. Fort Worth lawyer, by the of Currency Washinggeneral attorney for the receiver of the Texas National Bank. Lightfoot immediately conferred with R. Van and accepted the appointment. Assets of the bank probably will be turned over to Van Zandt Thursday, according to Paul C. Keyes and Jacob Embry, examiners, who have been working here since the bank closed more than ago. Embry will but Keyes will remain for several weeks to assist the receiver. It was at the bank Tuesday that blanket bond for employes had been requested the office by Van Zandt. While this bond is ually in the case of large ceiverships. Van Zandt declined to discuss the bank's affairs. saying would be unable make statement until assumed his duties. He did say, however, that the bank can not collect notes until they are due. bank's outstanding debts became due when the bank closed,' "but the notes are not payable until due."

14.

May 27, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

Water District Unable to Return Deposits to Texas Nat'l, Chief Says

The Tarrant County Water Control and Improvement District acting under special can not into Texas National Bank any part of its funds which secured as deposits before the bank closed. That observation was made by W. R. president of the board, when D. Porter and Clarence E. Farmer appeared before the directors for the bank's depositors asked that least 25 per cent of the district's deposit be returned. At the time the bank closed the district had more than $1,000,000 on deposit, which was secured by collateral put the bank. The collatup eral after the closed. After Porter and Farmer made talks, Ireland Hampton, attorney for the Farmer to present brief of the law points in his was made on the matter by the directors Bennett declared that the district by particular law and limited to doing certain thing. "Money can be only for that Bennett stated that the law under which the district makes no provision for contributions any and allows disbursements funds the way and the ends provided by law. "The district has been advised by legal Bennett "that the contract the board had with the bank depository was valid and the pledge of securities also valid. board has no reason to change its on that Farmer asked that the directors turn 25 of the district's posit the bank to lighten the burden the small Farmer indicated group of depositors will file suit against the water board similar steps are taken either by R. Zandt bank receiver. or the comptroller of currency

15.

June 5, 1930

Fort Worth Star-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

BANK RECEIVER FILES BANKRUPTCY ACTION

An involuntary pétition in bankruptey was filed in Federal District Court Thursday morning by Receiver R. L. Van Zandt the Texas Na tional Bank against H. S. Miller, Fort Worth. The petition claims that Miller is indebted to the receivership to the extent of $29,000 in eight notes which past due and unpaid. Miller act of bankruptey on Feb of this year, the petition when he property in Dallas to his brother, Alex Miller.

Mrs. McCormick Under Knife. CHICAGO. June Edith Rockefeller McCormick, Chicago society leader, Thursday was recovering from minor operation, the nature of which was not made public.

16.

June 6, 1930

Fort Worth Star-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

RECEIVER FOR TEXAS NATIONAL BANK SUED Receiver R. Van Zandt of the Texas Bank Friday named defendant suit in equity, filed United States District Court by the State Bank of Oakin Leon in the National which the hands the when bank closed. The petiBank State Bank's in Fort Worth.

17.

