Article Text

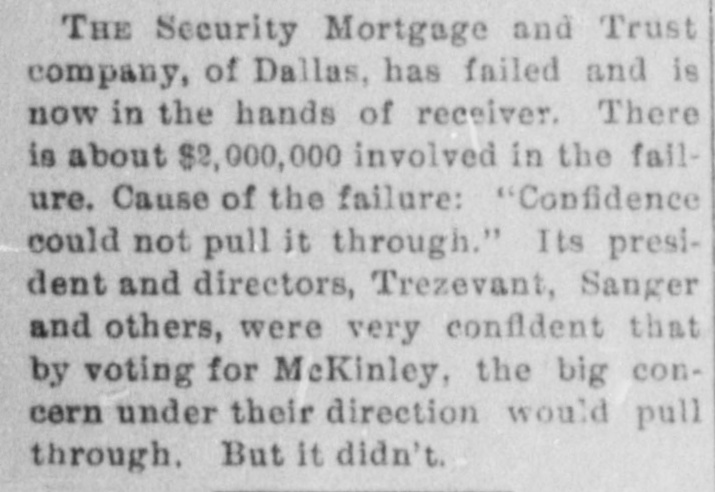

CHRONOLOGICAL Brief Notes of the More Important Happenings of 1896 THE YEAR AT HOME AND ABROAD. Financial and Industrial Interests Note ble Disasters of Various Kinds Crimes and Lynchings-ThePolitical Arena Sportsman's Column. BUSINESS FAILURES. BANKS GENERALLY INCLUDING VOLUNTARY SUSPENSIONS. Jan. -Exchange, Greeley Center. Neb. Avenue / savings, Columbus, O Ogalail of Jan Neb Bank Jan Banks at Blue Springs and Stratton, Neb -Bank of Wauneta, Neb City Jan Unneapolis bank, Jan --Irish-American, Minneapolis, Jan -Bank of Commerce, Grand Jan Neb. Island Momence. III., bank of Wilton M. Durham. .Maurice. Ia., State. CitFlemingsburg, Ky. Central Trust and Savings, Chicago. Mich Bank of Frankfort, Maynard Apple Malach River, Kan Commercial Bloomfield and Deposit Minn. Co Banking and Liberty sav Bedford ings, City, tional, Denver, Col., Apr. Grand Forks (N. D.) ational Apr. City savi Hot Springs, Ark. Fairland Bank Union City, Ind Sumner national. Wellingten May K Citizens' Edwardsburg, Mich May Jefferson.' National Bank of New England, Manches ter, Bank of Maroa, T11 June Mo ghton. national, Kan Ind Inburg, of and Bank C Cheney, Winchester, N. June H Mich Lansing, First national, llsboro, O. Omaha Rock Valley, Ia. Denison (O.) deposit Orleans bankers (Mo.) Conkling Bros., Banks Mo. Richards, Aug county Lansing, Mich $800,000 Col. City, Kan. & Son's state bank at Lowe Sioux national, Sloux City, Ia. $900. Sept First national, Beatrice, Neb Sept West bank, Du luth Minn State Loan & Trust Co. bank Ogalalla, Sept. -First national. Helena, Mont Sept Jackson county, Black River Falls, Wis. Mutual national, New Orleans Sept New Commerce Bank of Sep -Bennett national, New What com Midland state, Omaha, Neb. bank Shellsburg $449,000. bank Mapleto (Minn.) bank bank. state Argonia (Kan. (Kan bank Tribune -First national, Mount Pleasant national. Ithaca, Mich N H Duluth, Minn of Bank Buffalo, Bank 's, Atlanta, Ga ) Deposit Mecests Mich., Rapids, Marine national Duluth Minn Harpe (III.) bank national, Sloux City, Ia Sloux First national East Saginaw Mich Dakota national, Sloux Falls, S. Nov. D Nov Davis County Savings associa Mo. Gallatin tion, Tex. bank, Midlothian, national Missouri national, Kansas City Wis. Portage, estport of Bank D Baxter, of Baxter Springs, Kan. county, Tonathan Harlan Dec. Columbian Easter Bank Duluth Minn First national, Niagara, -First national. Holidaysburg, Dec Banks at Martinsburg and Williams ational bank of Illinois at Chi$1,200,000 Chicago of Minnesota, and Union Paul stocky Dec. 23-Bank of Superior, Wis American Banking & Trust Co., Auburn, Dec. 24 -Calumet state bank, Blue Island, n Dec. 26 Security Mortgage & Trust Co. Dallas, Tex.; Atlas ational, Chicago. Dec 28-Bank of Superior Wis Scan dia, Minneapoli McCoy Banking Co. LARGER OMMERCIAL CONCERNS $500,000 ES OF OR OVER. Philadelphia, Solicitors' Loan & Jan. 10-At Philadelphia, Keene, Sutter $4. Co., exporters and importers, At Minneapolis, American SavJan In and Jan. mining Belle of Nelson dis$709,242 -At New York, R &H. Adams, cotgoods ton Columbus, O., Northern Fire I Baltimore & Ohio Railroad Co. Holy oke, Mass., Albion Paper Co $500,000. Mar. 14- St. Paul, Patrick H. Kelly $1,000,000 thant; Peck Conn. Mar of plumbers' Bros. and materials; cinnati, Smith & Nixon, Apr dealers; plano Little Rock, Ark., James E. Detroit, J. L. Hudson & Co. $500,000. May New York, American Trading Akron, O., Ferdinand Schu May president American Cereal Co. St. Louis, United Eleva Cal. Jacob Rich, and Mich.. James T. $500. Buggy Co Aug Bay City Samuel G. M. Gates, Chicago, Moore Bros. dealers In Diamond and New York Biscuit stocks -At Chicago, George W. Hankins: Aug. B1 13-At New York. S. F. Myers Aug & $500,000 jewelers, manufacturing York. Archor & Pan$800,000. coast Alexandria, Ind., Union Steel New York, Hilton, H lughes & City Ia., Whita Terre Haute and Indianapolis Slade and F H Clough Clear woolen mills, Bur$1,000,000 rellville. Malting & Elevate $500.00 Dec. 6-Norton & Co., millers, Chicago $500,000 Dec. 28-W. M & J. 8. Van Nortwick bankers.and manufacturers, at Batavia III.: $2,000,000. CASUALTIES