Click image to open full size in new tab

Article Text

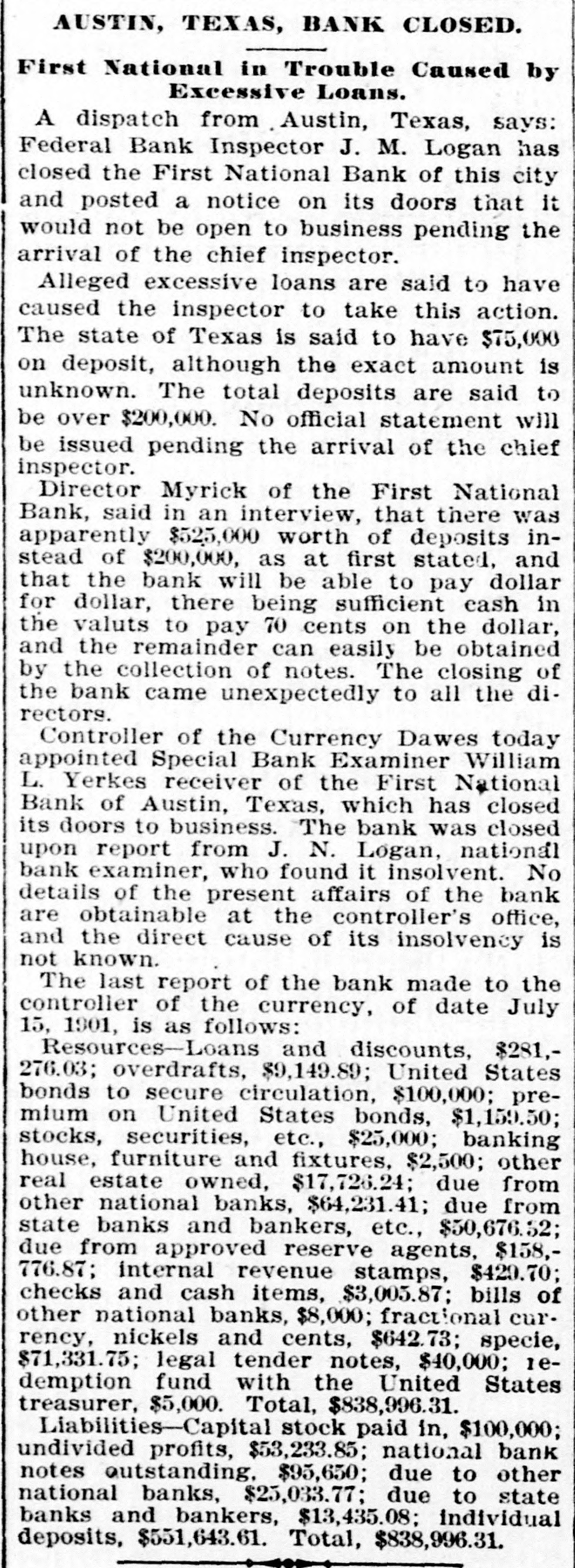

AUSTIN, TEXAS, BANK CLOSED. First National in Trouble Caused by Excessive Loans. A dispatch from Austin, Texas, says: Federal Bank Inspector J. M. Logan has closed the First National Bank of this city and posted a notice on its doors that it would not be open to business pending the arrival of the chief inspector. Alleged excessive loans are said to have caused the inspector to take this action. The state of Texas is said to have $75,000 on deposit, although the exact amount is unknown. The total deposits are said to be over $200,000. No official statement will be issued pending the arrival of the chief inspector. Director Myrick of the First National Bank, said in an interview, that there was apparently $525,000 worth of deposits instead of $200,000, as at first stated, and that the bank will be able to pay dollar for dollar, there being sufficient cash in the valuts to pay 70 cents on the dollar, and the remainder can easily be obtained by the collection of notes. The closing of the bank came unexpectedly to all the directors. Controller of the Currency Dawes today appointed Special Bank Examiner William L. Yerkes receiver of the First National Bank of Austin, Texas, which has closed its doors to business. The bank was closed upon report from J. N. Logan, national bank examiner, who found it insolvent. No details of the present affairs of the bank are obtainable at the controller's office, and the direct cause of its insolvency is not known. The last report of the bank made to the controller of the currency, of date July 15, 1901, is as follows: Resources-Loans and discounts, $281,276.03; overdrafts, $9,149.89; United States bonds to secure circulation, $100,000; premium on United States bonds, $1,159.50; stocks, securities, etc., $25,000; banking house, furniture and fixtures, $2,500; other real estate owned, $17,726.24; due from other national banks, $64,231.41; due from state banks and bankers, etc., $50,676.52; due from approved reserve agents, $158,776.87; internal revenue stamps, $420.70; checks and cash items, $3,005.87; bills of other national banks, $8,000; fractional currency, nickels and cents, $642.73; specie, $71,331.75; legal tender notes, $40,000; redemption fund with the United States treasurer, $5,000. Total, $838,996.31. Liabilities-Capital stock paid in, $100,000; undivided profits, $53,233.85; national bank notes outstanding, $95,650; due to other national banks, $25,033.77; due to state banks and bankers, $13,435.08; individual deposits, $551,643.61. Total, $838,996.31.