1.

November 8, 1930

St. Cloud Times

Saint Cloud, MN

Click image to open full size in new tab

Article Text

Bank of Tennessee Goes Into Hands of Receiver

Nashville, Tenn., Nov. 8. (UP)-The Bank of Tennessee was placed in the hands of State Supt. of Banks D. D. Robertson, on his request that a receivership be granted. The bank has resources of $15,867.071 and deposits of more than $12,000,000.

Following the appointment of Rob. ertson as receiver, the committee of Nashville bankers named to work out affeirs of Caldwell & Co., the southeast's largest investment bankers, is sued a statement pointing out the Bank of Tennessee is "among other assets" of Caldwell & Co.

The action in turning over the bank to receiver, according to the statement was considered advisable to prevent hasty disposition of the bank's securities.

Richmond, Va., Nov. 8. (UP)-James P. Jones, former treasurer of the Vir ginia Anti-Saloon league was found guilty of embeszzling funds of the Virginia Methodist orphanage, while treasurer of the institution, by a jury today. The verdict carries with an automatic sentence of five years im prisonment. Notice of appeal was filled.

2.

November 10, 1930

The Chattanooga News

Chattanooga, TN

Click image to open full size in new tab

Article Text

Report State Has Little Security for Protection of Approximately $4,000,000.

CITIES AND COUNTIES HIT

Tennessee Money Exceeded Legal Funds Involved.

Nashville, Nov. Three factors stand out in the developing examination of the difficulties Caldwell Nashville and investment house. and the Bank of Tennessee, its subsidiary. now in the hands of the Tennessee state banking department, These are: First, the total of public money on deposit in the Bank Ten. added counties cities which had deposits there. This figure estimated between $10,000,000 and Second, reports in circulation that has made the for several denied by Robertsaid the bank examined Third. political repercussions of the Caldwell beginning There here this that vigorous tempt would be made organize the coming general the state under independent, leadership.

Caldwell Subsidiary. While the Bank Tennessee operate general business. fact Caldsources landbusiness. far depublic Financial estimates its total liabilities are the effect run lion dollars of this and perhaps hundred more believed have due borrowings from finanAll variously from ten and half the milion public funds, either of state cities and within the state, the Caldwell Of this money the state deposit estimated between and The the Bank mainly Caldwell Co. officials. deposited Caldwell subsidiary by cities and estimated and deposits are believed be posited against these deposits pay them. This lateral thought Nashville to amount Exceeded Legal Figure. Under the general Tennesese law the state make deposits capital the bank question. The Bank Thus, under the the could by treasurer the Bank admitted October state had almost $350,000 more than figure, on deposit with the Caldwell Highway Funds The money on dethe have placed there the Unexisting governing the nancing of the state highway bid specific project been accepted the required draw the face conthis check over The requires official demoney this highway contract in bank banks close proximity the being Whether this the placing highway funds the Bank of

3.

November 12, 1930

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

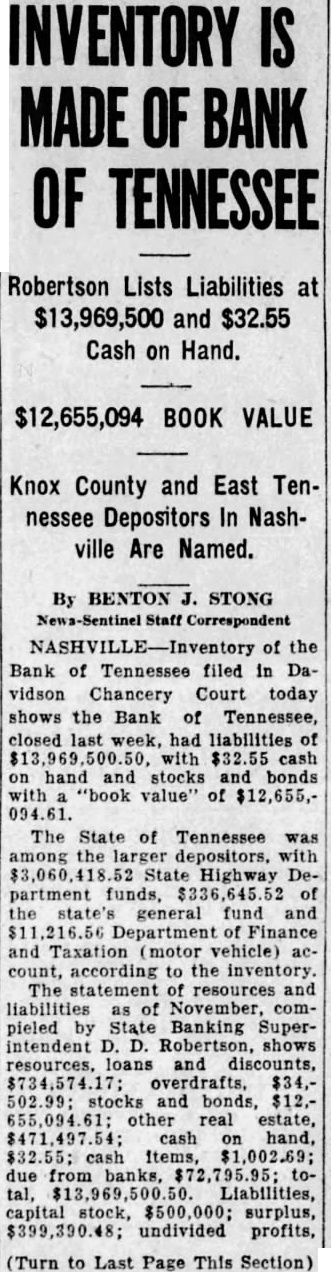

INVENTORY IS MADE OF BANK OF TENNESSEE

Robertson Lists Liabilities at and $32.55 Cash on Hand.

BOOK VALUE

Knox County and East Tennessee Depositors In Nashville Are Named.

By BENTON STONG of the Bank of Tennessee filed in Davidson Chancery Court today shows the Bank of Tennessee, closed last week, had liabilities of with $32.55 cash on hand and stocks and bonds "book value" of $12,655,The State of Tennessee was among the larger depositors, with State Highway partment funds, of the state's general fund and Department of Finance and Taxation (motor vehicle) count, according to the inventory. The statement resources and liabilities of November, pieled State Banking Superintendent Robertson, shows resources, loans and discounts, $734,574.17; overdrafts, stocks and bonds, other real estate, cash hand, $32.55; cash due from banks, tal, Liabilities, capital stock, surplus, undivided profits,

(Turn to Last Page This Section)

4.

November 12, 1930

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

HOLSTON-UNION IS CLOSED; RECEIVER IS SENT HERE BY

Suspends Activity at Both Banking Houses Here; Heavy Withdrawals Blamed; Poorly Secured Loans Believed a Factor.

CALDWELL CRISIS SEEN AS CAUSE

Decision To Close Reached After Conferences Tuesday; Directors Hope To Reorganize or Form New Bank.

The one of Knoxville's three National Banks, closed today. Its failure to open was preceded by an nouncement issued directors that the bank had suspended operation. Heavy withdrawals during the past few days were given by directors as the reason it was necessary for the bank to close. While their statement did not say so, it is known that these were occasioned by the recent collapse of the strueture of Caldwell and Company of Nashville and the subsequent closing last Friday of the Bank of Tennessee, Caldwell's Nashville state bank which had several millions in public funds on deposit.

Treasury Man Is Receiver Herbert Pearson of the Treasury staff has been appointed receiver the the currency comptroller's office informed the NewsSentinel correspondent today. Pearson, who has been member of the Treasury's regular staff receivers years, and who has had wide experience, working with bank Macon, Georgia, before being sent to Knoxville. He was due here time today and immediate charge. effort had been made by prominent Tennesseans have William Baxter Lee, Knoxville lawyer, appointed receiver; but the Treasury explained to those suggested his name that had not been their practice to point lawyers to such posts, and, addition, they had staff ceivers their own utilize such emergency, the dispatch the Treasury would talk of the reasons for the closing bank, but it learned that officials of the department had been kept the last days the withdrawals from the Knoxville institution. fact that Caldwell investment house that was put in the hands of committee trustees recentwas interested in the Knoxville bank, unofficially given Washington reason for the closing. An effort being made to form separate organization take the affairs of the HolstonUnion. this funds of depositors will immediately available, bank official said day.

Admit Boxholders Soon Safety deposit box holders will be admitted to the bank within few days. Some of employes of Holthe will be laid off and others will be kept. learned from bank official. National Bank examiner for charge the day. Depositors will be given preference in funds, assets of the including the Holston Bank building owned by the subject to their claims.

