Article Text

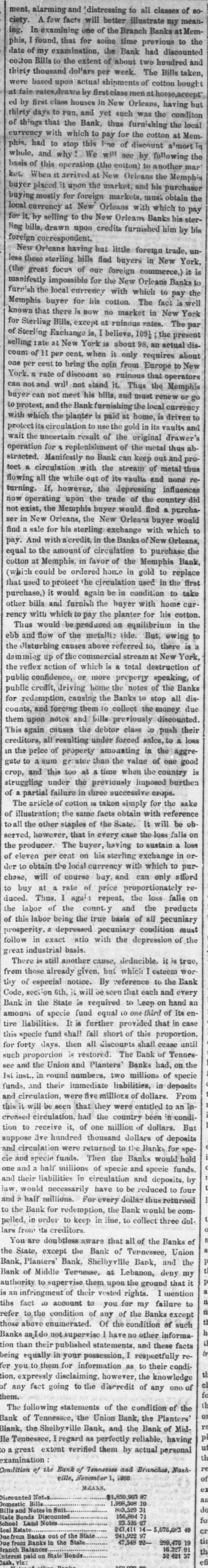

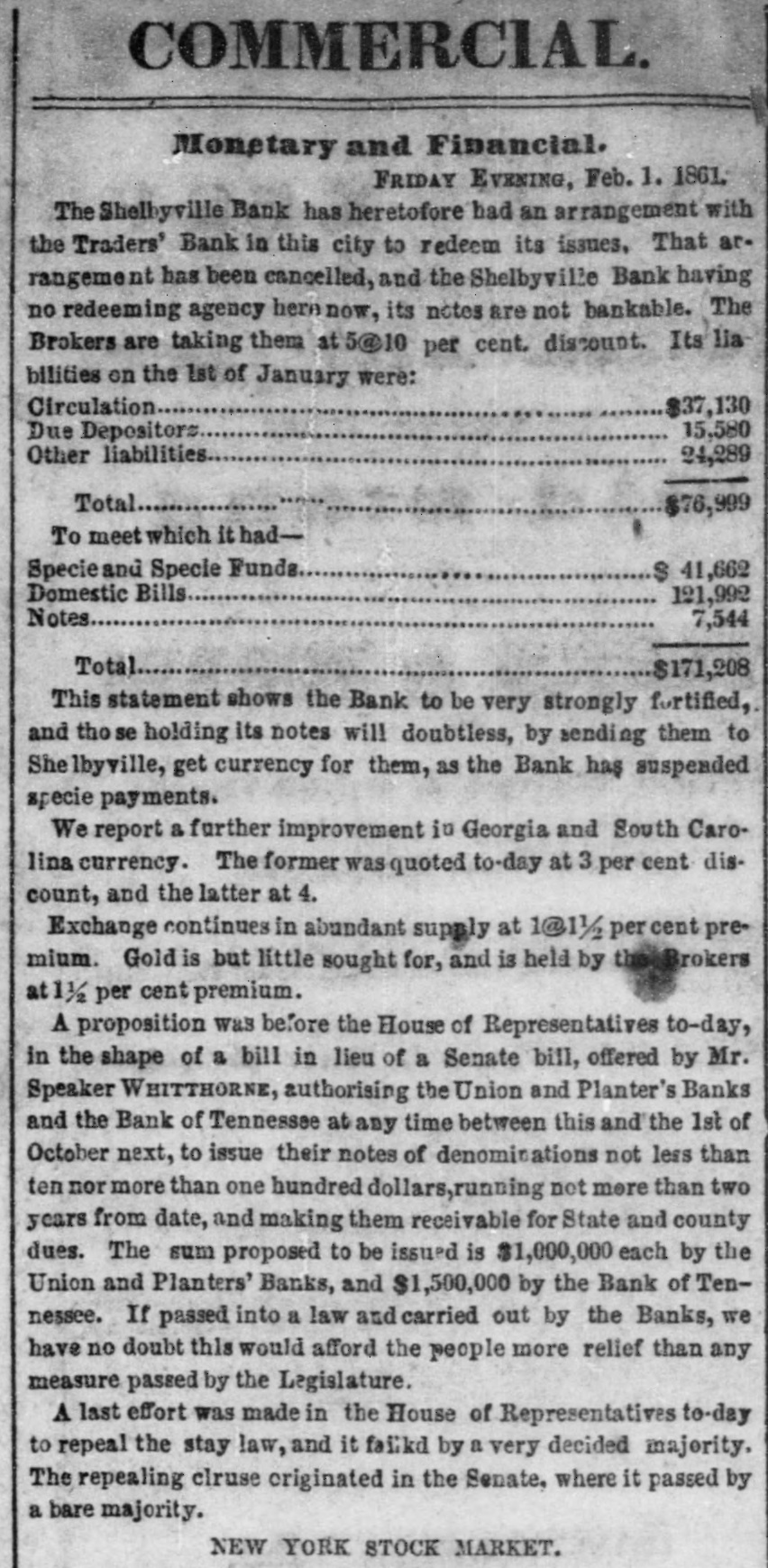

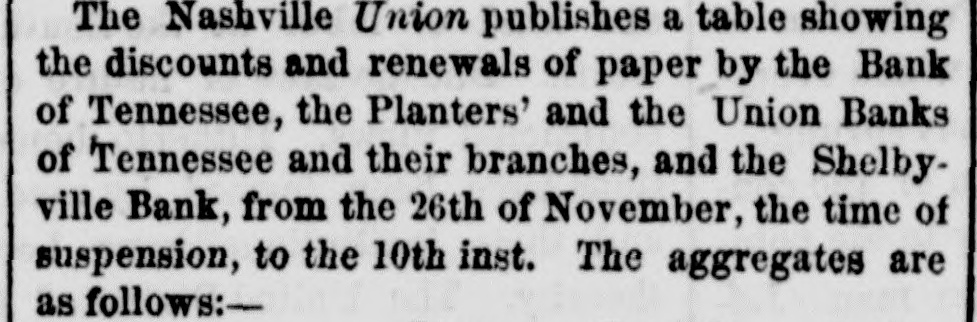

-08 JO classes II" 03 pus Surmary ciety. A few facts will better illustrate my meanBranch the Jo euo Suy phis, found, that for soine time previous to the date of my examination, the Bank had discounted cotton Bills to the extent of about two hundred and thirty thousand dol'ars per week. The Bills taken, were based upon actual shipments of cotton bough at fair rates,drawn by first class men at home,accept ed by first class houses in New Orleans, having but thirty days to run, and yet such was the conditon of things that the Bank, thus furnishing the local currency with which to pay for the cotton at Memas piscount Jo out siq1 dots 01 had 'sryd whole, and why We will see by following the basis of this operation (the eotton) to another mar ket. When it arrived at New Orleans the Memphis buyer placed it upon the market, and his purchaser buying mostly for foreign markets, must obtain the local currency at New Orleans with which to pay for by selling to the New Orleans Banks his sterling bills, drawn upon credits furnished him by bis foreign correspondent. New Orleans having but little foreign trade, unless these sterling bills find buyers in New York, st 4! ano jo focus Breat )the manifestly impossible for the New Orleans Banks to furnish the local currency with which to pay the Memphis buyer for his cotton. The fact is well known that there is now no market in New York for Sterling Bills, except at ruinous rates. The par quesand : 1601 believe "st Sugars Jo selling rate at New York is about 98, an actual discount of 11 per cent, when it only requires about one per cent to bring the coin from Europe to New York. 8 rate of discount so ruinous that operators can not and will not stand it. Thus the Memphis buyer can not meet his bills, and must renew or go to protest, and the Bank furnishing the local currency 04 usang 81 home 18 pind 81 planter the which protect its circulation to use the gold in its vaults and wait the uncertain result of the original drawer's operation for 8 replenishment of the metal thus abstracted. Manifestly no Bank can keep out and protect a circulation with the stream of metal thus -ast euou pus 61! 