Click image to open full size in new tab

Article Text

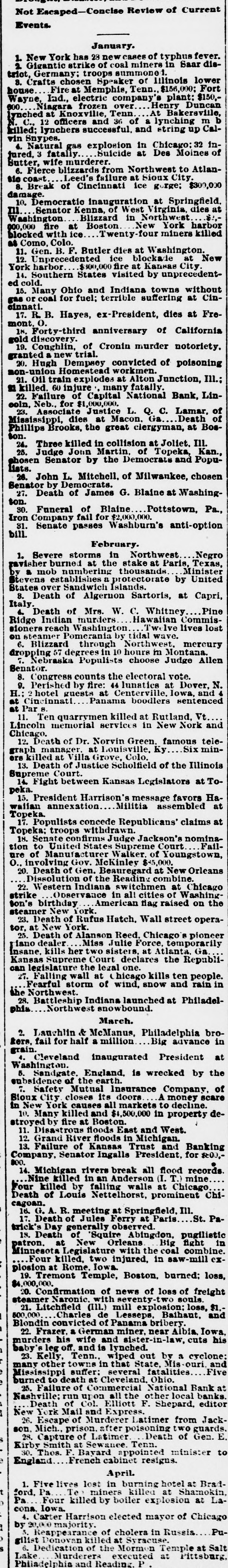

Not Escaped-Concise Review of Current Events. January. 1. New York has 23 new cases of typhus fever. 2. Gigantic strike of coal miners in Saar distriot, Germany; troops summone 8. Crafts chosen Speaker or Illinois lower house. Fire at Memphis, Tenn., $156,000; Fort Wayne, Ind., electric company's plant: $150,000. Niagara frozen over. Henry Duncan lynched at Knoxville, Tenn. At Bakersville, b C., 12 officers and 36 of a lynching m killed: lynchers successful. and string up Calvin Snypes. 4. Natural gas explosion in Chicago: 32 infured, 3 fatally Suicide at Des Moines of Butter, wife murderer. 6. Fierce blizzards from Northwest to Atlantie coast Leed's failure at Sioux City. 8. Break of Cincinnati Ice gorge: $300,000 damage. 10. Democratic inauguration at Springfield. III Senator Kenna, of West Virginia, dies at $1,Washington Blizzard in Northwest 000,000 fire at Boston New York harbor blocked with ice Twenty four miners killed at Como, Colo. 11. Gen. B. F. Butler dies at Washington. 12. Unprecedented ice blockade at New York harbor. $300,000 fire at Kansas City. 14. Southern States visited by unprecedented cold. 15. Many Ohio and Indiana towns without gas or coal for fuel; terrible suffering at Cincinnati. 17. R. B. Hayes, ex-President, dies at Fremont O. 18. Forty-third anniversary of California discovery. gold 19. Coughlin, of Cronin murder notoriety. granted a new trial. 20. Hugh Dempsey convicted of poisoning mon-union Homestead workmen. 21. Oil train explodes at Alton Junction, Ill.; a killed. 60 injure many fatally. 22. Failure of Capital National Bank, Lincoin, Neb., for $1,000,000. 23. Associate Justice L. Q. C. Lamar, of Mississippi, dies at Macon. Ga. Death of ton. Phillips Brooks, the great clergyman, at Bos24. Three killed in collision at Joliet. III. 25. Judge John Martin, of Topeka, Kan., lists. phosen Senator by the Democrats and Popu26. John L. Mitchell, of Milwankee, chosen Senator by Democrats. ton. 27. Death of James G. Blaine at Washing30. Funeral of Blaine Pottstown, Pa., Iron Company fail for $2,000,000. bill. 31. Senate passes Washburn's anti-option February. 1. Severe storms in Northwest Negro ravisher burned at the stake at Paris, Texas, by a mob numbering thousands Minister Stevens establishes a protectorate by United States over Sandwich Islands. Italy. 8. Death of Algernon Sartoris, at Capri, 4. Death of Mrs. W. C. Whitney Pine Ridge Indian murders. Hawaiian Commissioners reach Washington. Ive lives lost on steamer Pomerania by tidal wave. 6. Blizzard through Northwest, mercury dropping 57 degrees in 10 hours in Montana. Senator. Nebraska Populists choose Judge Allen 8. Congress counts the electoral vote. 9. Perished by fire: 44 lunatics at Dover, N. H.: hotel guests at Centerville. Iowa, and 4 at Cincinnati Panama boodlers sentenced at Par 8. 11. Ten quarrymen killed at Rutland, Vt Chicago. Lincoln memorial services in New Nork and 12. Death of Dr. Norvin Green, famous teleSix mingraph manager. at Louisville, Ky ers killed at Villa Grove, Colo. 13. Death of Justice Scholfield of the Illinois Supreme Court. 14. Fight between Kansas Legislators at Topeka. 