Time to Settle Uncertain don't know how long will determine the status bank. Basham told Depositors will, course, be given preference payment. Basil Ramsey, president not come kthis morning. At his the ban home Hills, told reporter that he did wish make statement other than that made by the rectors night. The federal banking officials will appoint receiver who will liquidate assets the the depositors first. other bank affected by the closing the number new accounts have been opened here and there have been speak Cowan Rogers, City National Bank president, said. President Carter, the East Tennessee National Bank. not comment the matter except to say that know my right.' Checks drawn on funds in the after close of busiMonday cannot be honored local bankers The bank closed all day yesterday for Armistice Day. Caldwell and the South's largest financial concern, placed the hands mittee three Nashville banklast week. Rogers was the owner of 700 shares stock, minority the He had also been heavy borrower the bank, Basil Ramsey, its presiadmitted statement last week which Ramsey pointed that Caldwell and Company not connected the He said that the bank had not time loaned any to Last This

5.

November 14, 1930

St. Louis Post-Dispatch

St. Louis, MO

Click image to open full size in new tab

Article Text

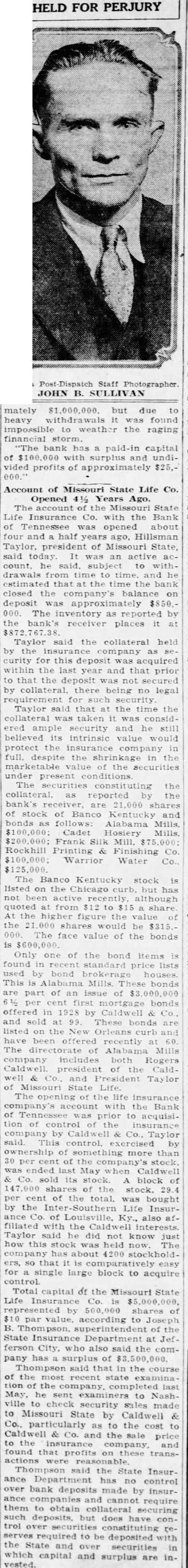

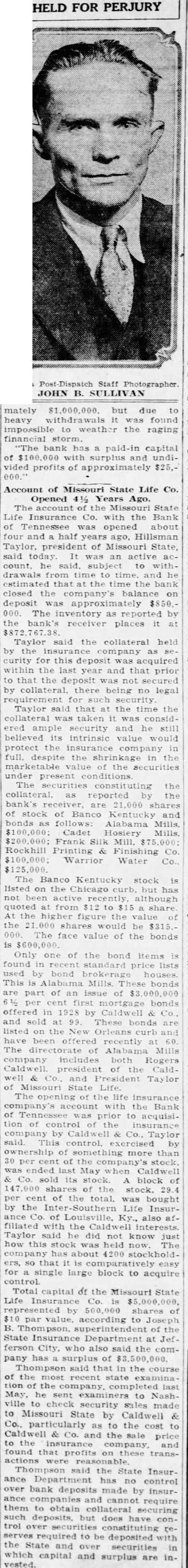

FOR PERJURY mately but due to heavy withdrawals found impossible to weather the raging financial bank has capital of with surplus and undivided profits of

Account of Missouri State Life Co. Opened Years Ago. The account the Missouri State Life Insurance with the Bank of Tennessee opened about four and half ago, Hillsman Taylor, president of Missouri State, said today. It an active said, subject drawals from time to time, and he estimated that the time the bank closed company's balance on deposit approximately $850.000. The inventory as reported by the bank's receiver places Taylor said the collateral held by the curity for deposit acquired within the last year and that prior to that the deposit was secured by collateral, there being no legal requirement for security Taylor said that the time the collateral taken was considample security and he still believed its intrinsic value would protect the insurance company full, despite the shrinkage the the under present The the as reported by the bank's shares of stock Banco Kentucky and bonds follows: Alabama Cadet Hosiery Frank Silk Rockhill Printing Finishing $100,000; Warrior Water The Banco Kentucky stock listed on the Chicago but has not been active although quoted from to share At the higher figure the value the shares would be $315, The face value of the bonds Only one of the bond items found standard lists used by bond This Mills. bonds part of issue first mortgage bonds offered in 1928 by Caldwell and sold These bonds listed the New Orleans curb been offered recently The directorate Alabama Mills company includes both Rogers president the Caldwell and President of Missouri State Life. The opening the company's account the Bank of prior acquisition of control the company by Caldwell said. by ownership of more than 30 of the stock, ended last May when Caldwell sold its stock. block of the stock. of the total. was bought by the Life Insurance Co. of Ky., also filiated the Caldwell interests. Taylor said he did not know how this stock was held The company has about that easy for single large block to acquire Total capital of the Missouri State Life Insurance Co. represented shares of $10 par value, according to of State Insurance Department ferson City, also said the company has surplus of said that in the course of the recent state the company, completed last he sent examiners to ville to check security sales made to Missouri State by Caldwell Co., particularly to the cost Caldwell and the price to the insurance and found that these transactions reasonable. Thompson the State Insurance Department has no control bank deposits made by insurcompanies and cannot require them to obtain collateral such but does have trol to deposited with the State and over securities which capital and surplus are invested.

6.

