Article Text

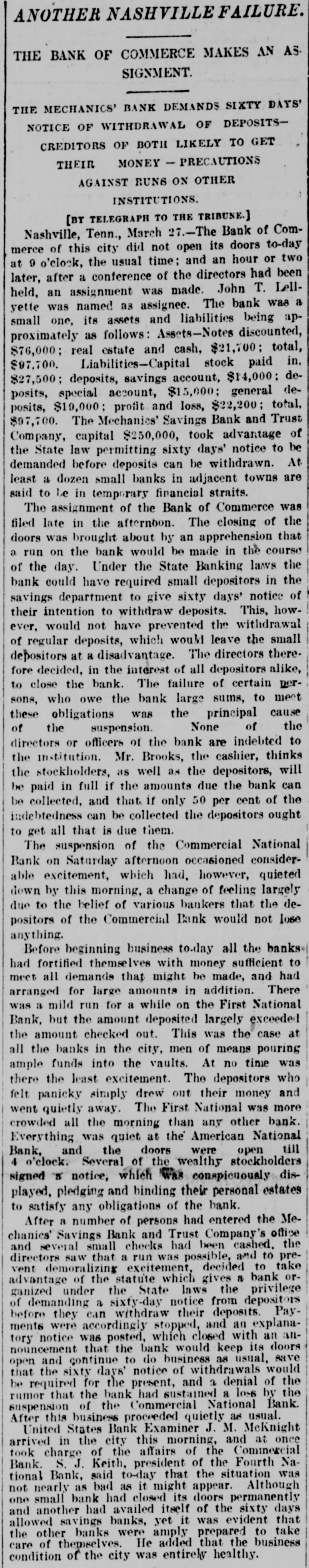

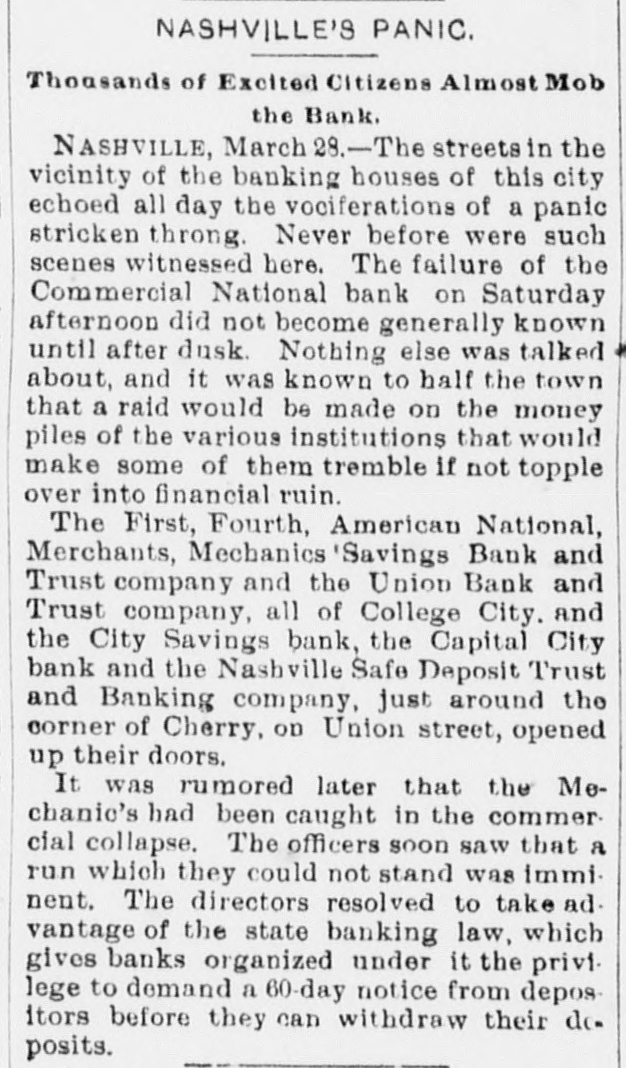

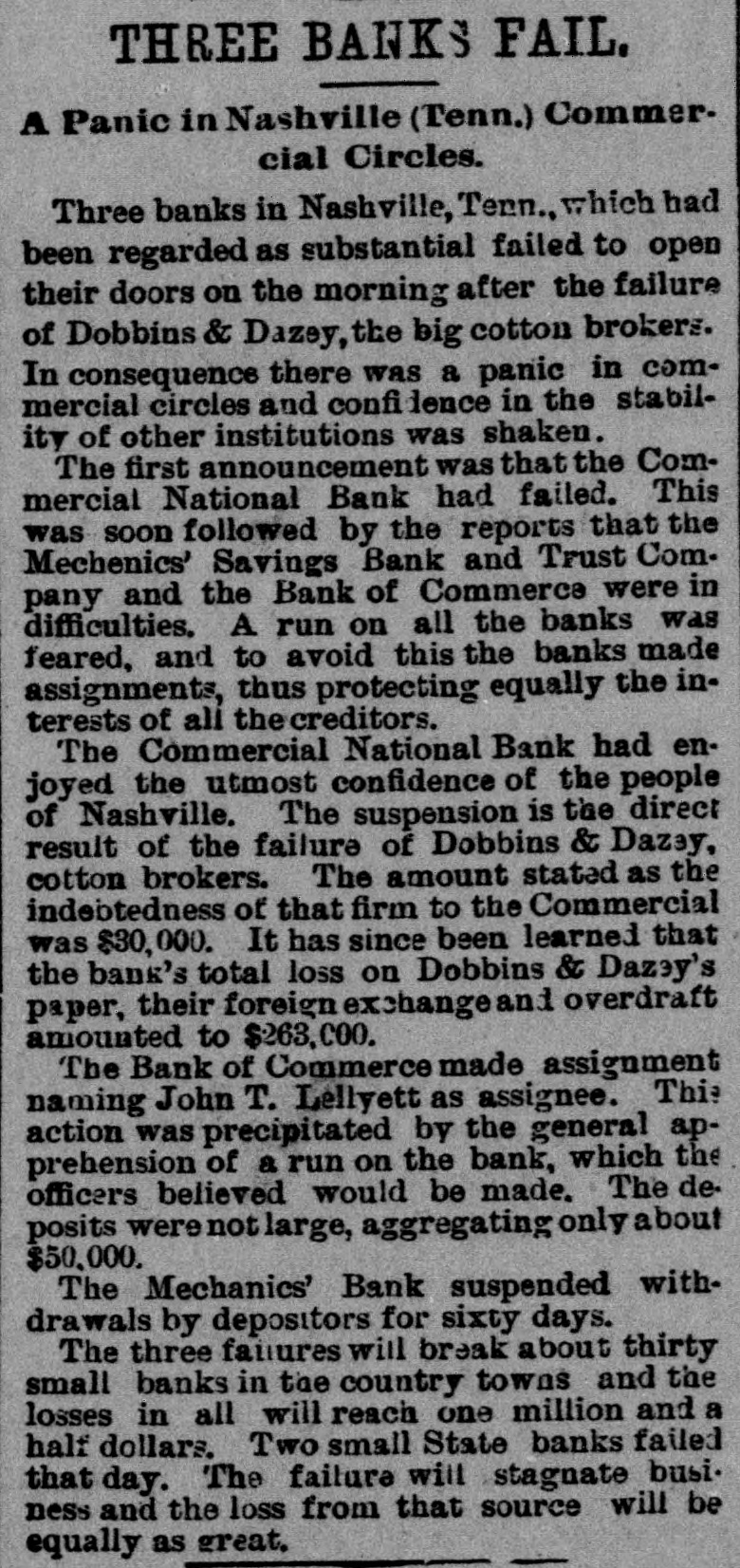

ANOTHER NASHVILLE FAILURE. THE BANK OF COMMERCE MAKES AN AS SIGNMENT THE MECHANICS' BANK DEMANDS SIXTY DAYS' NOTICE OF WITHDRAWAL OF DEPOSITSCREDITORS OF BOTH LIKELY TO GET THEIR MONEY - PRECAUTIONS AGAINST RUNS ON OTHER INSTITUTIONS. [BY TELEGRAPH TO THE TRIBUNE.] Nashville, Tenn., March 27.-The Bank of Commerce of this city did not open its doors to-day at 9 o'clock, the usual time: and an hour or two later, after a conference of the directors had been held, an assignment was made. John T. Lellyette was named as assignee. The bank was a small one, its assets and liabilities being approximately as follows: Assets-Notes discounted, $76,000; real estate and cash, $21,700; total, $97,700. Liabilities-Capital stock paid in. $27,500; deposits, savings account, $14,000; deposits, special account, $15,000; general deposits, $19,000; profit and loss, $22,200; total, $97,700. The Mechanics' Savings Bank and Trust Company, capital $250,000, took advantage of the State law permitting sixty days' notice to be demanded before deposits can be withdrawn. At least a dozen small banks in adjacent towns are said to Le in temporary financial straits. The assignment of the Bank of Commerce was filed late in the afternoon. The closing of the doors was brought about by an apprehension that a run on the bank would be made in the course of the day. Under the State Banking laws the bank could have required small depositors in the savings department to give sixty days' notice of their intention