Click image to open full size in new tab

Article Text

LOUISVILLE BANKS CONSERVE ASSETS BY CLOSING DOORS

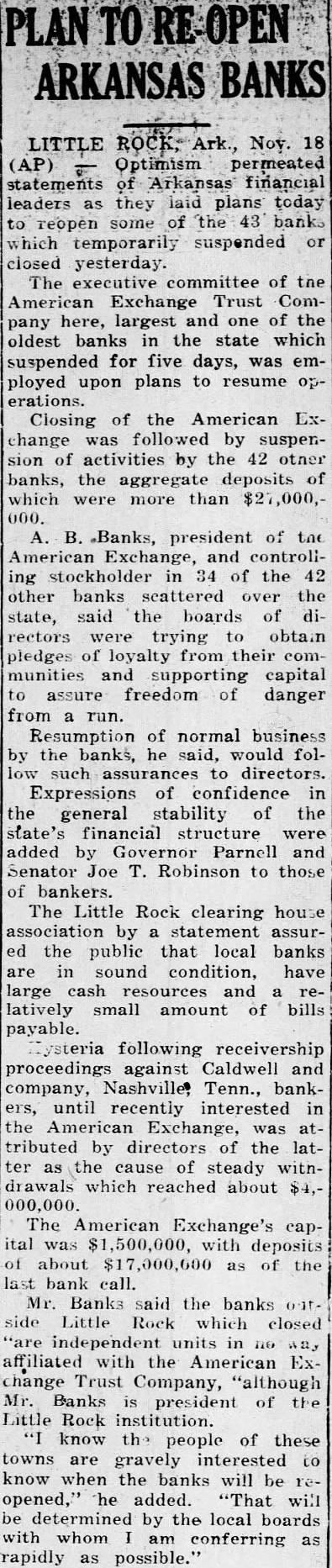

Arkansas Group Suspends Payments for 5 Days as Precaution

LOUISVILLE Ky., Nov. Closing of the National Bank of Kentucky here Monday was followed by five similar banks closing up as precautionary here and one Franklin Ky Meanwhile presidents the other banks city issued statements asserting their institutions were solvent every respect would not be affected The National Bank of Kentucky of which James president, was hands Paul Keyes comptroller general's office It's The other Louisville banks closed were the Security Bank which it was stated closed purely as preLouisville Company which affiliated the Bank of Kentucky negro the American Mutual Savings Bank the First Standard Bank The latter two are not members of the local clearing through the Louisville Trust Brown's Statement Brown issued the following statethe following statement withdrawals in the past week and constantly increasing rumors on the streets was deemed advisable by majority the board directors close the bank at temporarily the and The Bank Kentucky founded in 1834 the Bank Kentucky, and in its last statement listed total as and deposits of Directors the bank in their resothe this bank for the benefit of its creditors Directhe trust company said the insitution was placed in hands the banking Kentucky conserve its assets and benefit all concerned, the officers believed the Kentucky Formed Three the Company approved unification of the stock the trust with stock of the Na Bank of On July 19, 1929, co-incident with the the the Company participation shareholders National Bank Kentucky and the Trust Company were offered stock two shares BancoKentucky for each Trustees share Wednesday Mr. Brown who also president the an the merger would be pleted by December adding the institution have with the of the company deposits and $50,000 of approximately Mr recently announced that proposed affiliation the interests the Bancokentucky and Caldwell & Co. in receivership, had never consummated