November 14, 1930

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

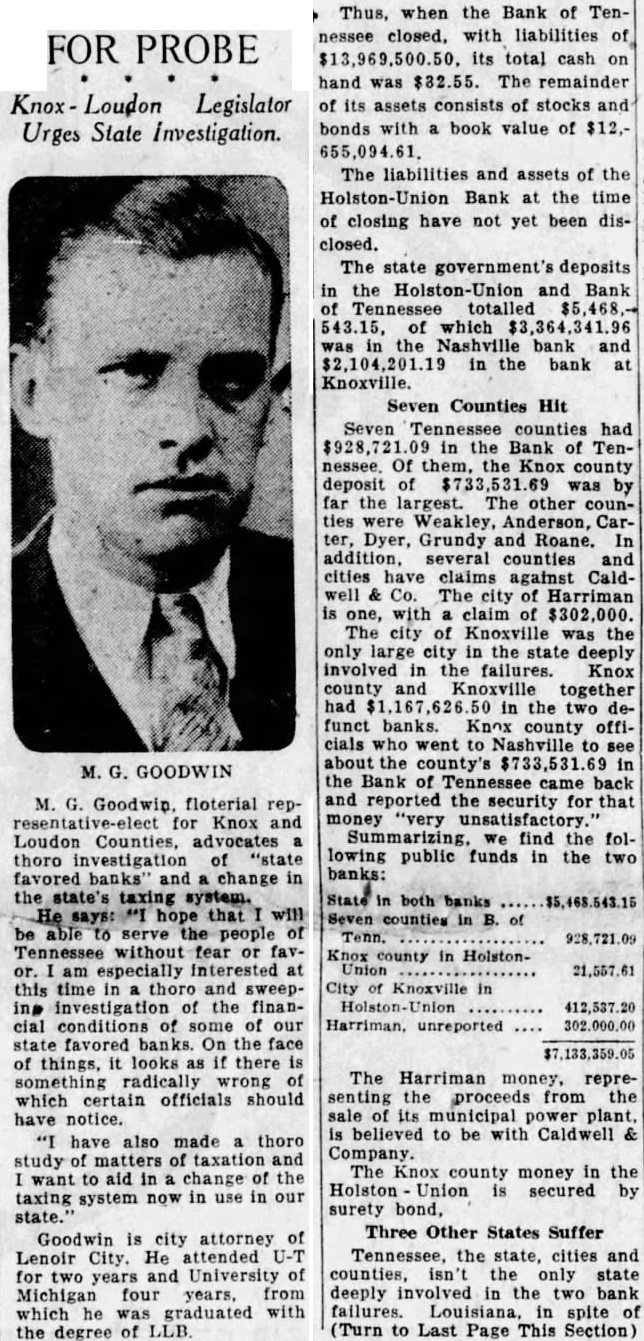

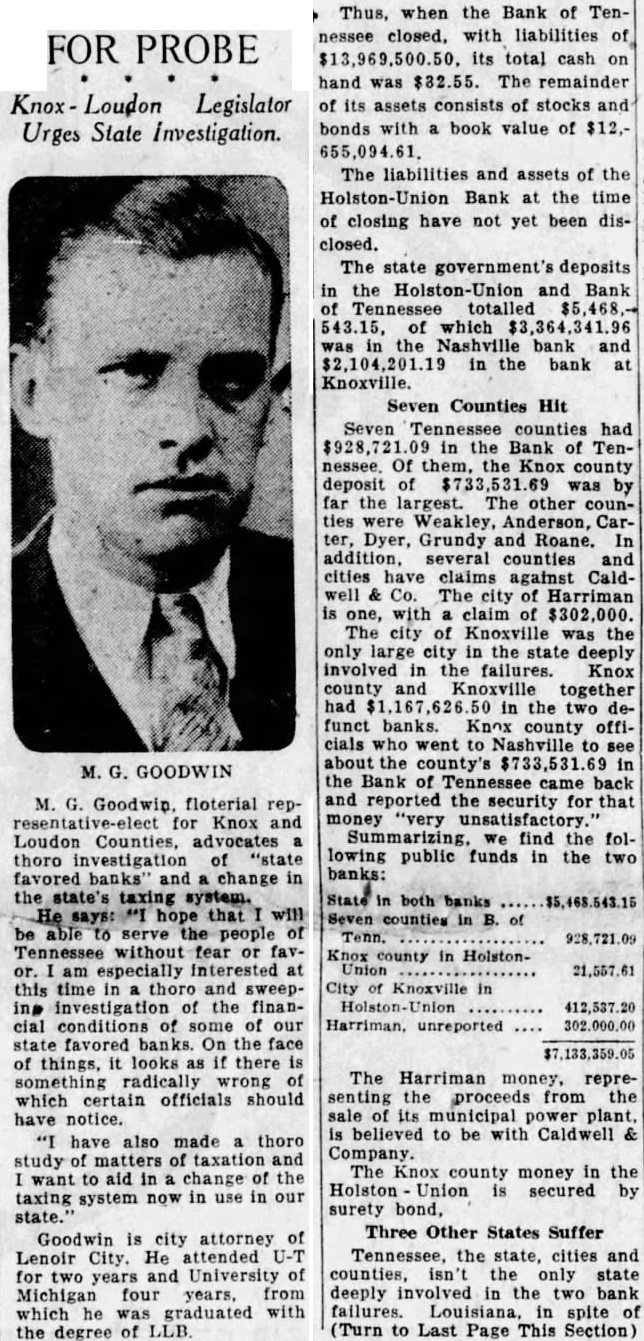

PROBE

Legislator Urges State Investigation.

Goodwin. floterial for Knox Loudon Counties, thoro "state favored banks" change in state's taxing system. hope be people without fear especially this time and ing the financial conditions some of our state favored banks. On the face of things, looks there radically wrong which certain officials should have notice. have also made thoro matters taxation want aid change the taxing system now in use Goodwin is city attorney of Lenoir City. He attended U-T for two years and University of Michigan four years, from which he was graduated with the degree of LLB.

Thus, when the Bank of Tennessee closed, with liabilities its total cash on hand $32.55. The remainder of its assets consists of stocks and bonds with book value of $12,655,094.61. The liabilities and assets of the Bank at the time of closing have not yet been disclosed. The state government's deposits the and Bank Tennessee totalled 543.15, which the Nashville bank and in the bank Knoxville.

Seven Counties Hit Seven Tennessee counties had in the Bank Of the Knox county deposit of by the The other counties were Weakley, CarDyer, Grundy and Roane. several counties and cities have claims against CaldCo. city with claim of $302,000. The city of Knoxville the only city in the deeply the failures. Knox county and Knoxville together had in the two funct banks. Knox county officials went Nashville the county's $733,531 the Bank of came back and reported the security money find the lowing public funds in the banks: both banks county HolstonCity Knoxville in unreported $7,133,359.05 The Harriman money, representing the proceeds from the its municipal power plant. believed to be with Caldwell Company. The Knox county money in the Holston Union is secured by surety bond, Three Other States Suffer Tennessee, the state, cities and counties, the only state deeply in the two bank failures. Louisiana, spite (Turn to Last Page This Section)

7.

November 15, 1930

The Anniston Star

Anniston, AL

Click image to open full size in new tab

Article Text

Merges With mitage National

NASHVILLE, Nov. 15. Bank of Nashville today took complete charge and control of the Tennessee-Hermitage National Bank the result of reached between the two banks and member banks of the Nashville Clearing House Association last night. The stood terrific run on the bank that lasted throughout the day Friday and the merger the two institutions was formed last night to guarantee the stability of the mitage through the strong influence of the and the backing of practically every bank in the city. With the assurance that the posits the the bank had let up this morning although hundred or more positors were waiting in line when the bank opened. The run on the Liberty Bank Thursday caused its doors close yesterday, and immediately thereafter the run started on the Tenrequiring special details of police to Keep crowd in order and to shows of violence as hundreds fought for places in the line that stretched more than city block outside the bank windows. Paul M. Davis, president American National now forming the second largest bank the South, announced the merger of the and Tenneslast night and assurthe of the stability the public institutions depositors did not continue the runs against the smaller institutions. Edward Potter. Jr., president of the Bank. bepresident of the merged incomes stitutions and will direct the operation of the beginning this morning. The banking warned formal statement last night that runs on the banks here would bring about economic disasted to the entire city. Such actions will force the banks to call loans to industry and cause the cessation of operations and the subsequent throwing of thousands out of work, Davis announced. of the two banks expected to bring close to the nancial panic that has swept Nashville with since the closing of the Bank of Tennesse on November

8.

November 15, 1930

The Courier News

Blytheville, AR

Click image to open full size in new tab

Article Text

Commerce Union Takes Over Hermitage at NashToday.

NASHVILLE Tenn. Nov. Commerce Union bank Nashville today complete charge and control of the Tennessee Hermitage National bank result agreements reached tween the two banks and banks the Clearing House association Inst night. The Tennessee Hermitage stood a terrific the bank that lasted throughout Friday, and the the two Institutions formed night to guarantee the stabllof the through the strong Influence of the Commerce Union and the backing practically every bank In the The run on the Liberty bank Thursday caused doors to close yesterday and Immediately thereafter run started on the Tennessee Hermitage. special details of to the keep crowd order and to prevent shows Paul M. Davis, president of the American National bank. now formthe second largest bank in the south, announced the merger last night and Insured the public of the stability of the Institutions the public did not continue the run against the smaller institutions. The banking committee warned in statement last night that continued runs on the banks here would bring about economic disnsto the entire The the two banks expected to bring close the financial panic that has swept Nashville with increasing since the closing of the Bank of Tennessee vember

Jacksboro Bank Closes JACKSBORO TENN. Nov. County Bank and Company of Jacksboro, has decided close because has deposit in Holston Union National Bank of Knoxville which closed Winston Baird, president of the small bank, today. Depositors will be paid Monday nd Tuesday

9.

