Click image to open full size in new tab

Article Text

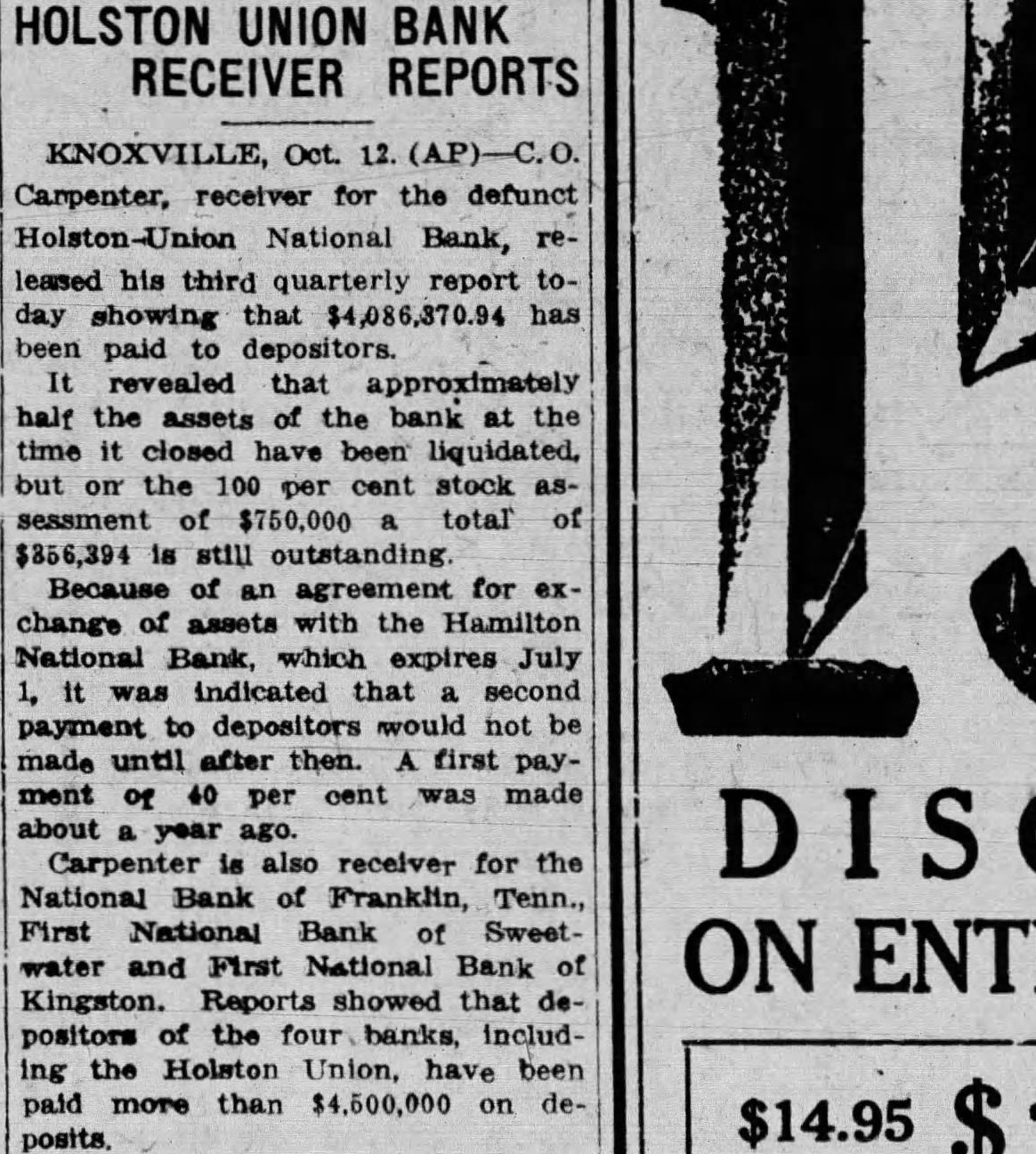

HOLSTON UNION BANK RECEIVER REPORTS

KNOXVILLE, Oct. 12. Carpenter, receiver for the defunct Holston-Union National Bank, released his third quarterly report today showing that $4,086,370.94 has been paid to depositors. It revealed that approximately half the assets of the bank at the time it closed have been liquidated. but on the 100 per cent stock assessment of $750,000 total of $356,394 is still outstanding Because of an agreement for exchange assets with the Hamilton National Bank, which expires July 1, it was indicated that second payment to depositors would not be made until after then. A. first payment of 40 per cent was made about year ago. Carpenter is also receiver for the National Bank of Franklin, Tenn., First National Bank of Sweetwater and First National Bank of Kingston. Reports showed that depositors of the four banks, including the Holston Union, have been paid more than $4,500,000 on de$14.95 posits.