June 17, 1930

Pampa Daily News

Pampa, TX

Click image to open full size in new tab

Article Text

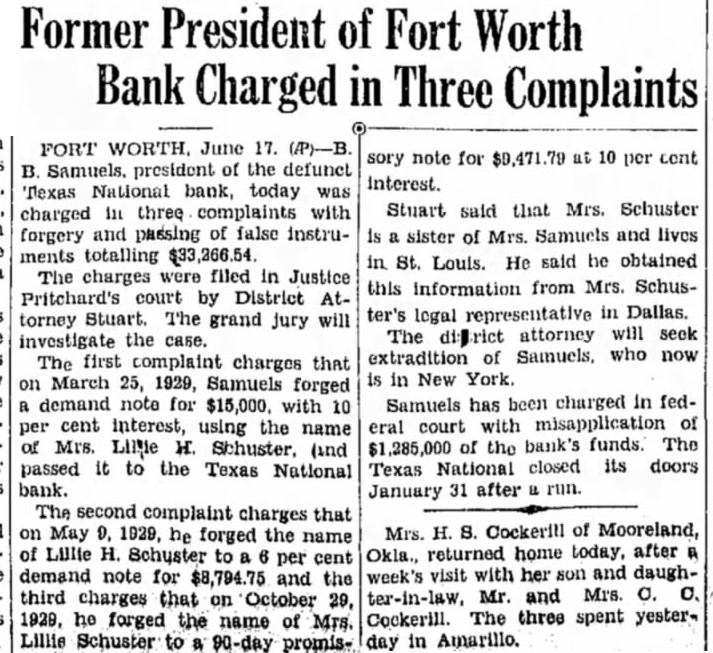

Former President of Fort Worth Bank in Charged Three Complaints

FORT WORTH, June 17. Samuels. president of the defunct Texas National bank, today was charged In three complaints with forgery and passing of false instruments totalling The charges were filed in Justice Pritchard's court by District Attorney Stuart. The grand jury will investigate the case. The first complaint charges that on March 25, 1929, Samuels forged demand note for $15,000, with 10 per cent interest, using the name of Mrs. Lillie H. Schuster, (ind passed it to the Texas National bank. The second complaint charges that on May 9. 1929, he forged the name of Lillie H. Schuster to per cent demand note for $8,794.75 and the third charges that on October 29, 1929, he forged the name of Mrs. Lillie Schuster to 90-day sory note for at 10 per cent interest.

Stuart said that Mrs. Schuster sister of Mrs. Samuels and lives in St. Louis. He said he obtained this information from Mrs. Schuster's legal representative in Dallas. The diffrict attorney will seek extradition of Samuels, who now is in New

Samuels has been charged in fedwith misapplication of eral court of the bank's funds. The $1,285,000 Texas National closed its doors January 31 after run.

Mrs. H. Cockerill of Mooreland, Okla., returned home today, after visit with her son and daughweek's Mr. and Mrs. ter-in-law, Cockerill. The three spent yesterin Amarillo.

18.