December 12, 1930

The Courier-Journal

Louisville, KY

Click image to open full size in new tab

Article Text

LEA HEARING IS POSTPONED have receiver named to hold a Publisher Denies Charges In Memphis Commercial Inc., stock, pledged by the Southern PubSuit By Nashville Bank lishers. Inc., to the Nashville, Tenn., Nashville Trust Co. of Nashville, to Receiver. secure a $1,500,000 bond issue pur-

SEEK TO MOVE SUIT The Minnesota & Ontario Paper Co.

Nashville, Tenn., Dec. 11 (4)-Hearing of a petition for a receiver for Southern Publishers, Incorporated, holding company for the companies publishing the Memphis Appeal Evening Appeal and the Knoxville Journal, was postponed by Chancellor James B. Newman today until Tuesday Whether the hearing will be held on the petition at that time depends on the chancellor's ruling on the defendant's motion to transfer the case to the Federal Court because of diversity of citizenship of the parties involved. On the preceding day hearing is scheduled before Chancellor Newman on the petition for a receiver for the Tennessee Publishing Company, publishers of the Nashville Tennessean and Evening Tennessean. Lea Makes Reply.

Col. Luke Lea, president of the Southern Publishers Incorporated. the holding company, and also president of Memphis Appeal, Incorporated, the Knoxville Journal & Tribune Company and the Tennessee Publishing Company, was back today for the announced purpose of resisting these suits and another action brought against him, Luke Lea, and others by the receiver for the Nashville Liberty Bank & Trust Company of Nashville. Receivership for Southern PublishInc., was asked in petition filed by the Minnesota Ontario Paper Co., the Nashville Trust Co. and D. D. Robertson, receiver for the Bank of Tennessee. It was sought chased by the Minneapolis compny. Contests Bank Sult. also was the complainant in the general creditors' bill against the Tennessee Publishing Co., claim for approximately $94,000 for newsprint being set up. the bill stating that another newsprint bill would be due December In addition to preparing answers to the suits invol ring the Tennessee Publishing Co. and stock in the phis and Knoxville newspapers. Colonel Lea announced his intention of the suit filed by the Nashville Liberty Bank Nashville, D. D. State Superintendent of Banks Judgment for $80,000 was sought against Colonel Lea and for approximately $86,000 against Colonel Lea and others, including several corporations. Referring to the Nashville Liberty Bank of Nashville's reeiver's suit, Colonel Lea said in formal statement that "the statements made in the bill. insofar as they allege any fraudulent act purpose of are utterly false adding that "whether such charges were honestly and fairly made the public shall be the judge through the introduction of evidence, facts shall supplant fiction Particularly without warrant." he said, "Is the allegation that on September negotiated to the Nashville Liberty Bank of Nashville certificates of deposit which were in any manner irregularly drawn and which were not direct obligations of the Asheville. N. C., Central Bank & Trust Company of Asheville, N. C., which was at that time to the best of my knowledge solvent and substantial banking institution Referring to the allegation that "fictitious or dummy corporations' were organized, with incorporators "in every instance being persons of no financial means of any consequence and having no real interest in the organization or management of the affairs of such corporations,' Colonel Lea said, "This gratuitous, unwarranted and perhaps malicious reflection on the integrity and personnel of the various corpora with which am connected: and in so far as it refers to the corporations made co-defendants in this bill is unqualifiedly false. The receiver asked judgment against Colonel Lea for $80,000 as the amount of certifica of deposit that the suit alleged he knew were "irregularly issued' when he deposited them with the Nashville Liberty Bank Nashville. The petition averred that after depositing these certificates he drew personal checks to discharge certain obligations. Judgment against Colonel Lea and other individuals and corporations was sought because of other alleged transactions against which complaint was made.

10.

December 12, 1930

Asheville Citizen-Times

Asheville, NC

Click image to open full size in new tab

Article Text

HEARING IN SUIT AGAINST MEMPHIS PUBLISHER RESET

Court Postpones Action On Lea Receivership Until Tuesday

NASHVILLE Tenn., Dec. 11. Hearing petition for receiver of Southern Inc., holdcompany for the companies publishing The Memphis Commercial and Evening Appeal and The Knoxville Journal by Chancellor James Newman today until Tuesday. Whether the hearing will be held the petition time depends the chancellor's ruling on the fendants motion to transfer the case to the Federal court versity citizenship of the parties

To Resist Suits On the praceding day hearing before the petition for receiver for the Tennessee Company publishers of The Nashville Tennesand Evening Tennessean ColLuke Lea. president Southern the holding company and also president Memphis Appeal, Inc. The Journal and Company and the Tennessee Publishing Company. returned from business trip today the announced purresisting these suits and other action brought against him Luke Lea others receiver for Liberty Bank and Trust Company Receivership Southern Publishers, petition filed by the Minnesota and Ontario Paper the Nashville Trust Company and Robertson celver for the Bank of Tennessee, Receiver Sought It sought have receiver named hold Memphis Commercistock pledged by Southern the Nashville Trust to secure bond issue purchased the Minneapolis The Minnesota and Paper Company the complainant in the general creditor's bill against the Tennessee Publishing Company claim for approximately $94,000 for being set addition answers the Publishing Company stock in the Memphis and Knoxville newspapers Colonel Lea his intention contesting the filed by the Liberty Bank Judgement $80,000 was sought against Colonel Lea and for approximately $86,000 against Colonel and othincluding several Referring the Liberty Bank ceiver's suit, Lea said formal statement that state. ments made bill, they allege ny fraudulent purpose of are utterlys false" adding that such charges were honestly and fairly made the public shall the judge. through the introduction of evidence. facts shall supplant fiction without warrant," he the allegation that

(Please Turn To Page Two)

11.

December 12, 1930

Chattanooga Daily Times

Chattanooga, TN

Click image to open full size in new tab

Article Text

LEA ISSUES DENIAL OF FRAUD CHARGES

Nashville Publisher to Fight Receivership Plea.

Hearing on Petition Postponed Until Take Case to U.S. Court.

NASHVILLE, Dec. petition receiver for Publishers, holding company for the companies publishing the Memphis Appeal and Evening Appeal and the Knoxville Journal, postponed Chancellor James Newman Tuesday Whether the will be held the petition that depends the ruling motion transfer the the federal because diversity citizenship involved. hearing the petition for for the publishers the Nashville Tennessean and of the South the pany, Memphis Appeal, Inc., the Knoxville Journal and Tribune the Publishing back today for the purpose of these and tion brought Luke Lea and the for the Liberty Bank Trust for Southern Publishers, Inc., was asked on petition filed by the and Ontario Paper comNashville Trust company and pany, Robertson, receiver for the Bank of Tennessee. was sought to have receiver named hold Memphis Commercial Appeal, pledged the Southern Publishers, the Trust company bond purchased by the The Minnesota and Ontario Paper complainant creditors against the Publishing claim for approximately for newsprint set bill due Dec. addition to preparing answers to lishing company stock in the Memnewspapers, announced his the suit the Liberty bank ceiver, tendent sought Col. against others, including several porations. Referring the Liberty bank ceiver's formal made allege utterly that charges fairly public shall the judge when, the introduction dence, facts supplant fiction." without added, allegation that Sept. the bank deposit which any manner irregularly which direct Central Bank Trust time to the best of my knowledge

See Page

12.

