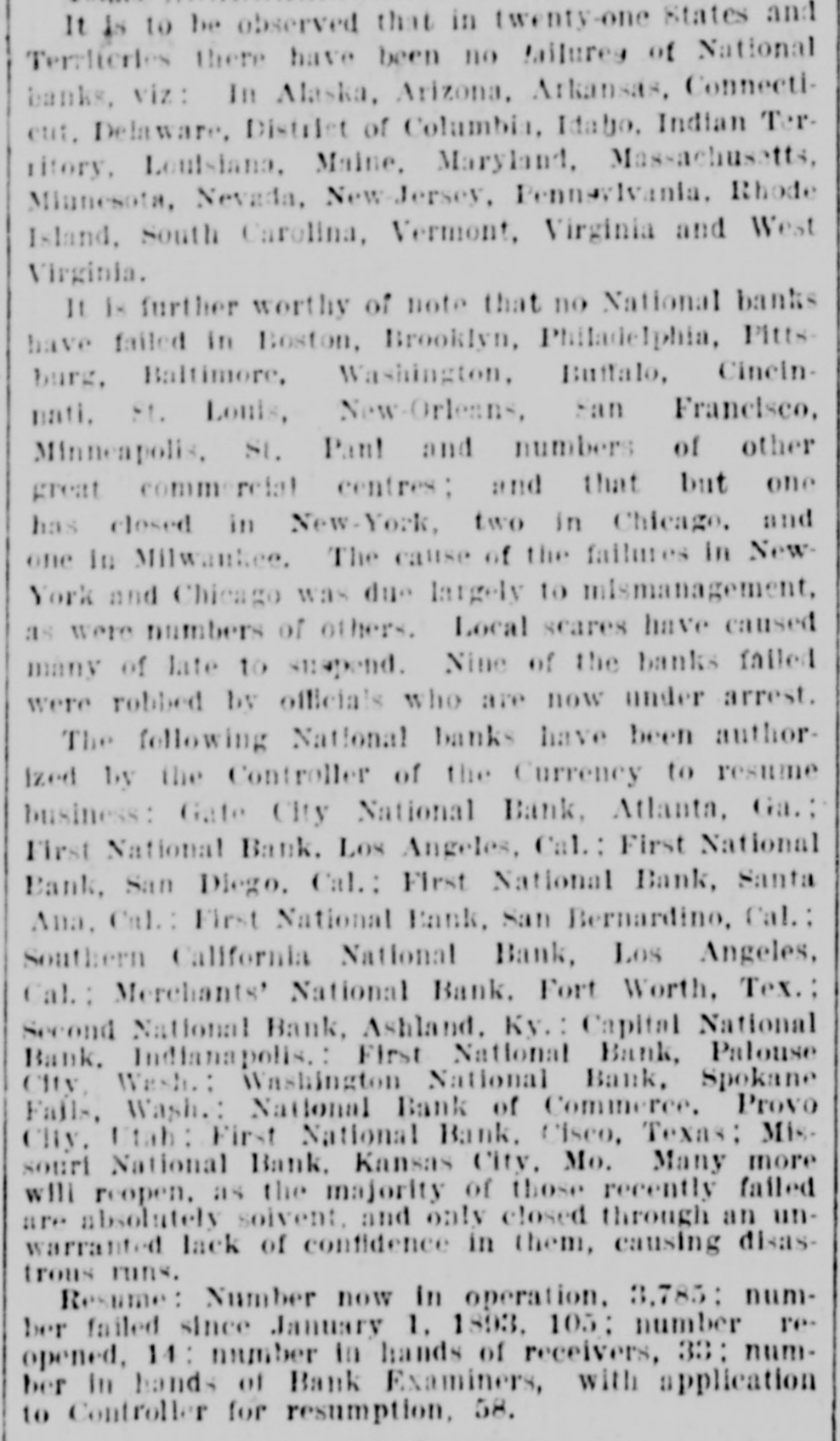

Article Text

LATE TELEGRAMS BCILED DOWN FROM PRIVATE, SPECIAL AND OTHER SOURCES. Railway strike at Paris collapses. Forty houses destroyed by fire in Guadalajara, Spain. Taylor will put up for railway connection with M. K. & T. at Trinity. President Finney, of Soo and South shore, at Minneapolis, resigns. The I. & G. N. receivership meets at Austin Monday the 27th. Governor of Minnesota and sheriff refuse to interfere in the prize fight A. Friedlander, Gainesville china merchant, fails. Two boys arrested at Tracy City, Tenn., for murdering a peadler. The state railway commission gives audience at Dallas to shippers. Jim Huntley wanted in Texas for forgery, extradited at Toronto. Mrs. Maybrick is denied the $10,000 insurance on her husband's lite. Another civil conflict is immenent in Samoa. Laredo is disconsolate over the Sunday law enforcement. San Angelo has shipped 3,000,000 pounds wool this season. Good rains at Belton give assurance of immense cotton crop. The Austin soldiers find running guard for beer rather risky business. The Austin riot is set for today, and the boys will have a circus. Major Ford is medical director of the Austin camp. Llewellen of Waco is charged with criminal assault on a young married woman. Uruguay is threatened with bankruptey. Clarkson says Quay wanted to resign immediately after Harrison's election. Patrick Kelly, Galveston jailer, from injuries received from an insane prisoner. J. S. Schweitzer's will probated at New Orleans; several public charities get from $5000 to $10,000 each. The Tennessee miners canture the militia and convicts and ship them to Knoxville. There will be bloodshed at Bruce. ville, Tenn., over the attempt to work convict miners. Gov. of Tennessee is urged to arrest and punish the miners, who took the camp. The miners threaten to destroy the bridges and burn the railroad if troops are sent Detail ha® been made for court martials at Austin, Major A. W. Houston judge advocate. San Antonio elect, ic ca's are doing temporary duty at Austin during encampment. There are about 2500 men In camp at Austin, one third regulars, the rest militia. Georgetown chautaqua closes, a nd gives a donation of $1,000 to the 80. ciety. Lawyerville, a Michigan lumber town of fifty buildings and mills, destroyed by fire Texas gets her world's fair building site set apart before the money is raised for it. Merchants national bank at Fort Worth is pronounced solvent, and will reopen in 30 days. R. Crain, San Jacinto veteran drowned in the Bosque, at Valley Mills. The Erie threatens to cat central traffic rates unless New England roads stop scalping. Reagan says rates cannot be established to give one place advantage over another. Railway committee is considering grain, cotton, lumber, and salt rates today. Silver is gradually nearing the $1 00 mark on the New York exchange. A revenue vessel will probably be sent to Eastport, Me., to protect American fishermen. Union Investment company of Kansas City, Winner's bursted concern, will be reorganized. Central bank, Kansas City, Kas., fails through failure of the Wyandotte bank. Petition for an Austrian society, to perpetuate national feeling, refused at St. Louis. An immense concourse of St. Paul people protest against the Hall-Fitzsimmons fight. Contract let for grading and ironing the road from Denison to Nebraska state line. Chairman of Chicago and Alton will pay no attention to Western Passenger association rates made without consulting them. Senator Quay has desired to resign as chairman of the republican com-