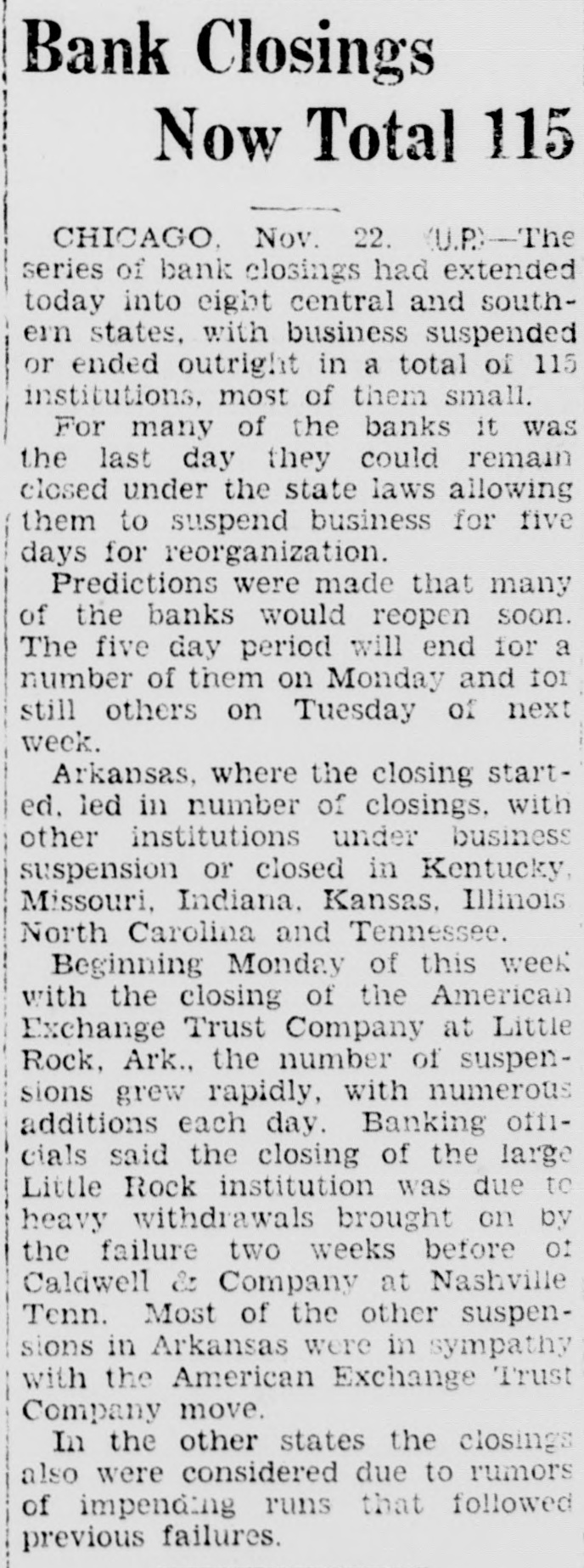

30 A. B. BANKS CO. DOORS IN ARKANSAS ROCK, Banks & Co that thirty banks in Arkansas with which affiliated pay ments to depositors Monday for pe riod of five Several affiliated banks advised the Banks & Co. they remaining The company not early Monday several others as decision the board Trust Little Rock largest in the late day night to suspend and for resulted in the temporary closing of the others the With the exception of the American and Pine Bluff and the and PlantBank Helena, those are Least Half" to Reopen J. Harrison president of the least half" of the banks will closing the Exchange Little Rock as permitted under state law was attributed directors to lic hysteria from the placing bankers Nashville Tenn., in re. affairs of Caldwell & are nothing but public mind could forced the closing this strong bank statement by the American board Mr announced Caldwell had placed in interests in American had been pur chased by local capitalists Under the five-day closing law banks may reopen at the expiration the period placed charge the State Bluff the ond largest in the and the the largest Banks director of the former the bank Protects Depositors and the rest the bank has pay ment of deposresuming payment within five We have in bonds and sight exchange than the legal requirements he depositors in that the of each and may be basis, the added tion American Exchange Lit tle had 000 on September mately the date of the last bank The board's statement said 000 withdrawn during the past few The Bluff bank on September 24 had deposits bank Saturday had deposits officials said. List of Banks Involved The banks which Mr Banks and are business Today for five days pended were announced by the company as Bank Altheimer, North Bank, Batesville: Peoples Bank of McRae: Eudora Bank and Trust Company, Eudora: Arkansas Bank and Trust Company, Hope Bank Bauxite, Bauxite Benton Bank Trust Company, Benton; Arkansas Bank, Carlisle: Bank of Carthage Carthage Bank, Casa: of Clarendon: Farmers' Bank Dardanelle: Hampton Hampton: Cleburne County Bank Heber Springs Merchants Planters Bank Helena Bank of Houston. Houston Merchants & Planters' Bank Cleveland County Bank Kingsland: Chi Company Lakevillage: Little Bank Morrilton Trust Newport: Bank Pangburn, Pangburn: Perry State Bank Perry Merchants' Planters' Bank Trust Company, Pine Bluff: Bank of Star Star Victoria Bank, Strong First State Bank, Bank, and Bank of Wabbaseka, Wabbaseka The banks affiliated with Mr. open for busithe company Bank Fordyce and First National Bank Fordyce; Bank of Harrisburg First National Bank, Min. Springs Bank Stephens and Bank Waldo, Waldo Efforts Junction the First National and Banks of at of ficials CREDIT STATE OF TENNESSEE NASHVILLE General Smith said Monday he was not prepared anthat approximately securities that destatement Saturday not among assets of the closed bank of These securities. Mr. Smith said in his as part the bank's assets September of Robertnon examination Cash in excess of was on that time the attorney eral reported and this, with the the superintendent that the bank was November Nash ville bankers over the affairs banking house which the Bank of Tennesdecided liquidate the bank Mr Robertson receiver for in Chancery Court on After the bank had closed an revealed that the securities deposited September 25 were found among assets and the cash hand had been dissipated The filed in Chancery Court, hand at $32.55 Hopeful of Recovery The Mr part of the them to the assets Bank Tennensee list 25, explained banks and purpose the disappearance has not reached the point where ment can be made as to its probable made leads 'that assets claimed by investment banking corporation of which the Bank Tennessee was merely subsidiary are in reality the Tennessee and may the purpose of applying Lee Douglas, appointed Thursday night by Judge John Gore of the United District Court ceiver for Caldwell & Co. said today he did when an concern would be ready for

