Click image to open full size in new tab

Article Text

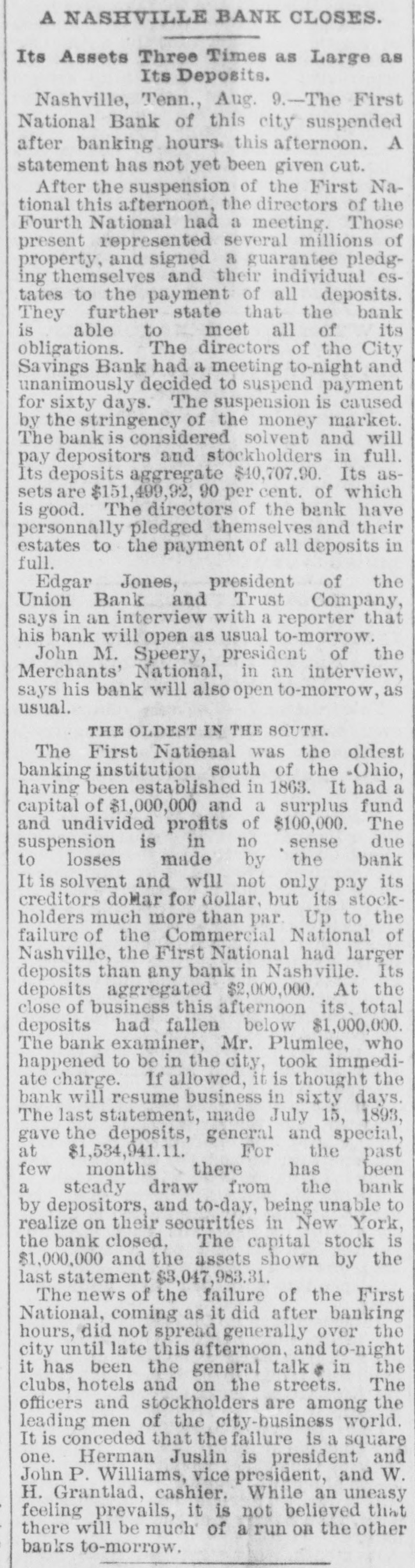

A NASHVILLE BANK CLOSES. Its Assets Three Times as Large as Its Deposits. Nashville, Tenn., Aug. 9.-The First National Bank of this city suspended after banking hours this afternoon. A statement has not yet been given cut. After the suspension of the First National this afternoon, the directors of the Fourth National had a meeting. Those present represented several millions of property, and signed a guarantee pledging themselves and their individual estates to the payment of all deposits. They further state that the bank is able to meet all of its obligations. The directors of the City Savings Bank had a meeting to-night and unanimously decided to suspend payment for sixty days. The suspension is caused by the stringency of the money market. The bank is considered solvent and will pay depositors and stockholders in full. Its deposits aggregate $40,707.90. Its assets are $151,499,92, 90 per cent. of which is good. The directors of the bank have personnally pledged themselves and their estates to the payment of all deposits in full. Edgar Jones, president of the Union Bank and Trust Company, says in an interview with a reporter that his bank will open as usual to-morrow. John M. Speery, president of the Merchants' National, in an interview, says his bank will also open to-morrow, as usual. THE OLDEST IN THE SOUTH. The First National was the oldest banking institution south of the -Ohio, having been established in 1863. It had a capital of $1,000,000 and a surplus fund and undivided profits of $100,000. The suspension is in no sense due to losses made by the bank It is solvent and will not only pay its creditors doMar for dollar, but its stockholders much more than par. Up to the failure of the Commercial National of Nashville, the First National had larger deposits than any bank in Nashville. Its deposits aggregated $2,000,000. At the close of business this afternoon its total deposits had fallen below $1,000,000. The bank examiner, Mr. Plumlee, who happened to be in the city, took immediate charge. If allowed, it is thought the bank will resume business in sixty days. The last statement, made July 15, 1893, gave the deposits, géneral and special, at the For $1,534,941.11. past few months there has been a steady draw from the bank by depositors, and to-day, being unable to realize on their securities in New York, the bank closed. The capital stock is $1,000,000 and the assets shown by the last statement $8,047,983.31. The news of the failure of the First National, coming as it did after banking hours, did not spread generally over the city until late this afternoon, and to-night it has been the general talk e in the clubs, hotels and on the streets. The officers and stockholders are among the leading men of the city-business world. It is conceded that the failure is a square one. Herman Juslin is president and John P. Williams, vice president, and W. H. Grantlad, cashier. While an uneasy feeling prevails, it is not believed that there will be much of a run on the other banks to-morrow.