December 24, 1930

The Courier-Journal

Louisville, KY

Click image to open full size in new tab

Article Text

COMPANY IS IN RECEIVERSHIP

Southern Publishers, Inc., In Hands of Court: Tennessee Company Wins Case.

Nashville, Tenn., Dec. 23 Chancellor James B. Newman today placed the Southern Publishers, Incorporated, in receivership, but denied application for receiver for the Tennessee Publishing Company, publishers of the Nashville Tennessean and Evening Tennessean, Southern Publishers, holding company for stock of the Memphis Commercial Appeal, Incorporated, Knoxville Journal, Incorporated, whose physical properties are in receiverships at Memphis and Knoxville. One company publishes the Memphis Commercial Appeal and Evening Appeal: the other prints the newspaper.

Lea Heads Companies. Col. Luke Lea president of the well the Memphis Commercial as Incorporated: the Knoxville Journal, Incorporated the Tennessee Publishing Company Rogers Caldwell associated with him all organizations, except the Tennessee Publishing Company The Chancellor named Larkin Nashville for and instructed the receiver to take immediate Memphis Commercial stock now held the Nashville Trust Company trustee to secure $1.issue Southern Pubthe Paper ComThe Ontario Paper Company, the Nashville Trust Company and Robertson, receiver for the Bank of Tennessee, made the application for the receiver. The bank shares of Southern pledged by Caldwell Co., to the bank closing.

Some Debts Paid.

In denying application for Publishing for Company Chancellor Newman said that allegations mismanagement and dissipation of which defendant justify the of of concern assets than its liabilithe bill to be greater The Chancellor pointed out that the petition alleged the answer mitted that company's assets exceed its fair although its assets are insufficient current obligaSince the hearing began. tions." some the obligations set of originally referred current liabilities have been discharged.

13.

January 28, 1931

Johnson City Chronicle

Johnson City, TN

Click image to open full size in new tab

Article Text

Assistant Attorney General, Testifies Before Senate Tipton,

Claims Securities Used as Collateral in Banks Only Worth 15 to 20 Cents on Dollar

Tenn., Jan. (AP) -Testimony substitutions made for securities deposited as additional collatteral upon demand of the state banking and reduction its cash hand all probability" rendered the bank of Teninsolvent while still accepting state deposits was heard today the legislative investigatcommittee. Nat Tipton, an sistant attorney general, told committee some of the for those valued which were originally deposited, district bonds worth from 10 15 cents the dollar. of the he had been bank what the in the street calls "cats and securities, has stated banks, were deposited the bank following examinalast cover preciation held by bank. When the bank closed November had state excess hand at the time of closing The first Mr. October shares intersouthern Other withdrawals continued, stated, until all the original curities had been withdrawn except shares Rogers Caldwell New York Corporation, and shares Nashville properties company. these securities were withdrawn by officials authorand others of value subgstituted, what criminal offense that asked ChairWalter Faulkner. think would fraudulent breach of trust, Tipton replied. assistant attorney general the person making not stated the ords. agents Caldwell been testified. He letter dated September from Caldwell Co., pledging the Tennessee, and said reply question pledge He tified later date cial bank that custom' had the privilege substituting equal Caldwell its subsidiary, bank Tennessee, were locking, the witness continued. understood Caldwell, owned stock the bank Tencapital and that bank dents also officers of Caldwell Tipton referred to repurch. agreement, whereby the bank Tennessee would invest surplus in securities that Caldwell funds agreed take back at the original price. Speaker Scott hugh of the Senate, member asked such agreement not "agreement between themselves, Tipton replied that ment between your right and your left

14.

January 28, 1931

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

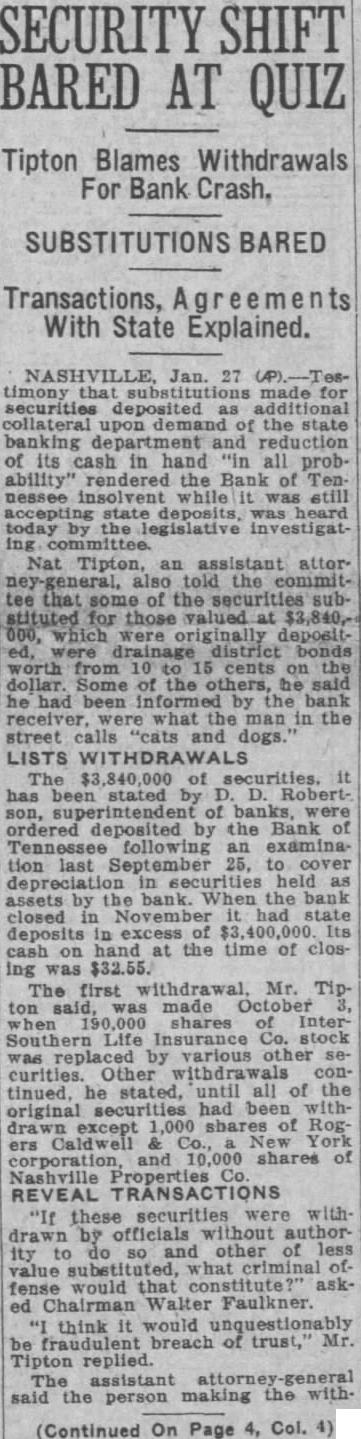

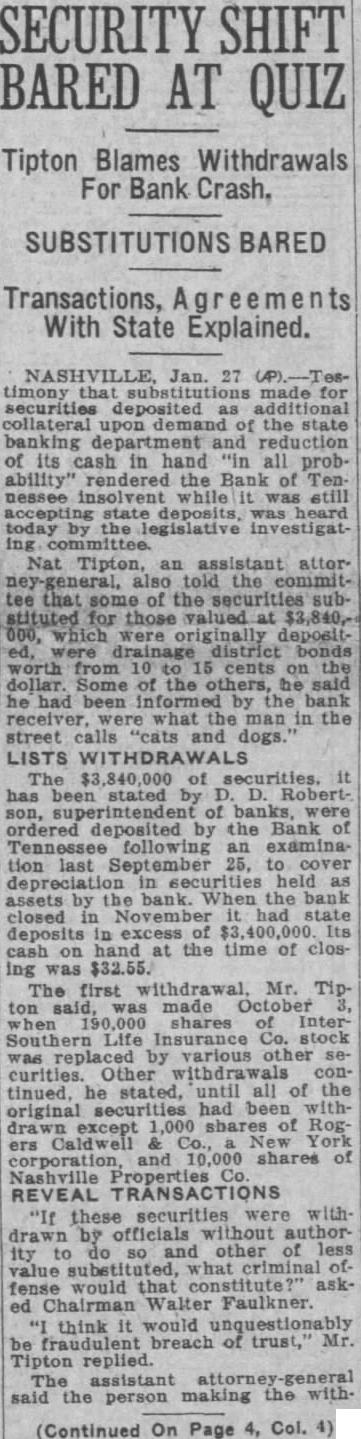

SECURITY SHIFT BARED AT QUIZ

Tipton Blames Withdrawals For Bank Crash,

SUBSTITUTIONS BARED

Transactions, With State Explained.