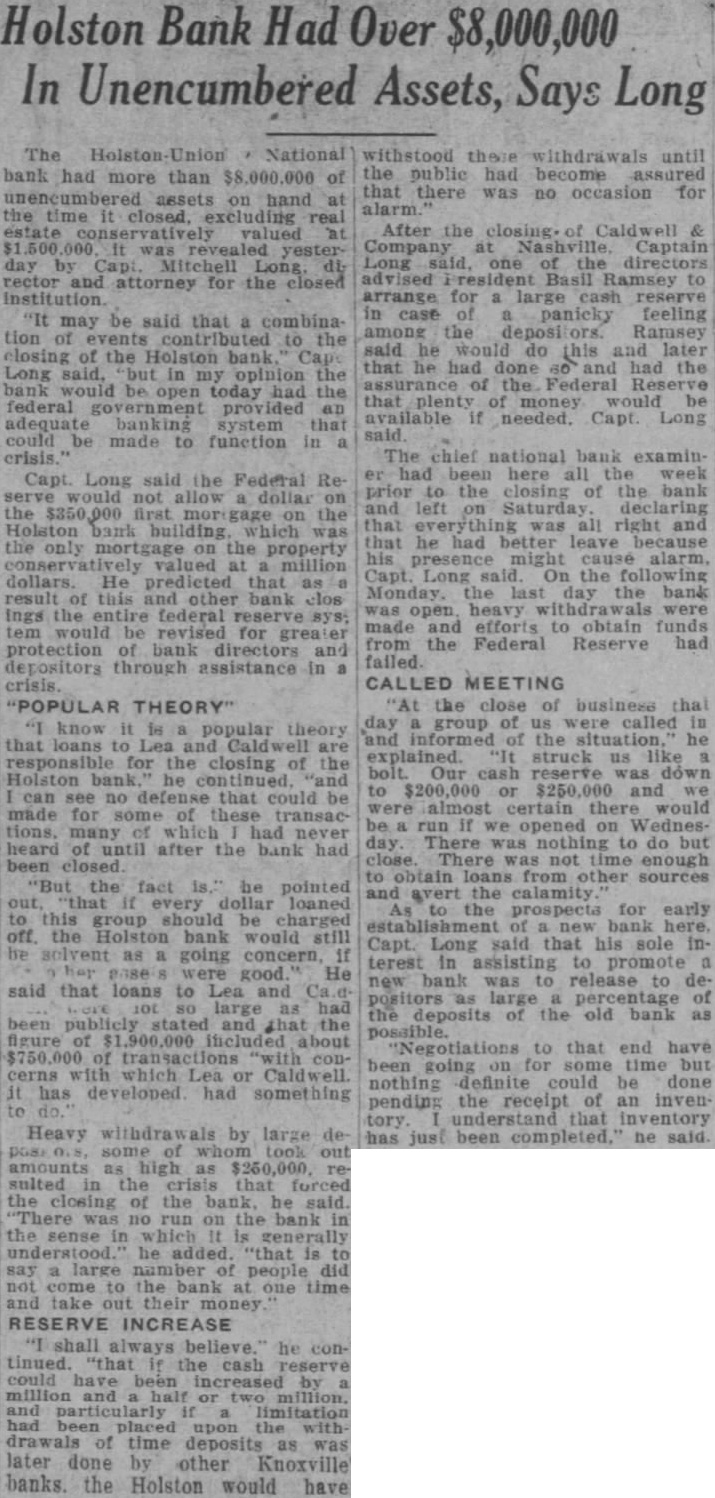

Credit Offered State banks has been appointed for the Bank charge Monday Mr also ing for the Liberty Bank closed Thursday Mr not long the liquidaIn the Bank of Tennessee and the Liberty Bank & Trust both of and the Naat closed Attorney General said than funds of state of Tennessee are Because of the funds tied in Bank & Trust Co of New York the state offered to place also the cem der in the Chattanooga BANKING TROUBLES OVER, TENNESSEE OFFICIAL SAYS an optimistic the situation nessee saying everybody is over along lines He the opinion that banking troubles are During and the nationally house Caldwell ship mergers banks have other of the fortNovember a committee of bankers took the & and the Bank subsidiary week the Union National Bank closed Last Thursday federal receiver was appointed for Caldwell & which and the same night the Bank Trust deposit in closed Holston Union Bank assigned Monday by Mr as the son for the closing of the Campbell County Bank and Trust Company Jackson deposit, constituted the Campbell Bank's entire reserve fund Mergers Announced In Nashville the Fourth and First National Bank was merged into the American National Bank joining the two largest banking institutions the and the TennesseeNational Bank, following an all-day run. taken over by the ComUnion In Knoxville the East Tennessee National Bank the East Tennessee Savings and the City National Bank an institution known the East Tennessee Bank With the combining of the Fourth and First National Bank and American National Bank, James E Caldwell president of the former, announced his retirement He is the father of Rogers Caldwell, presCo., and had been the head the and First tional Bank it was formed by merger of the Fourth National Bank and First National Bank two decades ago. Mr. Caldwell said he thought he had "right to retire after his banking In the Bank of Tennessee, the Liberty Bank & Trust Company and the Holston National Bank Attorney General D Smith has reported more of state funds are The state has been offered credit by the Chemical Bank & Trust Company, of New $1,000,000 has been offered Chattanooga for highway and bridge the The McElwain Megular Bank and Trust Company Franklin Ky., the fifth to close Its said had down because the Bank Kentucky one of its and its depaid in Security Suspends In Louisville slightly than patrons at banks but nothing approaching was noted and bank officials optimistic statements that the public would not become excited Crowds around the National Bank of Kentuc the Louisville Trust Company delayed traffic slightly and special police were on The Security Bank's temporary suspension notice follows Although the opinion of Its the Security Bank the directors and to safeguard the rights depositors, deemed advisable that the bank should susleast temporarily, and that its affairs be placed in the hands the State Banking Comwho make due report of the Missing $3,840,000 Attorney