Click image to open full size in new tab

Article Text

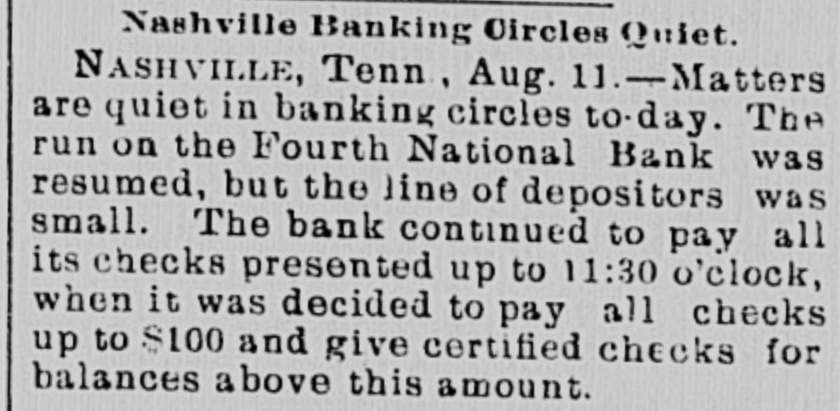

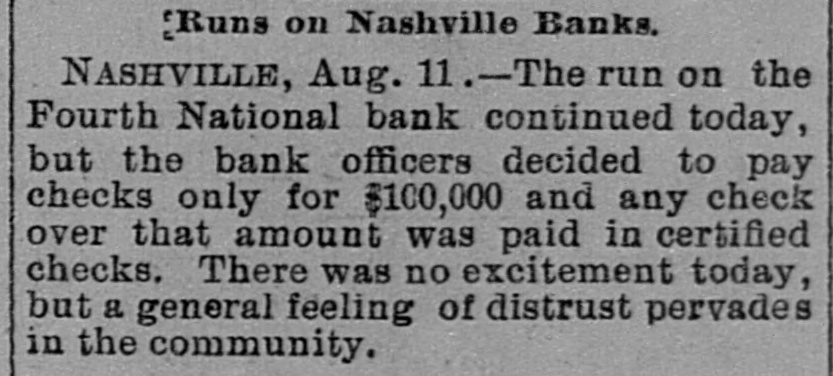

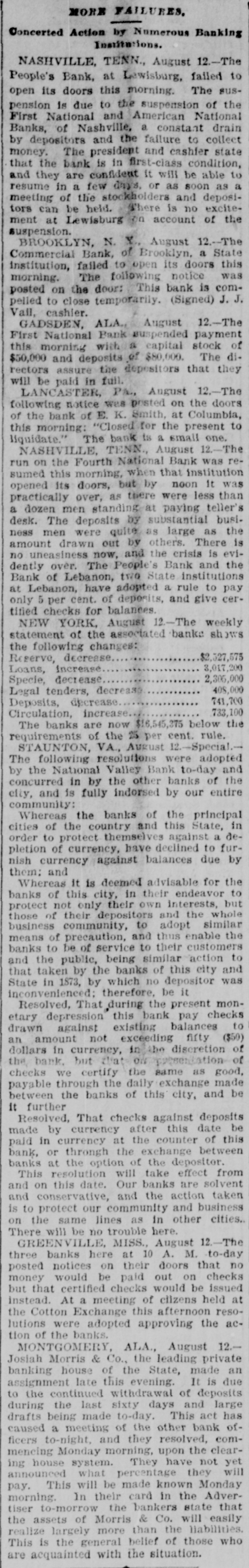

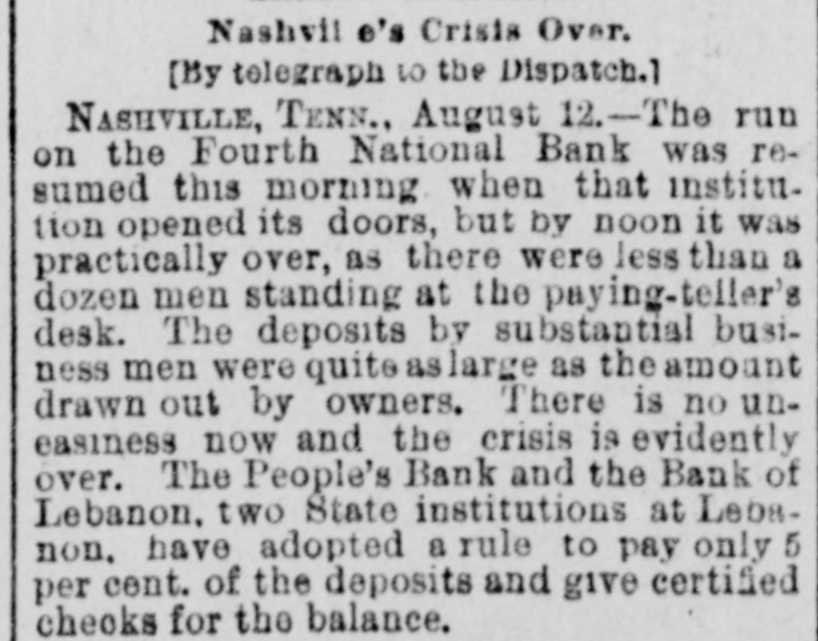

Concerted Action by Numerous Banking Institutions. NASHVILLE, TENN., August 12.-The People's Bank, at Lewisburg, failed to open its doors this morning. The suspension is due to the suspension of the First National and American National Banks, of Nashville, a constant drain by depositors and the failure to collect The president and cashier state bank is in are confident It will be to money. and that they the first-class condition, able a resume in a few days, or as soon as meeting of the stockholders and depositors can be held. There is no excite+ ment at Lewisburg on account of the suspension. BROOKLYN, N. Y., August 12.--The Commercial Bank, of Brooklyn, a State institution, failed to open its doors this morning. The following notice was posted on the door: This bank is compelled to close temporarily. (Signed) J.J. Vall, cashier. GADSDEN, ALA. August 12.-The First National Bank suspended payment this morning with a capital stock di- of $50,000 and deposits of $80,000. The rectors assure the depositors that they will be paid in full. LANCASTER, Pa., August 12.-The following notice was posted on the doors of the bank of E. K. Smith, at Columbia, this morning: "Closed for the present to liquidate." The bank is a small one. NASHVILLE, TENN., August 2.-The Fourth National Bank was rewhen that its doors, but by noon sumed opened run on this the morning, institution it than was practically over, as there were less dozen men standing at paying teller's desk. a The deposits by substantial busimen were quite as large as the ness amount drawn out by others. There is uneasiness now, and the crisis is evino dently over. The People's Bank and the Bank of Lebanon, two State institutions Lebanon, have adopted a rule to pay at only 5 per cent. of deposits, and give certitled checks for balances. NEW YORK, August 12.-The weekly statement of the associated banke shows the following changes: $2,327,575 Reserve, decrease 3,017,200 Loans, increase 2,306,000 Specie, decrease 408,000 Legal tenders, decrease 741,700 Deposits, decrease 733,100 Circulation, The banks increase. are now $16,545,375 below the requirements of the 25 per cent. rule. STAUNTON, VA., August -Special The following resolutions were adopted by the National Valley Bank to-day and the concurred in by