NASHVILLE, Jan. 27 timony made securities deposited additional collateral upon the state banking department of its cash in hand all probability' rendered the Bank of Tennessee today the Nat Tipton, an assistant attertee that some of the securities sub stituted for those valued which were deposit drainage worth from cents on the dollar. Some of the others, he had bank what the man in the street "cats and dogs. LISTS The of been stated by ordered deposited by the Bank Tennessee following examinalast September to cover securities held assets the bank. When the bank closed November had state deposits excess hand at the time of closing $32.55. The first withdrawal, Mr. Tipton said, was made when shares InterInsurance stock replaced by various other curities. Other withdrawals continued, he stated, until all of the original securities had been with1,000 shares of RogCaldwell York corporation, and 10,000 shares Nashville REVEAL TRANSACTIONS these securities withdrawn officials without author other of less ity value fense would that ed Faulkner. think would be breach of trust, Mr. Tipton replied. The attorney general said the person making the with.

(Continued On Page 4, Col. 4)

15.

February 6, 1931

The Atlanta Journal

Atlanta, GA

Click image to open full size in new tab

Article Text

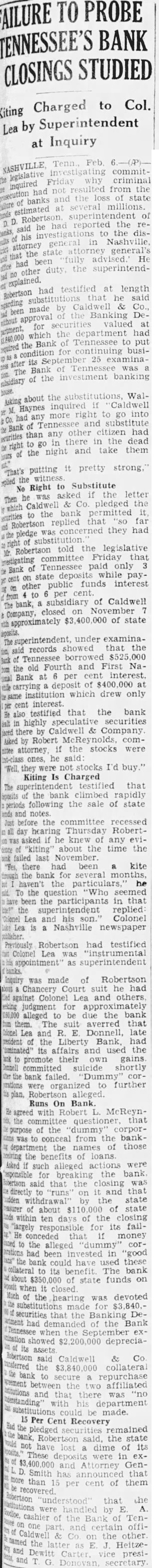

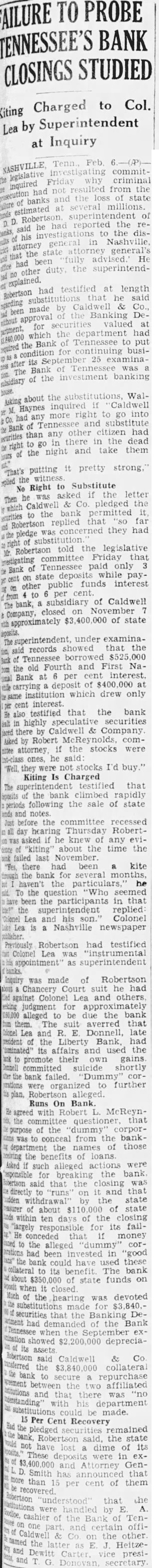

FAILURE TO PROBE TENNESSEE'S BANK CLOSINGS STUDIED

Kiting Charged to Col. Lea by Superintendent at Inquiry

Feb. NASHVILLE committhe inquired legislative Friday why criminal trosecution had not from the and the loss state banks estimated at several millions Robertson. superintendent of said he had reported the rehis investigations Nashville, the disgeneral attorney state attorney general's had the been fully He other duty the superintendexplained Robertson had testified at length regarding substitutions that he said by Caldwell & Co. rithout approval made of the Banking Devalued at for required the Bank of Tennessee to put condition for continuing busiits September 25 examina Bank of Tennessee was subsidiary The of the investment banking juse. about the substitutions, WalAsking Haynes inquired if Caldwell had any more right to go into the Bank of Tennessee and substitute securities than any other citizen had right to in there in the dead of the night and take them

"That's putting it pretty strong," the witness mplied No Right to Substitute Then he was asked if the letter which Caldwell Co. pledged the securities the bank permitted it, Robertson replied that 'so far the pledge was concerned they had Mr. right Robertson told the legislative irrestigating committee Friday that Bank of Tennessee paid only 3 of cent on state deposits while payon other public funds interest per from The bank, to subsidiary of Caldwell Company, closed on November rith approximately 400,000 of state said records showed that the of Tennessee borrowed $525,000 im the old Fourth and First Namal Bank at per cent interest. carrying deposit of $400 000 at same institution which drew only cent interest. also testified that the bank all highly speculative securities there by Caldwell & Company Asked Robert McReynolds comnitee attorney. if the stocks were ones, he Well, they were not stocks I'd buy. Kiting Is Charged The testified that deposits of the bank climbed rapidly periods following the sale of state Just before the committee recessed all day hearing Thursday Robertasked if he knew of any eviinte "kiting' about the time the failed last "Yes, there had been a kite trough the bank for several months, aid. To the question "Who seemed have been the participants in that be!" the superintendent replied Colonel Lea and his son. Colonel Lea is a Nashville newspaper Previously Robertson had testified at Colonel Lea was "instrumental appointment" as superintendent Inquiry was made of Robertson about Chancery Court suit he had against Colonel Lea and others etcing judgment for approximately 160,000 alleged to be due the bank him them. The suit averred that Colonel Lea and R. E. Donnell, late resident of the Liberty Bank, had iminated" its affairs and used the promote their own gains Donnell committed suicide shortly bank failed. "Dummy corwations were organized to further is plan, Robertson alleged. Runs On Bank He agreed with Robert L. McReynrids, the committee questioner, that purpose of the "dummy corporlitte was conceal from the bankdepartment the names of those reiving the benefits of loans Asked if such alleged actions were responsible for breaking the bank Robertson said that the closing was directly to "runs" on it and that udden withdrawal' by the state masurer of about $110,000 of state ttds within ten days of the closing "largely responsible for its failHe conceded that if money laned the alleged "dummy" corprations had been invested in "good ans" the bank could have used these collateral to its benefit The bank about $350,000 of state funds on when Much of the hearing was devoted substitutions made for $3,840,securities that the Banking Deariment had demanded of the Bank Tennessee when the September exmination showed $2,200,000 depreciaassets Robertson said Caldwell & Co masferred the $3,840,000 collateral the bank to secure a repurchase stement between the two affiliated atitutions and that there was "no merstanding" with his department substitutions be made. 15 Per Cent Recovery Had the pledged remained said, the state vould not have lost dime of its These deposits were in ex$3,400 and Attorney GenSmith has announced that more than 15 per cent of them Robertson "understood" that the institutions were by E. A. sodioe, cashier of the Bank Tenone part and certain offiCaldwell & Co. on the other named the latter as E. J. Heitzeand Dewitt Carter, vice presiand Donovan, secretary

16.