Smith has not yet announced what steps he plans approximately securities that he said were deposited by the Bank of Tennessee September 25 as part of its assets of the state subanks, but not found among the assets after the receiverSmith revealed in statement that he advised the state treasurer to much of his funds he could from the Holston Union Bank without threatening its said. this bank was affiliated business Caldwell & Company and all probability would be affected the precafious of the latter $300,000 draft that the however, was paid before the bank closed Judge John J. Gore Monday sustained petition for general creditors bill in the Caldwell & Company receivership suit and ordered creditors present their claims against the company before The creditors or from any separate suits against Caldwell & Company parties to "any and all suits now against Caldwell Company,' enjoined from further except by consent of the by Birmingham The the credibill by Fred Dean of Birmingham, complainant SHARES LOWER IN CHICAGO TRADE Bancokentucky shares affiliated with the National Bank Kentucky which sold down drasticalthe Stock Exchange Monday compared Saturday of Sales at Monday had reached total 6,500 shares while the total sales last week were 9,800 has sold high as 25 this year and week's high mark After opening Monday advanced to 2 TWO BANKS AT Ky., MERGE WITH CITY PADUCAH Nov City City National Bank of Paducah Monannounced the purchase of the First National Bank and the Trust Savings James Utterback president of the City announced bank had acquired all assets other institutions and had guaranteed their deposits Directors National affiliated the closing the Bank of Kenhad affected National Bank of Paducah. added the First National of Paducah added the First Naof Paducah Bancokennothing Bancokentucky the three local the City National Bank Paducah effective The consolidation was said to give resources negotiations for consolto have been pending for some INTER THERN REVEALS PLAN TO BUY BACK STOCK Inter Southern Company said formal statement that the company not lose dollar the receivership which & Co., Nashville been The said deal pending for sale Interby the nationally house will financial difficulties of Caldbeen seized upon as basis for false reports hurtful against the ern Life Insurance Company, read The "will not lose dollar account of the difficulties pending and will be concluded within ten days shares owned by Caldwell & under provision available over $3,000,000 of the purchase price to protect this against any loss by reason of its

HELENA INSTITUTION STOPS PAYMENT TO DEPOSITORS HELENA Ark., Nov 17.-(P)-The Merchants Bank in which B. Little Rock Monday suspension of payments to depositors for five The action followed similar anSunday night by American Exchange Trust Company, of Little Rock, which Mr. Banks is president

READ The Journal Want Ads constantly and keep in touch with the market in which you are interested.