10 no while the II" Surmoy turning. If, however, the depressing influences PIP country am jo орвл the uodn operature Mou not exist, the Memphis buyer would find & purchaser in New Orleans, the New Orleans buyer would find a sale for his sterling exchange with which to pay. And with acredit, in the Banks of New Orleans, equal to the amount of circulation to purchase the cotton at Memphis, in favor of the Memphis Bank, (which could be ordered home in gold to replace that used to protect the circulation used in the first 02[1] 01 condition u! 09 mede pinom # ('esupand other bills and furnish the buyer with home cur rency with which to pay the planter for his cotton. Thus would be produced an equilibrium in the 04 Surme and appli metal the Jo Moy put qqa the disturbing causes above referred to, there is damming up of the commercial stream at New York, the reflex action of which is R total destruction of public confidence, or more preperly speaking, of public credit, driving home the notes of the Banks -sip II" dois 01 Banks the canaling Joj onp money am collect 01 them Subject puv country them upon notes and bills previously discounted. This again causes the debtor class to push their creditors, all resulting under forced sales, to a loss hhe u! Superous Maadead 10 en ut pood auo jo Anjua the uuq: JOJE " was 01 mus st country on when time ' 1" 001 sin pus 'do.ro pasodum the Jopun sdore successive chice u! Failure particl B jo The article of cotton IS taken simply for the sake of illustration; the same facts obtain with reference -qo eq II!M 41 mmg one 10 other the that served, however, that in every case the loss falls on the producer. The buyer, having to sustain a loss of eleven per cent on his sterling exchange in order to obtain the local currency with which to purрлода only use pus Anq counse Jo 111 chase -as paid jo B 111 Ang 01 duced. Thus, I again repeat, the loss falls on the labor of the count.y and the products of this labor being the true basis of all pecuniary prosperity, a depressed pecuniary condition must follow in exact atio with the depression of the great industrial basis. There is still another cause, deducible. it is true, from those already given. but which esteem wor thy of especial notice. By reference to the Bank Code, sec on 6th, it will be seen that each and every UB has uo dear 04 ST State am u! Bank -ua #11 jo print euo 01 June punj