March 6, 1931

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

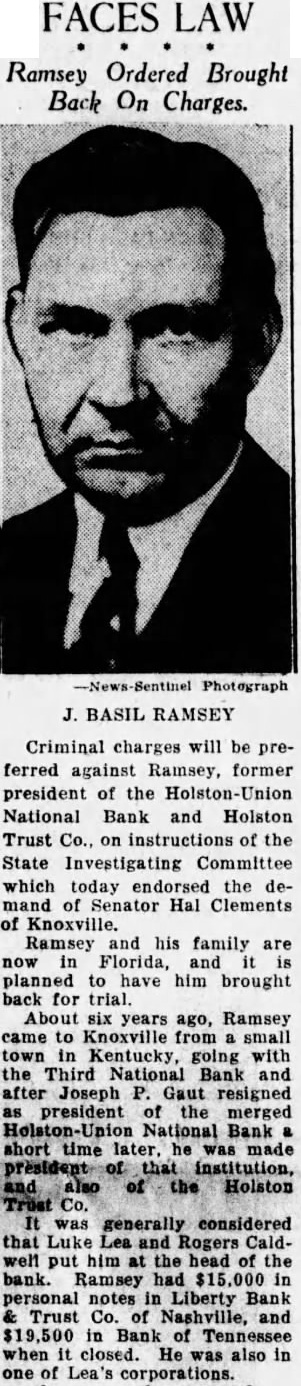

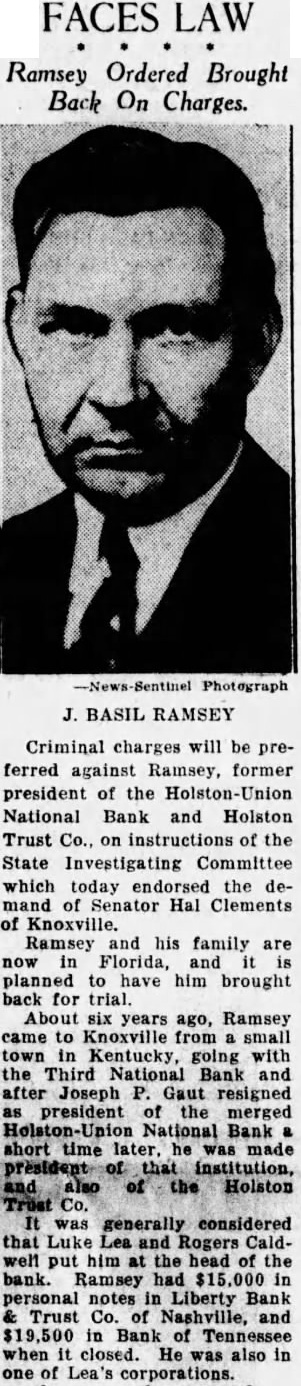

FACES

Ramsey Ordered Brought Back On Charges.

Criminal charges will be preferred against Ramsey, former president of the National Bank and Holston Trust Co., on instructions of the State Investigating Committee which today endorsed the demand of Senator Hal Clements of Knoxville. Ramsey and his family are Florida, and planned have him brought back for trial. About six years ago, Ramsey came to Knoxville from small town Kentucky, going with the Third National Bank and after Joseph Gaut resigned president of the merged National Bank short time later. he made the Holston generally considered that Luke Rogers Caldwell put him at the head the bank. Ramsey had personal notes Liberty Bank Trust Co. Nashville, and $19,500 Bank of Tennessee when closed. He also in one

17.

March 21, 1931

The Atlanta Constitution

Atlanta, GA

Click image to open full size in new tab

Article Text

CALDWELL NAMED IN TWO INDICTMENTS

NASHVILLE. Tenn., March 20.deposits made by the state less than two weeks before Caldwell & Company's Bank of Tennessee closed formed the basis for indictments returned by n county grand jury today against Rogers Caldwell, president of the two institutions. Both indictments each containing two counts, charged Caldwell with receiving deposits in an insolvent bank. The first count in each said Caldwell knew the institution was insolvent and the second said he had reason to believe it insolvent. The deposits were made. the indietments said, by Highway Commissioner Robert H. Baker and Treasurer John F. Nolan. One bill said Baker deposited $6,500 of bridge funds on October 28, 1930. and the other said Nolan deposited $50,000 of state general funds on October 25. The bank suspended November 5. and went into receivership November A week thereafter. Caldwell & Company went into receivership. Criminal Court Judge Chester K. Hart set bond at $10,000 in each case. James E. Caldwell, Rogers Caldwell's father, and T. D. Webb, formerly associated with James E. Caldwell in the Fourth and First National Bank. pledged real estate valued at $30,000 and $25,000, respectively, as bondsmen. Caldwell is now under six indict ments, two of which relate to alleged transactions at the Bank of Tennessee, two to operations of Caldwell & Company and the Bank of Tennessee and two to transactions at the Holston Union National Bank at Knox ville. The last named two were returned by federal grand jury at Greeneville, Tenn. The jury at the same time jointly indicted Colonel Luke Lea, Nashville publisher, and J. Basil Ramsey, president of the Holston Union Bank, Conviction for receiving deposits in an insolvent bank carries with it penitentiary sentence of from one to five years if the deposit exceeds $25.

18.

July 3, 1931

Birmingham Post-Herald

Birmingham, AL

Click image to open full size in new tab

Article Text

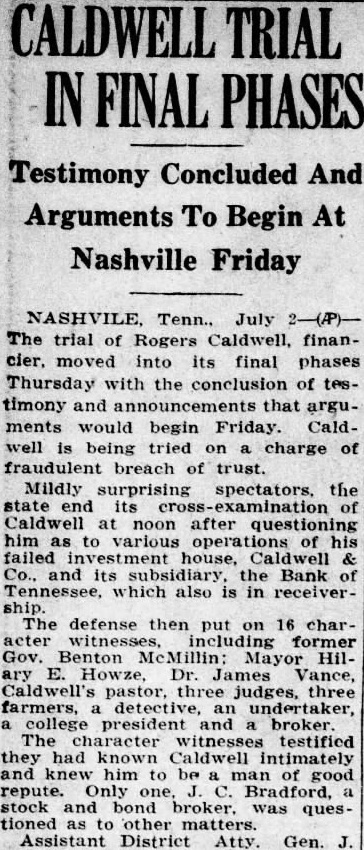

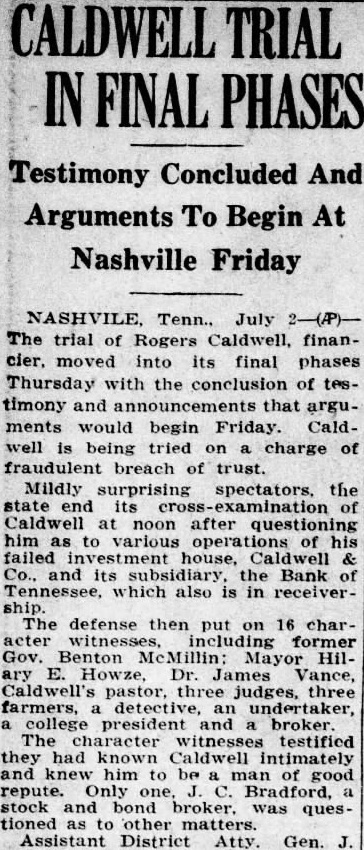

CALDWELL TRIAL IN FINAL PHASES

Testimony Concluded And Arguments To Begin At Nashville Friday

NASHVILE Tenn., July 2-(P)The trial of Rogers Caldwell, financier, moved into its final phases Thursday with the conclusion of testimony and announcements that arguments would begin Friday. Caldwell is being tried on charge of fraudulent breach of trust. Mildly surprising spectators, the state end its examination of Caldwell at noon after questioning him as to various operations of his failed investment house, Caldwell & Co., and its subsidiary, the Bank of Tennessee, which also is in receivership. The defense then put on 16 character witnesses, including former Gov. Benton McMillin: Mayor Hilary E. Howze, Dr. James Vance, Caldwell's pastor, three judges, three farmers, detective, an undertaker, a college president and broker. The character witnesses testified they had known Caldwell intimately and knew him to be a man of good repute. Only one. C. Bradford, a stock and bond broker. was questioned as to other matters. Assistant District Atty. Gen. J.

19.

July 4, 1931

The Independent-Record

Helena, MT

Click image to open full size in new tab

Article Text

Securities of Bank Declared Missing

NASHVILLE Tenn., Nov. 15-(P) -Attorney General L. D. Smith said today that nothing of approximately $3,840,000 in securities deposited by the Bank of Tennessee September 25 at the demand of the superintendent of banks, were found among the bank's assets when it went into receivership November 10.