June 18, 1930

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

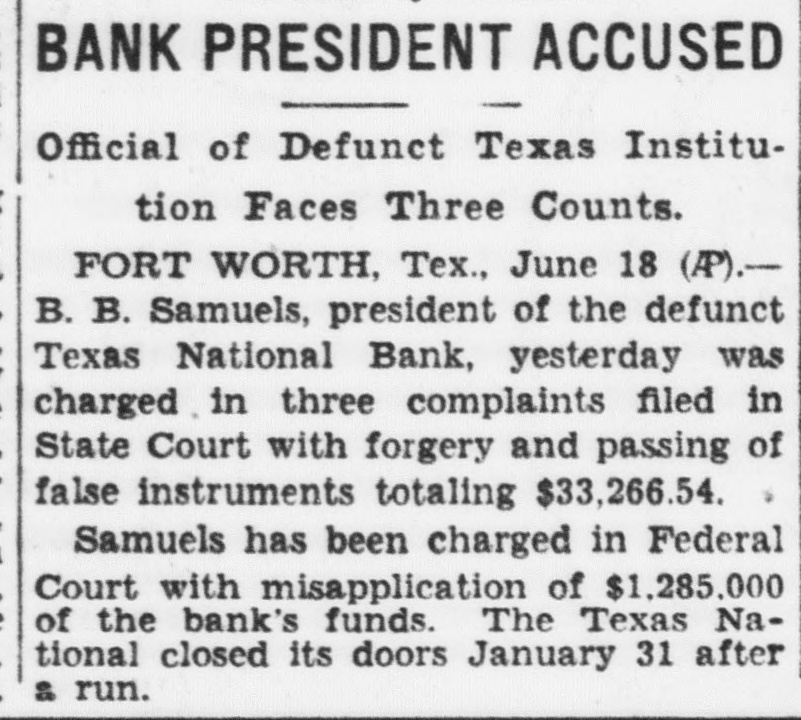

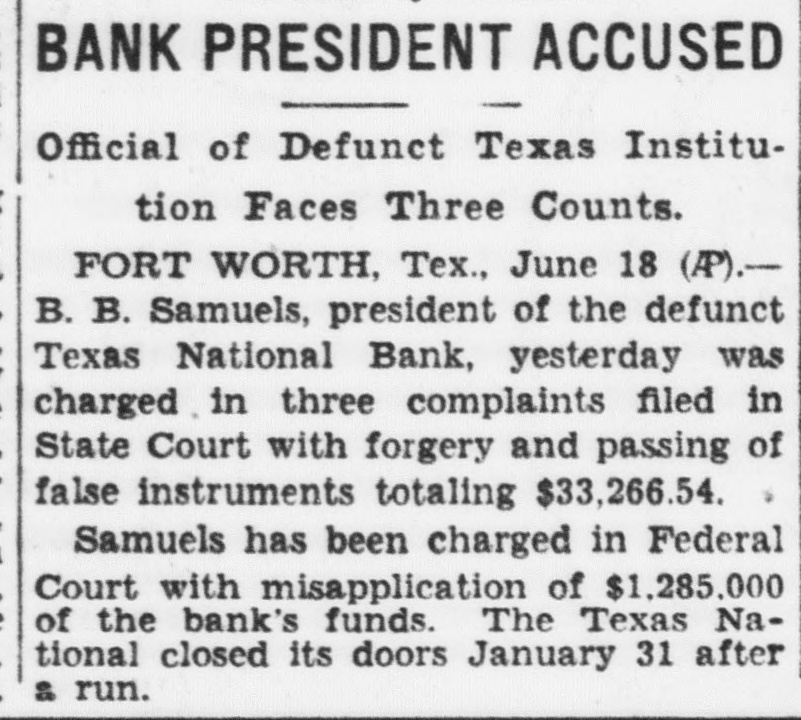

BANK PRESIDENT ACCUSED Official of Defunct Texas Institution Faces Three Counts. FORT WORTH, Tex., June 18 (P).B. B. Samuels, president of the defunct Texas National Bank, yesterday was charged in three complaints filed in State Court with forgery and passing of false instruments totaling $33,266.54. Samuels has been charged in Federal Court with misapplication of $1,285,000 of the bank's funds. The Texas National closed its doors January 31 after = run.

19.

July 22, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

SUES ON DEBT TO BANK

Receiver R. Van Zandt of the Texas National Bank yesterday filed suit Federal Court to collect notes held by the bank. One note. $3.500. signed by W. Arnold. and the other. for $2,000. signed by Herbert Voss and Ethel B. Anderson.

20.

July 22, 1930

Fort Worth Record-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

SUES ON DEBT TO BANK

Receiver R. Van Zandt of the Texas National Bank yesterday filed suit in Court to collect two held by the bank signed Arnold the for Herbert Voss and Ethel B. An derson.

21.

January 21, 1931

The St. Louis Star and Times

St. Louis, MO

Click image to open full size in new tab

Article Text

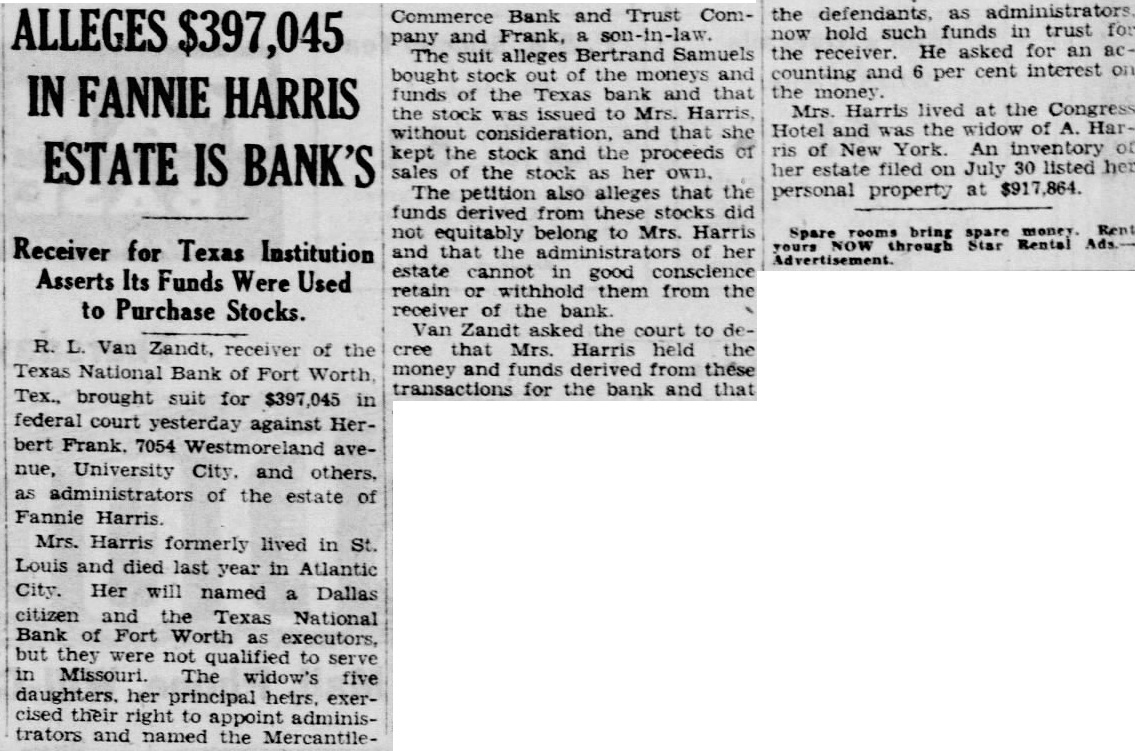

ALLEGES $397,045 IN FANNIE HARRIS ESTATE IS BANK'S

Receiver for Texas Institution Asserts Its Funds Were Used to Purchase Stocks.