the other banks of city, and is fully indorsed by our entire community: Whereas the banks of the principal of the country and this State, de- in cities order to protect themselves against a pletion of currency, have declined to furnish currency against balances due by them: and Whereas it is deemed advisable for the of this city, in their endeavor to not only their own of their depositors and the banks protect those adopt interests, similar whole but community, to of and thus to be of service to their to business banks means precaution, enable customers action the the public, being similar and and taken by the banks of this city State that in 1873, by which no depositor was inconvenienced; therefore, be it Resolved, That during the present checks mondepression this bank pay to etary against existing balances drawn amount not exceeding fifty ($50) of an dollars in currency, in the discretion the bank. but that ON good, of checks we certify the same as payable through the daily exchange and made be between the banks of this city, it further Resolved, That checks against deposits be by currency after this date of this made in currency at the counter between bank, paid or through the exchange banks at the option of the depositor. resolution will take effect from This this date. Our banks are solvent and and on conservative, and the action taken is to protect our community and business cities. on the same lines as in other There will be no trouble here. GREENVILLE, MISS., August 12. to-day The banks here at 10 A. M. three notices on their doors that checks no posted would be paid out on issued money that certified checks would be at instead. but At a meeting of cilzens held the Cotton Exchange this afternoon reso- aclutions were adopted approving the tion of the banks. MONTGOMERY, ALA., August 12.Josiah Morris & Co., the leading private an banking house of the State, made is due assignment late this evening. It continued withdrawal of deposits to during the the last sixty days and large drafts being made to-day. This act has ofcaused a meeting of the other bank to-night, and they resolved, clear- commencing ficers Monday morning, upon the not yet ing house system. what percentage They have they will announced This will be made known Monday pay. In their card in the Adverthe bankers of Morris & Co. tiser morning. assets to-morrow will state liabilities. easily that the largely more than the who This realize is the general belief of those are acquainted with the situation.