speate Jo junome tire liabilities. It is further provided that in case this specie fund shall fall short of this proportion, until for forty days, then all discounts shall cease such proportion is restored. The Bank of Tennesand the Union and Planters' Banks had, on the specie jo millings OMT "staquinu puno. u! aas 181 funds, and their immediate liabilities, in deposits and circulation, were five millions of dollars. From this it will be seen that they were entitled to an increased circulation, had the country been in condition to receive it, of one million of dollars. But peperits 10 pursnoqi ag asoddns and circulati were returned to the Banks for specie and specie funds. Then the Banks would hold one and a half millions of specie and specie funds. 4q susodep pur checkstic a! amount per anoj 01 eq 01 DAVE Decessarily plnom MIL and a half millions. For every dollar thus returned to the Bank for redemption, the Bank would be compelled, in order to keep in line, to collect three dolcreditors 811 ano.y 8.18] You are doubtless aware that all of the Banks of the State, except the Bank of Tennessee, Union Bank, Planters Bank. Shelbyvllle Bank, and the Bank of Middle Ternesse, at Lebanon, deny my # THIS punoas am nodn them 01 is an infringment of their vested rights. I mention tihs fact to account to you for my failure to except Banks and Jo AUB jo condition the 01 refer those above enumerated. Of the condition of such informa- other ou have I op1st Ranks tion than their published statements, and these facts being equally in your possession, respectfully re11 fer you to them for information as to their condition, expressly disclaiming, however, the knowledge Jo euo Aug Jo the 07 Sujos the Aue JO them. The following statements of the condition of the Bank of Tennessee, the Union Bank, the Planters' Blank, the Shelbyville Bank, and the Bank of Midd lle Tennessee, regard as perfectly reliable, having to great extent verified them by actual personal Condition of examination the Bank of Tennessee and Branches, Nash 0981 'I 'ma 'SNV2K 28 E06'098'1$ Discounted Not.s #1118 of 806'866'1 Bills Domestic and Notes Suit 1-08'991 State Bonds Discounted School Land Notes OF ERD'940'S Real Estate 13 L6 266'116 from Banks out of the State 113 61 815'51 ams eus at Banks most and on( Branch Interest paid on Balances State Bonds ZIA