R. L. Van Zandt, receiver of the Texas National Bank of Fort Worth Tex., brought suit for $397,045 in federal court yesterday against Herbert Frank. 7054 Westmoreland avenue, University City and others. as administrators of the estate of Fannie Harris. Mrs. Harris formerly lived in St. Louis and died last year in Atlantic City. Her will named a Dallas citizen and the Texas National Bank of Fort Worth as executors, but they were not qualified to serve in Missouri The widow's five daughters. her principal heirs, exercised their right to appoint administrators and named the Mercantile-

Commerce Bank and Trust Company and Frank, a son-in-law The suit alleges Bertrand Samuels bought stock out of the moneys and funds of the Texas bank and that the stock was issued to Mrs. Harris, without consideration, and that she kept the stock and the proceeds of sales of the stock as her own. The petition also alleges that the funds derived from these stocks did not equitably belong to Mrs. Harris and that the administrators of her estate cannot in good conscience retain or withhold them from the receiver of the bank Van Zandt asked the court to decree that Mrs. Harris held the money and funds derived from these transactions for the bank and that the defendants as administrators now hold such funds in trust for the receiver. He asked for an accounting and 6 per cent interest on the money Mrs. Harris lived at the Congress Hotel and was the widow of A Harris of New York. An inventory of her estate filed on July 30 listed her personal property at $917,864. bring spare Rent Spare NOW through Star Rental

22.

June 2, 1931

Fort Worth Star-Telegram

Fort Worth, TX

Click image to open full size in new tab

Article Text

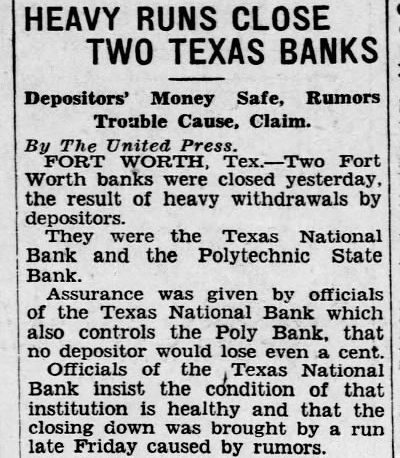

TELLER SAYS HE SECRETED 'DUMMIES' AT HOME

How dummy ledger sheets, used to mislead bank examiners to the true financial condition of the Texas National Bank were secreted in his desk and removed to his home on the night the bank failed, was revealed for the first time in Federal Court Tuesday by Turner Locke. bookkeeper. Locke, who had charge of numlarge accounts said were juggled to carry the Johnson Baker, officials of the defunct bank. The falsified records taken out of the bank were turned to United Attorney few days furnish evidence the bank's Van for institution, took the stand shortly before to testify that shortage discovered at the the He the total was found to be about $1,283,400. Water Account. This shortage. according to Locke, finally lodged in the account of Tarrant County Water Control and District No. after the exhaustion some the counts to which it previously had charged. ledger sheets intended to hide the from bank the Baker and These sheets the ledger until visit the bank examiner was anticipated, he said, and then were withdrawn and the false sheets substituted. The totals of the large accounts, said, were from the head the without actually Daily Report Prepared. In addition. he said. report was prepared inform officials of the bank to the condition of the larger One of these reports, went morning. He said was instructed by Baker state correct balances the daily reports, but that no exmade for this order. He said inledgers were kept that he "guessed" Johnson did "Didn't make the true daily sheet keep from knowing of the shortage he- was asked on cross Is Ruled Admissible. "It keep anyone from knowing Locke replied. the in regard the sheets objection from counsel. but was ruled admissible when Dodge explained its purpose. Government takes the position. sad. the of the bank. its with its condition and liable for to the Comptroller of the Currency, they sign the the indictment on which being tried charge falsification of reports on the bank's condition. Locke traced the shortages through various large accounts which said they charged and told all the except were restored by the loss count of the water district. The debit tickets instructing charges to be made against these signed the initials of Baker and Samuels, he Checks He identified checks in the indictLocke told of the creation Feb. 24. 1928. on an account, charged the Government to have been fictitious, which original overdraft was debited. The account, under the name of "B. Samuels, opened the instruction of both Baker and Samuels, he said. money ever was deposited in the account, he testified. but three subsequent made against it. One the charges enumerated charged the first of the made to Equitable Trust Company of New York. to have been applied upon a $25,000 The shortage in the trustee account transferred State and still distributed among accounts the Texas Hotel, Tarrant County Building and Loan Association, and C. Turman. special. Transfer Is Described. The transfer from the State Treasaccount made when the books showed exhausted. $263,000. He said the water district account opened of nearly and that a balance of between $60,000 and

(CONTINUED ON PAGE 4.)