to withdraw deposits. This, however, would not have prevented the withdrawal of regular deposits, which would leave the small depositors at a disadvantage. The directors there. fore decided, in the interest of all depositors alike, to close the bank. The failure of certain persons, who owe the bank large sums, to meet these obligations was the principal cause of the suspension. None of the directors or officers of the bank are indebted to the institution. Mr. Brooks, the cashier, thinks the stockholders, as well as the depositors, will be paid in full if the amounts due the bank can be collected, and that if only 50 per cent of the indebtedness can be collected the depositors ought to get all that is due them. The suspension of the Commercial National Bank on Saturday afternoon occasioned considerable excitement, which had, however, quieted down by this morning, a change of feeling largely due to the belief of various bankers that the depositors of the Commercial Bank would not lose anything. Before beginning business to-day all the banks had fortified themselves with money sufficient to meet all demands that might be made, and had arranged for large amounts in addition. There was a mild run for a while on the First National Bank, but the amount deposited largely exceeded the amount checked out. This was the case at all the banks in the city, men of means pouring ample funds into the vaults. At no time was there the least excitement. The depositors who felt panicky simply drew out their money and went quietly away. The First National was more crowded all the morning than any other bank. Everything was quiet at the American National Bank, and the doors were open till 4 o'clock. Several of the wealthy stockholders signed a notice, which was conspicuously displayed, pledging and binding their personal estates to satisfy any obligations of the bank. After a number of persons had entered the Mechanics' Savings Bank and Trust Company's office and several small checks had been cashed, the directors saw that a run was possible, and to prevent demoralizing excitement, decided to take advantage of the statute which gives a bank organized under the State laws the privilege of demanding a sixty-day notice from depositors before they can withdraw their deposits. Payments were accordingly stopped, and an explanatory notice was posted, which closed with an announcement that the bank would keep its doors open and continue to do business as usual, save that the sixty days' notice of withdrawals would be required for the present, and a denial of the rumor that the bank had sustained a loss by the suspension of the Commercial National Bank. After this business proceeded quietly as usual. United States Bank Examiner J. M. McKnight arrived in the city this morning, and at once took charge of the affairs of the Commercial Bank. S. J. Keith, president of the Fourth National Bank, said to-day that the situation was not nearly as bad as it might appear. Although one small bank had closed its doors permanently and another had availed itself of the sixty days allowed savings banks, yet it was evident that the other banks were amply prepared to take care of themselves. He added that the business condition of the city was entirely healthy.