RADIO FOR ALL POLICEMEN To fight the serious and growing auto bandit menace in England a committee of police chiefs and ra dio experts recently met in London and outlined a system by which every policeman in the country will be equipped with a pocket radio set. This will keep all officers in constant touch with headquarters as they patrol their beats. An electric buzzer carried on the outside of the tunic will warn them when they are being called. and small earphones will enable them to receive messages. It is expected that within the next few months all English police forces will have their own broadcasting stations.

LONDON WOMEN'S CLUB BUSY Women clubs in London are becoming so popular that they are. not only growing rapidly in number but found themselves too busy to close down during the usual 'dead'' months of the summer. Some, like the Ladies' Carlton, are in such favor that the question of limiting their membership has been discussed. One of the chief reasons for the way in which women's clubs thrive is that women put_them to much greater use than men do their clubs. It is increasingingly becoming the practice for women to use their clubs for wedding receptions, while the special suites are often booked by hostesses for private parties.

20.

October 29, 1931

The Dodge Criterion

Dodge, NE

Click image to open full size in new tab

Article Text

Had $4,and Counties State 400,000 Deposited in Defunct Bank

Nov 12 Nashville. various the in the Bank Tennessee deposit Tennes filed to total approximately today listed in the invenState as the State highway departcredit the vehicle ment, finance account of the of the general and credit to specounty fund deposited credit counties, computed from the was time deposits, funds in trust. Claims Have Priority. While the inventory not list securities pledged collateral for State's deposits, the State supreme court the State titled claims the bank payable its depositors no priority claim unpledged assets. made what might realized from the sale unpledged securities and from the favorable from the pledged Loans overdrafts and other real estate in invenbook value stocks, municipal corporation bonds and stocks of trolled Caldwell and Company, of which the Bank of was subsidiary and certificates deposits. Liabilities given as the same listed the securities pledged secure deposits and bills payable The Bank of Tennessee acted f1nancial agent Caldwell Combanking house, of which Total time deposits companies controlled Caldwell and Company the and included the following Caldwell and Company the Southern Surety Company Bills payable included the following Bank LouisNational York, National $200,000, the National bills payable the Holston Union Tenn. which closed yesterday.

21.

November 5, 1931

The Alliance News

Alliance, NE

Click image to open full size in new tab

Article Text

POSTPONE HEARING FOR RECEIVERSHIP

Petition Against Southern Publishers, Inc., Deferred Until Tuesday

Nashville, Tenn. Dec. 11 ing on petition for receiver for Southern Publishers, Inc., holding company for the companies publishing the Memphis Commercial Appeal and Memphis Evening Appeal and the Knoxville Journal was postponed by Chancellor James B. Newman today until Tuesday Whether the hearing will be held on the petition at that time depends on the chancellor's ruling on the defendant's motion to transfer the case to the Federal court because of diversity of citizenship of the involved On the preceding day hearing is scheduled before Chancellor Newman on the petition for receiver for the Tennessee Publishing Company, publishers the Nashville Tennesseean and Evening Tennesseean. Colonel Lea Returns. Colonel Luke Lea, president of the Southern Publishers, Inc. the holding company, and also of the Commercial Appeal. Inc., the Knoxville Journal and Tribune Company and the Tennessee Publishing Co., returned from business trip today for the announced purpose of resisting these suits and another action brought against him Luke Lea, Jr., and others by D. Robertson for the Liberty Bank and Trust Co. Receivership for Southern Publishthe Minnesota and Ontario Paper Co., the Nashville Trust Co., and Mr Robertson as receiver for the Bank of Tennessee It was sought to have receiver named hold Memphis Commercial Appeal, stock pledged by the Southern Publishers, Inc. to the Nashville Trust Company to secure 500 000 bond issue purchased by the Minneapolis The Minnesota and Ontario Paper Company also was the complainant in the general creditors bill against the for approximately $94,000 for news print being set In addition to preparing answers to the suit involving the Tennessee Publishing Company and stock in the Memphis and Knoxville newspapers, Col. Lea announced his intention of contesting the suit filed by the Liberty Bank Judgment for $80,000 was sought against Colonel Lea and for $86,000 Colonel Lea and others, several corReferring to the Liberty Bank receiver's Colonel Lea said in formal statement that statements made in the bill in so far as they allege any fraudulent act or purpose of mine are utterly false.' adding that "whether such charges were honestly and fairly made the public shall be the judge when through the introduction of evidence, facts shall supplant fiction "Particularly without warrant." he added. "is the allegation that on Sep-

22.

December 9, 1933

Hope Star

Hope, AR

Click image to open full size in new tab

Article Text

Luke Lea and Son Lose Final Fight To Escape Prison

Tennessee Supreme Court Orders Them Into Corolina

CALDWELL'S CRASH

Failure of Tenn House Closed 46 Banks in Arkansas in 1930

NASHVILLE, Colonel Luke Lea, former senator, and his eldest son Luke Lea, Jr., fighting extradition to North Carolina, lost in the Tennessee Supreme Court Saturday. The high court sustained North Carolina's demurrer to the Leas' petition

Another Appeal

NASHVILLE, Lea and his son announced late Saturday that they planned to carry the North Carolina extradition proceedings to the United States Supreme Court. It will be their third appeal to the highest tribunal, having lost on two preVious points. for writ of habeas corpus following Governor McAlister's order for their extradition. The Leas were convicted more than two years ago at Ashville, N. C., of violating the North Carolina banking laws. The elder Lea was sentenced to to ten years imprisonment and the younger the alternative of paying $25,000 fine or serving two six years.

A Record Court Fight By one technicality or another the Leas have set something of legal record in delaying execution of their sentences for banking violations following the crash of the Bank of Tennessee and the Rogers Caldwell-Luke Lea financial and newspaper interests. Their appeal was taken twice to the United States Supreme Court and Then, when 1.orth Carolina formalrequested extradition from their native state of Tennessee the Lea father and son went into hiding in the which they emerged what appears to be the final chapter before they begin serving time in prison. Luke Lea, Sr., publisher of the Nashville Tennessean, allied himself with Rogers Caldwell, son of famous Tennessee banker, building up the brokerage and investment house Bought Commercial Appeal In 1927 they bought the Memphis Commercial Appeal, and tried unsuccessfully buy the Atlanta Constitution, Clark Howell and his son finally withdrawing from what they believed to be an unwise contract Caldwell & Co. failed in 1930, carrying down with Banks Co. of Arkansas, which included the defunct Arkansas Bank Trust Co. Although Mr. Banks had Caldwell only portion of his business, failure the Bank of Tennessee Nashville, Tenn., November 10, 1930, alarmed the public that run started on Bank's key bank, the American-Exchange Trust compay at Little Rock, ending with the suspension the entire Banks' system NovemLea entered the Caldwell picture primarily publisher the Memphis Commercial Appeal, which he and his partner bought the year followthe death of its great editor C. Mooney. With the failure of the Caldwell investment and banking houses was revealed that Lea and Caldwell withdrew $1,300,000 in cash from the Commercial Appeal's to save their paper-mill company threw the Commercial Appeal into receivership.

Paper Sold The Appeal finally sold last spring James Hammond. an man who years ago went East and rose to eminence first in banking and stores. and then with William Randolph Hearst head his Detroit Times, Mr. Hammond announced, however, that bought the Commercial Appeal for fewhimself and for not Mr. Hearst. Indictment and conviction of Luke Lea and his son occurred in bank Asheville,