15. President Harrison's message favors HaTopeka. watian annexation Militia assembled at 17. Populists concede Republicans' claims at Topeka: troops withdrawn. 18. Senate confirms Judge Jackson's nomination to United States Supreme Court Failare of Manufacturer Walker. of Youngstown, O., involving Gov. McKinley $35,000. Orleans 20. Death of Gen. Beauregard at New Dissolution of the Reading combine. 22. Western Indiana switchmen at Chicago strike Observance in all cities of Washington's birthday American flag raised on the steamer New York. 23. Death of Rufus Hatch. Wall street operator, at New York. 25. Death of Alanson Reed. Chicago 8 pioneer fiano dealer Miss Julie Force. temporarily Insane. kills her two sisters, at Atlanta Ga Kansas Supreme Court declares the Republican legislature the legal one. 27. Falling wall at hicago kills ten people. the Fearful Northwest. storm of wind, snow and rain in 28. Battleship Indiana launched at Philadelphis Northwest snowbound. March. 2. Lauchlin & McManus, Philadelphia broAers. grain. fail for half a million Big advance in Washington. Cleveland inaugurated President at 5. Sandgate. England. is wrecked by the subsidence of the earth. 7. Safety Mutual Insurance Company, of Stoux City closes its doors A money scare in New York causes all markets to decline. 10. Many killed and $1,500,000 in property destroyed by fire at Boston. 11. Disastrous floods East and West. 12. Grand River floods in Michigan. 13. Failure of Kansas Trust and Banking 800. Company, Senator Ingalls President. for $800,14. Michigan rivers break all flood records Nine killed in an Anderson (I. T.) mine Four killed by falling walls at Chicago cagoan. Death of Louis Nettelhorst, prominent Chi16. G. A. R. meeting at Springfield. Ill. St. Pa17. Death of Jules Ferry at Paris trick's Day generally observed. 18. Death of Squire Abingdon, pugilistic patron. at New Orleans Big fight in Minnesota Legislature with the coal combine. Four killed, two injured. in saw-mill explosion at Rome Iowa. 19. Tremont Temple, Boston. burned: loss, $4,000,000. 20. Confirmation of news of loss of freight steamer Naronic. with seventy-two souls 21. Litchfield (III.) mill explosion: loss, $1,600,000 Charles de Lesseps, Baihant, and Blondin convicted of Panama bribery. 22. Frazer. a German miner. near Albia. Iowa, murders his wife and sister-in-law, cuts his baby's leg off and is lynched. 23. Kelly, Tenn. wiped out by a cyclone: many other towns in that State, Mis ouri, and Five Mississippi suffer: several fatalities burned to death at Cleveland. Ohio. 25. Failure of Commercial National Bank at Nashville: run upon all the other local banks. Death of Col. Elliott F. Shepard. editor New York Mail and Express. 26. Escape of Murderer Latimer from Jackson. Mich., prison. after poisoning two guards. 28. Capture of Latimer Death of Gen. E. Kirby Smith at Sewanee. Tenn. 30. Thos. F. Bayard appointed minister to England French cabinet resigns. April. 1. Five lives lost in burning hotel at Bradford. Pa Te) miners killed at Shamokin, Pa cona. Iowa. Four killed by boiler explosion at La4. Carter Harrison elected mayor of Chicago by 20,000 majority. Pu5. Reappearance of cholera in Russia gilist Donovan killed at Syracuse. 6. Dedication of the Mormon Temple at Salt Lake Murderers executed